Form 941-X Instructions

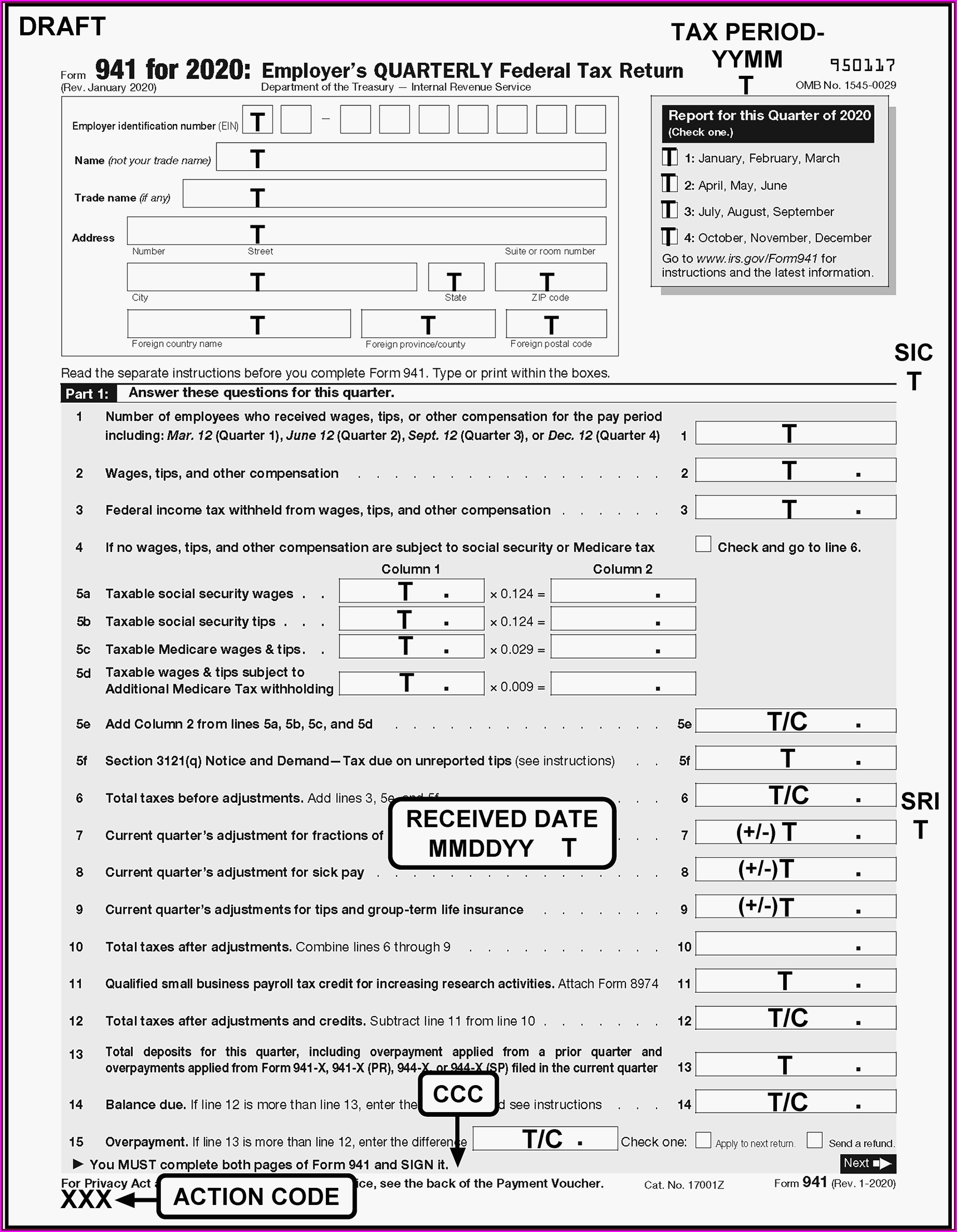

Form 941-X Instructions - You must complete all five pages. You will use the claim process if you overreported. You can mail your completed. Type or print within the boxes. Web the employee retention credit nonrefundable and refundable amounts need to be calculated by following the worksheets that are included on page 28 and page 30 of. Click the link to load the. Where can you get help? Expiration of the period of file two separate forms. An employer is required to file an irs 941x in the event of an. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Who must file form 941? Web purpose of form 941. Web the employee retention credit nonrefundable and refundable amounts need to be calculated by following the worksheets that are included on page 28 and page 30 of. These instructions have been updated for changes to the. These instructions have been updated for changes under the. Web purpose of form 941. These instructions have been updated for changes to the. You must complete all five pages. Web the employee retention credit nonrefundable and refundable amounts need to be calculated by following the worksheets that are included on page 28 and page 30 of. You can mail your completed. These instructions have been updated for changes to the. Who must file form 941? Type or print within the boxes. Web the employee retention credit nonrefundable and refundable amounts need to be calculated by following the worksheets that are included on page 28 and page 30 of. You can mail your completed. These instructions have been updated for changes under the. Click the link to load the. Who must file form 941? You will use the claim process if you overreported. How should you complete form 941? You must complete all five pages. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and. An employer is required to file an irs 941x in the event of an. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb. Type or print within the boxes. Web the employee retention credit nonrefundable and refundable amounts need to be calculated by following the worksheets that are included on page 28 and page 30 of. How should you complete form 941? These instructions have been updated for changes under the. July 2020) adjusted employer’s quarterly federal tax return or claim for refund. These instructions have been updated for changes under the. You will use the claim process if you overreported. How should you complete form 941? Web the employee retention credit nonrefundable and refundable amounts need to be calculated by following the worksheets that are included on page 28 and page 30 of. Who must file form 941? Type or print within the boxes. You will use the claim process if you overreported. These instructions have been updated for changes to the. You must complete all five pages. Web purpose of form 941. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. An employer is required to file an irs 941x in the event of an. Who must file form 941? These instructions have been updated for changes to the. You will use the claim process if you overreported. Web the employee retention credit nonrefundable and refundable amounts need to be calculated by following the worksheets that are included on page 28 and page 30 of. You must complete all five pages. Click the link to load the. Who must file form 941? You will use the claim process if you overreported. Type or print within the boxes. An employer is required to file an irs 941x in the event of an. You must complete all five pages. Where can you get help? These instructions have been updated for changes to the. You can mail your completed. These instructions have been updated for changes under the. You will use the claim process if you overreported. How should you complete form 941? Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and. Web purpose of form 941. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Expiration of the period of file two separate forms. Web the employee retention credit nonrefundable and refundable amounts need to be calculated by following the worksheets that are included on page 28 and page 30 of. Who must file form 941? Click the link to load the.Form 941 Instructions & FICA Tax Rate [+ Mailing Address]

Irs.gov Form 941 X Instructions Form Resume Examples 1ZV8dX3V3X

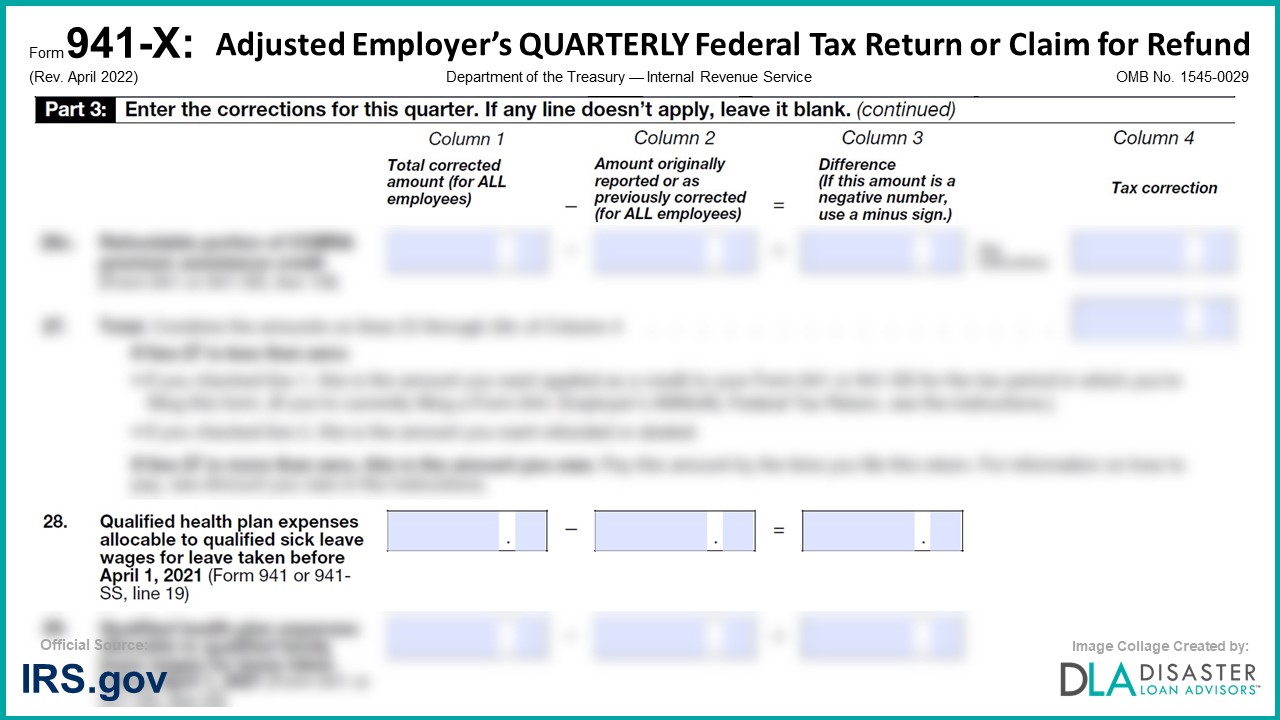

941X 28. Qualified Health Plan Expenses Allocable to Qualified Sick

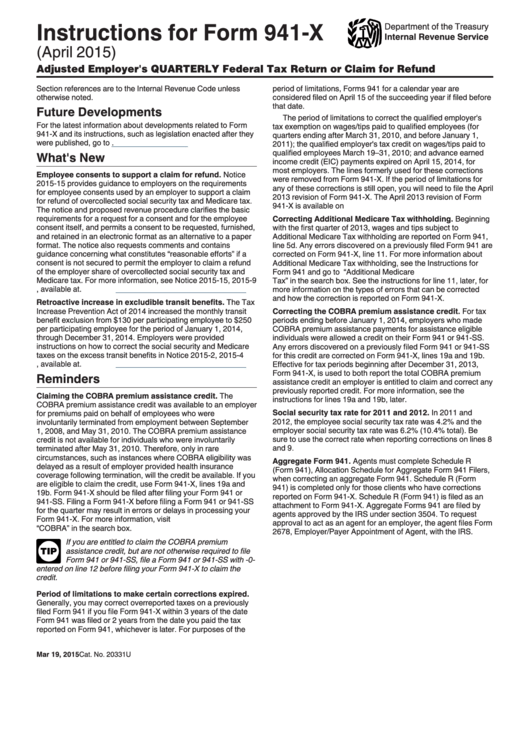

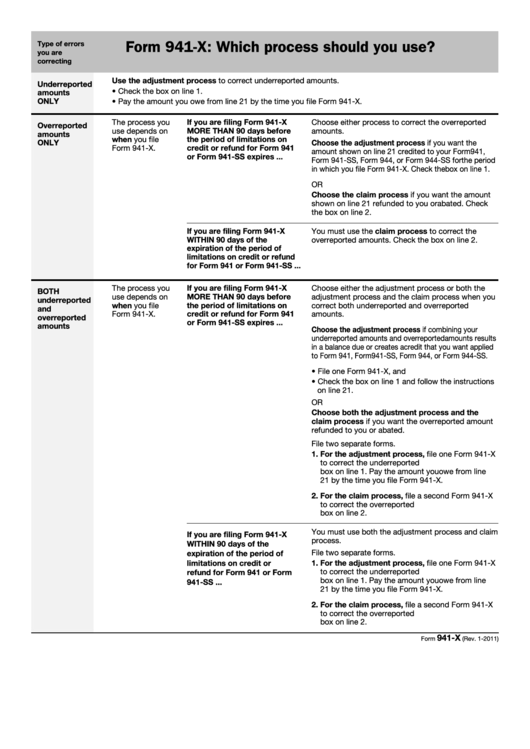

Instructions For Form 941x Adjusted Employer's Quarterly Federal Tax

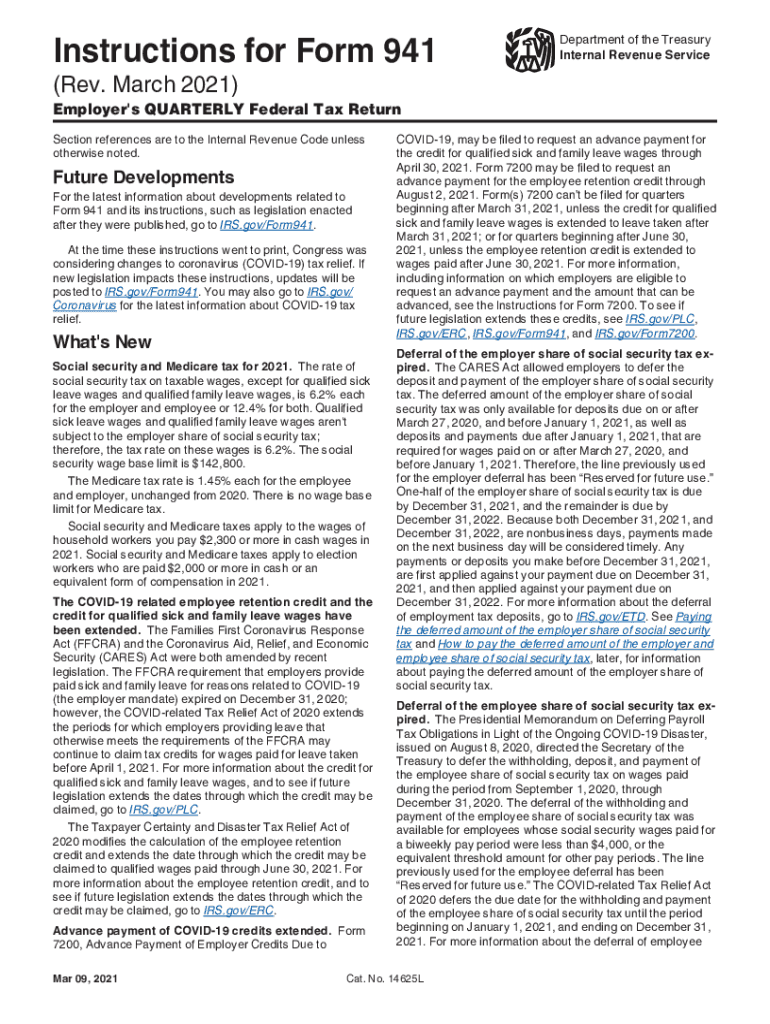

2021 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Form 941 X 2023 Fill online, Printable, Fillable Blank

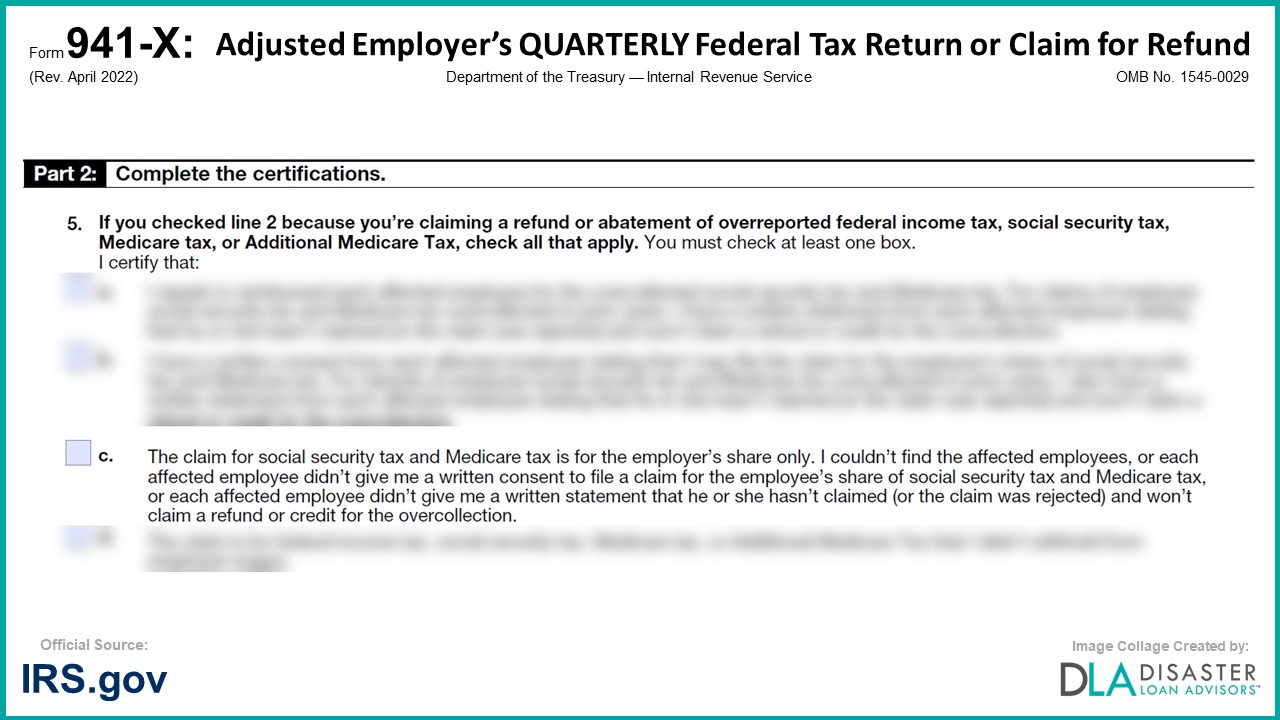

941X 5c. Certifying Claims, Form Instructions

Instructions For Form 941X Adjusted Employer'S Quarterly Federal Tax

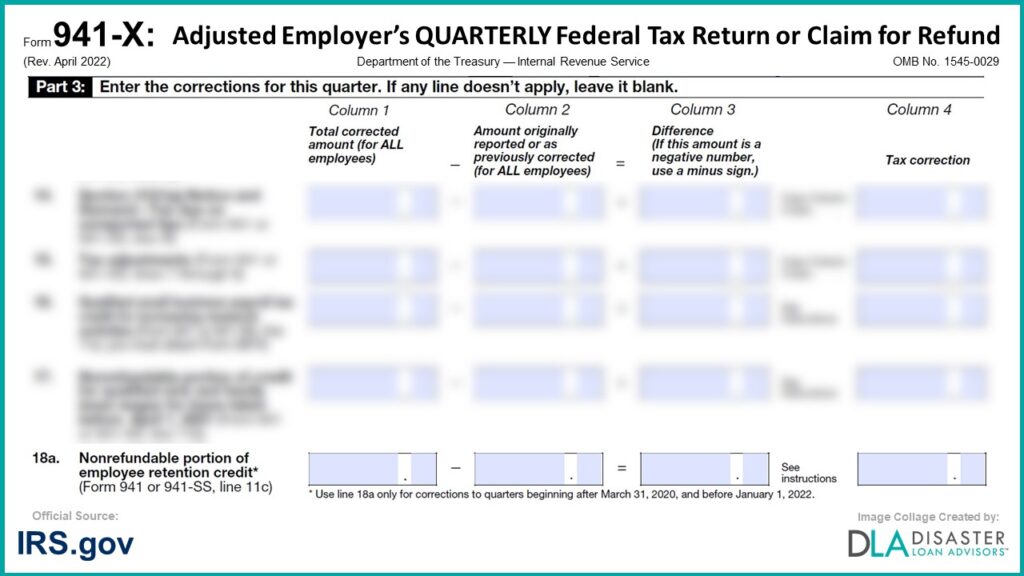

941X 18a. Nonrefundable Portion of Employee Retention Credit, Form

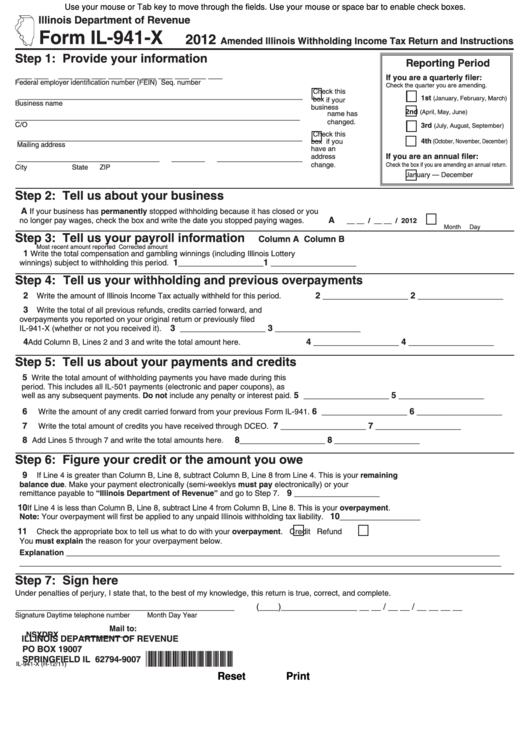

Form Il941X Amended Illinois Withholding Tax Return And

Related Post:

![Form 941 Instructions & FICA Tax Rate [+ Mailing Address]](https://fitsmallbusiness.com/wp-content/uploads/2018/12/word-image-1461-730x932.png)