Form W 7 Instructions

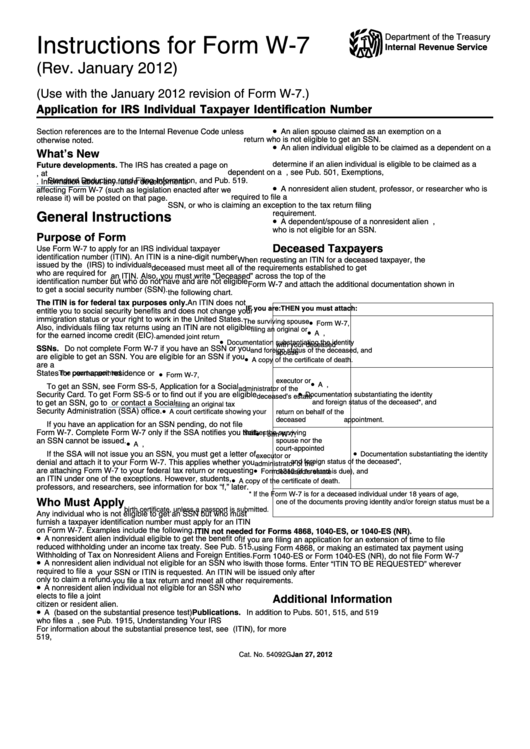

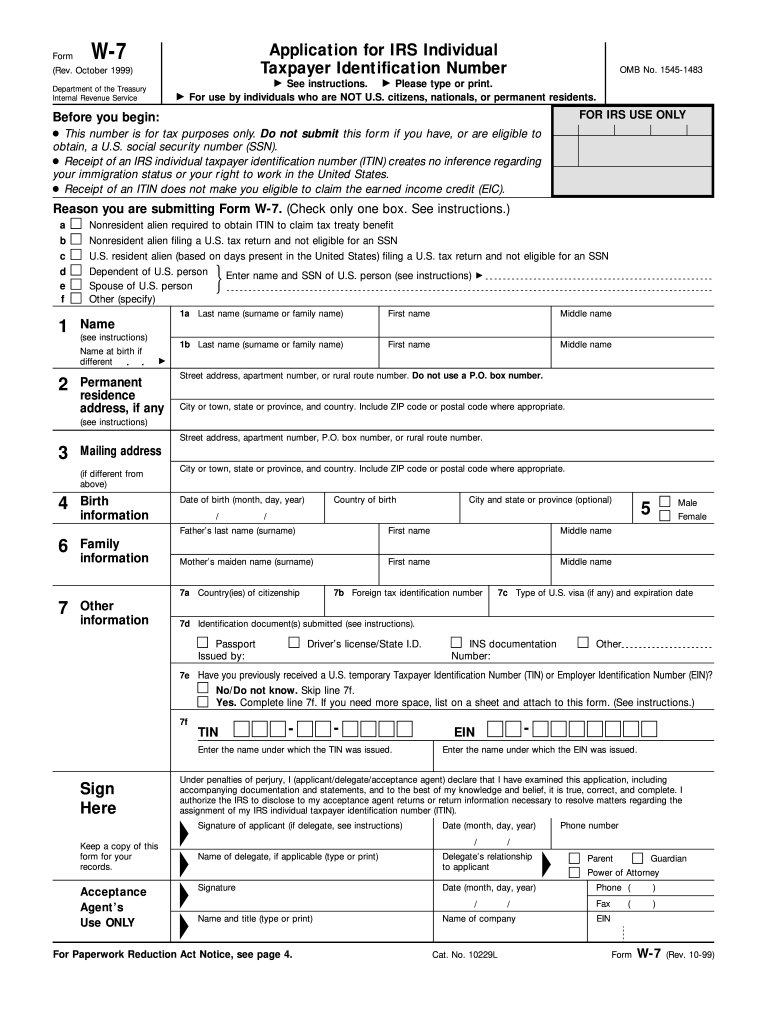

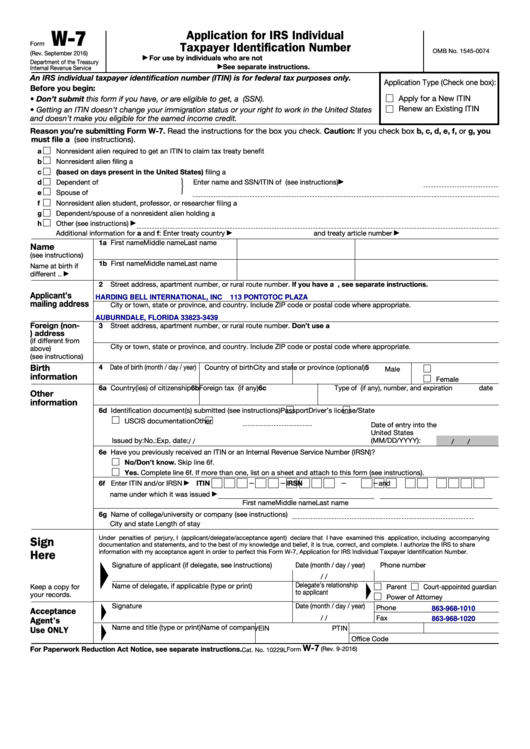

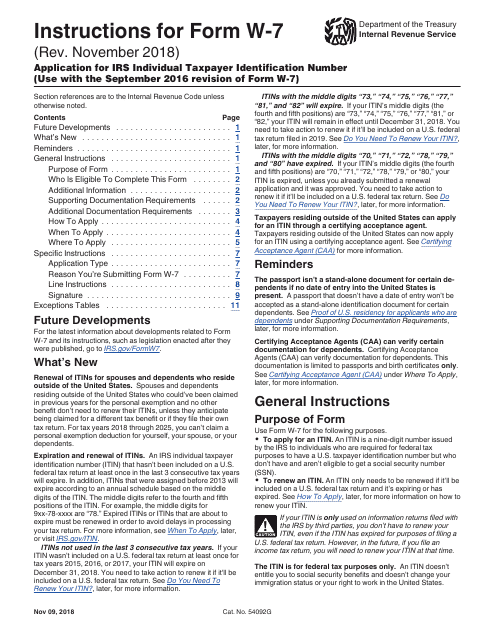

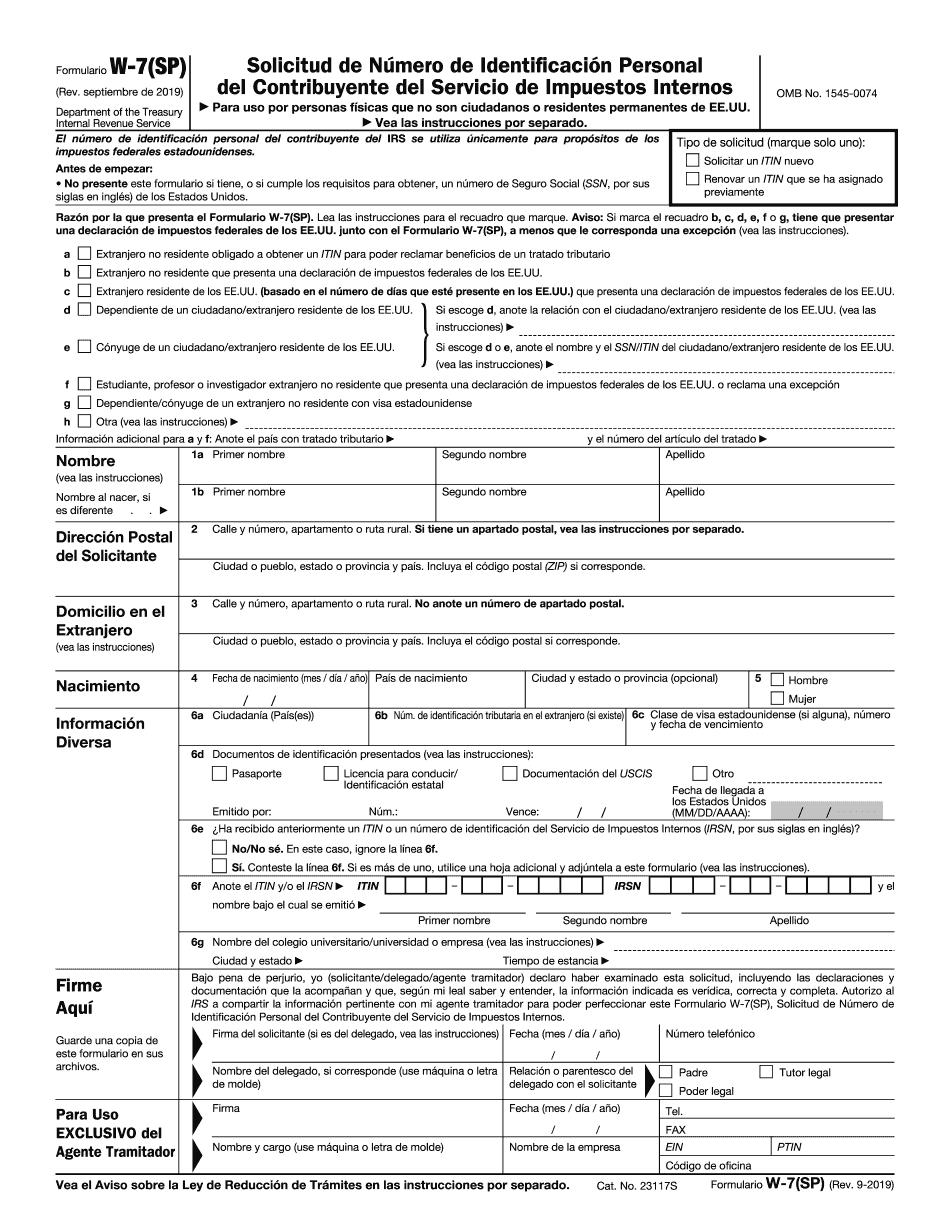

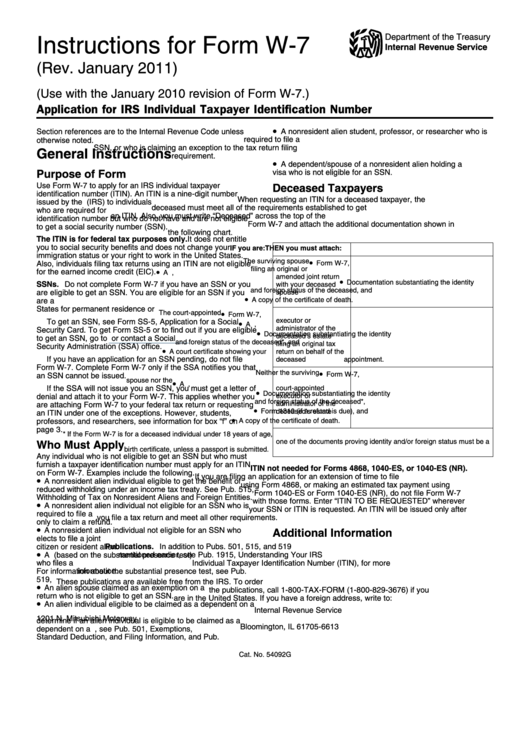

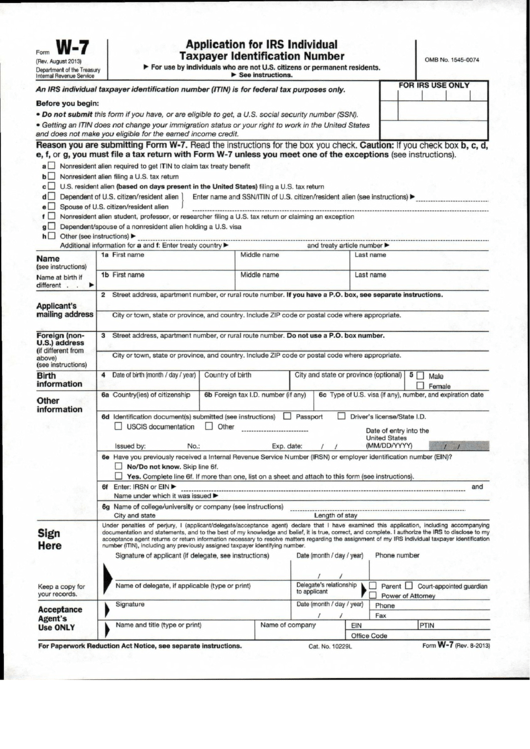

Form W 7 Instructions - For paperwork reduction act notice, see separate instructions. An itin is an individual taxpayer identification number. Include your original federal tax return (s) for which the itin is required. January 24, 2022 | last updated: August 2019) department of the treasury internal revenue service. Individual income tax return, documentation substantiating the identity and foreign status of the deceased*, form 1310 (if a refund is due), and a copy of the. Web filing tax return: Web instructions and how to file (7 steps) spanish (español) version: Application for irs individual taxpayer identification. Application for irs individual taxpayer identification number. To claim several tax treaty benefits, including. Get ready for tax season deadlines by completing any required tax forms today. For paperwork reduction act notice, see separate instructions. Application for irs individual taxpayer identification number. An itin is an individual taxpayer identification number. Application for irs individual taxpayer identification number. Get ready for tax season deadlines by completing any required tax forms today. Must be removed before printing. An itin is an individual taxpayer identification number. Internal revenue service (irs) to. Application for irs individual taxpayer identification. Internal revenue service (irs) to. Get ready for tax season deadlines by completing any required tax forms today. Include your original federal tax return (s) for which the itin is required. An itin is an individual taxpayer identification number. Application for irs individual taxpayer identification. Application for irs individual taxpayer identification number. Application for irs individual taxpayer identification number. Get ready for tax season deadlines by completing any required tax forms today. Web instructions and how to file (7 steps) spanish (español) version: Web w i h g n a a h v v w i h m l g y m a f p w p t p r x p ` i k y g m w h j i g w i h g i n [ y i h m y g [ i ` i bq r g. For paperwork reduction act notice, see separate instructions. Include your original federal tax return (s) for which the itin is required. Application for irs individual taxpayer identification. January 24, 2022 | last updated: Internal revenue service (irs) to. Individual income tax return, documentation substantiating the identity and foreign status of the deceased*, form 1310 (if a refund is due), and a copy of the. Web instructions and how to file (7 steps) spanish (español) version: An itin is an individual taxpayer identification number. Get ready for tax season deadlines by completing any required tax forms today. August 2019). Web instructions and how to file (7 steps) spanish (español) version: For paperwork reduction act notice, see separate instructions. Get ready for tax season deadlines by completing any required tax forms today. January 24, 2022 | last updated: An itin is an individual taxpayer identification number. Application for irs individual taxpayer identification number. To claim several tax treaty benefits, including. Web w i h g n a a h v v w i h m l g y m a f p w p t p r x p ` i k y g m w h j i g w i h g i n. August 2019) department of the treasury internal revenue service. Must be removed before printing. Include your original federal tax return (s) for which the itin is required. Application for irs individual taxpayer identification. For paperwork reduction act notice, see separate instructions. Web w i h g n a a h v v w i h m l g y m a f p w p t p r x p ` i k y g m w h j i g w i h g i n [ y i h m y g [ i ` i bq r g h [ w m Web instructions and how to file (7 steps) spanish (español) version: Get ready for tax season deadlines by completing any required tax forms today. Application for irs individual taxpayer identification number. August 2019) department of the treasury internal revenue service. An itin is an individual taxpayer identification number. Application for irs individual taxpayer identification number. For paperwork reduction act notice, see separate instructions. Must be removed before printing. Internal revenue service (irs) to. Web filing tax return: January 24, 2022 | last updated: Application for irs individual taxpayer identification. To claim several tax treaty benefits, including. Individual income tax return, documentation substantiating the identity and foreign status of the deceased*, form 1310 (if a refund is due), and a copy of the. Include your original federal tax return (s) for which the itin is required.Instructions For Form W7 Application For Irs Individual Taxpayer

W7 Form Fill Out and Sign Printable PDF Template signNow

18 W7 Form Templates free to download in PDF, Word and Excel

Download Instructions for IRS Form W7 Application for IRS Individual

W7sp Fill out and Edit Online PDF Template

Instructions for Form W7 (09/2019) Internal Revenue Service

Form W7 (Rev. August 2019) 店小二日記

IRS Form W7 Applying for Individual Taxpayer Identification Number

Instructions For Form W7 Application For Irs Individual Taxpayer

Form W7 Application For Irs Individual Taxpayer Identification

Related Post: