Form 8886 Threshold

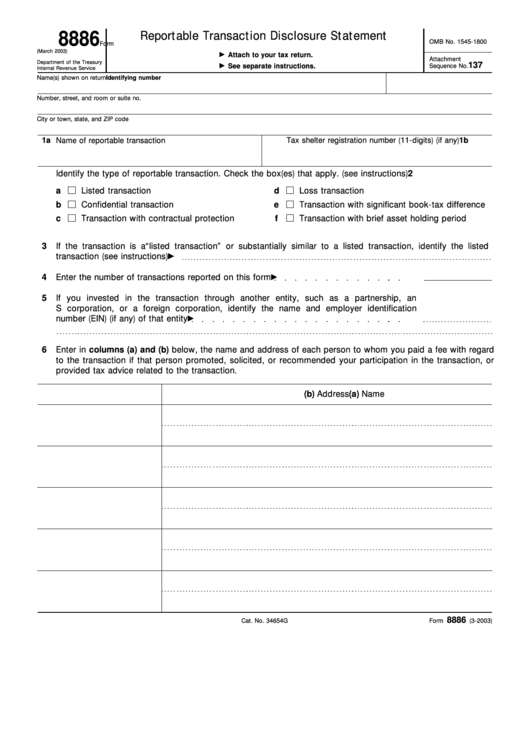

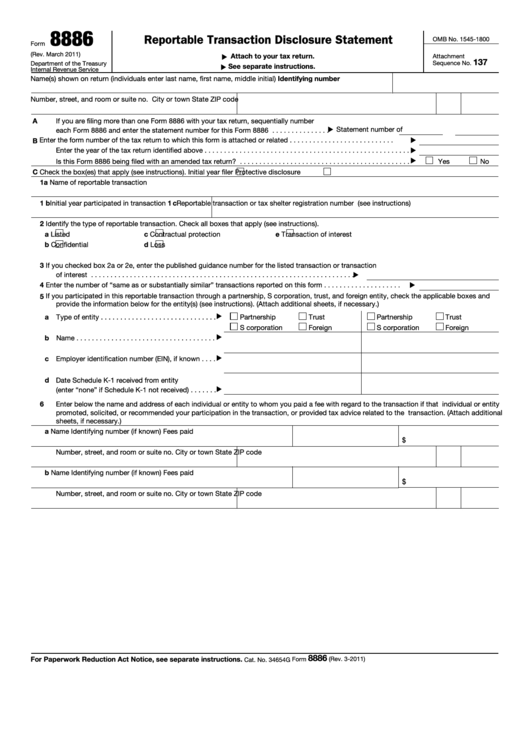

Form 8886 Threshold - Web instructions for form 8886 available on irs.gov. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Attach to your tax return. (a) in the case of a listed transaction, $200,000. Web form 8886 reportable transactions: See form 8886, reportable transaction. Web if a transaction becomes a loss transaction because the losses equal or exceed the threshold amounts described earlier in loss transactions, form 8886 must be filed as. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for. Web taxpayers with these transactions are required to file form 8886. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web the amount of the penalty under subsection (a) with respect to any reportable transaction shall not exceed—. Attach to your tax return. (a) in the case of a listed transaction, $200,000. Web 16 rows the individual partner will have to disclose its $2.4 million share of the loss since it’s over the $2 million individual threshold. It seems to me that the tax preparers of this. Web losses that must be reported on forms 8886 and 8918. Web if a taxpayer has an obligation to file and fails to file timely,. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web losses that must be reported on forms 8886 and 8918. The irs can impose a minimum penalty. Web the amount of the penalty under subsection (a) with respect to any reportable transaction shall not exceed—. Web losses that must be reported on forms 8886 and 8918. It seems to me that the tax preparers of this. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886,. The irs can impose a minimum penalty of $5,000 for individual taxpayers or a 75 percent. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Web by mark heroux, j.d., and mai chao thao, j.d. It seems to me that the tax preparers of this. Does an individual with. Web by mark heroux, j.d., and mai chao thao, j.d. Form 8886 is used to. Attach to your tax return. Web a taxpayer required to disclose their participation in a transaction of interest must file a form 8886, reportable transaction disclosure statement. When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally. Web losses that must be reported on forms 8886 and 8918. Attach to your tax return. Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for. Web instructions for form 8886 available on irs.gov. If a taxpayer claims a loss under § 165. December 2019) department of the treasury internal revenue service. Form 8886 is used to. Web form 8886 reportable transactions: Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for. Web if a transaction becomes a loss transaction because the losses equal or exceed. Does an individual with an irc § 165 loss in the current year that arose from a single irc § 988 transaction of $50,000 have a form. Web taxpayers with these transactions are required to file form 8886. December 2019) department of the treasury internal revenue service. Web the amount of the penalty under subsection (a) with respect to any. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the llc has claimed or reported income from, or a deduction, loss,. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has. Web the disclosures are made by filing. Web by mark heroux, j.d., and mai chao thao, j.d. It seems to me that the tax preparers of this. When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid. Web if a transaction becomes a loss transaction because the losses equal or exceed the threshold amounts described earlier in loss transactions, form 8886 must be filed as. If you filed federal form 8886, reportable transaction disclosure statement, with the irs, enter an “x” in part 3. Web the amount of the penalty under subsection (a) with respect to any reportable transaction shall not exceed—. (a) in the case of a listed transaction, $200,000. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web a taxpayer required to disclose their participation in a transaction of interest must file a form 8886, reportable transaction disclosure statement. Web instructions fillable forms the internal revenue service defines certain transactions to be reportable for federal income tax purposes. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has. December 2019) department of the treasury internal revenue service. Web instructions for form 8886 available on irs.gov. Web taxpayers with these transactions are required to file form 8886. Web 16 rows the individual partner will have to disclose its $2.4 million share of the loss since it’s over the $2 million individual threshold. Web form 8886 reportable transactions: Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Form 8886 is used to. Attach to your tax return. Web losses that must be reported on forms 8886 and 8918.Irs Form 8886 Fillable Printable Forms Free Online

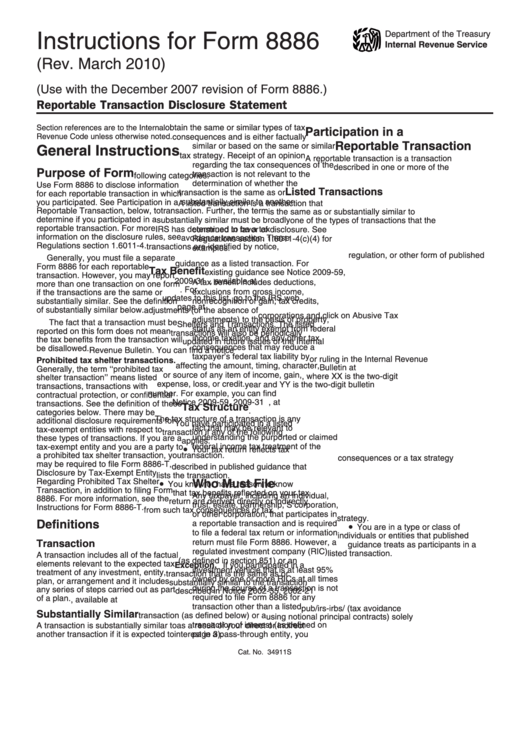

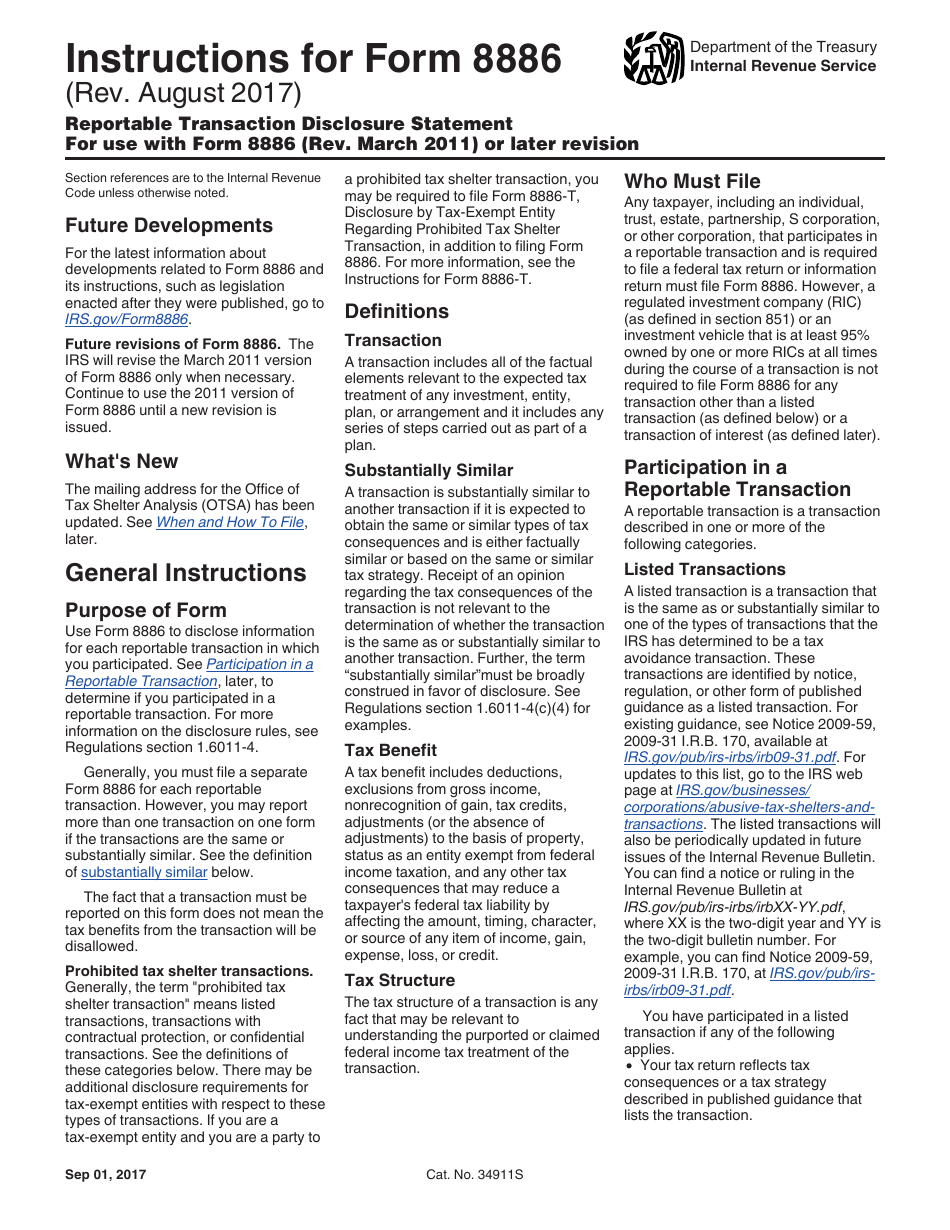

Instructions For Form 8886 Reportable Transaction Disclosure

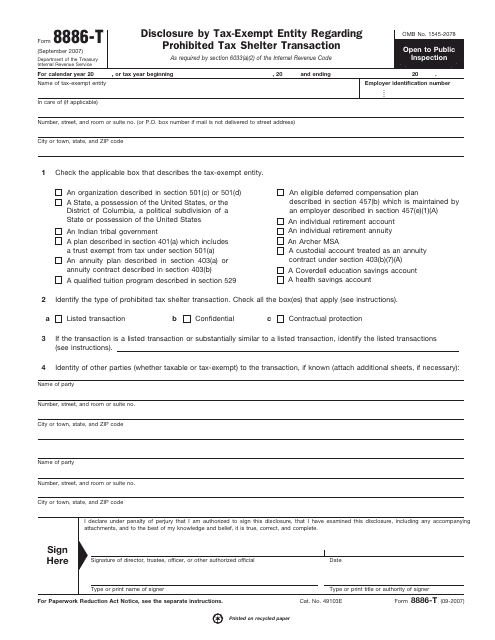

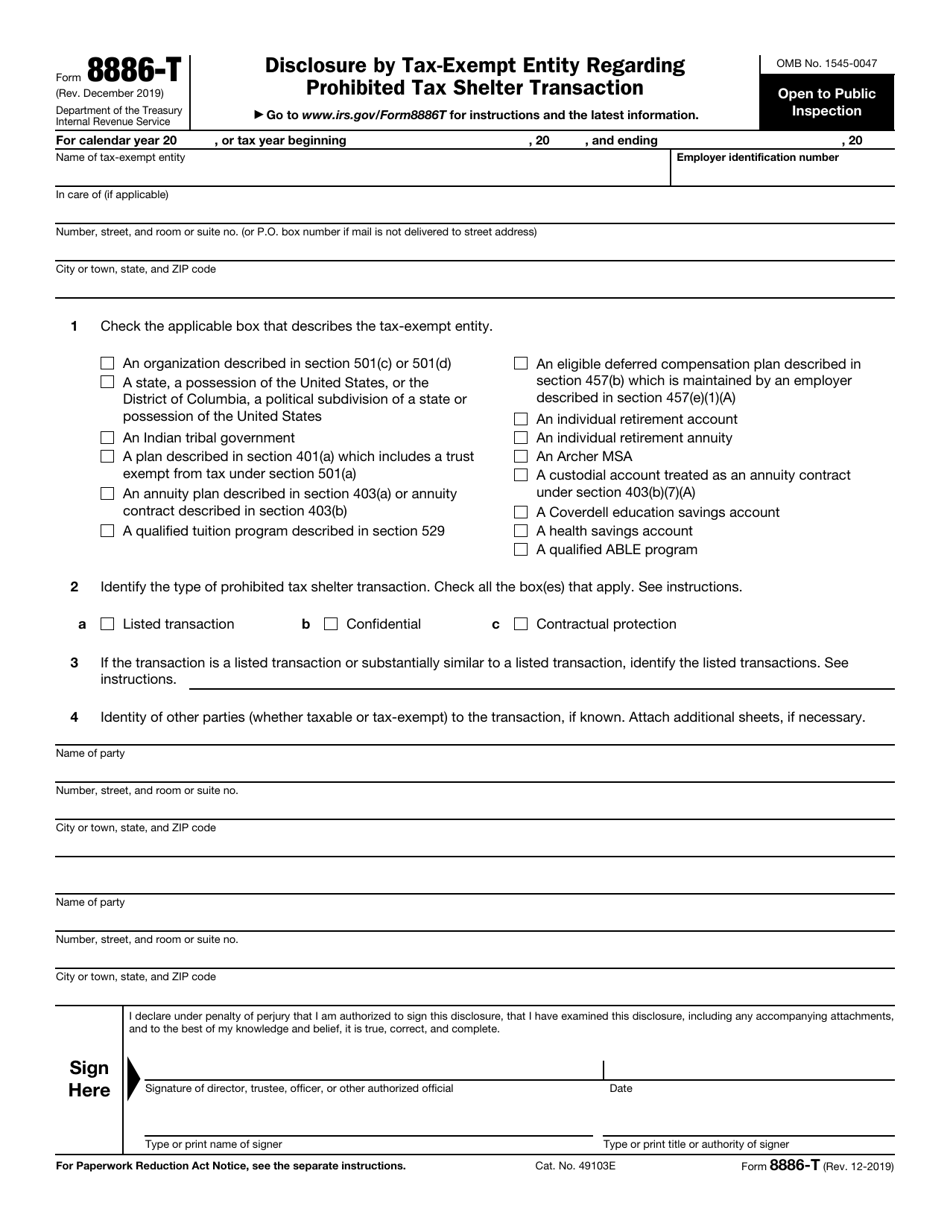

Form 8886T Disclosure by Tax Exempt Entity Regarding Prohibited Tax

Threshold Reimbursement Form Fill Online, Printable, Fillable, Blank

IRS Form 8886T Download Fillable PDF or Fill Online Disclosure by Tax

Download Instructions for IRS Form 8886 Reportable Transaction

Fill Free fillable Form 8886 Reportable Transaction Disclosure

Fillable Form 8886 (Rev. March 2003) Reportable Transaction Disclosure

Fillable Form 8886 Reportable Transaction Disclosure Statement

Form 8886 Instructions Fill Out and Sign Printable PDF Template signNow

Related Post: