How To Fill Out Form 8606

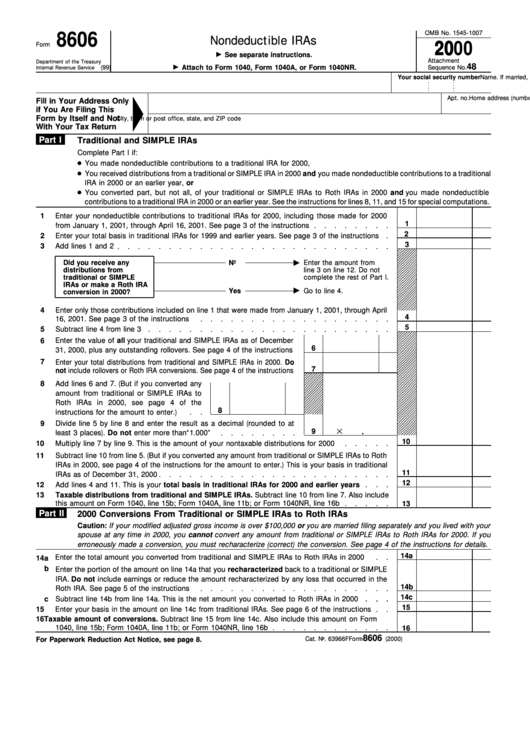

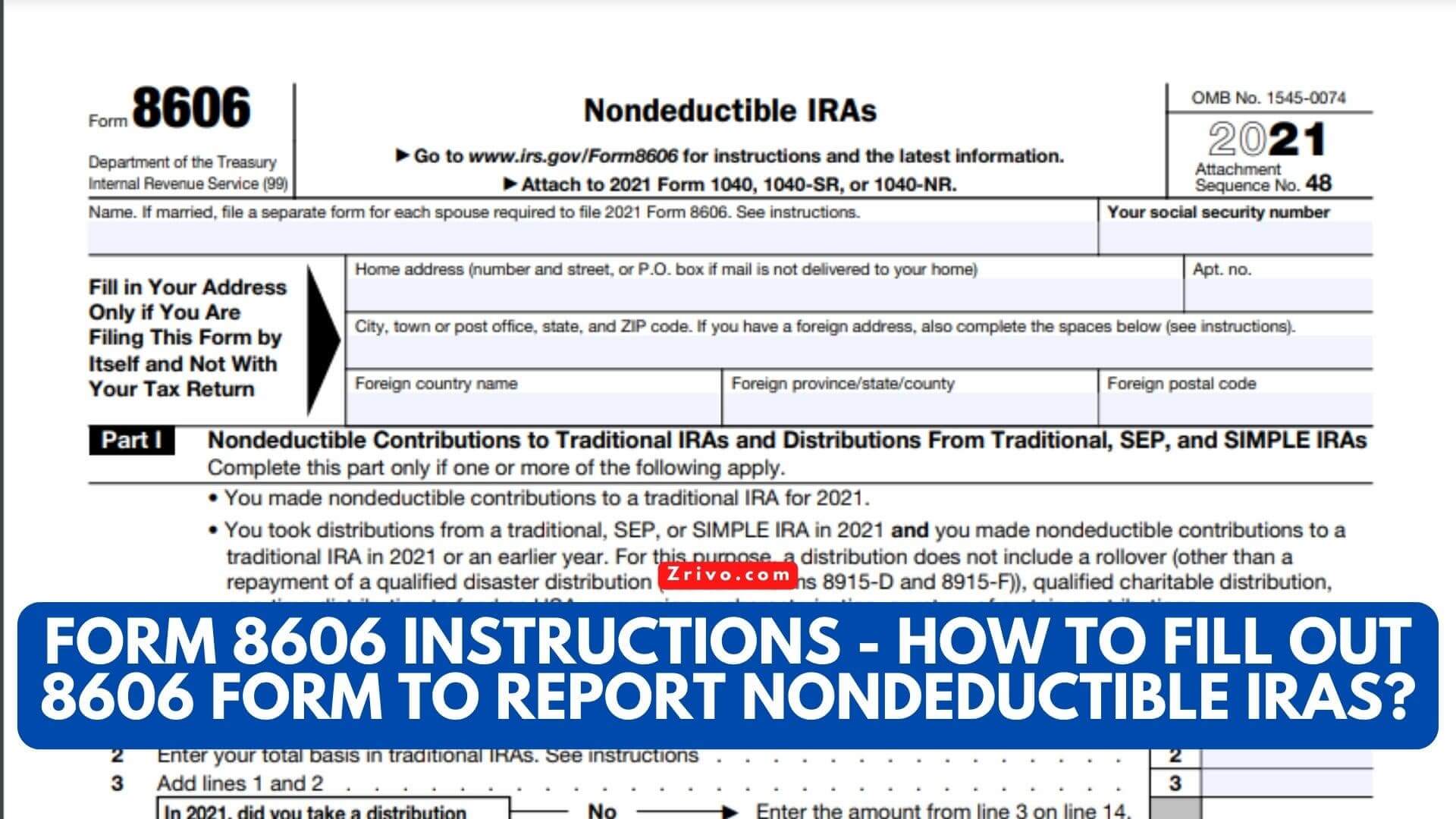

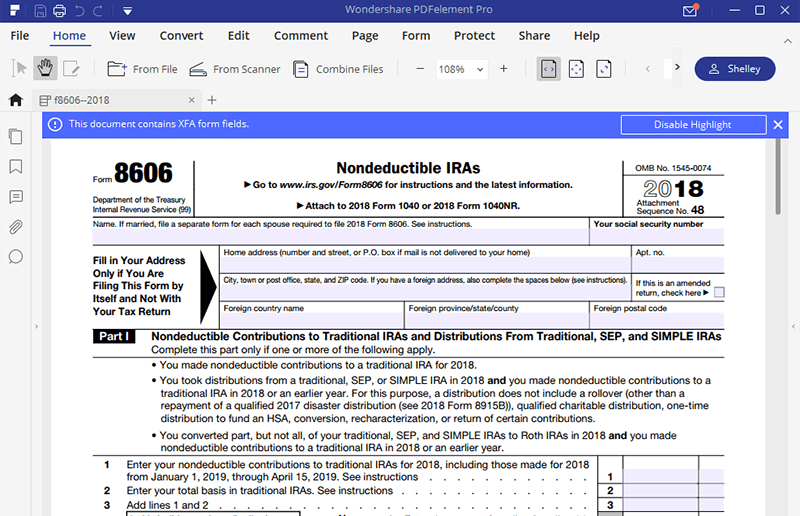

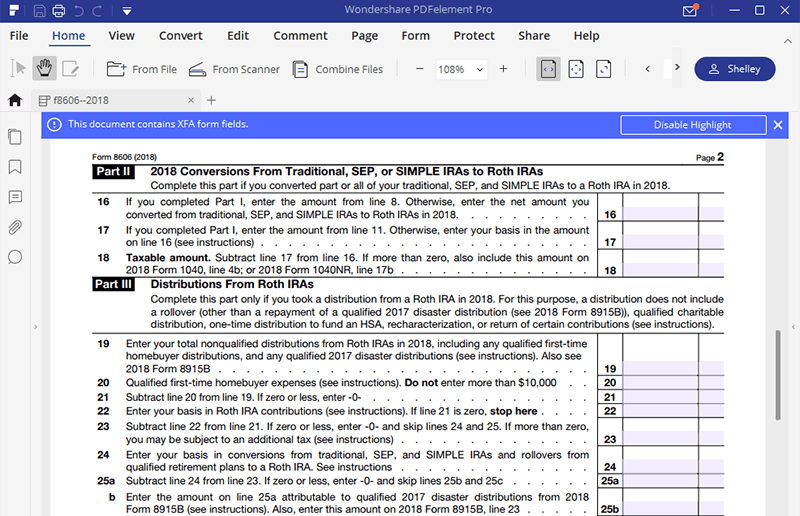

How To Fill Out Form 8606 - We'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any of these on your tax return:. Web first visit the form 8606 entry and complete section one for contributions. Web updated february 22, 2023. Complete, edit or print tax forms instantly. How to file form 8606, step by step. Web report the distributions on 2020 form 8606. The form 8606 is a tax form distributed by the internal revenue service (irs) and used by filers who make nondeductible contributions to an ira. Web 1 best answer. Total basis in traditional iras. As a reminder, this is not tax advice. Select topic search (see attached image) 4. For instructions and the latest information. Tip if you aren’t required to file an income tax return. Web department of the treasury internal revenue service (99) nondeductible iras. Web 1 best answer. Web how to complete form 8606. Tip if you aren’t required to file an income tax return. Follow these steps to enter a roth ira distribution: Web updated february 22, 2023. For instructions and the latest information. Web solved • by turbotax • 2913 • updated 2 weeks ago. Web department of the treasury internal revenue service (99) nondeductible iras. Web how to complete form 8606. For instructions and the latest information. Department of the treasury internal revenue service (99) nondeductible iras. Ad download or email form 8606 & more fillable forms, try for free now! If you aren’t required to file an income tax return but. Select topic search (see attached image) 4. Sign into your account and select your current return. Form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with. We'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any of these on your tax return:. For instructions and the latest information. Web solved • by turbotax • 2913 • updated 2 weeks ago. Web updated february 22, 2023. Department of the treasury internal revenue service (99) nondeductible iras. We'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any of these on your tax return:. Ad download or email form 8606 & more fillable forms, try for free now! Web report the distributions on 2020 form 8606. Here you will complete the following if applicable: This section will give you a layman’s guide to filling. How to file form 8606, step by step. Ad download or email form 8606 & more fillable forms, register and subscribe now! Learn irs rules for reporting data on nondeductible iras on form 8606 in 2. Form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with a basis and. Web first. The form 8606 is a tax form distributed by the internal revenue service (irs) and used by filers who make nondeductible contributions to an ira. Web this article explains how to report a roth ira distribution in part iii of form 8606. Ad download or email form 8606 & more fillable forms, try for free now! Form 8606 is used. If you aren’t required to file an income tax return but. Web report the distributions on 2020 form 8606. Ad download or email form 8606 & more fillable forms, try for free now! Web 1 best answer. As a reminder, this is not tax advice. Here you will complete the following if applicable: Form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with a basis and. Ad download or email form 8606 & more fillable forms, try for free now! For instructions and the latest information. Web solved • by turbotax • 2913 • updated 2. Tip if you aren’t required to file an income tax return. As a reminder, this is not tax advice. Here you will complete the following if applicable: Form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with a basis and. For instructions and the latest information. If you aren’t required to file an income tax return but. For instructions and the latest information. Department of the treasury internal revenue service (99) nondeductible iras. Sign into your account and select your current return. Ad download or email form 8606 & more fillable forms, register and subscribe now! Web report the distributions on 2020 form 8606. Web 1 best answer. Web how to complete form 8606. Web department of the treasury internal revenue service (99) nondeductible iras. Learn irs rules for reporting data on nondeductible iras on form 8606 in 2. Web solved • by turbotax • 2913 • updated 2 weeks ago. The form 8606 is a tax form distributed by the internal revenue service (irs) and used by filers who make nondeductible contributions to an ira. Ad download or email form 8606 & more fillable forms, try for free now! Total basis in traditional iras. Web this article explains how to report a roth ira distribution in part iii of form 8606.IRS Form 8606 Printable

2023 Form 8606 Instructions How To Fill Out 8606 Form To Report

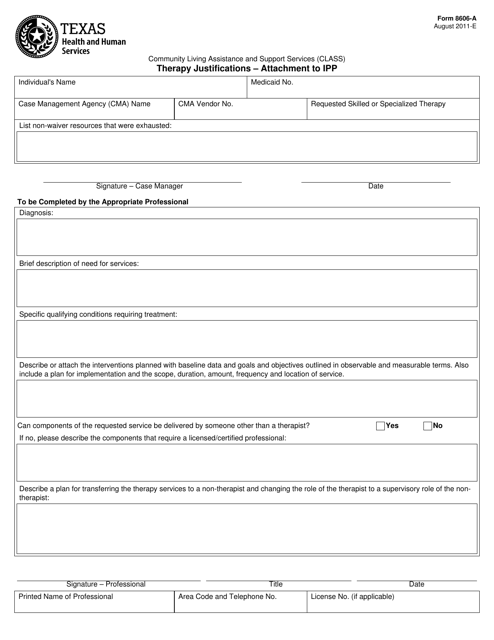

Form 8606A Fill Out, Sign Online and Download Fillable PDF, Texas

for How to Fill in IRS Form 8606

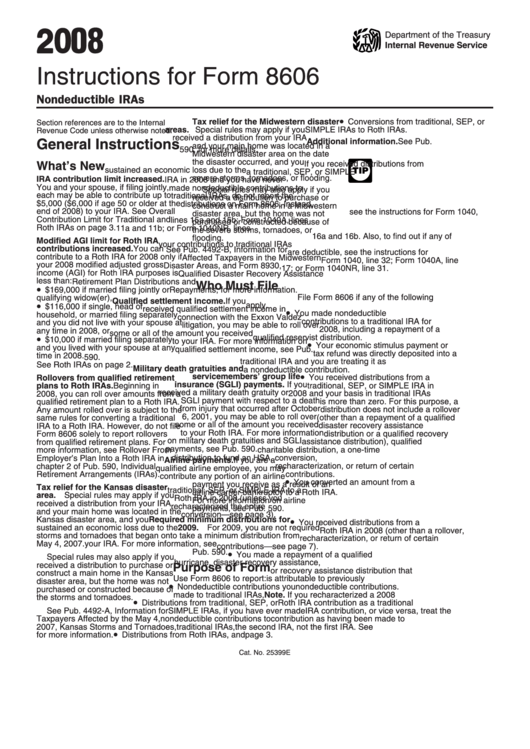

Instructions For Form 8606 Nondeductible Iras 2008 printable pdf

for How to Fill in IRS Form 8606

How to file form 8606 when doing a recharacterization followed by

HOW TO FILL OUT FORM 8606 BACKDOOR ROTH IRA YouTube

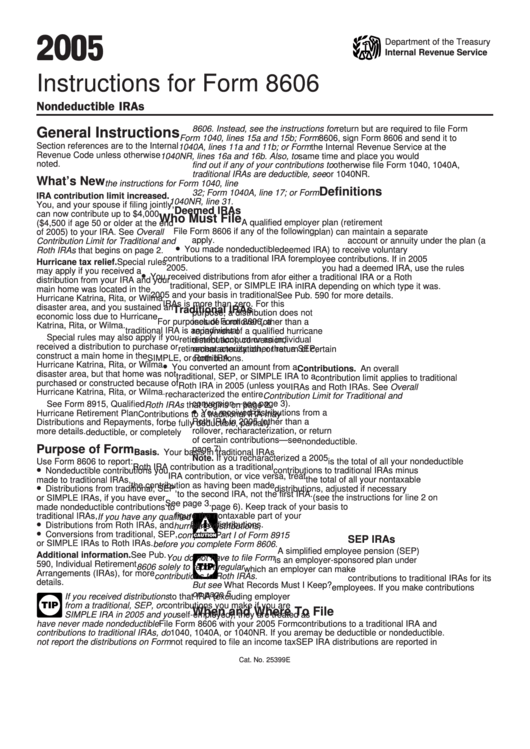

Instructions For Form 8606 Nondeductible Iras 2005 printable pdf

Form 8606 Nondeductible IRAs Fill Out and Report Your Retirement Savings

Related Post: