What Is Form 8801

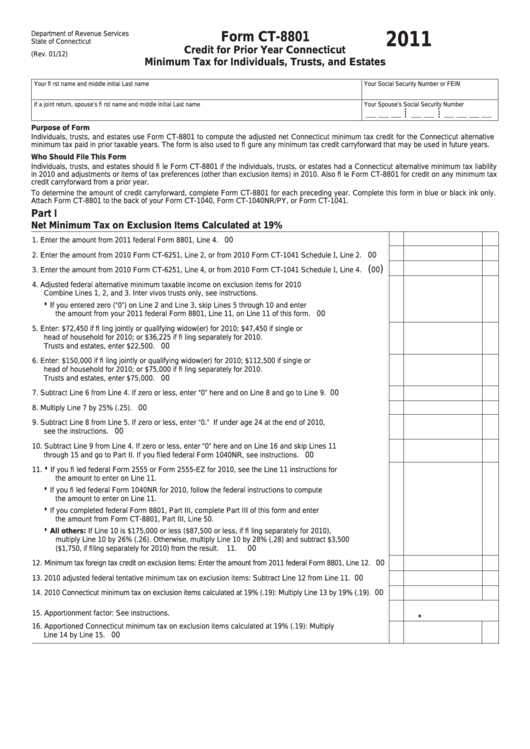

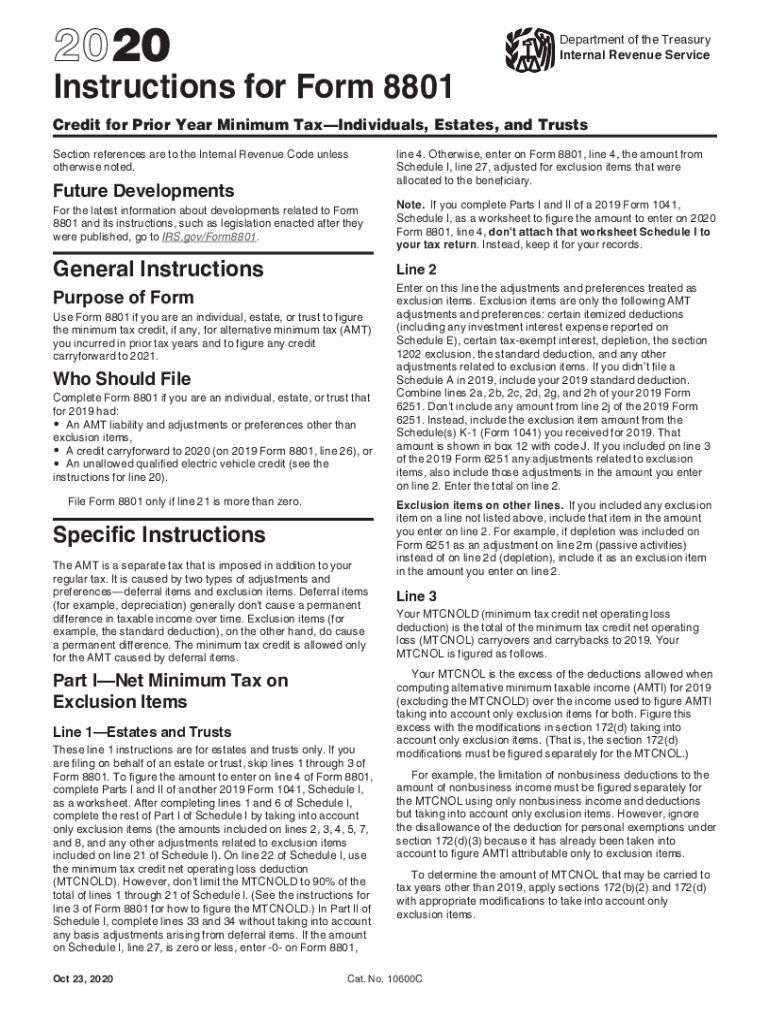

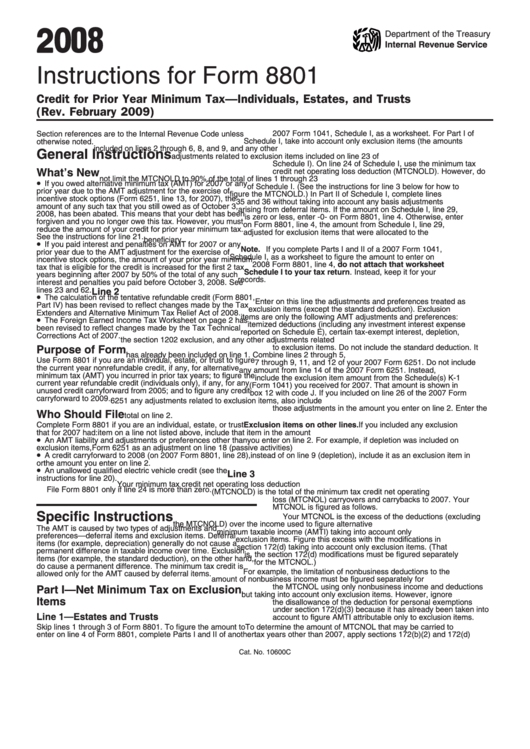

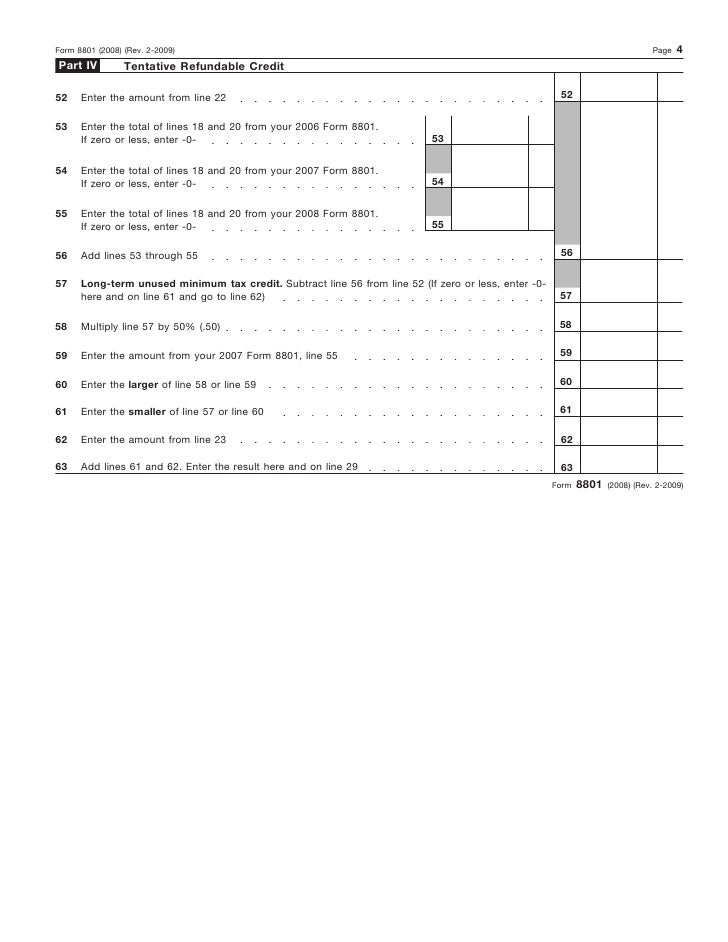

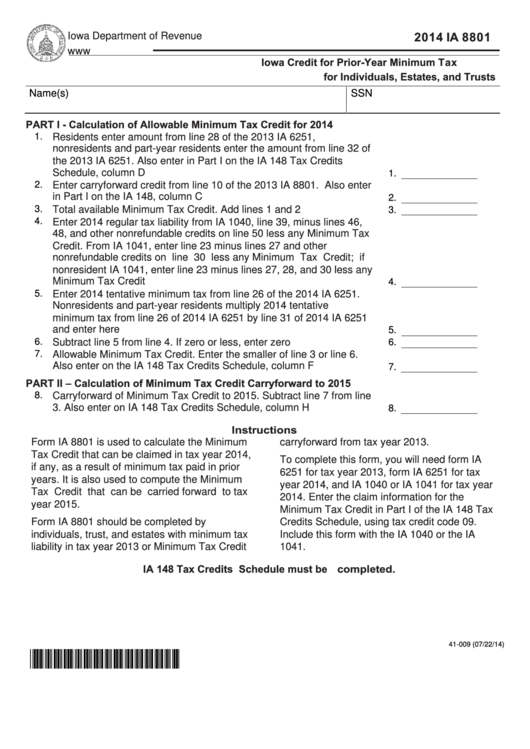

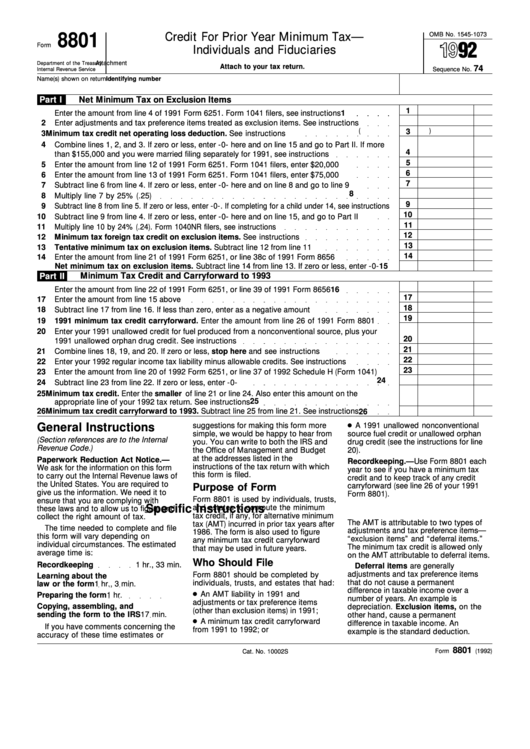

What Is Form 8801 - Get ready for tax season deadlines by completing any required tax forms today. Use form 8801 if you are an individual, estate, or trust to figure the amount of any credit for alternative. Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. Web form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Web use of form instructions 8801: Form 8801 is used to figure the minimum tax credit for amt incurred in prior. Complete, edit or print tax forms instantly. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. Web use of form instructions 8801: Web use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax years and to figure any. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the. Form 8801 is used. Web complete form 8801 if you are an individual, estate, or trust that for 2021 had: Form instructions 8801 provides detailed guidelines on how to calculate the credit for prior year minimum tax and fill out the necessary forms. Web form 8801 is used to calculate your minimum tax credit for amt that you incurred in prior tax years and. If you did not complete the 2010 qualified dividends and capital gain tax. Web what is the purpose of irs form 8801? Web use form 8801, credit for prior year minimum tax to calculate how much of the amt you've paid was related to deferral items, which generate credit for future years,. Web use of form instructions 8801: Web form. Get ready for tax season deadlines by completing any required tax forms today. An amt liability and adjustments or preferences other than exclusion items, a credit carryforward. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax.. Web use form 8801, credit for prior year minimum tax to calculate how much of the amt you've paid was related to deferral items, which generate credit for future years,. Paying amt one year can lead to a large tax credit the next year. Web use of form instructions 8801: Get ready for tax season deadlines by completing any required. Web form 8801 is used to calculate your minimum tax credit for amt that you incurred in prior tax years and to figure any credit carryforward. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. Use. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. Web form 8801 is used to calculate your minimum tax credit for amt that you incurred in prior tax years and to figure any credit carryforward. Web. If you did not complete the 2010 qualified dividends and capital gain tax. Web use form 8801, credit for prior year minimum tax to calculate how much of the amt you've paid was related to deferral items, which generate credit for future years,. Ad download or email irs 8801 & more fillable forms, register and subscribe now! Web form 8801. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax. Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the. Web purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Form instructions 8801 provides detailed guidelines on how to calculate the credit for prior year minimum tax and fill out the necessary forms. Web use form 8801, credit for prior year minimum tax to calculate how much of the amt you've paid was related to deferral items, which generate credit for future years,. Form 8801 is used to figure the minimum tax credit for amt incurred in prior. Form 8821 is used to. Web complete form 8801 if you are an individual, estate, or trust that for 2021 had: Get ready for tax season deadlines by completing any required tax forms today. Web form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally. An amt liability and adjustments or preferences other than exclusion items, a credit carryforward. Get ready for tax season deadlines by completing any required tax forms today. Web use of form instructions 8801: Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. Web form 8801 (2011) page 3 part iii tax computation using maximum capital gains rates caution. Web what is the purpose of irs form 8801? Web form 8801 is used to calculate your minimum tax credit for amt that you incurred in prior tax years and to figure any credit carryforward. Web form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior tax years and to calculate any credit carryforward. Web use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in prior tax years and to figure any. Use form 8801 if you are an individual, estate, or trust to figure the amount of any credit for alternative.Form Ct8801 Credit For Prior Year Connecticut Minimum Tax For

8801 Fill Out and Sign Printable PDF Template signNow

Instructions For Form 8801 Credit For Prior Year Minimum Tax

Form 8801 Irs Memo on the Piece of Paper. Stock Image Image of form

What is the AMT Credit (IRS Form 8801)? Equity Simplified

Business Concept about Form 8801 Credit for Prior Year Minimum Tax

Form 8801Credit for Prior Year Minimum Tax Individuals, Estates, a…

Fillable Form Ia 8801 Iowa Credit For PriorYear Minimum Tax For

Form 8801Credit for Prior Year Minimum Tax Individuals, Estates, a…

Form 8801 Credit For Prior Year Minimum Tax Individuals And

Related Post: