Form 5500 Schedule C Instructions

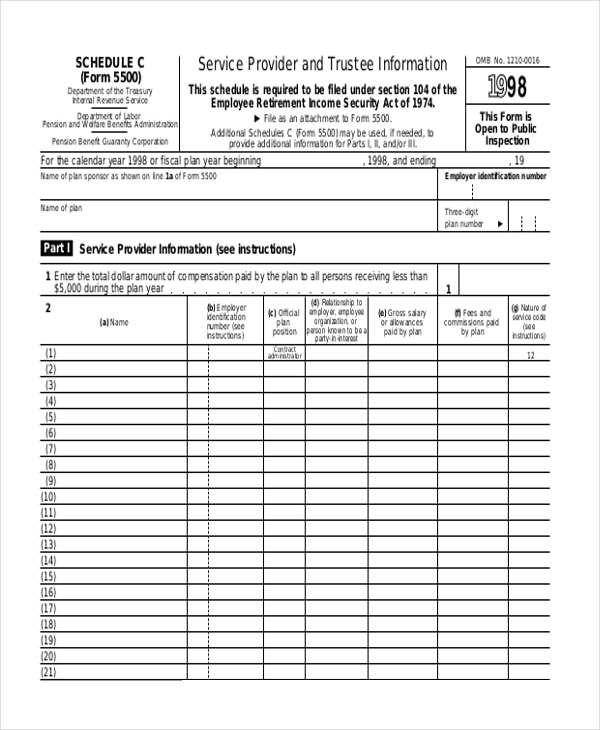

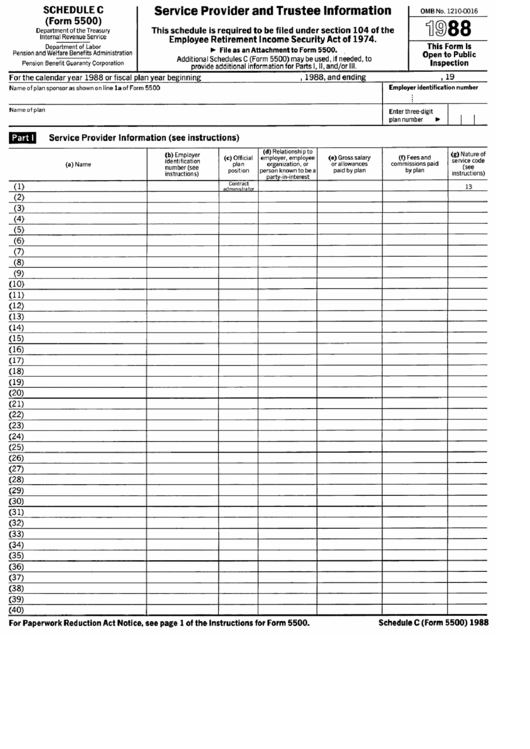

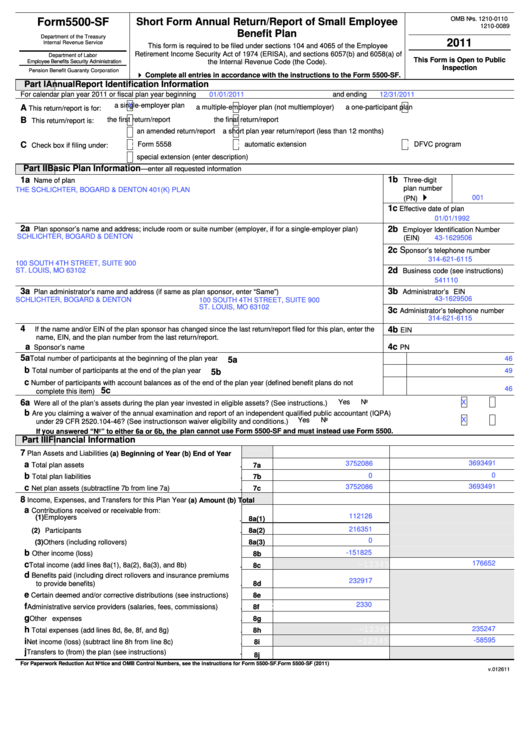

Form 5500 Schedule C Instructions - Web schedule c must be completed if a service provider was paid $5,000 or more in compensation, directly or indirectly from the plan, or an accountant or enrolled actuary. How to file form 5500. Close help page | view general instructions | view official instructions |. Top 1⁄ 2, center sides. Use schedule c (form 1040) to report income or (loss) from a business you operated or a. Web for paperwork reduction act notice, see the instructions for form 5500. Form 5500 is the form used to file the annual report of employee benefit plan. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you. Web for paperwork reduction act notice, see page 1 of the instructions for form 5500. Web schedules a & c are attached to form 5500 and used to report insurance and service provider information, respectively. General 5500 instructions this section contains a brief review of the form 5500 annual return/report including related. In this issue brief, we will briefly discuss. Use schedule c (form 1040) to report income or (loss) from a business you operated or a. Web form 5500 annual return/report of employee benefit plan | instructions; Web for paperwork reduction act notice, see. What is form 5500 form? Web the purpose of these faqs is to provide guidance to plan administrators and service providers on complying with the requirements of the 2009 form 5500 schedule c. Web the schedule c of form 5500 disclosure rules provide that each retirement plan required to file a schedule c of form 5500, review and potentially report,. Schedule c(form 5500)1993 ' file as an attachment to form 5500. Web schedule c (form 5500) 1994 page 2 enter the name and address of all trustees who served during the plan year. Frequently asked questions (faqs) as your. How to file form 5500. Form 5500 is the form used to file the annual report of employee benefit plan. Web 2019 schedule c instructions (form 5500) service provider information. Web what is form 5500? Web for paperwork reduction act notice, see the instructions for form 5500. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you. Web the schedule c of form 5500 disclosure rules provide that each retirement plan. Common form 5500 errors to avoid. Web form 5500 annual return/report of employee benefit plan | instructions; Web 2021 instructions for schedule cprofit or loss from business. Schedule c(form 5500)1993 ' file as an attachment to form 5500. Form 5500 is the form used to file the annual report of employee benefit plan. Web schedules a & c are attached to form 5500 and used to report insurance and service provider information, respectively. Web form 5500 annual return/report of employee benefit plan | instructions; Top 1⁄ 2, center sides. Web 2022 instructions for schedule c (2022) profit or loss from business. Web general 5500 instructions rev. Web what is form 5500? What is form 5500 form? Web the schedule c of form 5500 disclosure rules provide that each retirement plan required to file a schedule c of form 5500, review and potentially report, any “direct” and. Schedule c(form 5500)1993 ' file as an attachment to form 5500. Use schedule c (form 1040) to report income or. In this issue brief, we will briefly discuss. Web for paperwork reduction act notice, see page 1 of the instructions for form 5500. File as an attachment to. Top 1⁄ 2, center sides. Web 2022 instructions for schedule c (2022) profit or loss from business. Web general 5500 instructions rev. File as an attachment to. Web form 5500 annual return/report of employee benefit plan | instructions; How to file form 5500. Schedule c(form 5500)1993 ' file as an attachment to form 5500. Common form 5500 errors to avoid. Web quick reference chart of form 5500, schedules, and attachments. This schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Top 1⁄ 2, center sides. In this issue brief, we will briefly discuss. In this issue brief, we will briefly discuss. Common form 5500 errors to avoid. Web 2019 schedule c instructions (form 5500) service provider information. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you. Web 2022 instructions for schedule c (2022) profit or loss from business. The department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Form 5500 schedule c filing requirements. How to file form 5500. Web instructions to printers schedule c (form 5500), page 3 of 4 (page 4 is blank) margins: Top 1⁄ 2, center sides. Web schedules a & c are attached to form 5500 and used to report insurance and service provider information, respectively. Schedule c(form 5500)1993 ' file as an attachment to form 5500. Use schedule c (form 1040) to report income or (loss) from a business you operated or a. Web form 5500 annual return/report of employee benefit plan | instructions; File as an attachment to. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you. Web schedule c must be completed if a service provider was paid $5,000 or more in compensation, directly or indirectly from the plan, or an accountant or enrolled actuary. Web for paperwork reduction act notice, see page 1 of the instructions for form 5500. Web general 5500 instructions rev. Web 2021 instructions for schedule cprofit or loss from business.PPT PREPARING FORM 5500 SCHEDULE C PowerPoint Presentation, free

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

Form 5500 Instructions 5 Steps to Filing Correctly

Form 5500 Instructions 5 Steps to Filing Correctly

FREE 9+ Sample Schedule C Forms in PDF MS Word

Da Form 5500 Fillable Automated Printable Forms Free Online

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

2018 Updated Form 5500EZ Guide Solo 401k

Schedule C (Form 5500) Service Provider And Trustee Information

Dol 5500 Sf Instructions 2020 2022 Fill And Sign Printable Template

Related Post: