If On The 1040Ez Form The Amount On Line 10

If On The 1040Ez Form The Amount On Line 10 - Web if the amount of the tax liability exceeds the payments made, the amount owed appears in the amount you owe section of the form 1040. Rules if you do not have a qualifying child if you have a. Web before recent tax reforms, you could file with form 1040ez if: Your filing status was single or married filing jointly you had taxable income of less than $100,000. Enclose, but do not attach, any payment. However, not all taxpayers are eligible. For paperwork reduction act notice, see your tax return instructions. Web the applicable box(es) below and enter the amount from the worksheet on back. Web your taxable income must be under $100,000. Web your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Web before recent tax reforms, you could file with form 1040ez if: Your filing status was single or married filing jointly you had taxable income of less than $100,000. Subtract line 24 from line 33. Web through q2 2023, the state, territorial, and. Web the form 1040ez no longer exists for use by taxpayers, but previous ez filers may still qualify for a “simple return.”. Web if the amount of the tax liability exceeds the payments made, the amount owed appears in the amount you owe section of the form 1040. Subtract line 24 from line 33. However, not all taxpayers are eligible.. Not owe any taxes or get a refund. Web through q2 2023, the state, territorial, and tribal recipients of haf have expended over $5.5 billion to assist homeowners, a 32% increase from q1 2023. The irs and treasury department attempted to simplify the. Line 11 is a manual. Rules if you do not have a qualifying child if you have. If on the 1040ez form, the amount on line 10 is greater than the amount on line 11 in the payments, credits, and tax section shown below, the taxpayer. Combine lines 1 through 7 and 9. Ad discover helpful information and resources on taxes from aarp. Web your tax return amount is, in general, based on line 24 (total tax. Your filing status was single or married filing jointly you had taxable income of less than $100,000. Use this form to request a monthly installment plan if. Ad discover helpful information and resources on taxes from aarp. Get ready for tax season deadlines by completing any required tax forms today. Web if on the 1040ez form, the amount on line. Web line 10 calculates, adding lines 1 through 7 and line 9. 1 wages, salaries, and tips. Web rule 10—you cannot be a qualifying child of another taxpayer child of person not required to file a return. The 1040ez is a simplified form used by the irs for income taxpayers that do not require the complexity of the full 1040. By the end of the tax season of 2021, the irs expects that at least 160 million individual tax returns will have. Line 11 is a manual. Web updated for tax year 2017 • december 1, 2022 9:44 am overview citizens or residents of the united states can file a tax return on form 1040, 1040a or 1040ez. Rules if. Ad access irs tax forms. Web rule 10—you cannot be a qualifying child of another taxpayer child of person not required to file a return. Web if on the 1040ez form, the amount on line 10 is greater than the amount on line 11 in the payments, credits, and tax section shown below, the taxpayer will: Ad discover helpful information. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key details about the direct file pilot for the 2024. Web before recent tax reforms, you could file with form 1040ez if: Web if the amount of the tax liability exceeds the payments made, the amount owed appears in the amount you owe section. If the amount on line 33 is larger. Web 2022 department of the treasury—internal revenue service omb no. Not owe any taxes or get a refund. Web rule 10—you cannot be a qualifying child of another taxpayer child of person not required to file a return. Get ready for tax season deadlines by completing any required tax forms today. Rules if you do not have a qualifying child if you have a. Combine lines 1 through 7 and 9. Web your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). The irs and treasury department attempted to simplify the. Use this form to request a monthly installment plan if. If the amount on line 33 is larger. Line 11 is a manual. Web the form 1040ez no longer exists for use by taxpayers, but previous ez filers may still qualify for a “simple return.”. While it’s possible you could make a tad over $100,000 (since you subtract your standard tax deduction and personal. Get ready for tax season deadlines by completing any required tax forms today. The 1040ez is a simplified form used by the irs for income taxpayers that do not require the complexity of the full 1040 tax form. You spouse if no one can claim you (or your spouse if a joint return), enter $10,150 if single;. Ad discover helpful information and resources on taxes from aarp. Explore the collection of software at amazon & take your skills to the next level. Subtract line 24 from line 33. Complete, edit or print tax forms instantly. Web 2022 department of the treasury—internal revenue service omb no. Web through q2 2023, the state, territorial, and tribal recipients of haf have expended over $5.5 billion to assist homeowners, a 32% increase from q1 2023. For paperwork reduction act notice, see your tax return instructions. By the end of the tax season of 2021, the irs expects that at least 160 million individual tax returns will have.How to Fill Out a US 1040EZ Tax Return (with Form) wikiHow

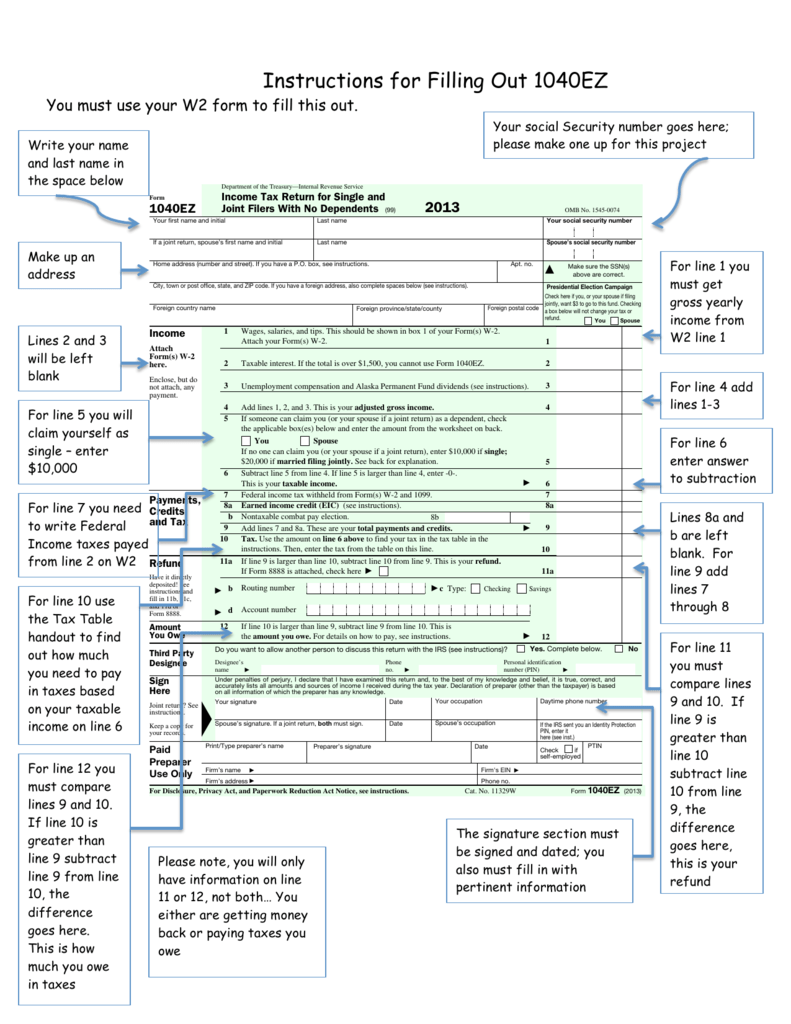

Instructions for Filling Out 1040EZ

Tax Form 1040ez Line 10 Universal Network

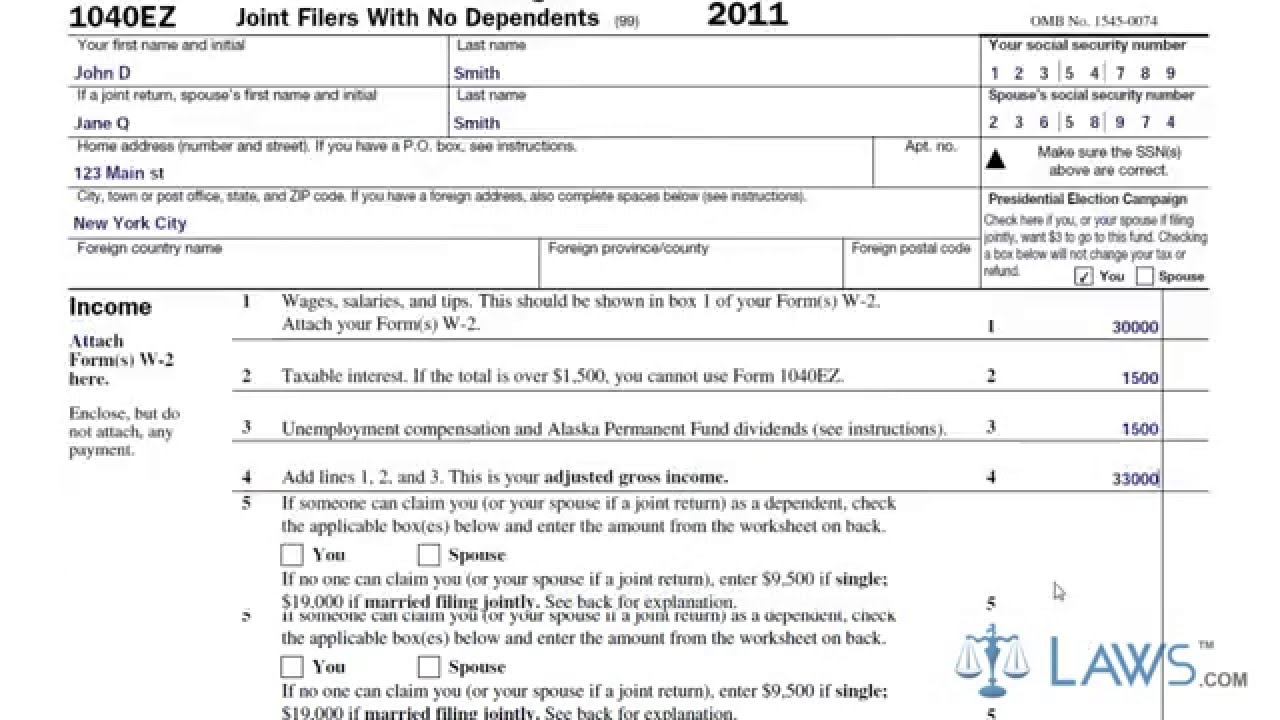

How to Fill the Form 1040EZ Tax Return YouTube

How to Fill Out a US 1040EZ Tax Return (with Form) wikiHow

How to Fill Out a US 1040EZ Tax Return (with Form) wikiHow

How to Fill Out a US 1040EZ Tax Return (with Form) wikiHow

1040ez line 10 instructions

What is a 1040EZ Form and How to Use It

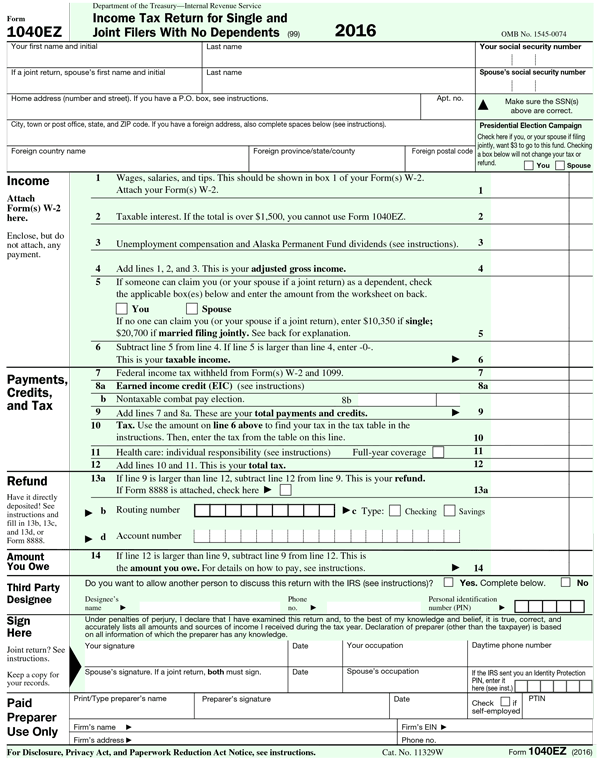

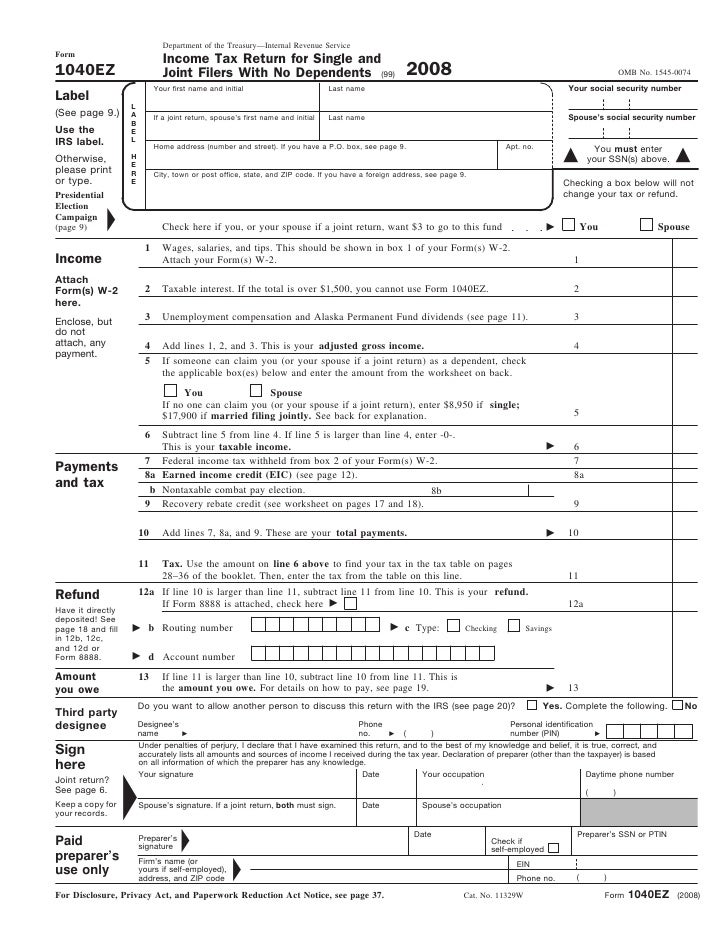

Form 1040EZ For filers with no dependents and taxable less

Related Post: