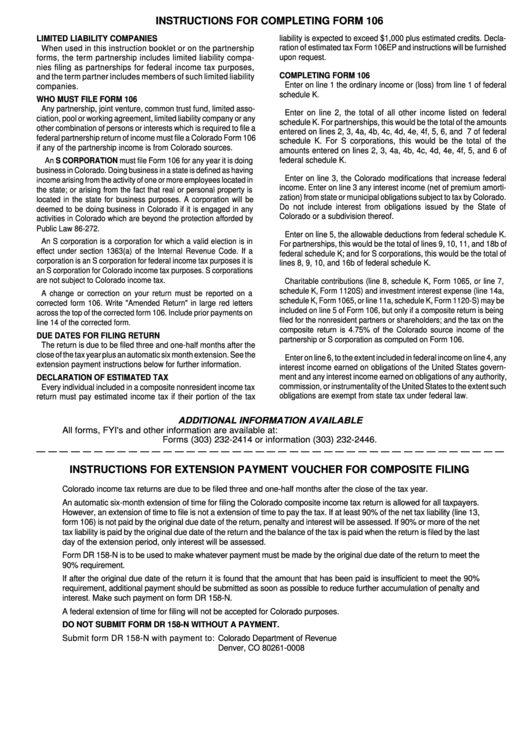

Colorado Form 106 Instructions

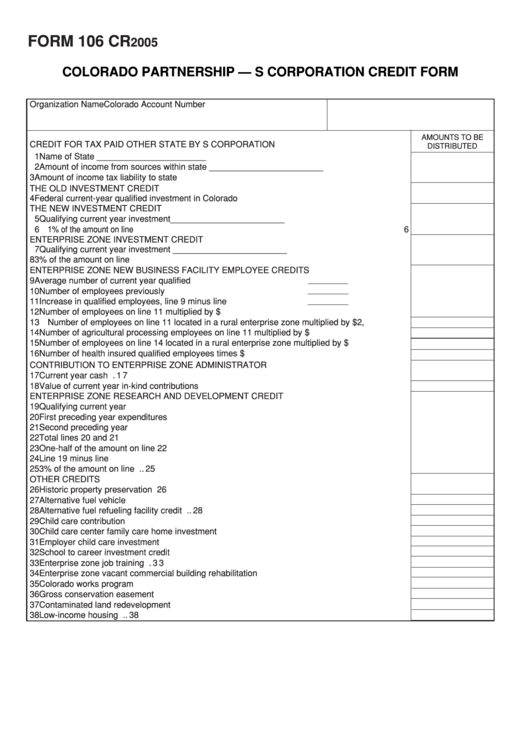

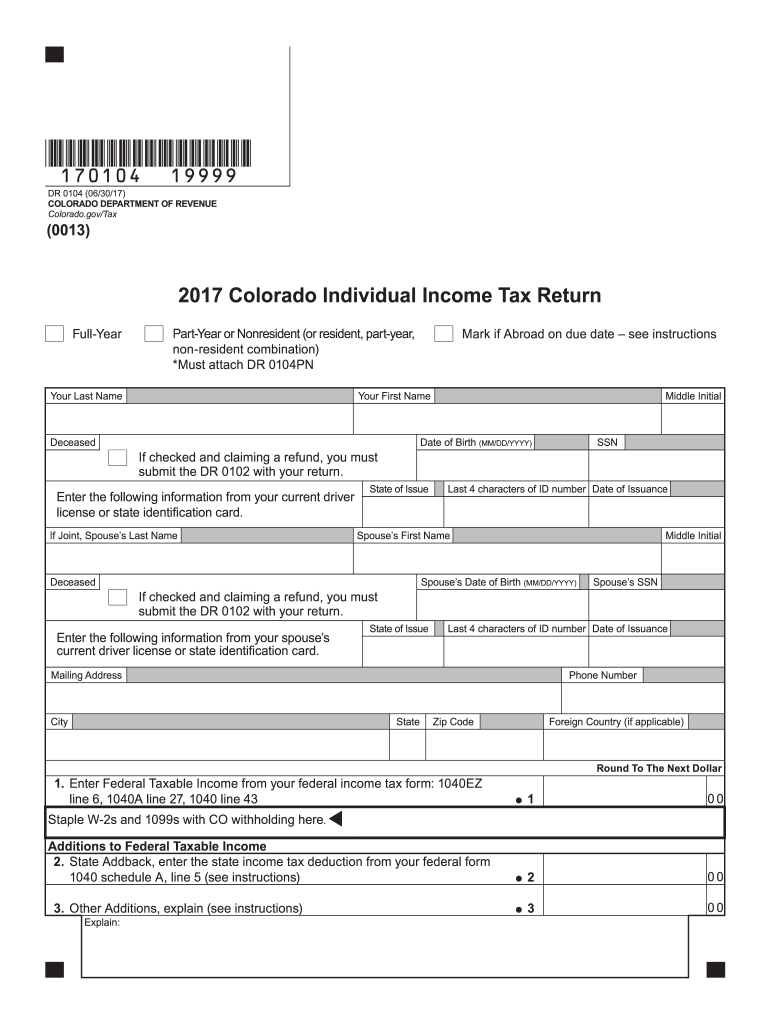

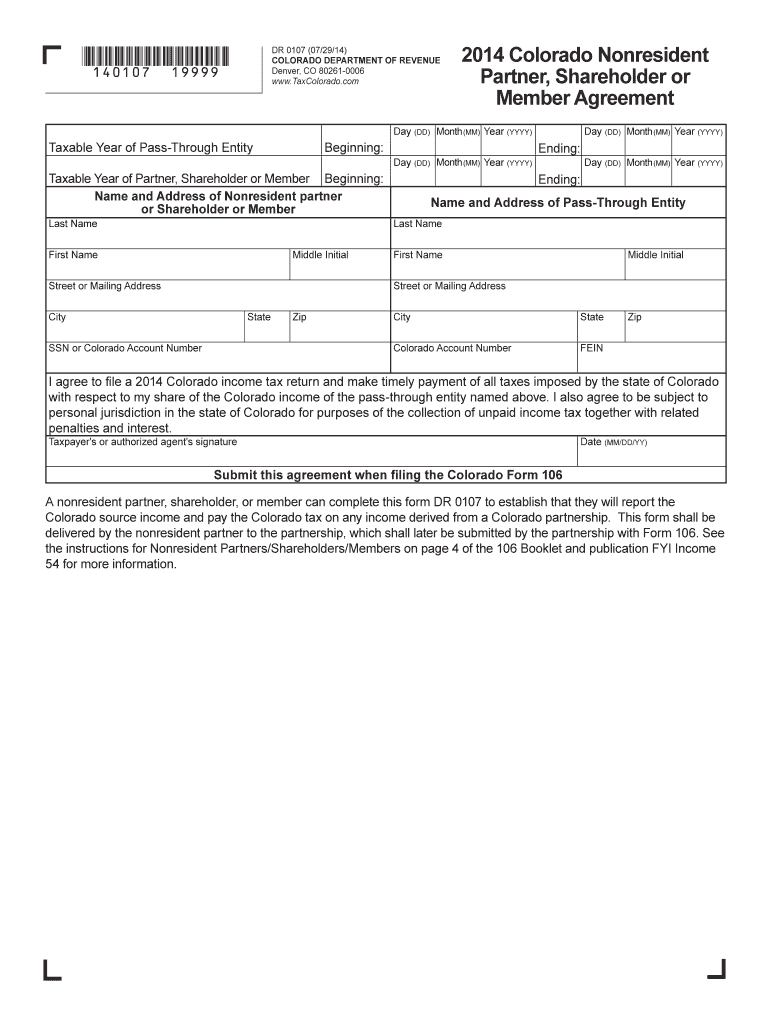

Colorado Form 106 Instructions - Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Web using entries from the federal tax return and colorado worksheets, the following forms and schedules are prepared for the colorado return: Line 2 — allowable deduction from federal schedule k. Web we last updated colorado form 106 in february 2023 from the colorado department of revenue. Please read through this guide before starting your return. Web form 106 instructions all s corporations in colorado need to complete and file form 106. Line 1 — report the total income from federal schedule k. Web colorado forms and guidance. An s corporation must file form 106 for. Ad pdffiller.com has been visited by 1m+ users in the past month Line 3 — report the amount of. Line 1 — report the total income from federal schedule k. Web form 106 instructions all s corporations in colorado need to complete and file form 106. Web colorado forms and guidance. This form is for income earned in tax year 2022, with tax returns due in april. Ad pdffiller.com has been visited by 1m+ users in the past month Web using entries from the federal tax return and colorado worksheets, the following forms and schedules are prepared for the colorado return: Line 1 — report the total income from federal schedule k. Web see the instructions for nonresident partners and shareholders in the 106 book and the. Please read through this guide before starting your return. Web see the instructions for nonresident partners and shareholders in the 106 book and the income tax guidance publications available at tax.colorado.gov for more information. Please read through this guide before starting your return. Line 3 — report the amount of. Line 2 — allowable deduction from federal schedule k. Web see the instructions for nonresident partners and shareholders in the 106 book and the income tax guidance publications available at tax.colorado.gov for more information. Web 106 book instructions this filing guide will assist you with completing your colorado income tax return. Please read through this guide before starting your return. Web colorado uses part ii of form 106 to. Web colorado forms and guidance. Line 2 — allowable deduction from federal schedule k. Line 3 — report the amount of. This form is for income earned in tax year 2022, with tax returns due in april. Web 106 book instructions this filing guide will assist you with completing your colorado income tax return. Web colorado forms and guidance. This form need only to be filed with the department for the year in which the agreement is made. Web be submitted by the partnership or s corporation with form dr 0106. Ad pdffiller.com has been visited by 1m+ users in the past month Web we last updated colorado form 106 in february 2023 from. Web we would like to show you a description here but the site won’t allow us. Web colorado forms and guidance. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Line 3 — report the amount of. An s corporation must file form 106 for. Ad pdffiller.com has been visited by 1m+ users in the past month Web colorado forms and guidance. Web see the instructions for nonresident partners and shareholders in the 106 book and the income tax guidance publications available at tax.colorado.gov for more information. Web we last updated colorado form 106 in february 2023 from the colorado department of revenue. Web 106. Web we would like to show you a description here but the site won’t allow us. Line 2 — allowable deduction from federal schedule k. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. This form is for income earned in tax year 2022, with tax returns due in april. Web colorado forms. Line 2 — allowable deduction from federal schedule k. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Web file a federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. Web how do i prepare colorado dr 0106k (s) to be. This form is for income earned in tax year 2022, with tax returns due in april. Web be submitted by the partnership or s corporation with form dr 0106. Line 3 — report the amount of. Web 106 book instructions this filing guide will assist you with completing your colorado income tax return. Web using entries from the federal tax return and colorado worksheets, the following forms and schedules are prepared for the colorado return: Please read through this guide before starting your return. Please read through this guide before starting your return. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Line 1 — report the total income from federal schedule k. Ad pdffiller.com has been visited by 1m+ users in the past month Web we would like to show you a description here but the site won’t allow us. This form need only to be filed with the department for the year in which the agreement is made. Web file a federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. Web colorado forms and guidance. Web 106 book instructions this filing guide will assist you with completing your colorado income tax return. Web form 106 instructions all s corporations in colorado need to complete and file form 106. Line 2 — allowable deduction from federal schedule k. An s corporation must file form 106 for. Web see the instructions for nonresident partners and shareholders in the 106 book and the income tax guidance publications available at tax.colorado.gov for more information. Web how do i prepare colorado dr 0106k (s) to be uploaded to the state website as an alternative to mailing with the dr 1706 (s) with a 1065 return using cch®.Instructions For Completing Form 106 Colorado printable pdf download

Colorado form 106 Fill out & sign online DocHub

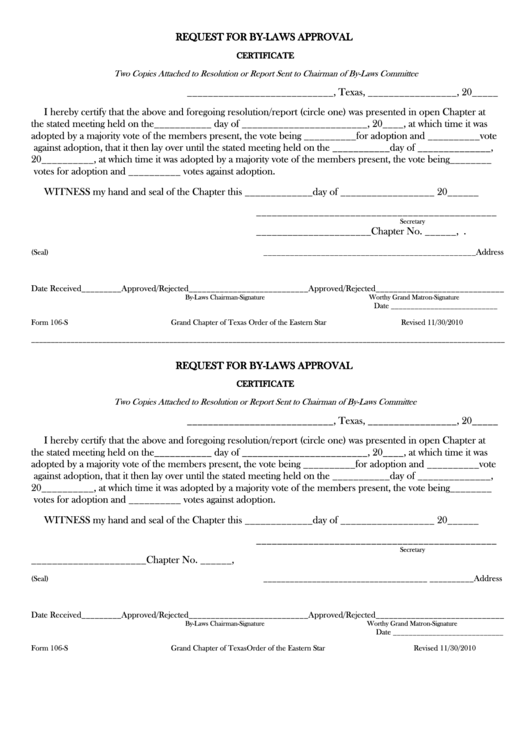

Fillable Form 106S Request For ByLaws Approval printable pdf download

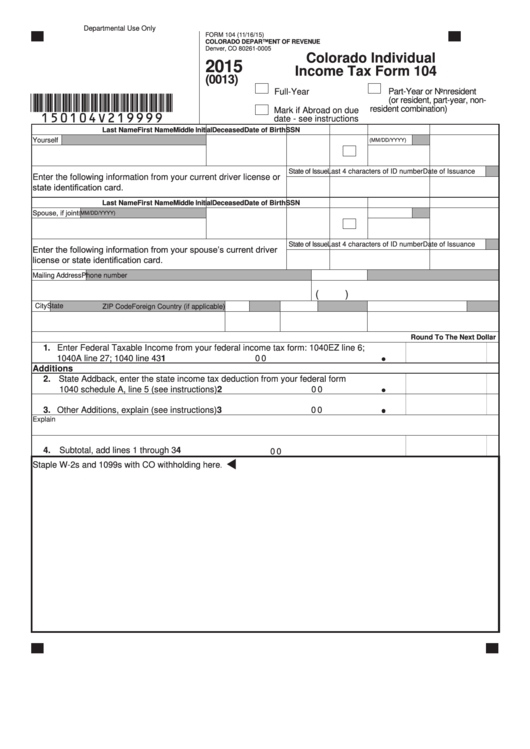

Colorado State Tax Fillable 105 Forms Printable Forms Free Online

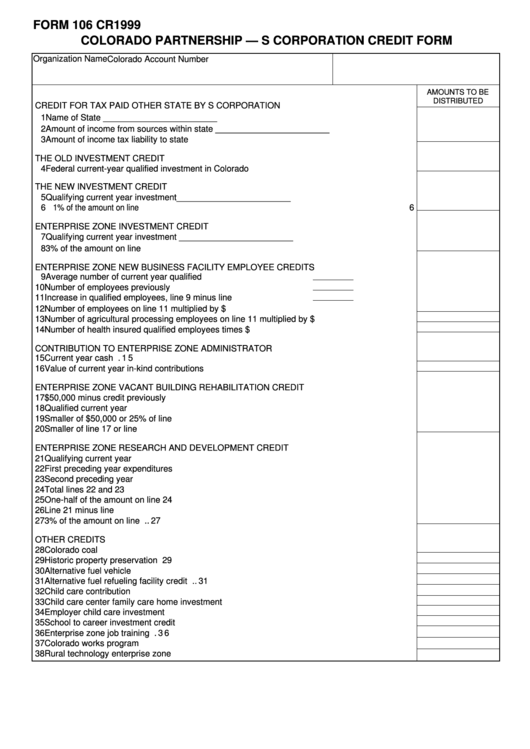

Form 106 Cr Colorado Partnership S Corporation Credit Form 1999

Fillable Form 106 Cr Colorado Partnership S Corporation Credit

Dr 2559 Fill out & sign online DocHub

Colorado Form Tax Fill Out and Sign Printable PDF Template signNow

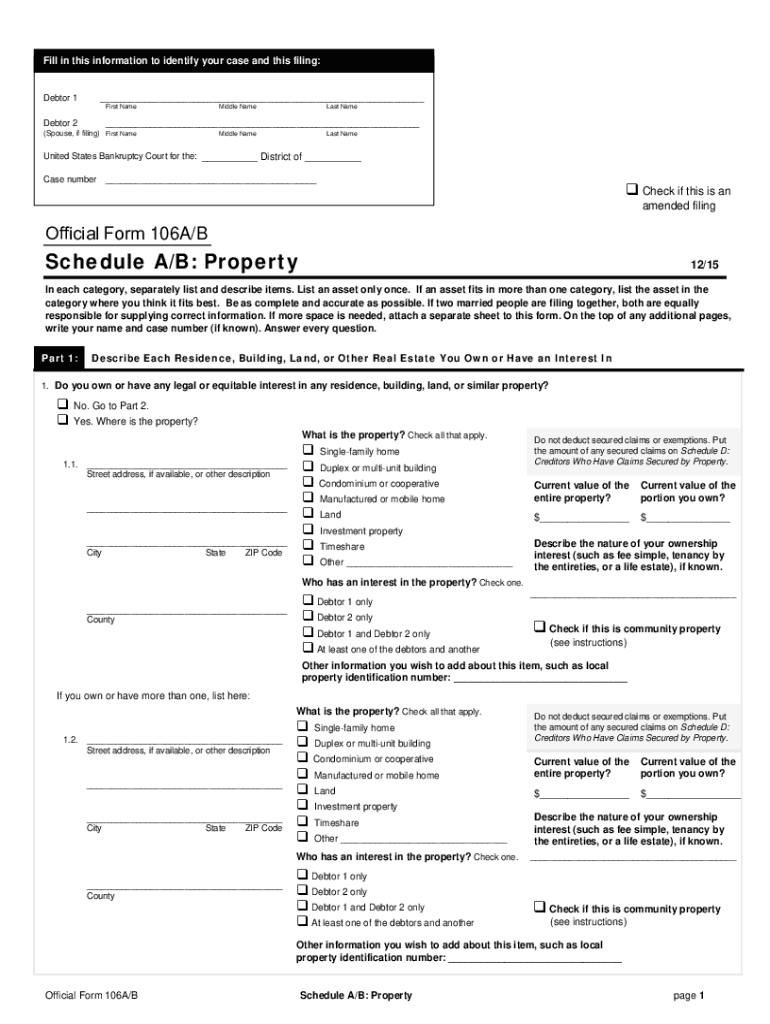

Form 106a B Fill Online, Printable, Fillable, Blank pdfFiller

Colorado Form 106 Fill Out and Sign Printable PDF Template signNow

Related Post: