Form 1120F Instructions

Form 1120F Instructions - Section references are to the. Increase in penalty for failure to file. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! The no double benefit rules continue to apply. Income tax liability of a foreign. Income tax return of a foreign corporation. Get ready for tax season deadlines by completing any required tax forms today. Income tax return of a foreign corporation. Income tax liability of a foreign. Department of the treasury internal revenue service. The no double benefit rules continue to apply. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and. Department of the treasury internal revenue service. Increase in penalty for failure to file. Instructions for form 1120 ( print version pdf) recent developments. Get ready for tax season deadlines by completing any required tax forms today. Income tax liability of a foreign. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Ad easy guidance & tools for c corporation tax returns. Income tax return of a foreign corporation. Instructions for form 1120 ( print version pdf) recent developments. Section references are to the. The no double benefit rules continue to apply. Section references are to the. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Instructions for form 1120 ( print version pdf) recent developments. Department of the treasury internal revenue service. Income tax liability of a foreign. Section references are to the. Income tax liability of a foreign. Income tax return of a foreign corporation. Department of the treasury internal revenue service. Department of the treasury internal revenue service. Web see the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information. The no double benefit rules continue to apply. Department of the treasury internal revenue service. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Department of the treasury internal revenue service. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Income tax liability of a foreign. Instructions for form 1120 ( print version pdf) recent developments. Income tax return of a foreign corporation. Web see the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information. Ad easy guidance & tools for c corporation tax returns. Department of the treasury internal revenue service. The no double benefit rules continue to apply. Income tax liability of a foreign. Section references are to the. Income tax liability of a foreign. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and. Income tax return of a foreign corporation. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Income tax return of a foreign corporation. Income tax return of a foreign corporation. Increase in penalty for failure to file. Department of the treasury internal revenue service. Income tax return of a foreign corporation. Get ready for tax season deadlines by completing any required tax forms today. Income tax return of a foreign corporation. Section references are to the. Income tax liability of a foreign. Department of the treasury internal revenue service. Department of the treasury internal revenue service. Instructions for form 1120 ( print version pdf) recent developments. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Income tax return of a foreign corporation. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and. Web see the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information. Get ready for tax season deadlines by completing any required tax forms today. Ad easy guidance & tools for c corporation tax returns. Income tax liability of a foreign. The no double benefit rules continue to apply. Increase in penalty for failure to file.Form Ia 1120f Instructions printable pdf download

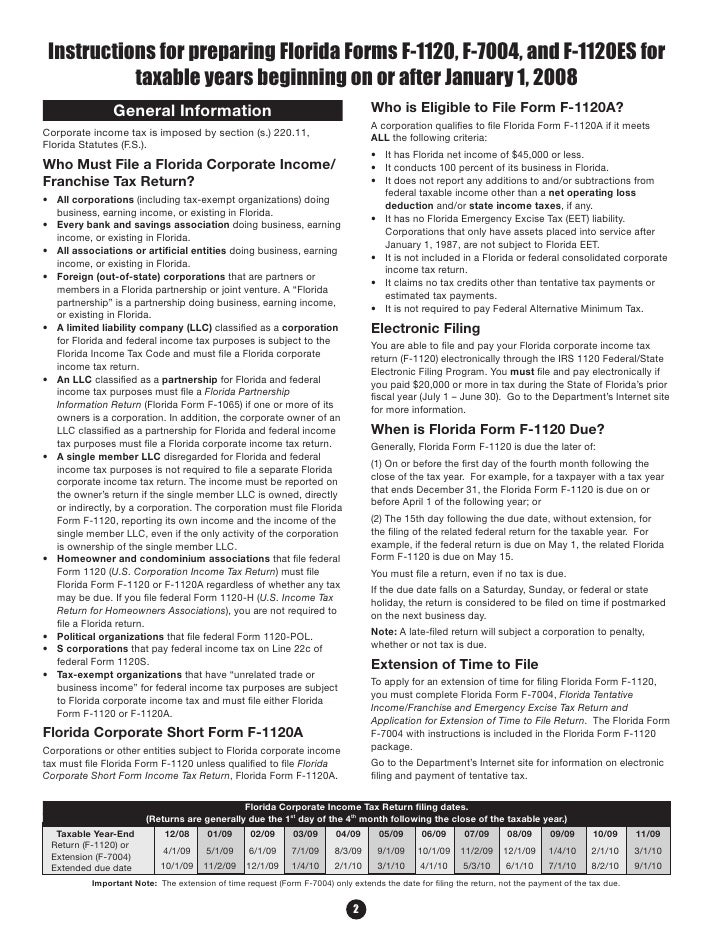

Instructions for Preparing Form F1120 for 2008 Tax Year R.01/09

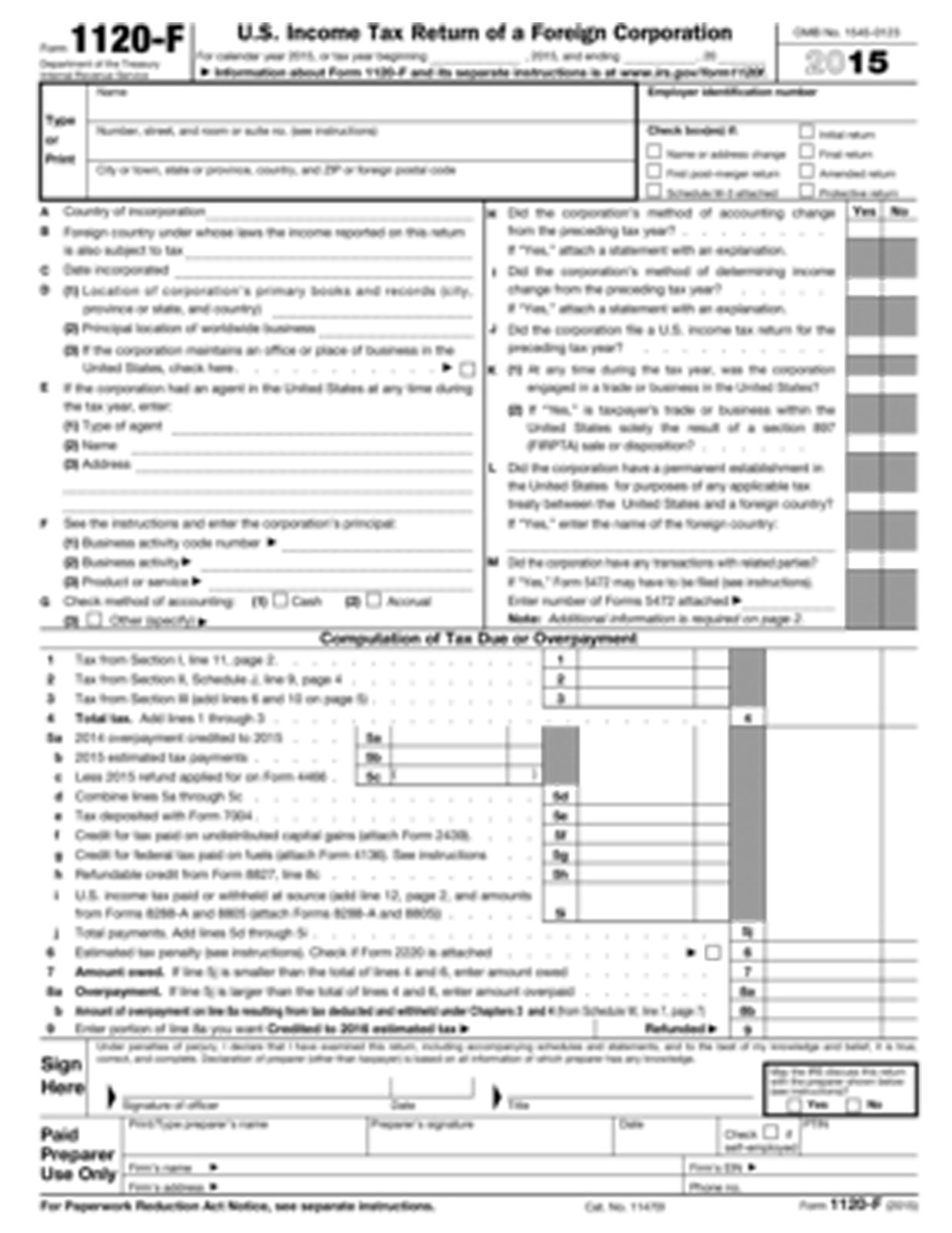

Instructions for IRS Form 1120f U.S. Tax Return of a Foreign

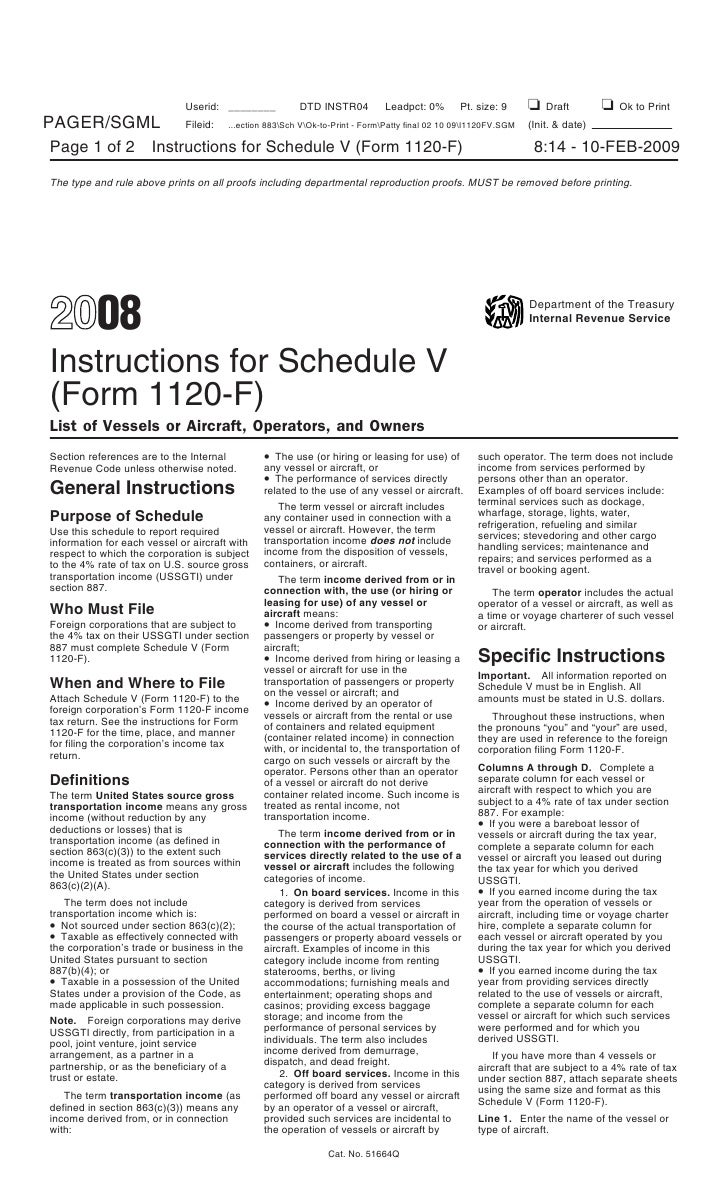

Inst 1120F (Schedule V)Instructions for Schedule V (Form 1120F)

Instructions For Schedule V (Form 1120F) Department Of The Treasury

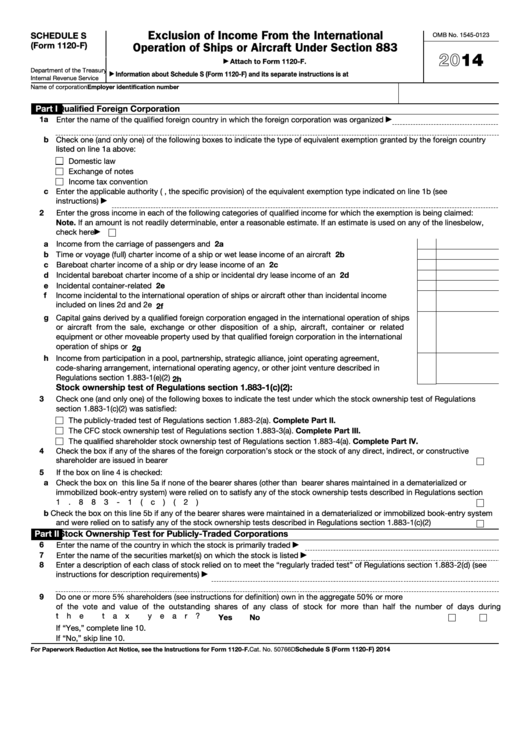

Fillable Schedule S (Form 1120F) Exclusion Of From The

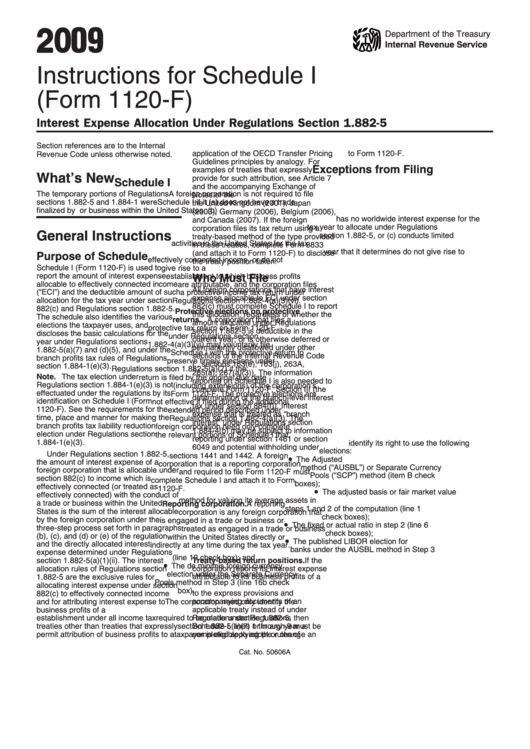

Instructions For Schedule I (Form 1120F) 2009 printable pdf download

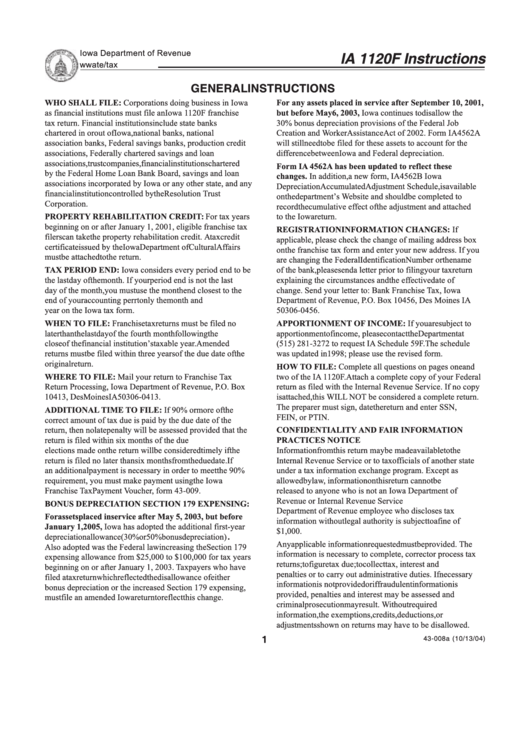

Instructions For Form Ia 1120f printable pdf download

form 1120 f instructions 2022 JWord サーチ

form 1120f instructions 2020 Fill Online, Printable, Fillable Blank

Related Post: