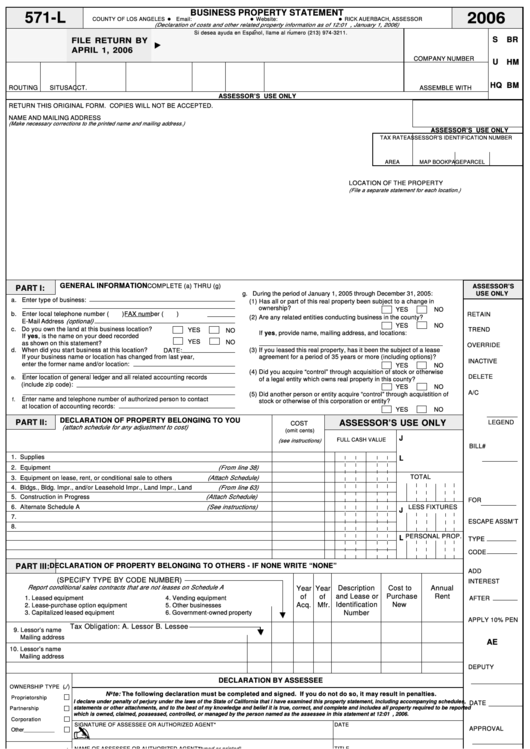

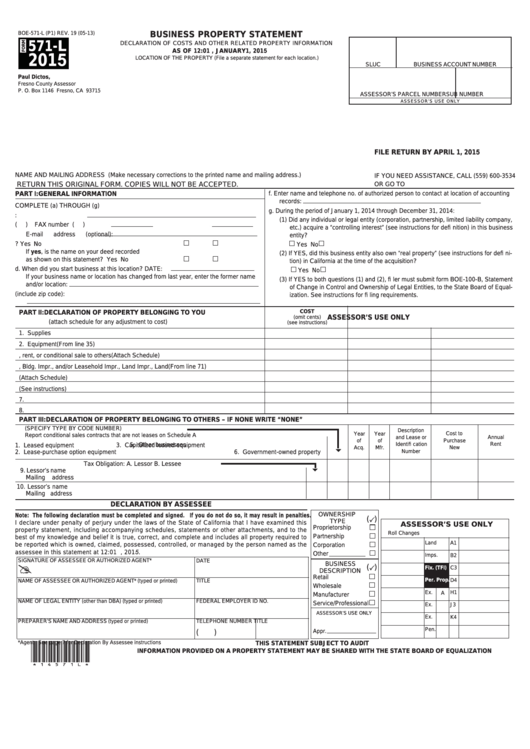

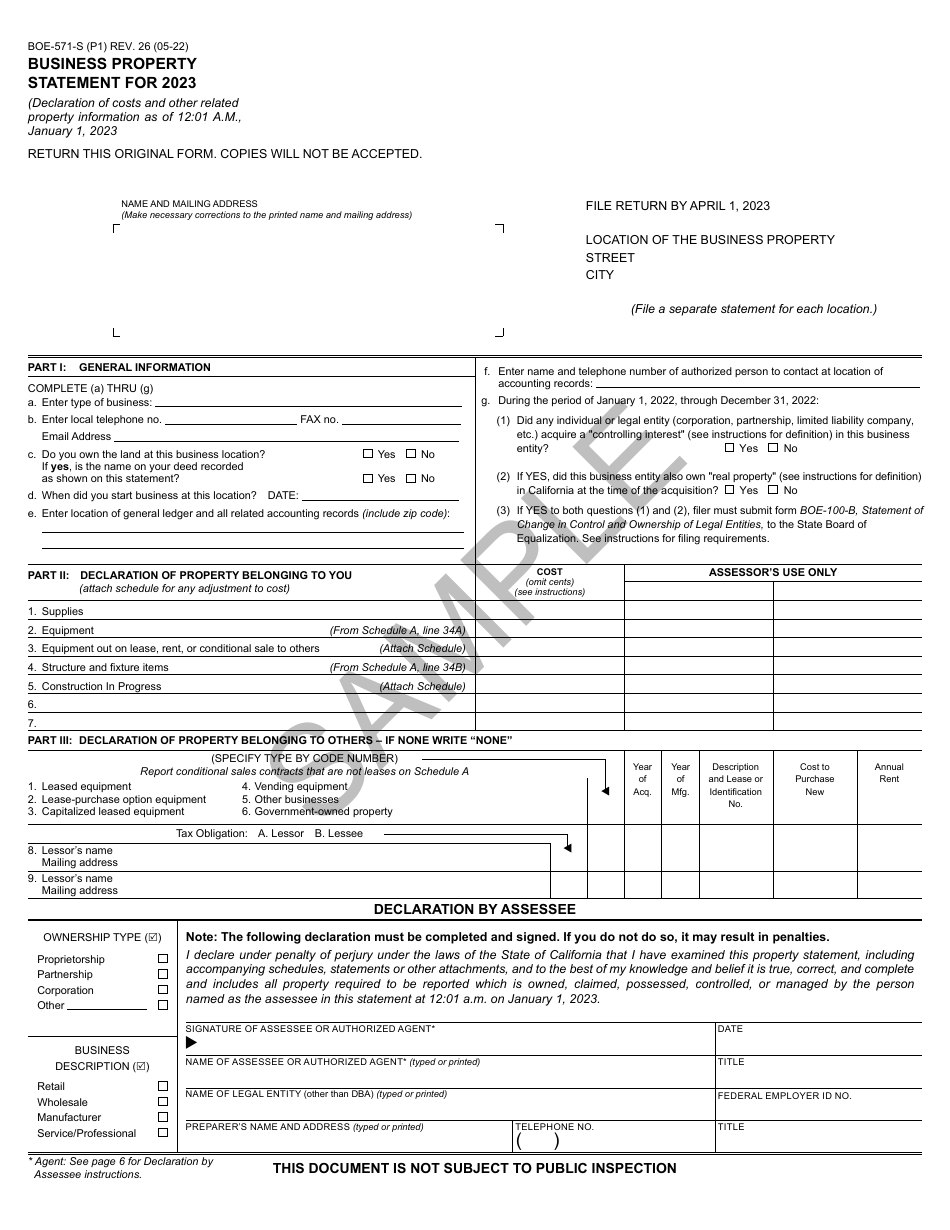

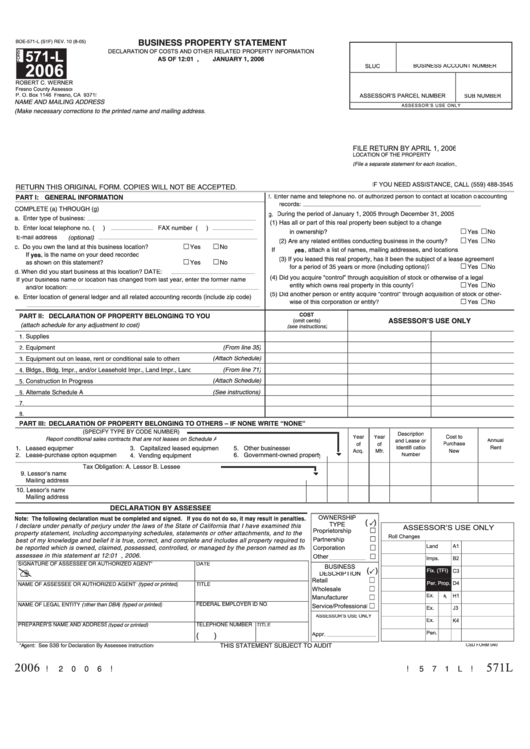

Form 571 L Business Property Statement

Form 571 L Business Property Statement - Filing the business property statement online. Find your assigned district office by searching your. This government document is issued by assessor/recorder/county clerk for use in san diego county, ca. What is business personal property? Who must file a bps? Instructions for the arizona business property statement which is processed by the county assessor's office. Overview for filing a business property statement. Web property tax forms. You are required to report the total cost of all. You can filter the results to a particular category or properties and services using the filter by category. What is the “lien date” for property tax purposes? Who must file a bps? Ad manage all your business expenses in one place with quickbooks®. Instructions for the arizona business property statement which is processed by the county assessor's office. Web business property statement and filing requirements. Web file a business property statement, form dor 82520, or an agricultural business property statement, form dor 82520a, with the county assessor each year. You can filter the results to a particular category or properties and services using the filter by category. Web business property statement and filing requirements. (declaration of costs and other related property information as of 12:01. Web property tax forms. This government document is issued by assessor/recorder/county clerk for use in san diego county, ca. You are required to report the total cost of all. Who must file a bps? How do i know if my business is located in san. Web business property statement and filing requirements. Web property tax forms. Who must file a bps? Find your assigned district office by searching your. 87% of customers say quickbooks® simplifies their business finances. You are required to report the total cost of all. Web business property statement (form. What is business personal property? Web file a business property statement, form dor 82520, or an agricultural business property statement, form dor 82520a, with the county assessor each year. 87% of customers say quickbooks® simplifies their business finances. Web file a business property statement, form dor 82520, or an agricultural business property statement, form dor 82520a, with the county assessor each year. You are required to report the total cost of all. 2023 busi ness proper ty statement. Instructions for the arizona business property statement which is processed by the county assessor's office. Ad manage all your business. 87% of customers say quickbooks® simplifies their business finances. Please call our office at. Ad manage all your business expenses in one place with quickbooks®. Web file a business property statement, form dor 82520, or an agricultural business property statement, form dor 82520a, with the county assessor each year. 2023 busi ness proper ty statement. You can filter the results to a particular category or properties and services using the filter by category. How do i know if my business is located in san. Overview for filing a business property statement. Web business property statement and filing requirements. Find your assigned district office by searching your. Web property tax forms. What is the “lien date” for property tax purposes? How do i know if my business is located in san. Instructions for the arizona business property statement which is processed by the county assessor's office. Who must file a bps? Ad manage all your business expenses in one place with quickbooks®. Please call our office at. 2023 busi ness proper ty statement. Web property tax forms. Find your assigned district office by searching your. Find your assigned district office by searching your. Web find answers to the a list of common questions other users have asked. Filing the business property statement online. Ad manage all your business expenses in one place with quickbooks®. Web file a business property statement, form dor 82520, or an agricultural business property statement, form dor 82520a, with the county assessor each year. You are required to report the total cost of all. This government document is issued by assessor/recorder/county clerk for use in san diego county, ca. Web business property statement (form. Who must file a bps? 87% of customers say quickbooks® simplifies their business finances. (declaration of costs and other related property information as of 12:01 a.m., january 1,. Web property tax forms. What is the “lien date” for property tax purposes? How do i know if my business is located in san. Instructions for the arizona business property statement which is processed by the county assessor's office. Overview for filing a business property statement. Ad manage all your business expenses in one place with quickbooks®. Web what is a form 571l business property statement (bps)? Web business property statement and filing requirements. What is business personal property?Form 571L Business Property Statement Los Angeles County Assessor

Fillable Form 571L Business Property Statement 2015 printable pdf

Boe 571 l p1 rev 17 02 11 2012 form Fill out & sign online DocHub

Form BOE571S Download Printable PDF or Fill Online Business Property

Form BOE571S Download Printable PDF or Fill Online Business Property

Form Boe571L Business Property Statement 2006 printable pdf download

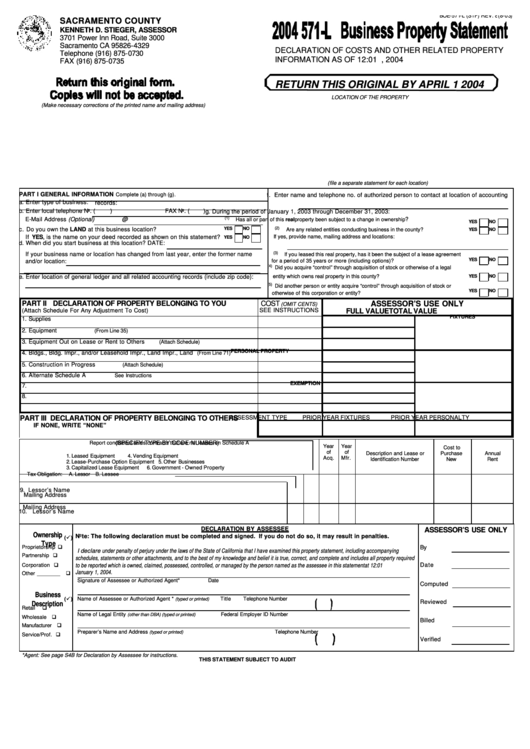

Form Boe571L Business Property Statement 2004 printable pdf download

Fillable Online 571L 2019 BUSINESS PROPERTY STATEMENT Fax Email Print

Santa barbara county assessor business property statement form 571 l

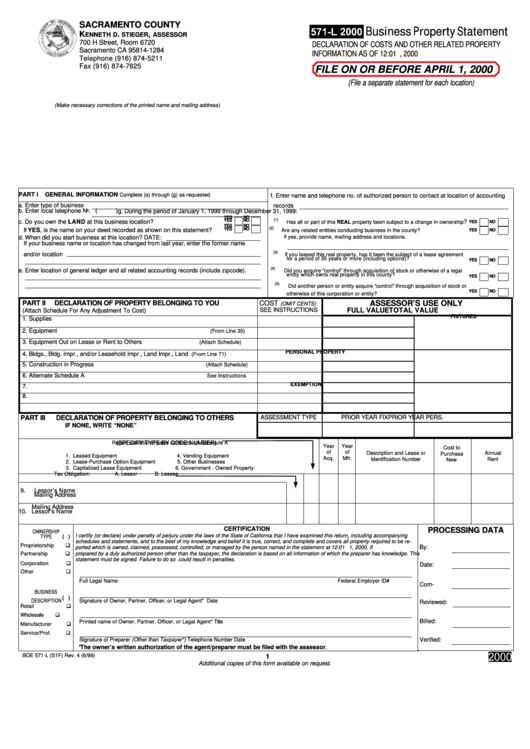

Form 571L Business Property Statement 2000 printable pdf download

Related Post: