Form 541 Instructions

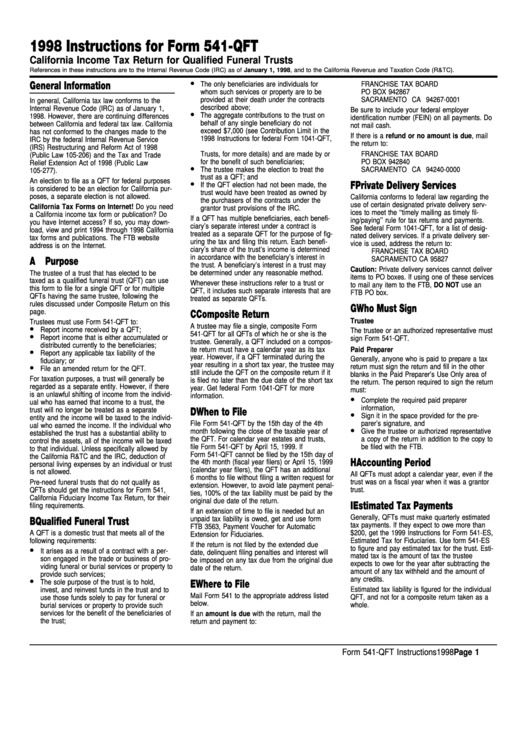

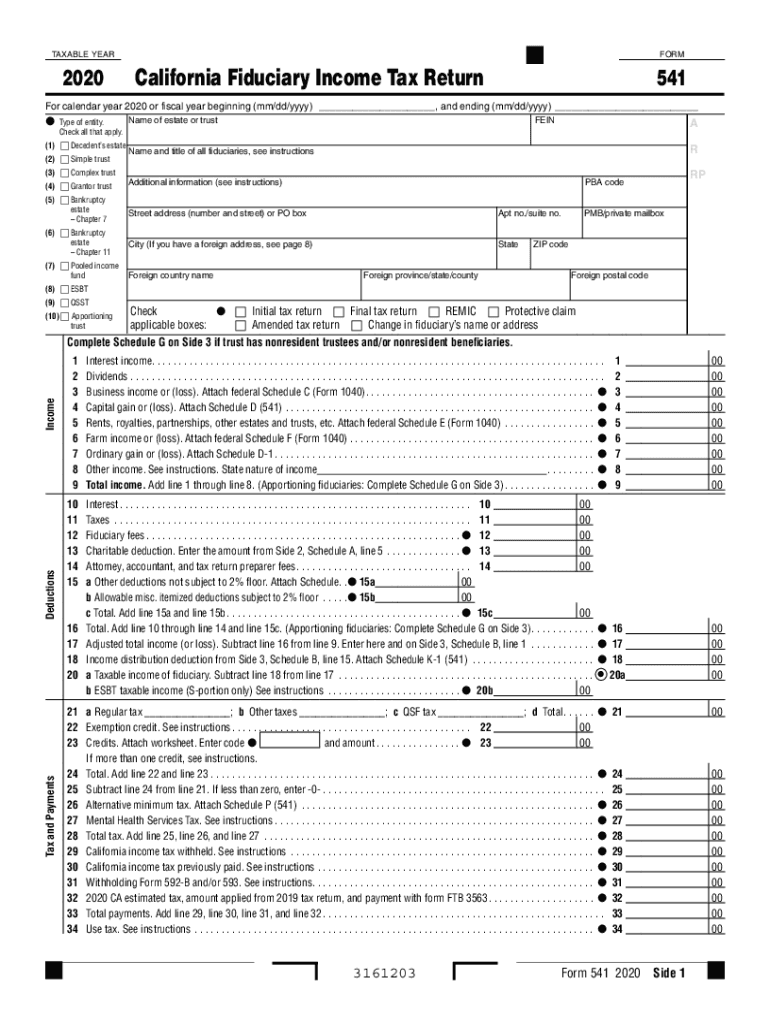

Form 541 Instructions - 2021 instructions for form 541 fiduciary income 541 tax booklet revised: Part i fiduciary’s share of alternative. 08/2023 related content request printable pdf of this document There is imposed an income tax for each taxable year upon the louisiana taxable. Special rule for certain revocable trusts. Your name, address, and tax identification. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). California fiduciary income tax return. Form 941 part 1, lines 1 through 15. California fiduciary income tax return. 2 schedule a charitable deduction. 08/2023 related content request printable pdf of this document There is imposed an income tax for each taxable year upon the louisiana taxable. Web instructions for form 541. There is imposed an income tax for each taxable year upon the louisiana taxable. Web correction to the instructions for form 941 (rev. 2021 instructions for form 541 fiduciary income 541 tax booklet revised: Note, that the trust will be required to file a california form 541. Web we last updated the california fiduciary income tax return in february 2023,. Attach this schedule to form 541. Web california fiduciary income tax return. Special rule for certain revocable trusts. Prompt audit request under california revenue and taxation code (r&tc) section. For calendar year 2022 or fiscal year beginning (mm/dd/yyyy) _____________________, and ending (mm/dd/yyyy). Web in sum, $75,000 of the trust's income is allocated to california under the apportionment formula. Who must file a return. 1041 (2021) form 1041 (2021) page. Web for paperwork reduction act notice, see the separate instructions. Who must file a return. 1041 (2021) form 1041 (2021) page. Web instructions for form 541. For purposes of column (a), if the ale member offered. Web schedule p (541) 2022. Form 541, california fiduciary income tax return schedule d (541),. Form 941 part 1, lines 1 through 15. There is imposed an income tax for each taxable year upon the louisiana taxable. Note, that the trust will be required to file a california form 541. Louisiana revised statute (r.s.) 47:162 provides that. There is imposed an income tax for each taxable year upon the louisiana taxable. Special rule for certain revocable trusts. Form 541, california fiduciary income tax return schedule d (541),. 2021 instructions for form 541 fiduciary income 541 tax booklet revised: Web for paperwork reduction act notice, see the separate instructions. California fiduciary income tax return. Web california fiduciary income tax return. 1041 (2021) form 1041 (2021) page. Web instructions for form 541. Form 941 part 1, lines 1 through 15. There is imposed an income tax for each taxable year upon the louisiana taxable. Form 941 part 1, lines 1 through 15. Who must file a return. There is imposed an income tax for each taxable year upon the louisiana taxable. Louisiana revised statute (r.s.) 47:162 provides that. 2021 instructions for form 541 fiduciary income 541 tax booklet revised: Web we last updated the california fiduciary income tax return in february 2023, so this is the latest version of form 541, fully updated for tax year 2022. 2021 instructions for form 541 fiduciary income 541 tax booklet revised: Web reporting instructions for more information. Part i fiduciary’s share of alternative. For calendar year 2022 or fiscal year beginning (mm/dd/yyyy). Web correction to the instructions for form 941 (rev. Web schedule p (541) 2022. Who must file a return. Web we last updated the california fiduciary income tax return in february 2023, so this is the latest version of form 541, fully updated for tax year 2022. There is imposed an income tax for each taxable year upon the louisiana taxable. You can download or print. Prompt audit request under california revenue and taxation code (r&tc) section. Who must file a return. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). California fiduciary income tax return. Web in sum, $75,000 of the trust's income is allocated to california under the apportionment formula. 08/2023 related content request printable pdf of this document Web although the california fiduciary income tax return (form 541) and instructions do address the throwback tax, the form and instructions do not fully determine the. Your name, address, and tax identification. Web for paperwork reduction act notice, see the separate instructions. There is imposed an income tax for each taxable year upon the louisiana taxable. Part i fiduciary’s share of alternative. Note, that the trust will be required to file a california form 541. Louisiana revised statute (r.s.) 47:162 provides that. Special rule for certain revocable trusts.Instructions For Form 541Qft California Tax Return For

Ca Form 541 Fill Out and Sign Printable PDF Template signNow

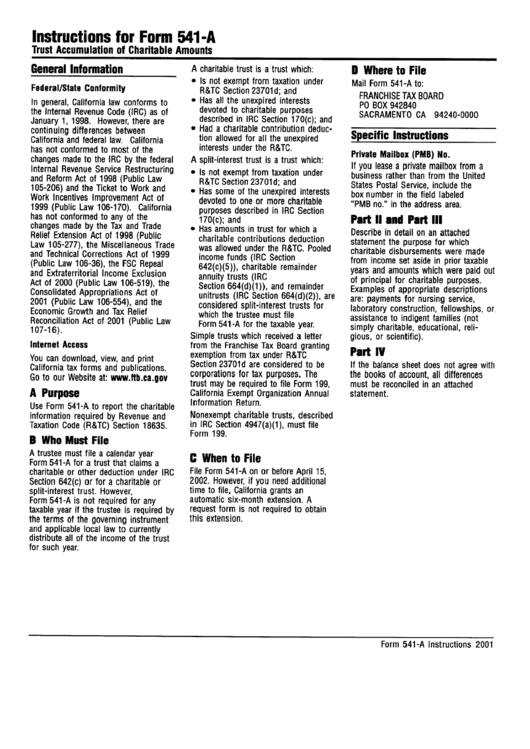

Form 541A Instructions 2001 printable pdf download

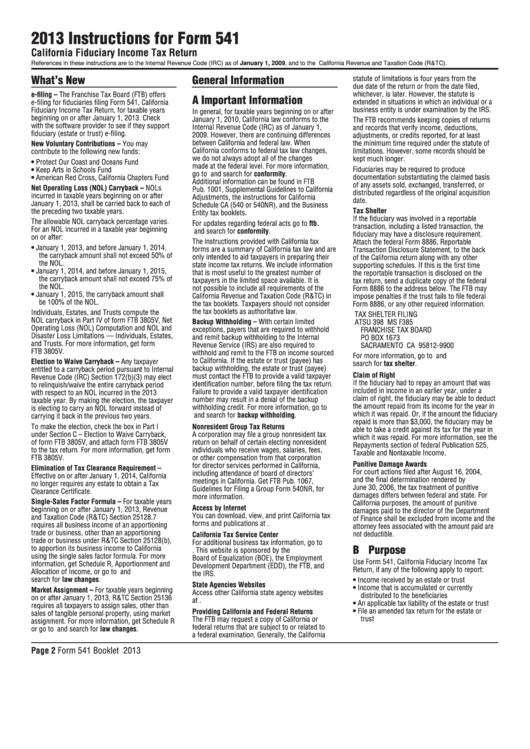

Instructions For Form 541 California Fiduciary Tax Return

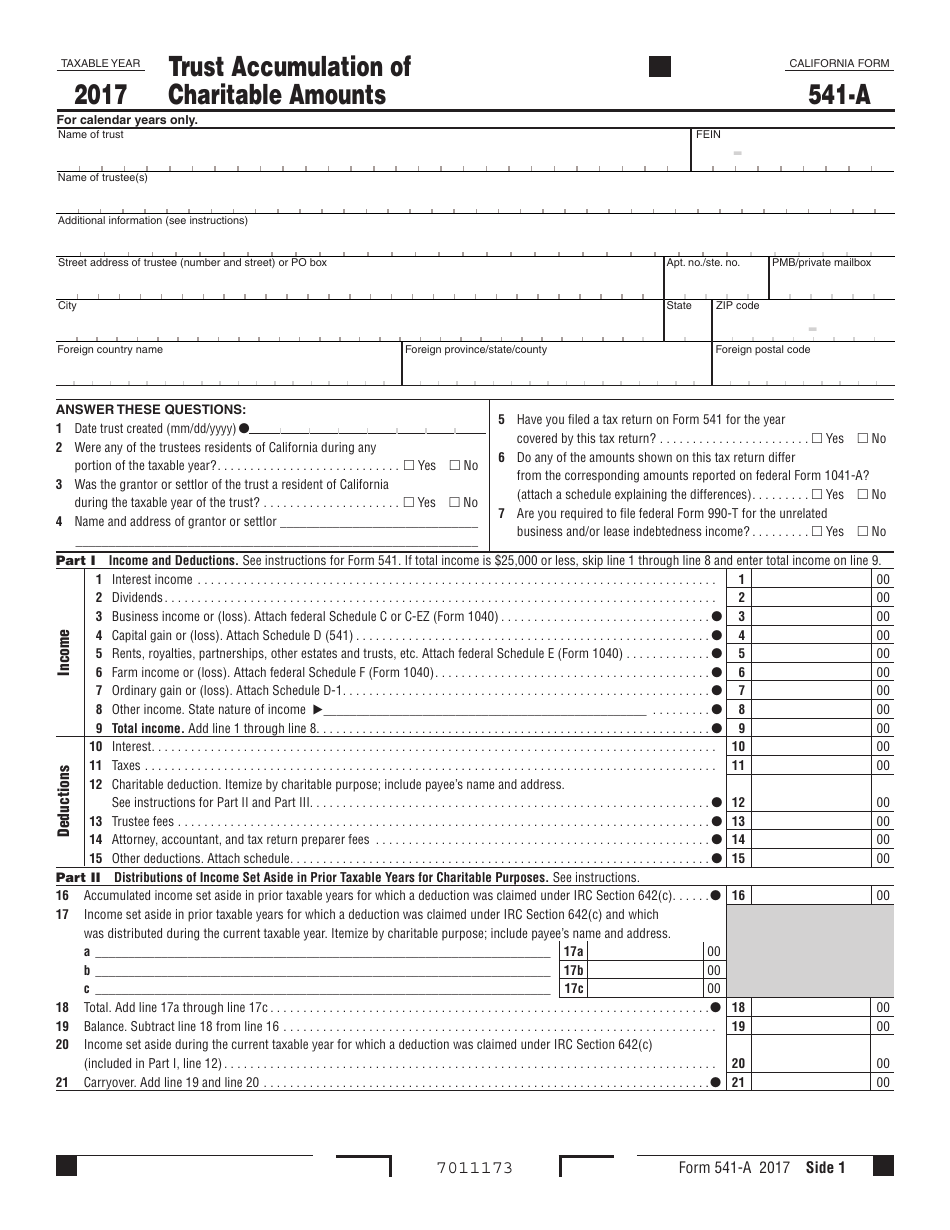

Form 541A 2017 Fill Out, Sign Online and Download Printable PDF

Instructions For Schedule K1 (541) Beneficiary'S Share Of

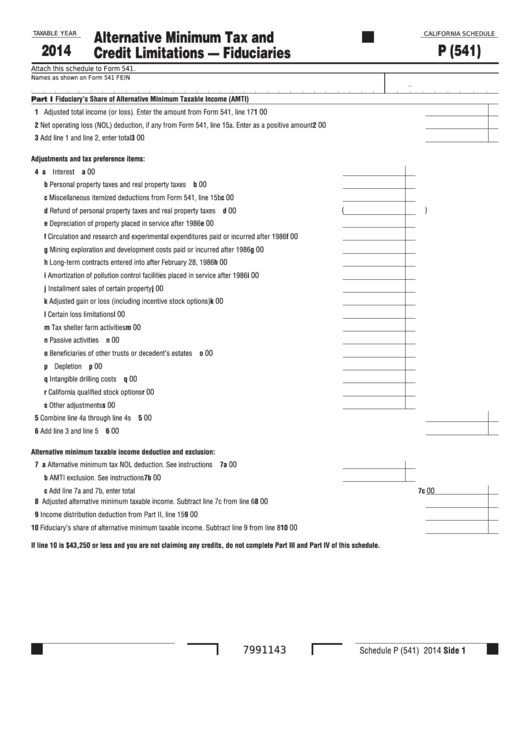

Fillable California Schedule P (541) Attach To Form 541 Alternative

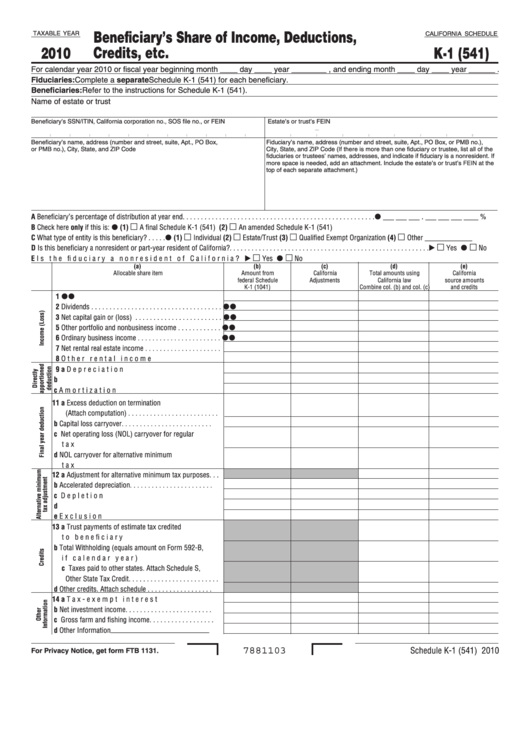

Fillable California Schedule K1 (541) Beneficiary'S Share Of

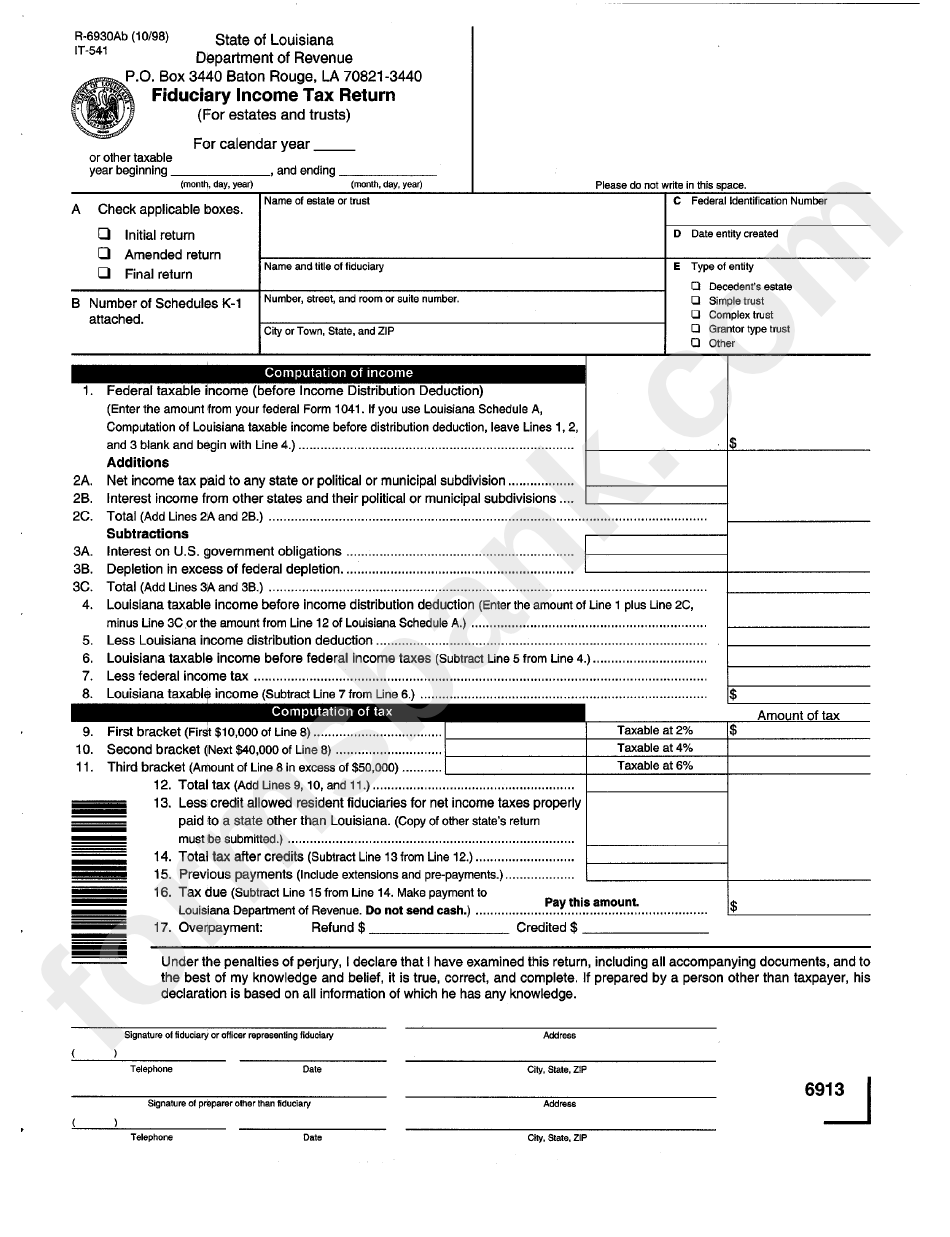

Fillable Form It541 Louisiana Fiduciary Tax Return printable

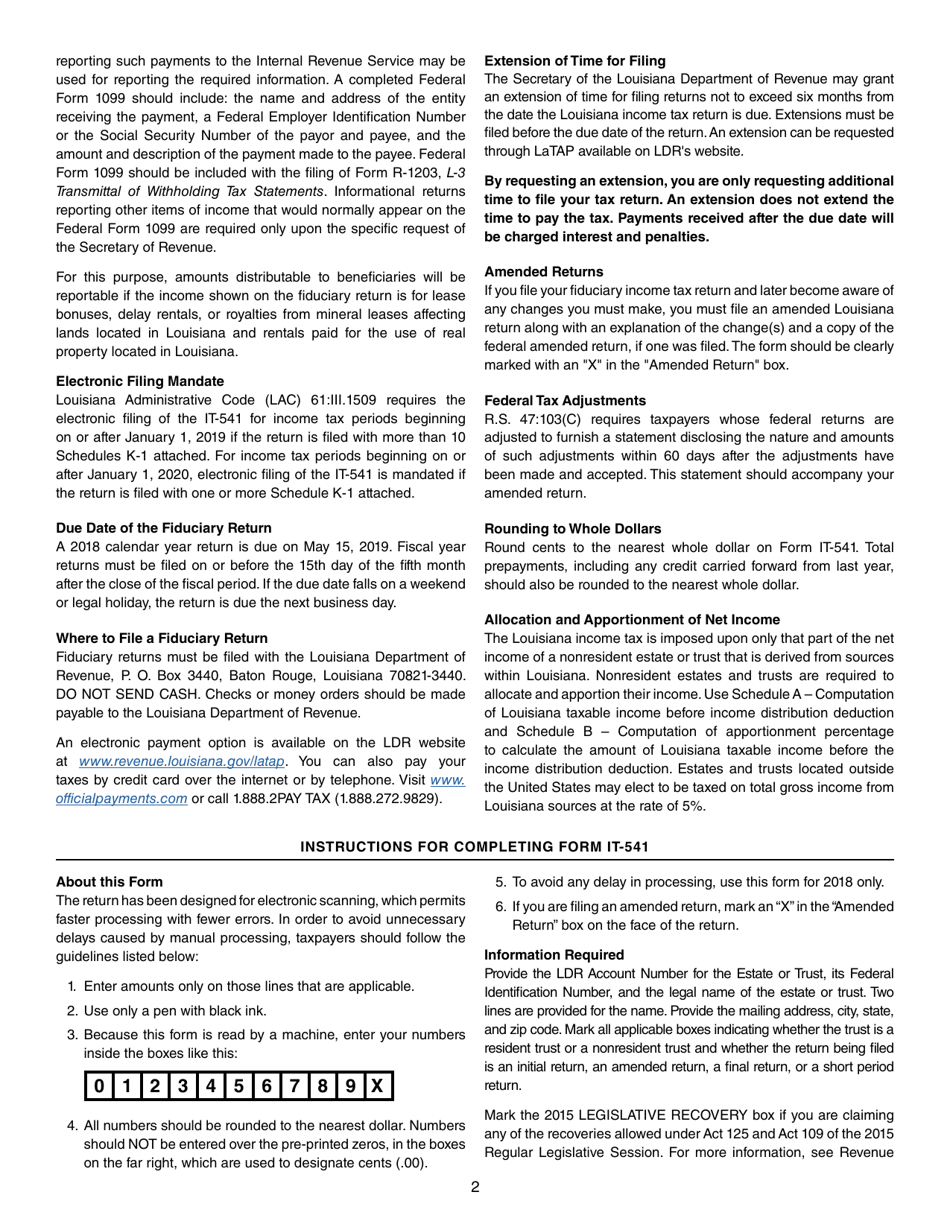

Download Instructions for Form IT541 Fiduciary Tax Return PDF

Related Post: