Form Il-941

Form Il-941 - • you need to correct. Web click ‘next’ to continue and complete your return. Page last reviewed or updated: If the amount due is: Web where to file your taxes for form 941. Filing online is quick and easy! Web employers use form 941 to: † visit our web site at. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. 2023 withholding income tax payment and return due dates. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Complete, edit or print tax forms instantly. Easily sign the form with your finger. This form is required to be filed electronically. Web click ‘next’ to continue and. We will update this page with a new version of the form for 2024 as soon as it is made available. Filing online is quick and easy! Complete, edit or print tax forms instantly. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. We will update this page with a new version of the form for 2024 as soon as it is made available. † visit our web site at. Open form follow the instructions. Page last reviewed or updated: Open form follow the instructions. If the amount due is: Web employers use form 941 to: • you need to correct. Find mailing addresses by state and date for form 941. Pay the employer's portion of social security or. We will update this page with a new version of the form for 2024 as soon as it is made available. Find mailing addresses by state and date for form 941. Complete, edit or print tax forms instantly. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. • you need to correct. Easily sign the form with your finger. We will update this page with a new version of the form for 2024 as soon as it is made available. Pay the employer's portion of social security or. Get ready for tax season deadlines by completing any required tax forms today. Pay the employer's portion of social security or. Get ready for tax season deadlines by completing any required tax forms today. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Open form follow the instructions. Filing online is quick and easy! Web where to file your taxes for form 941. This form is required to be filed electronically. Filing online is quick and easy! • you need to correct. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Report for this quarter of 2023. † visit our web site at. It appears you don't have a pdf plugin for this browser. Complete, edit or print tax forms instantly. Pay the employer's portion of social security or. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. † visit our web site at. Send filled & signed form or save. Web click ‘next’ to continue and complete your return. It appears you don't have a pdf plugin for this browser. Web click ‘next’ to continue and complete your return. If the amount due is: Filing online is quick and easy! Complete, edit or print tax forms instantly. We will update this page with a new version of the form for 2024 as soon as it is made available. Send filled & signed form or save. Find mailing addresses by state and date for form 941. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. • you need to correct. This form is required to be filed electronically. Easily sign the form with your finger. 2023 withholding income tax payment and return due dates. † visit our web site at. Get ready for tax season deadlines by completing any required tax forms today. Web where to file your taxes for form 941. Open form follow the instructions. Web employers use form 941 to: Web this form is for income earned in tax year 2022, with tax returns due in april 2023.What Is Form 941 and How Do I File It? Ask Gusto

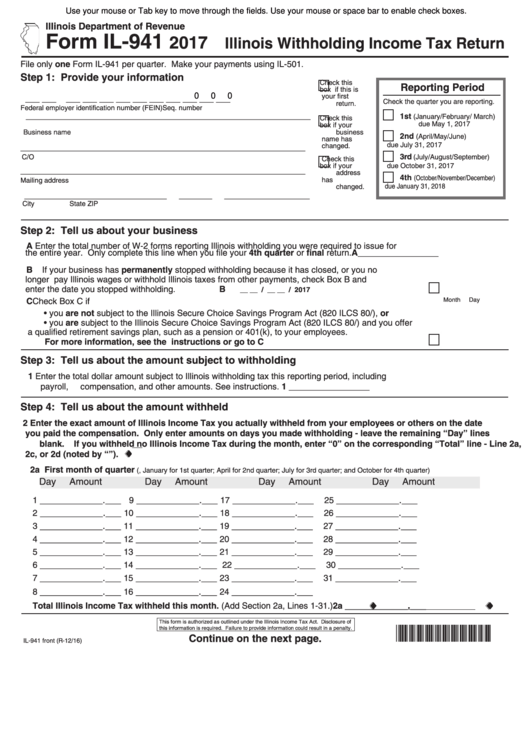

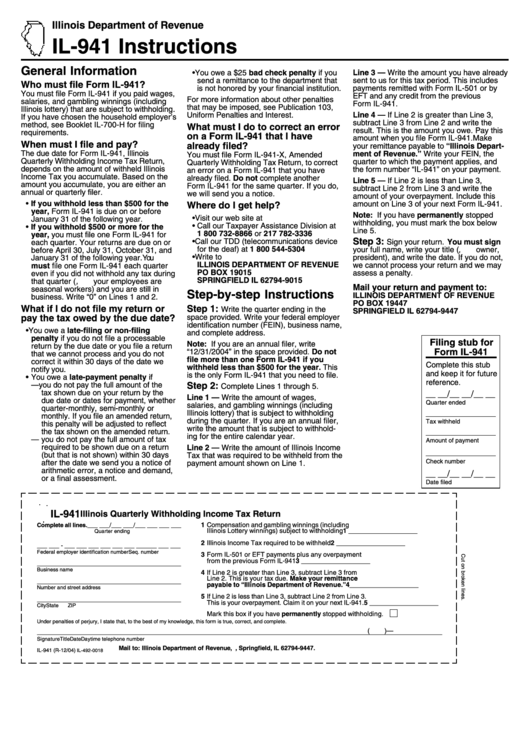

Printable Il 941 Form Printable Forms Free Online

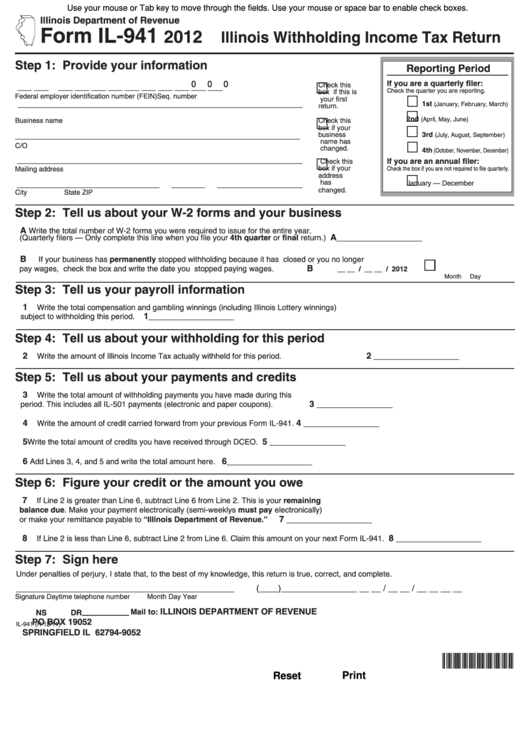

Fillable Form Il941 Illinois Withholding Tax Return 2012

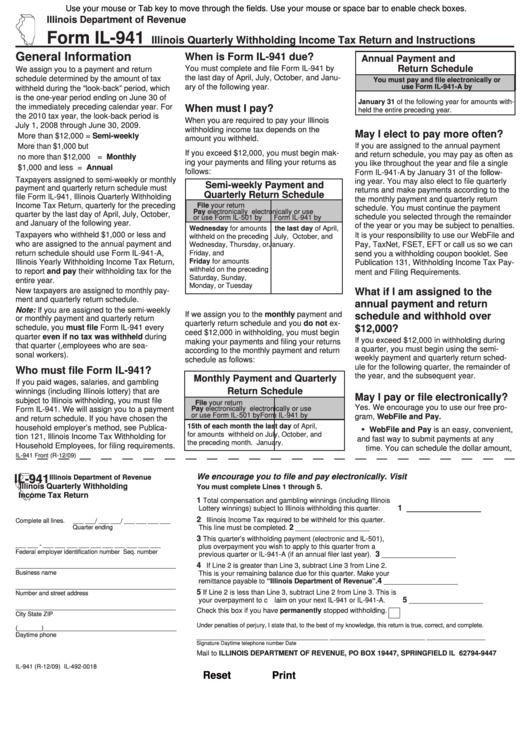

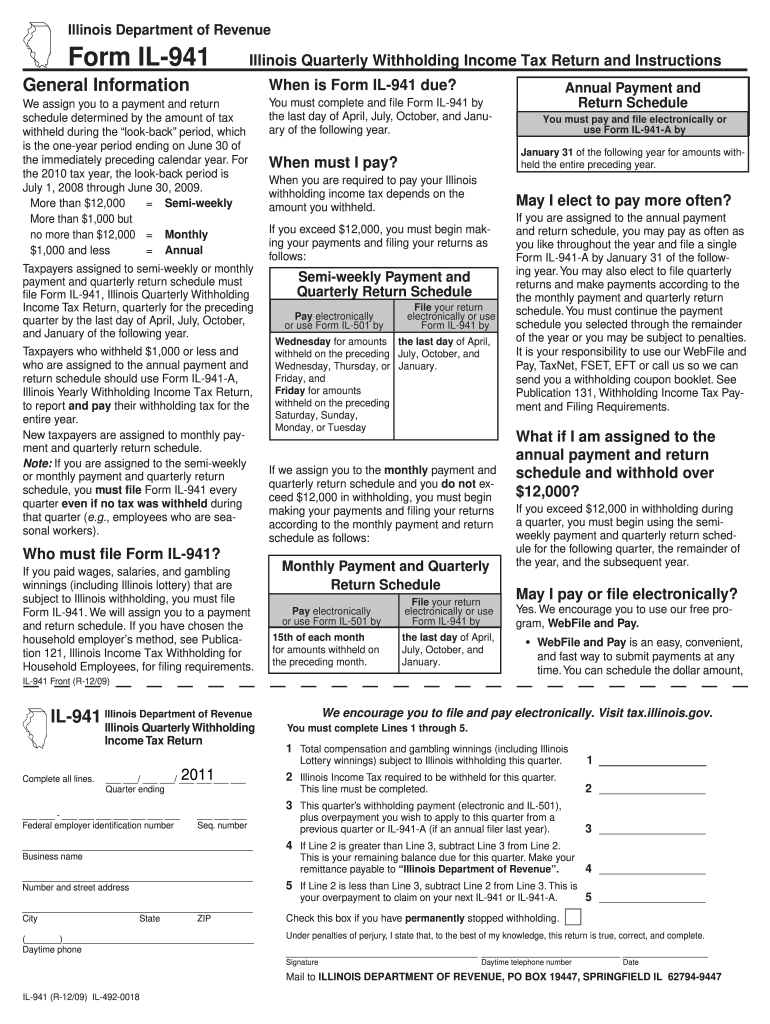

Form Il941 Illinois Quarterly Withholding Tax Return And

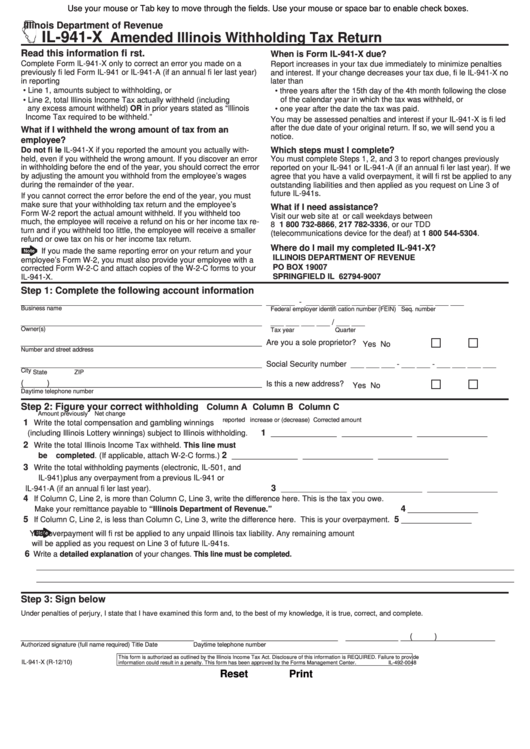

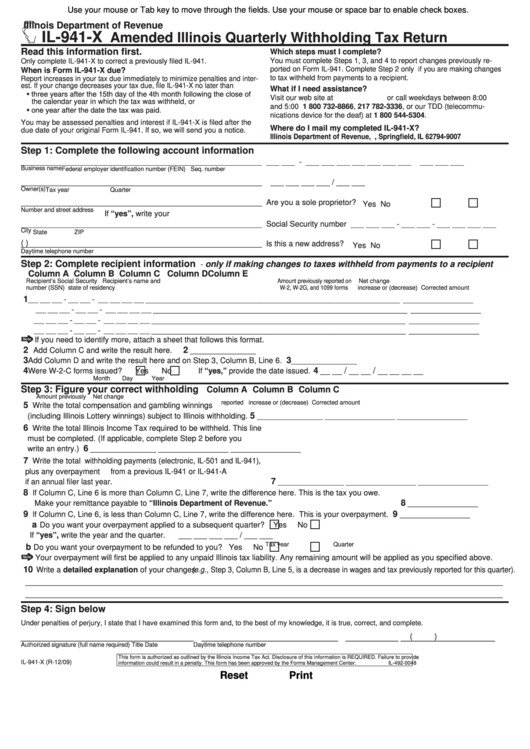

2010 Form IL DoR IL941X Fill Online, Printable, Fillable, Blank

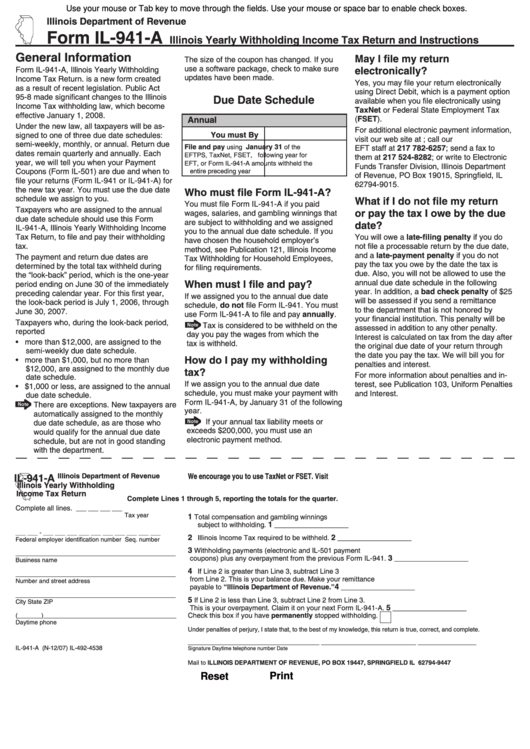

Fillable Form Il941A Illinois Yearly Withholding Tax Return

Form Il941 Illinois Quarterly Withholding Tax Return 2004

2009 Form IL DoR IL941 Fill Online, Printable, Fillable, Blank pdfFiller

Printable Il 941 Form Printable Forms Free Online

Fillable Form Il941X Amended Illinois Quarterly Withholding Tax

Related Post: