Georgia Form 600 Instructions

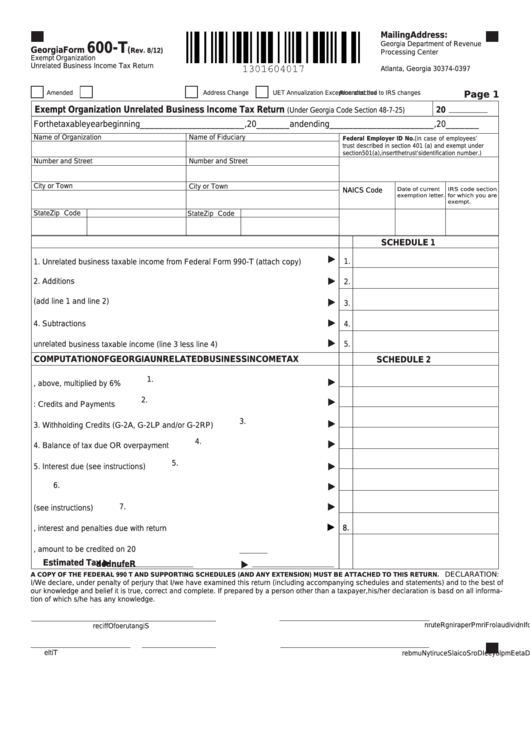

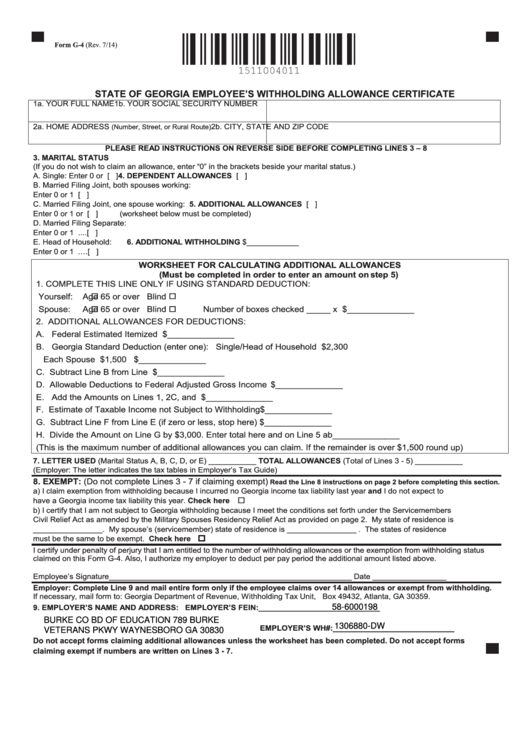

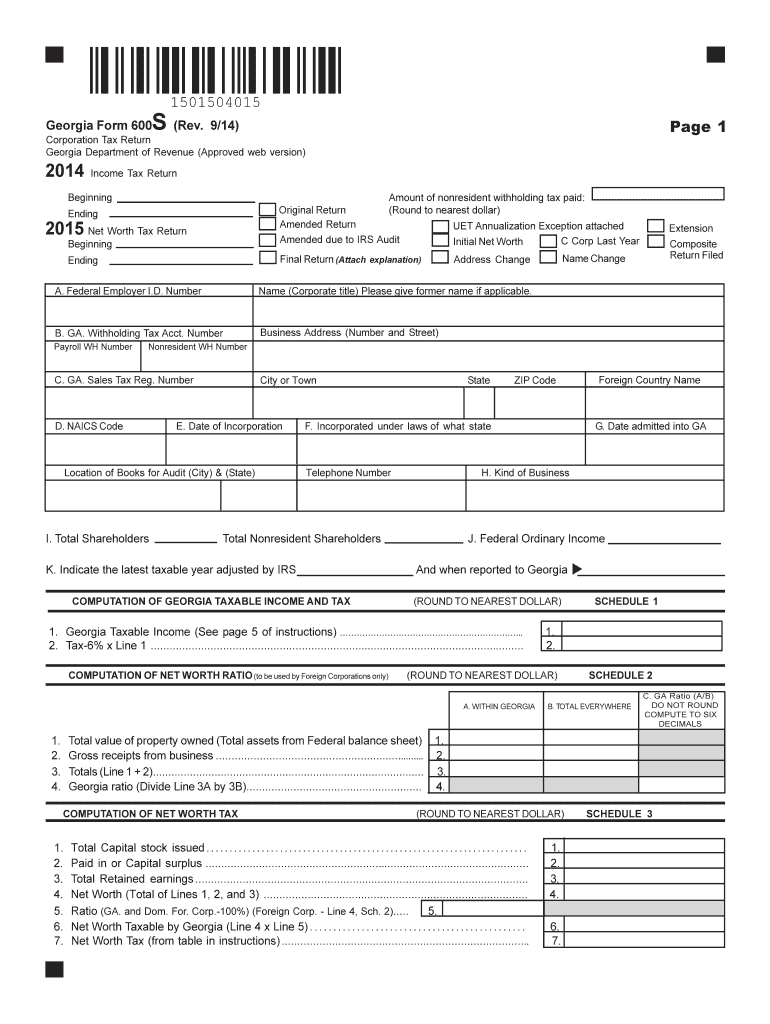

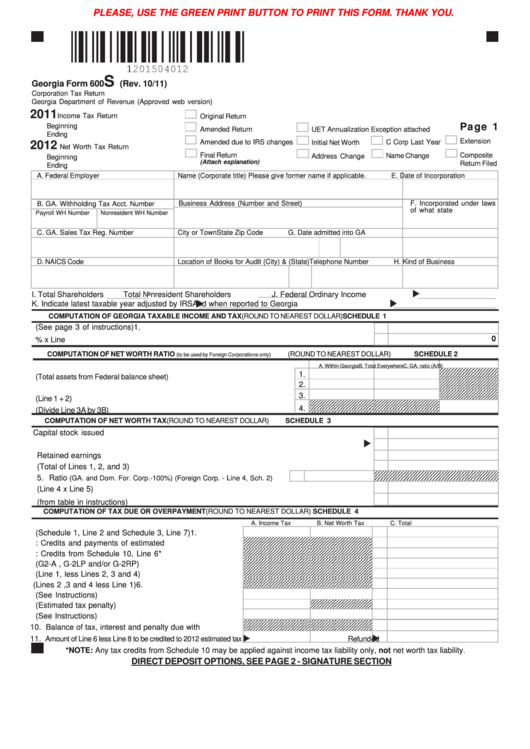

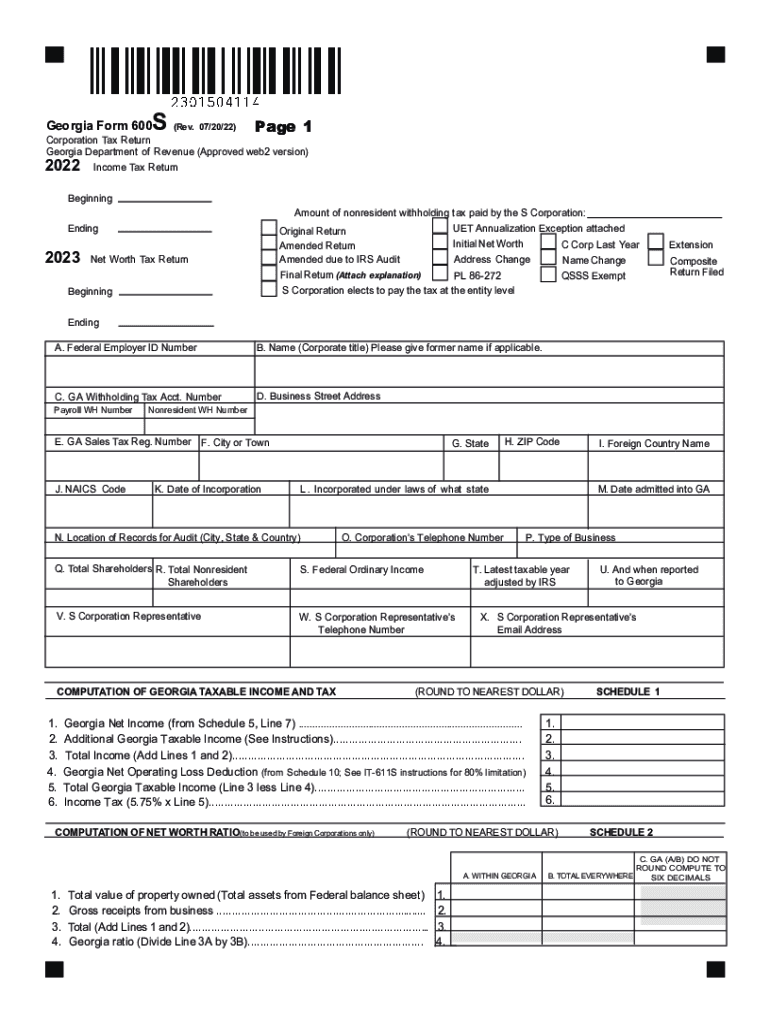

Georgia Form 600 Instructions - Credit card payments) it 611 rev. Web form 600 uet (estimated tax penalty). Accounts only) see booklet for further instructions. Other penalty due (see instructions). Other penalty due (see instructions). Web corporation income tax general instructions booklet. Due dates for partnership returns partnership returns are. Transform an online template into an accurately completed ga 600 instructions 2021 in. Georgia individual income tax is based on the taxpayer's. Web show sources > form 600 is a georgia corporate income tax form. Direct deposit options (for u.s. Balance of tax, interest and penalty due with return. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Web print blank form > georgia department of revenue print Visit our website dor.georgia.gov for more information. Electronic filing the georgia department of revenue accepts visa,. Web corporation income tax general instructions booklet. Web show sources > form 600 is a georgia corporate income tax form. Complete, edit or print tax forms instantly. Visit our website dor.georgia.gov for more information. Other penalty due (see instructions). This form is for income earned in tax year 2022, with tax returns due in april. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Due dates for partnership returns partnership returns are. Web we last updated georgia form 600 in january 2023 from the georgia. Complete, edit or print tax forms instantly. Web visit our website at dor.georgia.gov for instructions and registration information. Web corporation income tax general instructions booklet. 06/20/19) page 1 corporation tax return georgia department of revenue (approved web version) 2019 income tax return beginning ending original. Any tax credits from schedule 11 may be applied against income tax liability only, not. Indicate the date to the form with the date function. 06/20/19) page 1 corporation tax return georgia department of revenue (approved web version) 2019 income tax return beginning ending original. Loss year loss amount income year nol utilized. Get ready for tax season deadlines by completing any required tax forms today. Georgia individual income tax is based on the taxpayer's. Web georgia form 600 is known as the corporation tax return form. State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the. Web file form 600s and pay the tax electronically. Loss year loss amount income year nol utilized. Direct deposit options (for u.s. Complete, edit or print tax forms instantly. Click on the sign icon and. To successfully complete the form, you must download and use the current version of. Web georgia form 600 (rev. Web georgia form 600 is known as the corporation tax return form. Form 600 uet (estimated tax penalty). Get ready for tax season deadlines by completing any required tax forms today. Loss year loss amount income year nol utilized. Visit our website dor.georgia.gov for more information. The purpose of this rule is to prescribe the income. Credit card payments) it 611 rev. Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. Form 600 uet (estimated tax penalty). State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the. Georgia ratio (divide line 3a by 3b). Web corporation income tax general instructions booklet. Get ready for tax season deadlines by completing any required tax forms today. Accounts only) see booklet for further instructions. Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. Visit our website dor.georgia.gov for more information. Web video instructions and help with filling out and completing ga form 600 instructions. 2022 it611 corporate income tax instruction booklet (pdf, 871.18 kb) 2021 it611 corporate income tax instruction. The purpose of this rule is to prescribe the income. Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. Web visit our website at dor.georgia.gov for instructions and registration information. 8233 and has provided a copy of such form to the georgia department of revenue at the. Credit card payments) it 611 rev. Georgia individual income tax is based on the taxpayer's. Web corporation income tax general instructions booklet. Web georgia form 600 (rev. File form 600 and pay the tax electronically. Visit our website dor.georgia.gov for more information. Electronic filing the georgia department of revenue accepts visa,. Other penalty due (see instructions). For calendar year or fiscal year beginning and ending. Any tax credits from schedule 11 may be applied against income tax liability only, not. Balance of tax, interest and penalty due with return. Web print blank form > georgia department of revenue print This form is for income earned in tax year 2022, with tax returns due in april. Loss year loss amount income year nol utilized.Fillable Form 600T Exempt Organization Unrelated Business

Form 600s Fillable Printable Forms Free Online

2014 Form GA DoR 600S Fill Online, Printable, Fillable, Blank pdfFiller

Fillable Online Ga form 600 instructions 2020. Ga form 600 instructions

Form 600s Fillable Printable Forms Free Online

2015 Form GA DoR 600S Fill Online, Printable, Fillable, Blank pdfFiller

Ga Form 600S ≡ Fill Out Printable PDF Forms Online

Form 600s Fillable Printable Forms Free Online

Form DR600 Fill Out, Sign Online and Download Printable PDF, Florida

Form 600 Instructions 2022 Fill Out and Sign Printable PDF

Related Post: