How To File Form 8606 For Previous Years

How To File Form 8606 For Previous Years - Ad access irs tax forms. My dad has been filing my taxes using proseries. Uscis does not place a restriction on the number of times you may file a form. Information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to. If for any tax year, you were eligible to make deductible contributions to a traditional ira, and did make the contributions in timely. June 4, 2019 1:13 pm. Web when and where to file. Later on, when you take distributions, a portion of the money you get. Review your previous years tax returns with copies of your form 5498s. If you aren’t required to. If you have form 5498s for any year that show that you. If for any tax year, you were eligible to make deductible contributions to a traditional ira, and did make the contributions in timely. Ad we offer a variety of software related to various fields at great prices. Uscis does not place a restriction on the number of times. If for any tax year, you were eligible to make deductible contributions to a traditional ira, and did make the contributions in timely. You will need your form 8606 for the most recent year prior to 2022 when you received a distribution. If married, file a separate form for each spouse required to file. Complete, edit or print tax forms. Web when and where to file. I missed filing 8606 for the years 2009, 2019 and 2020. Ad we offer a variety of software related to various fields at great prices. Get deals and low prices on turbo tax online at amazon If married, file a separate form for each spouse required to file. I'm hoping someone can help me figure out how to file form 8606 properly for the past several years. Get deals and low prices on turbo tax online at amazon My dad has been filing my taxes using proseries. If for any tax year, you were eligible to make deductible contributions to a traditional ira, and did make the contributions. I missed filing 8606 for the years 2009, 2019 and 2020. Later on, when you take distributions, a portion of the money you get. If you have form 5498s for any year that show that you. If you aren’t required to. If married, file a separate form for each spouse required to file. Review your previous years tax returns with copies of your form 5498s. Ad we offer a variety of software related to various fields at great prices. Web ira discussion forum. Later on, when you take distributions, a portion of the money you get. Web see the instructions for form 8606: Web page last reviewed or updated: Complete, edit or print tax forms instantly. Web form 8606 is used to report a variety of transactions related to traditional individual retirement agreements (iras), roth iras, and other types of retirement plans. Later on, when you take distributions, a portion of the money you get. Web ira discussion forum. Uscis does not place a restriction on the number of times you may file a form. If married, file a separate form for each spouse required to file. Download or email form 8606 & more fillable forms, try for free now! I missed filing 8606 for the years 2009, 2019 and 2020. Get deals and low prices on turbo tax. Get deals and low prices on turbo tax online at amazon If you aren’t required to. Web when and where to file. I'm hoping someone can help me figure out how to file form 8606 properly for the past several years. If married, file a separate form for each spouse required to file. Ad access irs tax forms. If you aren’t required to. June 4, 2019 1:13 pm. Web when and where to file. Web form 8606 is used to report a variety of transactions related to traditional individual retirement agreements (iras), roth iras, and other types of retirement plans. Web page last reviewed or updated: If married, file a separate form for each spouse required to file. Ad access irs tax forms. Web when and where to file. I missed filing 8606 for the years 2009, 2019 and 2020. You will need your form 8606 for the most recent year prior to 2022 when you received a distribution. Web when and where to file. Review your previous years tax returns with copies of your form 5498s. Uscis does not place a restriction on the number of times you may file a form. My dad has been filing my taxes using proseries. Later on, when you take distributions, a portion of the money you get. Complete, edit or print tax forms instantly. Tip if you aren’t required. If you aren’t required to. Get deals and low prices on turbo tax online at amazon Web form 8606 gets it “on the record” that a portion of the money in your ira has already been taxed. Download or email form 8606 & more fillable forms, try for free now! Web previous income tax returns. Web ira discussion forum. June 4, 2019 1:13 pm.What Is IRS Form 8606?

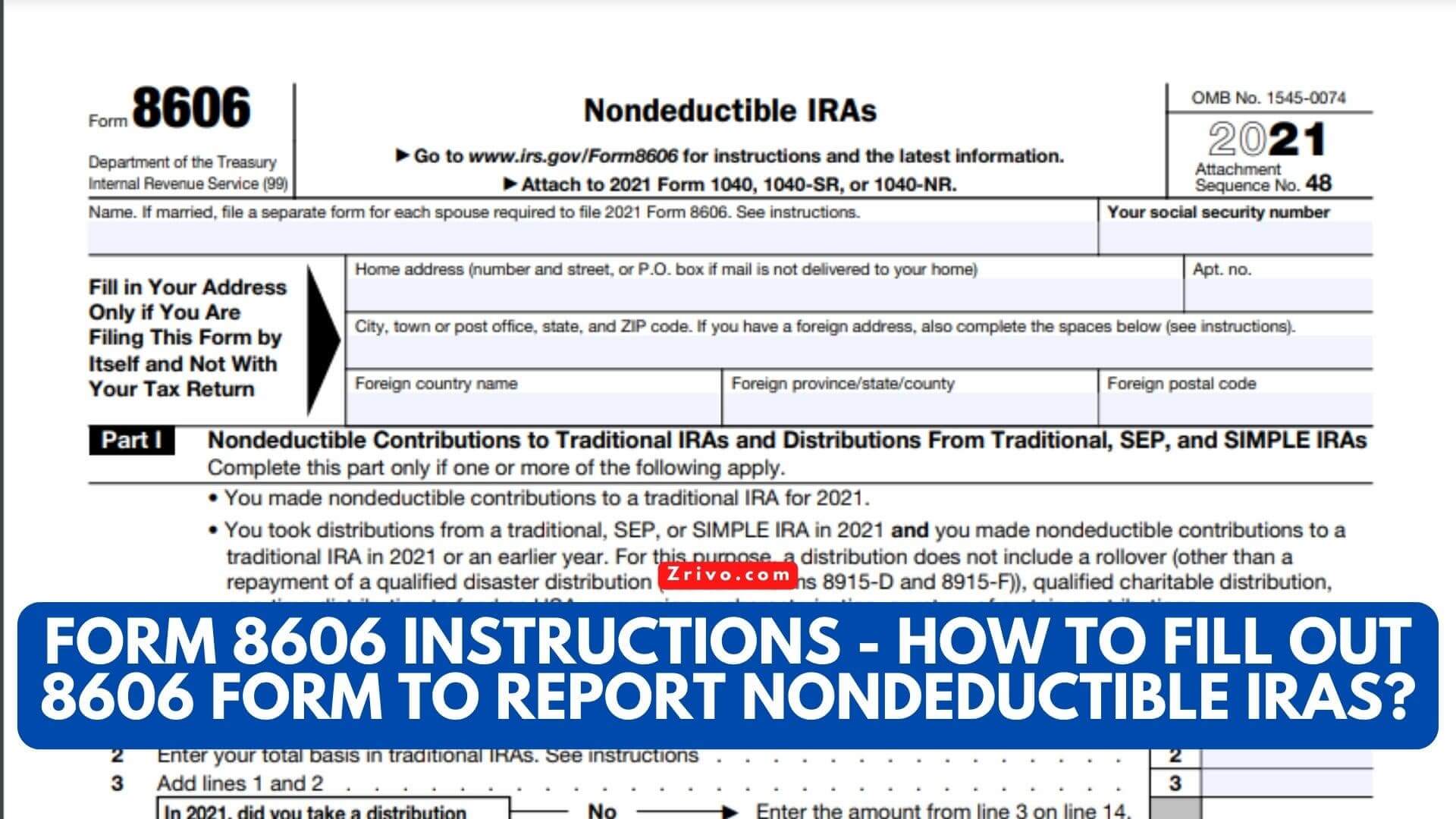

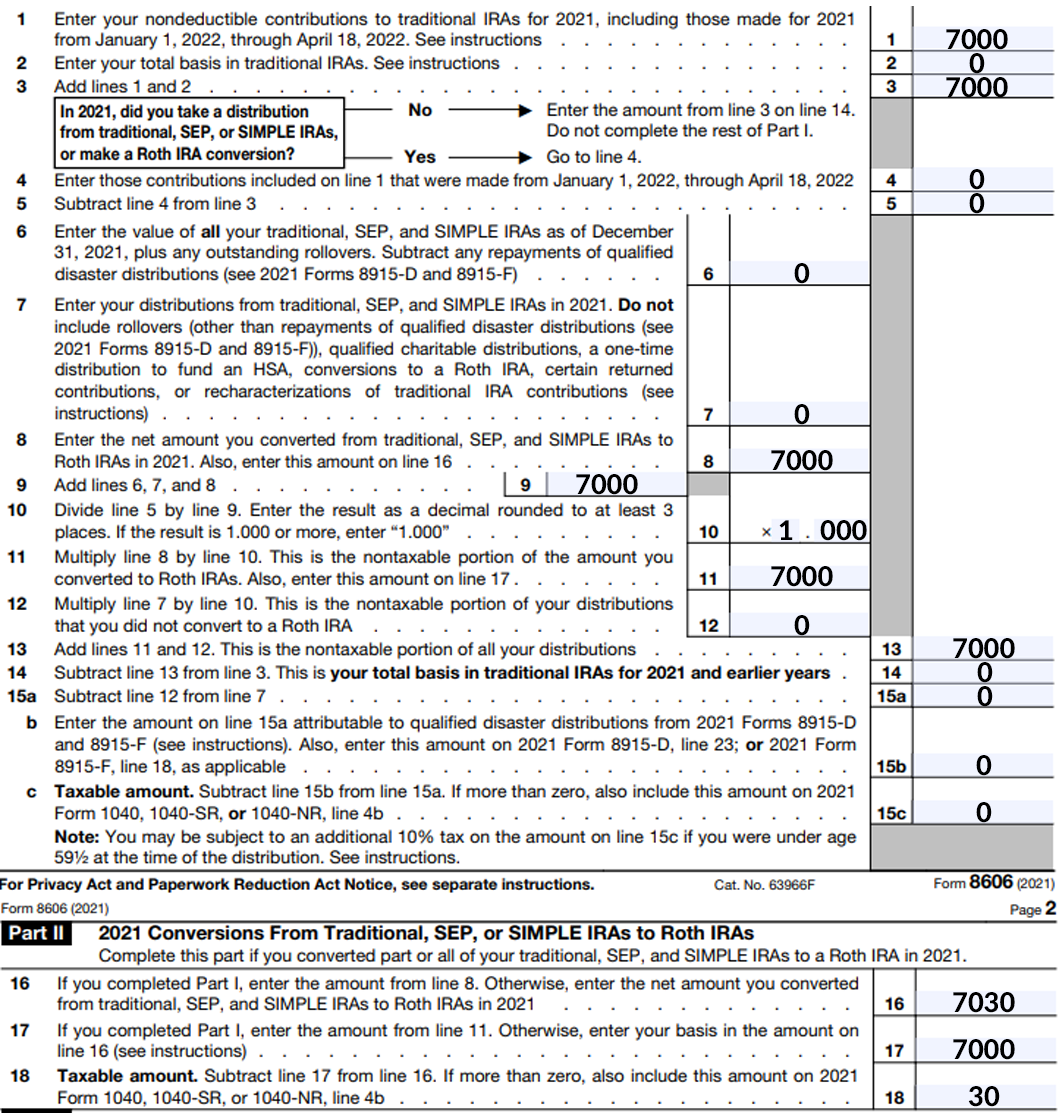

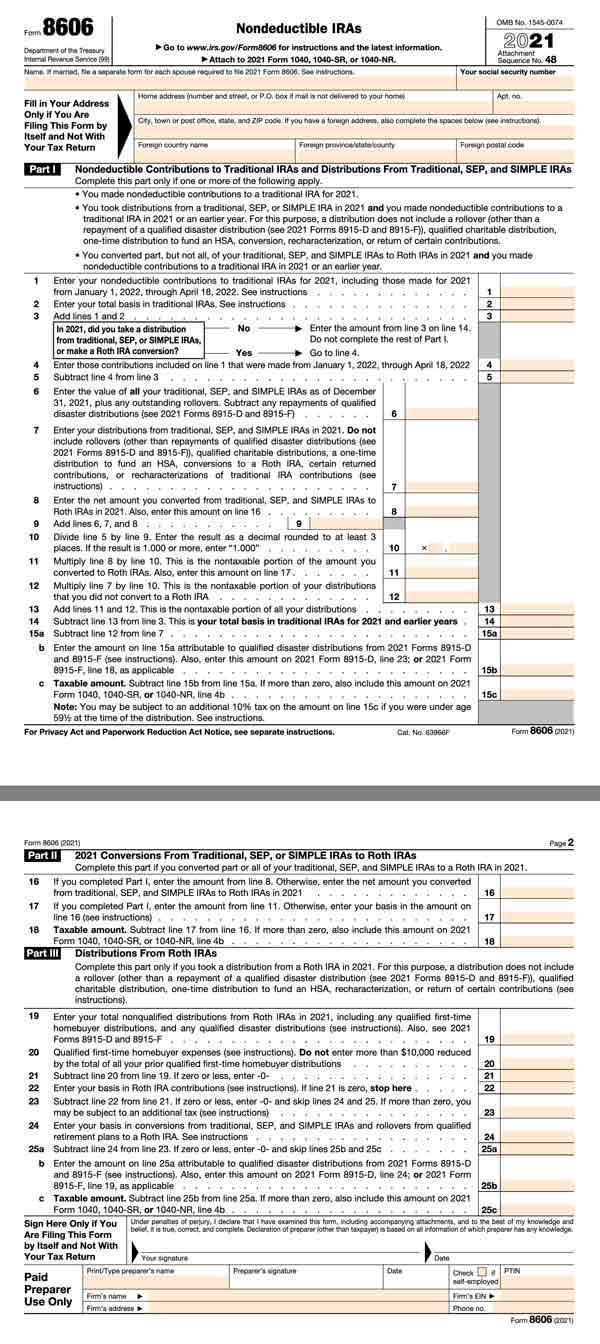

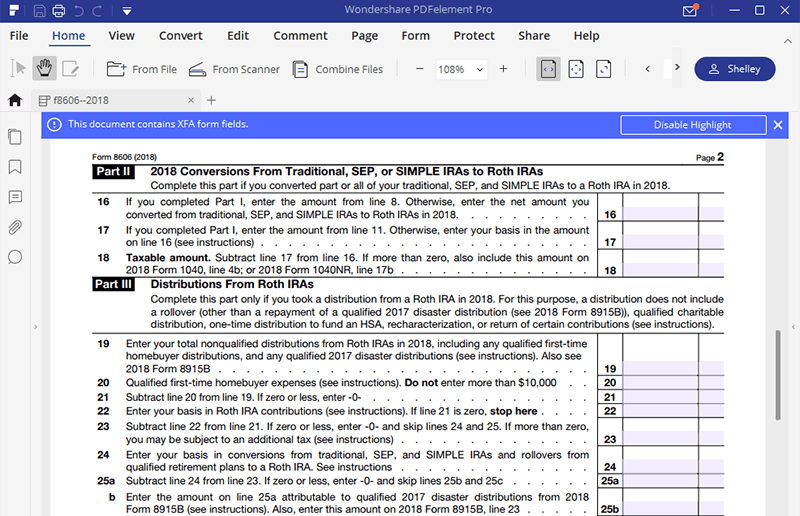

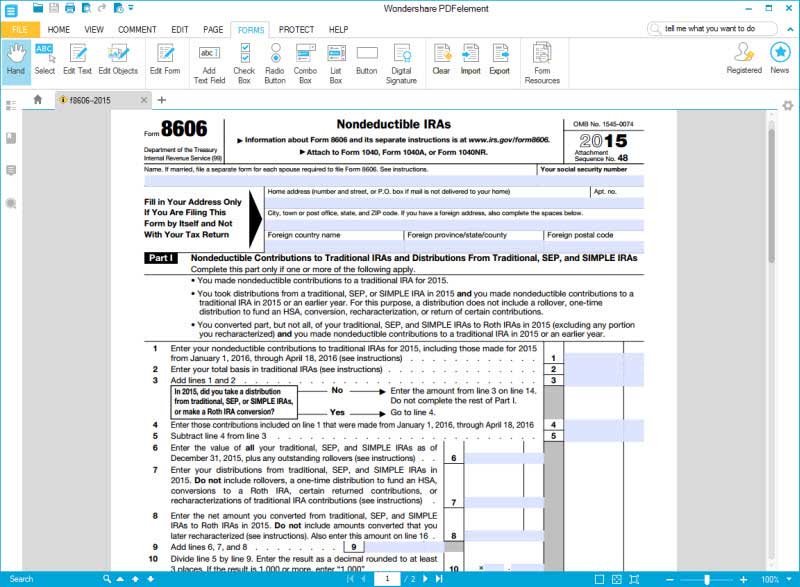

2023 Form 8606 Instructions How To Fill Out 8606 Form To Report

Considering a Backdoor Roth Contribution? Don’t Form 8606!

How to file form 8606 when doing a recharacterization followed by

united states How to file form 8606 when doing a recharacterization

IRS Form 8606 What Is It & When To File? SuperMoney

Irs form 8606 2016 Fill out & sign online DocHub

Make Backdoor Roth Easy On Your Tax Return

for How to Fill in IRS Form 8606

Instructions for How to Fill in IRS Form 8606

Related Post:

:max_bytes(150000):strip_icc()/Form8606pg2-4983aa8619774bbf99bde1e607598d87.jpg)