Form Tc 40

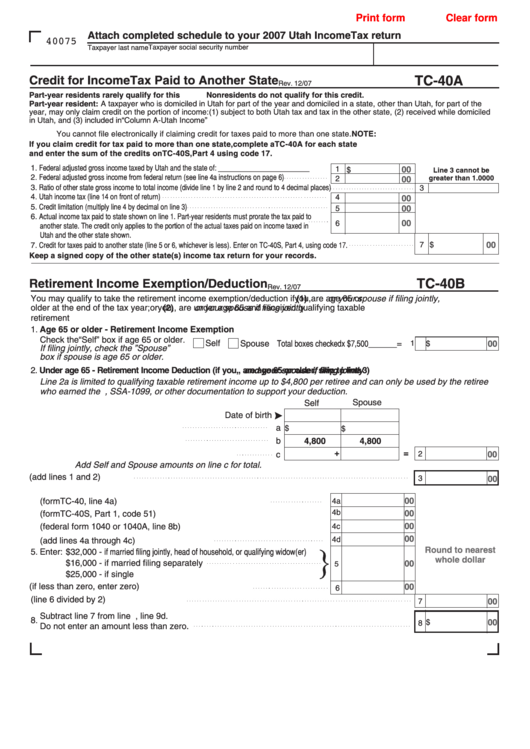

Form Tc 40 - Web form 1040 department of the treasury—internal revenue service (99) u.s. Submit page only if data entered. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Current & past year forms & publications. Web utah state tax commission. Nonresidents do not qualify for. Web form 1040 treasury department page 1 internal revenue service (auditor's stamp) (do not use these spaces) file code serial no. Attach completed schedule to your utah income tax return. Web follow these steps to calculate your utah tax: Credit for income tax paid to another state. Irs use only—do not write or staple in. Web ty 2014 accepted forms and schedules for form 1040 series form 1040 1040a 1040ez 1040ss(pr) 56 2350 4868 9465 form 8820 unbounded 0 0 0 0 0 0 0 form 8824. You can download or print. The form determines if additional taxes are due or if the filer will receive a. Submit page only if data entered. Attach completed schedule to your utah income tax return. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Nonresidents do not qualify for. All state income tax dollars support education, children and individuals with disabilities. Web follow these steps to calculate your utah tax: Nonresidents do not qualify for. State refund on federal return. Web form 1040 department of the treasury—internal revenue service (99) u.s. Submit page only if data entered. Web utah state tax commission. Nonresidents do not qualify for. Submit page only if data entered. Current & past year forms & publications. State refund on federal return. Web ty 2014 accepted forms and schedules for form 1040 series form 1040 1040a 1040ez 1040ss(pr) 56 2350 4868 9465 form 8820 unbounded 0 0 0 0 0 0 0 form 8824. Credit for income tax paid to another state. Utah individual income tax return. The form determines if additional taxes are due or if the filer will receive a. Web form 1040 department of the treasury—internal revenue service (99) u.s. Current & past year forms & publications. Web form 1040 treasury department page 1 internal revenue service (auditor's stamp) (do not use these spaces) file code serial no. Web form 1040 is what individual taxpayers use to file their taxes with the irs. All state income tax dollars support. Or fiscal year beginning , 1940, and ended ,. Web utah state tax commission. You can download or print. Web form 1040 department of the treasury—internal revenue service (99) u.s. State refund on federal return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Or fiscal year beginning , 1940, and ended ,. Credit for income tax paid to another state. Web utah state tax commission. Current & past year forms & publications. The form determines if additional taxes are due or if the filer will receive a tax refund. Utah individual income tax return. Submit page only if data entered. Current & past year forms & publications. State refund on federal return. Nonresidents do not qualify for. Irs use only—do not write or staple in. Web follow these steps to calculate your utah tax: All state income tax dollars support education, children and individuals with disabilities. You can download or print. Current & past year forms & publications. Credit for income tax paid to another state. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. You can download or print. Web follow these steps to calculate your utah tax: Web utah state tax commission. Web form 1040 department of the treasury—internal revenue service (99) u.s. Or fiscal year beginning , 1940, and ended ,. File online for the fastest refund. Irs use only—do not write or staple in. The form determines if additional taxes are due or if the filer will receive a tax refund. All state income tax dollars support education, children and individuals with disabilities. Web form 1040 is what individual taxpayers use to file their taxes with the irs. Utah individual income tax return. Web form 1040 treasury department page 1 internal revenue service (auditor's stamp) (do not use these spaces) file code serial no. State refund on federal return. Submit page only if data entered. Web ty 2014 accepted forms and schedules for form 1040 series form 1040 1040a 1040ez 1040ss(pr) 56 2350 4868 9465 form 8820 unbounded 0 0 0 0 0 0 0 form 8824. Name, address, ssn, & residency. This form is for income earned in tax year 2022, with tax returns due in april 2023.Fillable Form Tc40a Credit For Tax Paid To Another State

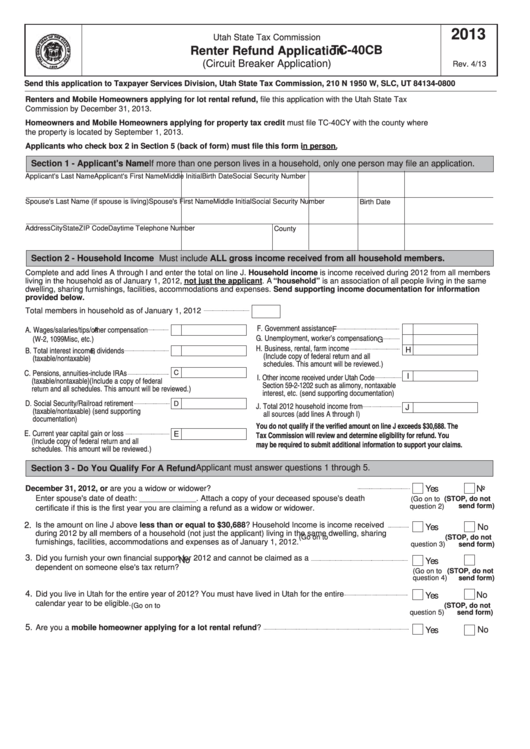

Fillable Form Tc40cb Renter Refund Application (Circuit Breaker

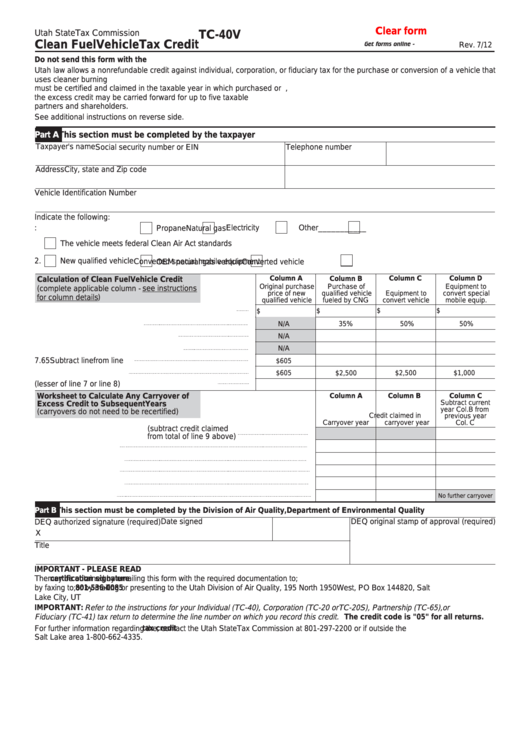

Fillable Form Tc40v Clean Fuel Vehicle Tax Credit printable pdf download

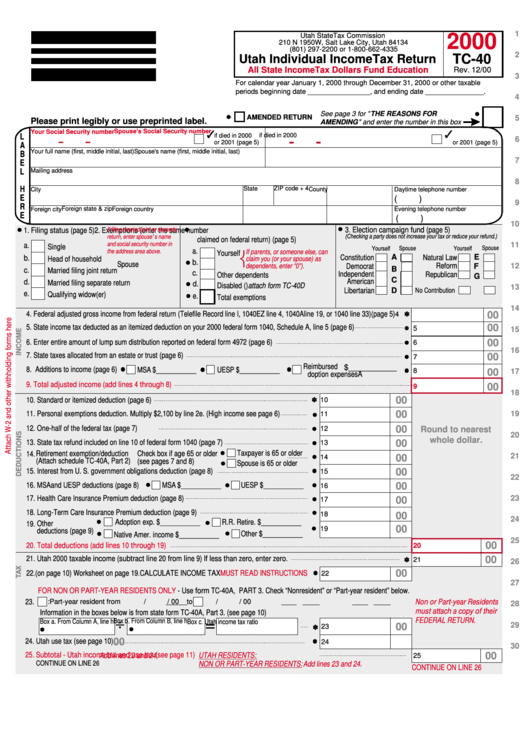

Form Tc40 Utah Individual Tax Return 2000 printable pdf

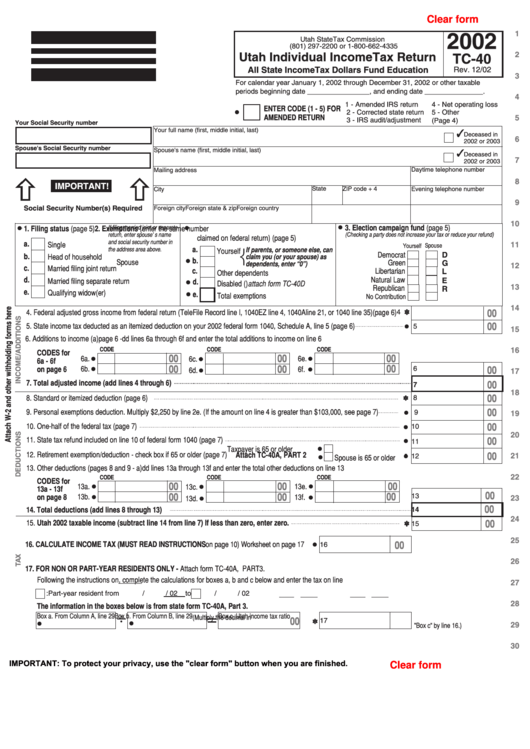

Fillable Form Tc40 Utah Individual Tax Return 2002

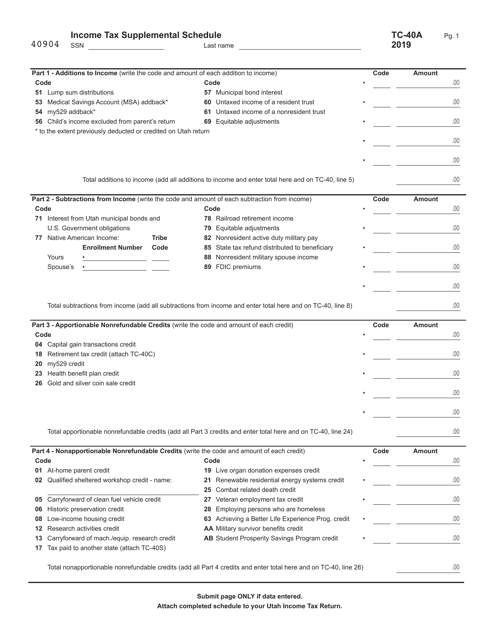

Form TC40A Schedule A 2019 Fill Out, Sign Online and Download

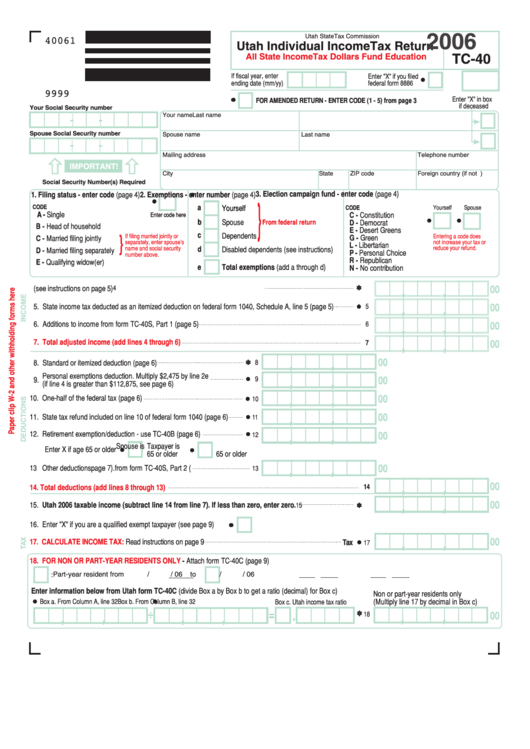

Form Tc40 Utah Individual Tax Return 2006 printable pdf

tax.utah.gov forms current tc tc40cy

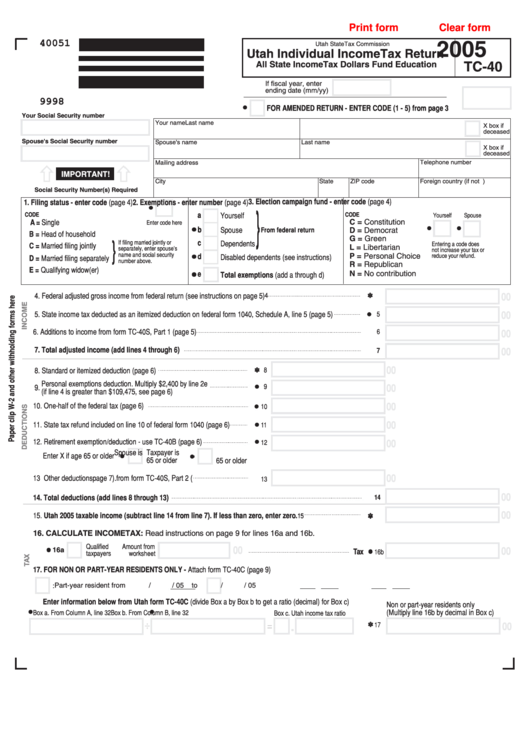

Fillable Form Tc40 Utah Individual Tax Return 2005

Utah Tc 40e Fill Online, Printable, Fillable, Blank pdfFiller

Related Post: