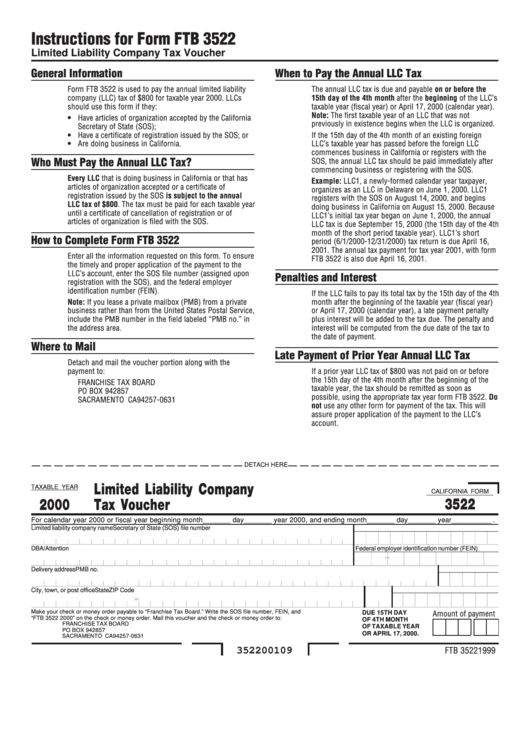

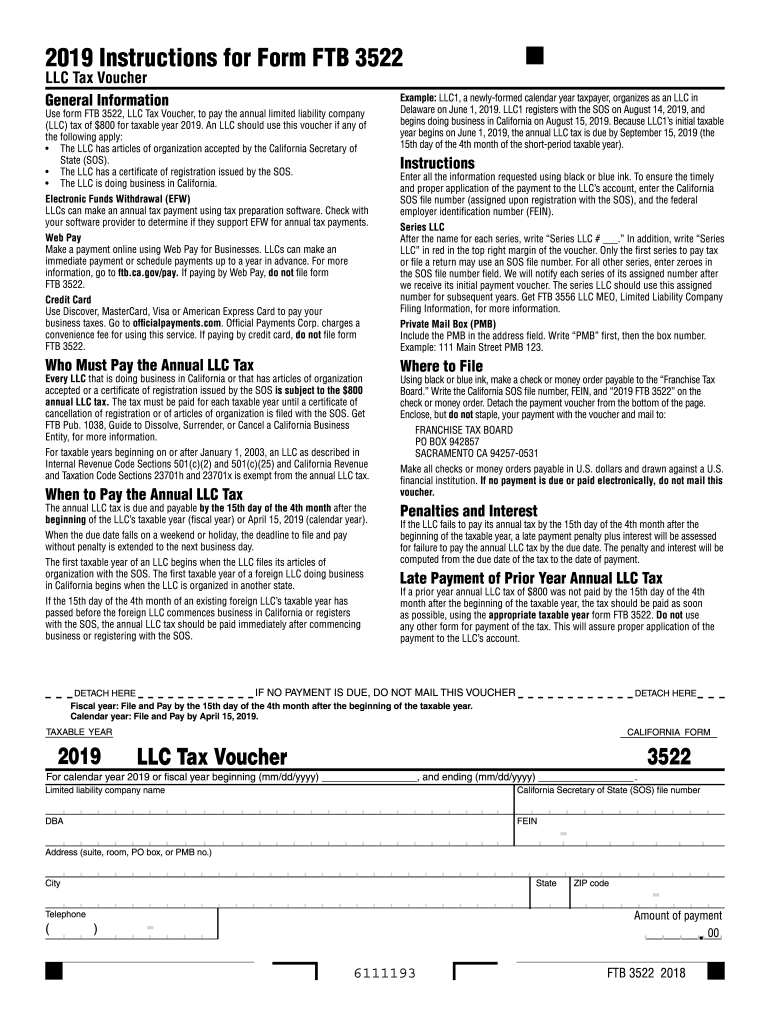

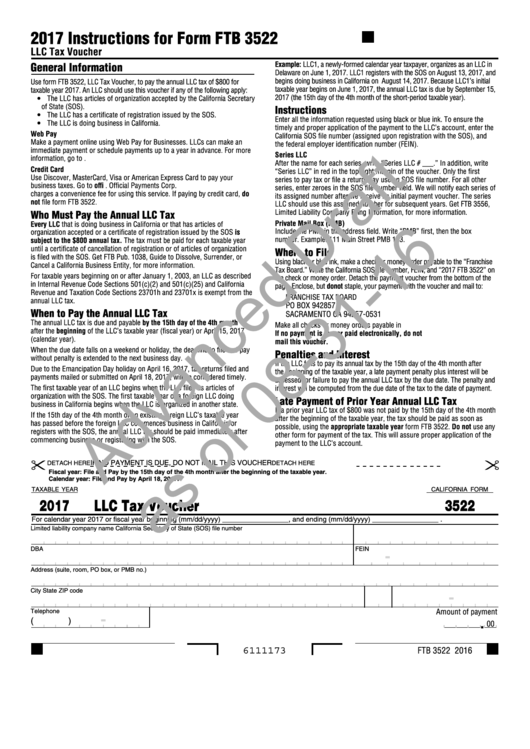

Annual Tax Payment Form 3522

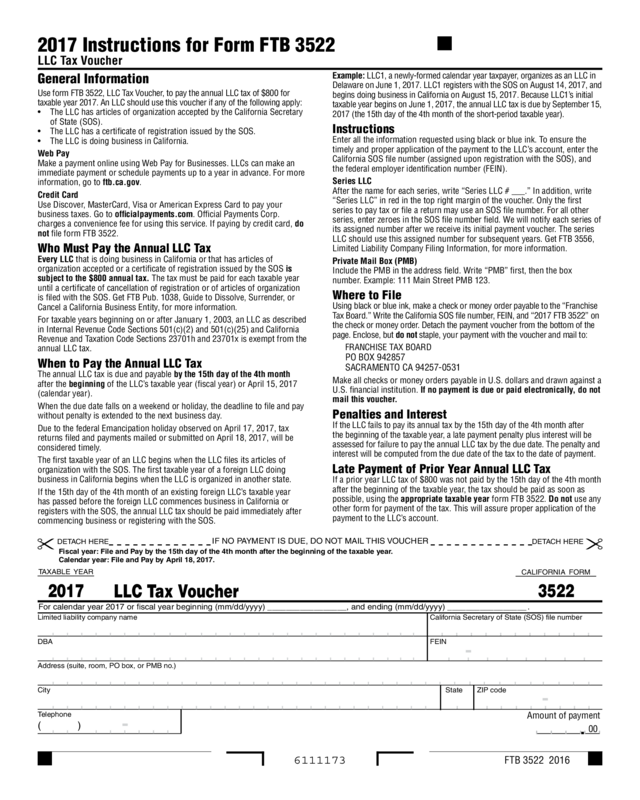

Annual Tax Payment Form 3522 - If the due date falls on a weekend or holiday, you have until the next. Llcs protects its members against personal liabilities. We will assess a late payment penalty if the limited liability company makes the payment after. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. Individual tax return form 1040 instructions; The 15th day of 3rd month after end of their tax year. Easily sign the form with your finger. An llc should use this. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Ad uslegalforms.com has been visited by 100k+ users in the past month Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. All llcs in the state are required to pay this annual tax. We will assess a late payment penalty if the limited liability company makes the payment after. Web use form ftb 3522, llc tax voucher, to pay the annual llc. If the due date falls on a weekend or holiday, you have until the next. Web use form ftb 3522, llc tax voucher, to pay the annual llc tax of $800 for taxable year 2011. Send filled & signed form or save. Easily sign the form with your finger. Form 3522 is a form used by llcs in california to. All llcs in the state are required to pay this annual tax. You can form an llc to run a business or to hold assets. Llcs protects its members against personal liabilities. Web more about the arizona form 322 tax credit. An llc will be either: The 15th day of 3rd month after end of their tax year. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. Your california llc has to pay annual fees to the state to remain in good standing and be able to do business in california.. Send filled & signed form or. We last updated arizona form 322 in february 2023 from the arizona department of revenue. Web more about the arizona form 322 tax credit. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. .5% penalty of tax unpaid of each. The fees include the following. Individual tax return form 1040 instructions; Your california llc has to pay annual fees to the state to remain in good standing and be able to do business in california. Ad uslegalforms.com has been visited by 100k+ users in the past month Use form ftb 3522, llc tax voucher, to pay the annual limited liability. Llcs protects its members against personal liabilities. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Open form follow the instructions. Ad uslegalforms.com has been visited by 100k+ users in the past month Form 3536 only needs to be filed if your income is. Avoid this penalty if you pay up to 90% of the final arizona taxes. A nonrefundable individual tax credit for fees or cash contributions paid to a public school located in arizona for the support of. Individual tax return form 1040 instructions; Web use form 3522, limited liability company tax voucher to pay the annual tax. Web form 3522 is. Extension based late tax payment penalty: An llc should use this voucher if any of the following. All llcs in the state are required to pay this annual tax. Web every llc that is conducting business or has established or registered to conduct business in california is required to complete and submit form 3522 to the. Your california llc has. Individual tax return form 1040 instructions; .5% penalty of tax unpaid of each month or fraction of month. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021. ★ ★ ★ ★ ★. Web to avoid penalties we can pay the annual llc tax online, or paper file. The owners of an llc are members. An llc should use this. Form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web form 3522 is a california corporate income tax form. Web to avoid penalties we can pay the annual llc tax online, or paper file the 3522 voucher and payment prior to the due date. The fees include the following. Request for taxpayer identification number (tin) and. Avoid this penalty if you pay up to 90% of the final arizona taxes. Get ca ftb 3522 2023. Web what is form 3522? Open form follow the instructions. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. Ad uslegalforms.com has been visited by 100k+ users in the past month Open form follow the instructions. An llc will be either: Web more about the arizona form 322 tax credit. Individual tax return form 1040 instructions; We will assess a late payment penalty if the limited liability company makes the payment after.Form Ftb 3522 Limited Liability Company Tax Voucher 2000 printable

Business CA LLC entity 800 minimum Annual Tax Payment (Form 3522

California Form 3522 ≡ Fill Out Printable PDF Forms Online

Form 3522 Fill Out and Sign Printable PDF Template signNow

Business CA LLC entity 800 minimum Annual Tax Payment (Form 3522

California Form 3522 (Draft) Llc Tax Voucher 2017 printable pdf

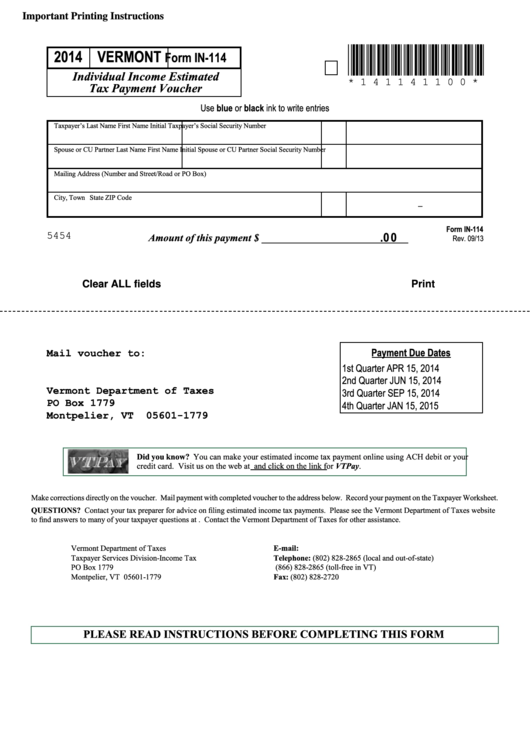

Fillable Form In114 Individual Estimated Tax Payment Voucher

2017 Form 3522 Llc Tax Voucher Edit, Fill, Sign Online Handypdf

2017 Form 3522 Llc Tax Voucher Edit, Fill, Sign Online Handypdf

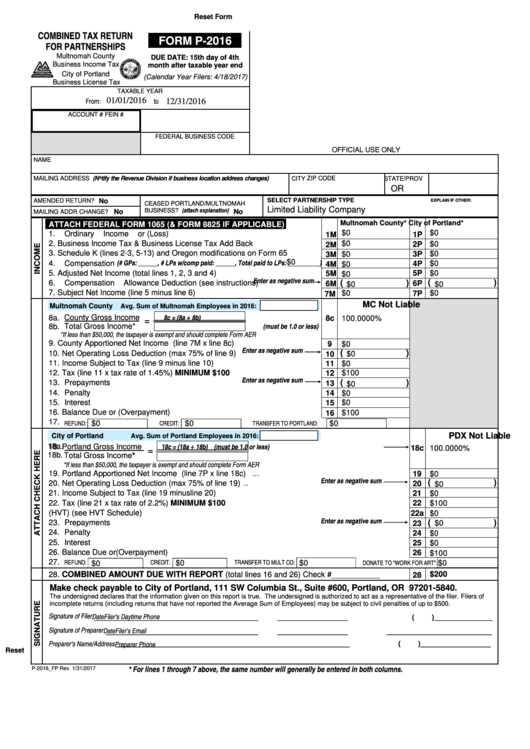

Fillable Form P2016 Combined Tax Return For Partnerships printable

Related Post: