Form Ct-8822

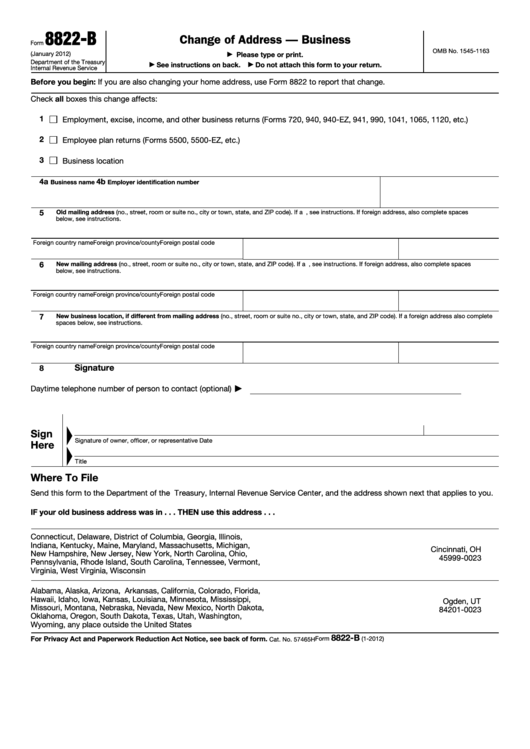

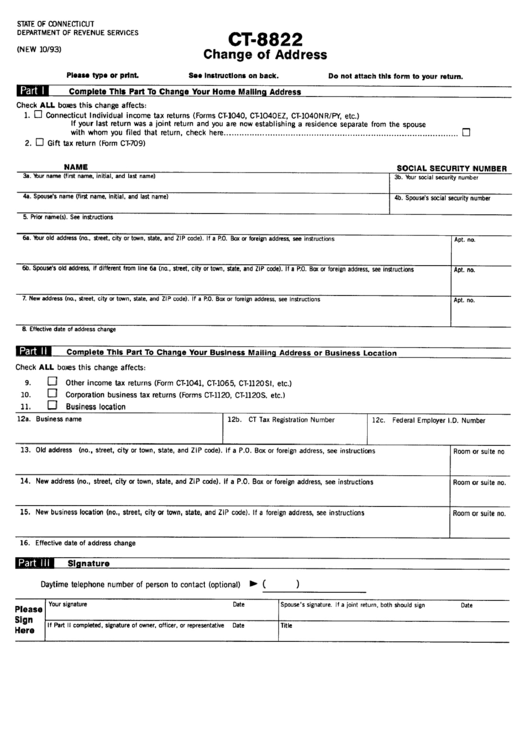

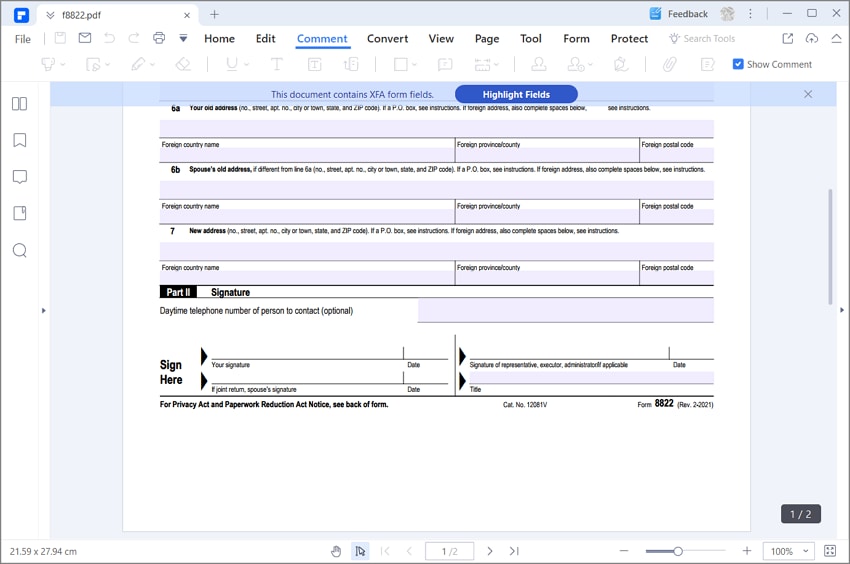

Form Ct-8822 - Web page last reviewed or updated: Easily sign the form with your finger. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Visit the drs website at. Information about form 8822, change of address, including recent updates, related forms and instructions on how to file. Web to file tax returns, pay connecticut tax responsibilities, and update account information, such as a change of address, electronically. The ct 8822c form isn’t an exception. Others who may sign anyone with a signed power of attorney on file may sign on behalf of the principal officer (including attorneys, accountants, and enrolled agents). What makes the ct 8822c form legally valid? Open form follow the instructions. Send filled & signed form or save. What makes the ct 8822c form legally valid? Easily sign the form with your finger. Open form follow the instructions. Information about form 8822, change of address, including recent updates, related forms and instructions on how to file. Send filled & signed form or save. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Open form follow the instructions. Complete in blue or black ink only. 1380 ct tax forms and templates are collected for any of your needs. Check the appropriate box and enter below any change to the corporation’s physical location or mailing address. Open form follow the instructions. Do not attach this form to your return. Complete in blue or black ink only. Others who may sign anyone with a signed power of attorney on file may sign on behalf of the principal officer (including attorneys,. What makes the ct 8822c form legally valid? The following tips can help you complete fillable ct 8822 quickly and easily: This form can be filed electronically; Easily sign the form with your finger. As the world ditches office work, the execution of paperwork more and more takes place online. Web to file tax returns, pay connecticut tax responsibilities, and update account information, such as a change of address, electronically. What makes the ct 8822c form legally valid? This form can be filed electronically; Check all boxes this change affects: Easily sign the form with your finger. Do not attach this form to your return. Check all boxes this change affects: 1380 ct tax forms and templates are collected for any of your needs. Web page last reviewed or updated: Complete in blue or black ink only. Complete ct form 8822c easily on any device. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. If this change affects the mailing address of your children The ct 8822c form isn’t an exception. You can print other connecticut tax forms here. Information about form 8822 is available at www.irs.gov/form8822. Check the appropriate box and enter below any change to the corporation's physical location or mailing address. Do not attach this form to your return. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Complete ct form 8822c easily on. Send filled & signed form or save. Do not attach this form to your return. 1380 ct tax forms and templates are collected for any of your needs. We are not affiliated with any brand or entity on this form. This form can be filed electronically; Complete in blue or black ink only. Open form follow the instructions. 1380 ct tax forms and templates are collected for any of your needs. Information about form 8822 is available at www.irs.gov/form8822. Send filled & signed form or save. Easily sign the form with your finger. Web page last reviewed or updated: Web handy tips for filling out form ct 8822 fillable online. Visit the drs website at. Information about form 8822 is available at www.irs.gov/form8822. Check the appropriate box and enter below any change to the corporation’s physical location or mailing address. Check all boxes this change affects: You can print other connecticut tax forms here. Others who may sign anyone with a signed power of attorney on file may sign on behalf of the principal officer (including attorneys, accountants, and enrolled agents). Do not attach this form to your return. If this change affects the mailing address of your children Complete in blue or black ink only. Open form follow the instructions. Send filled & signed form or save. Web use a ct form 8822c template to make your document workflow more streamlined. Form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Printing and scanning is no longer the best way to manage documents. What makes the ct 8822c form legally valid? This form can be filed electronically; The following tips can help you complete fillable ct 8822 quickly and easily:8822 B Fillable Form Printable Forms Free Online

Form Ct Form Fill Online, Printable, Fillable, Blank pdfFiller

Form 8822 (Rev. October 2015) Internal Revenue Service Irs Tax

Fillable Online Form Ct 8822 Instructions Fax Email Print pdfFiller

Form CT8822 Download Printable PDF or Fill Online Change of Address

Form 8822 B 2019 Fillable and Editable PDF Template

Form 8822 Change of Address (2014) Free Download

Fillable Form Ct8822 Change Of Address Connecticut Department Of

IRS Form 8822 The Best Way to Fill it

FORM 8822 AUTOFILL PDF

Related Post: