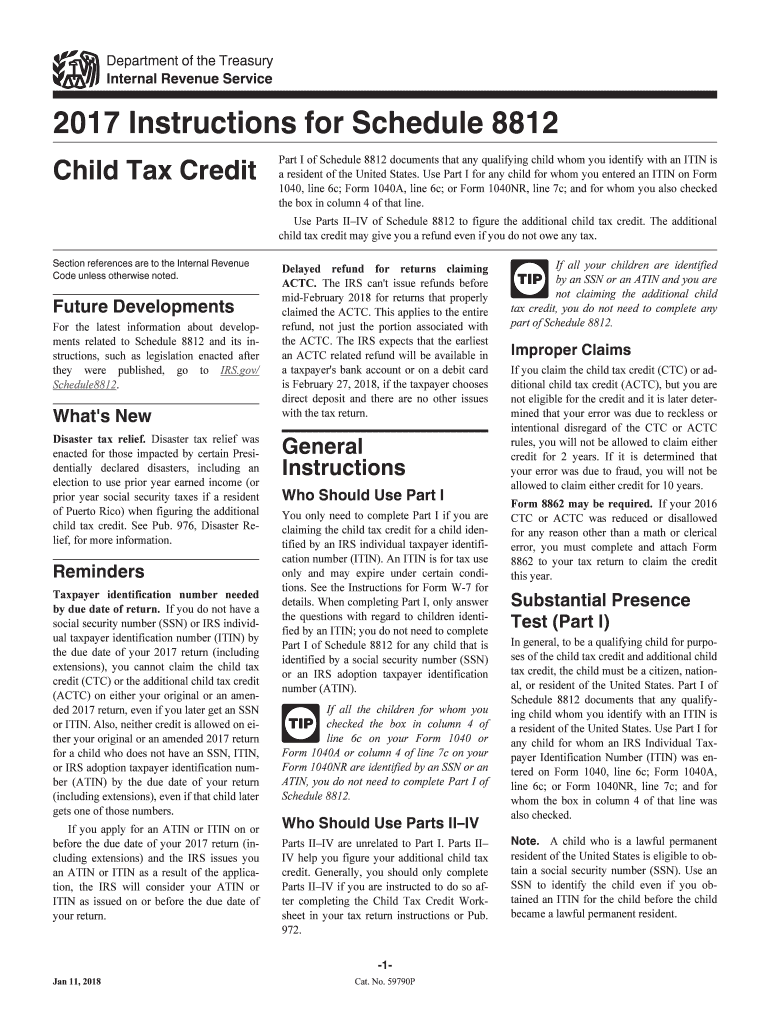

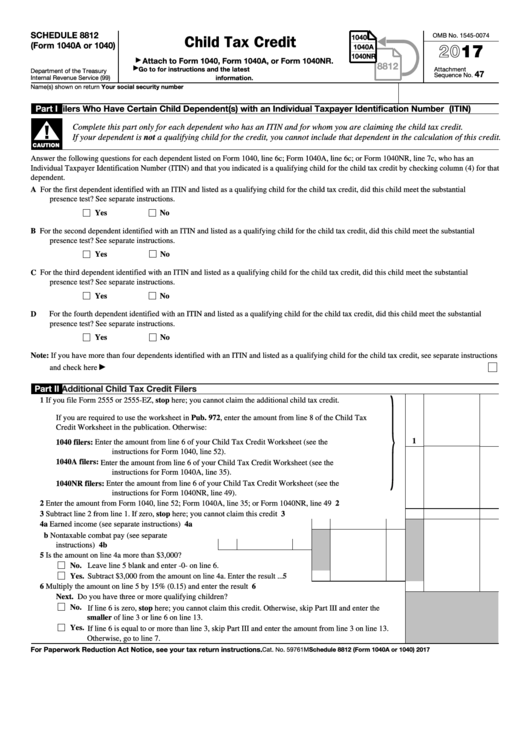

Form 8812 Instructions

Form 8812 Instructions - Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax. Get ready for tax season deadlines by completing any required tax forms today. Web all you need is to follow these easy instructions: Ad access irs tax forms. Go through the form 8812 instructions to understand how to complete the form correctly. Web solved • by turbotax • 3274 • updated january 25, 2023. The ctc and odc are nonrefundable credits. For example, if the amount. Open the record with our advanced pdf editor. Complete the form along with your regular taxes. For example, if the amount. Web schedule 8812 (form 1040). Go through the form 8812 instructions to understand how to complete the form correctly. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to form 1040, 1040. Web use schedule 8812 (form 1040) to figure your child. Child tax credit and credit for other dependents. Web how to file form 8812. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). Open the record with our advanced pdf editor. Web all you need is to follow these easy instructions: Web 2022 schedule 8812 credit limit worksheet a keep for your records 1. Schedule 8812 instructions schedule 8812 requires. Web download the irs form from the irs website and a copy of the form. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to form 1040, 1040.. Advanced payments from july 2021 to december 2021, taxpayers may. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). The schedule 8812 (form 1040) and its instructions have been revised to be the single source for figuring and reporting the child tax credits and. Web 2022. Web schedule 8812 is the irs tax form designed to help eligible taxpayers claim the additional child tax credit. Claim the additional child tax credit for each qualifying child using irs form 8812 on your form 1040 (schedule 8812 instructions). Complete, edit or print tax forms instantly. Web the schedule 8812 form is found on form 1040, and it’s used. Web schedule 8812 (form 1040). Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax. Enter the amount from form 1120, schedule j, line 5b (or the amount from the applicable line of your return) plus any form 8978 amount included. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web 2022 schedule 8812 credit limit worksheet a keep for your records 1. Advanced payments from july 2021 to december 2021, taxpayers may. Web use schedule 8812 (form 1040) to figure your child tax credits, to report. Ad access irs tax forms. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Web follow the irs form 8812 instructions carefully. Complete, edit or print tax forms instantly. You will need to complete the form using the schedule 8812. Web use part i of schedule 8812 to document that any child for whom an irs individual taxpayer identification number (itin) was entered on form 1040, line 6c; The ctc and odc are. Web download the irs form from the irs website and a copy of the form. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other. The actc is a refundable credit. You will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. Get ready for tax season deadlines by completing any required tax forms today. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit. Web schedule 8812 (form 1040). You will need to complete the form using the schedule 8812. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to form 1040, 1040. Schedule 8812 instructions schedule 8812 requires. The actc is a refundable credit. Web irs schedule 8812: Claim the additional child tax credit for each qualifying child using irs form 8812 on your form 1040 (schedule 8812 instructions). The ctc and odc are nonrefundable credits. Get ready for tax season deadlines by completing any required tax forms today. Ad schedule 8812 & more fillable forms, register and subscribe now! Go through the form 8812 instructions to understand how to complete the form correctly. Web solved • by turbotax • 3274 • updated january 25, 2023. Upload, modify or create forms. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Web how to file form 8812. Web download the irs form from the irs website and a copy of the form. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). The ctc and odc are. Complete the form along with your regular taxes. Advanced payments from july 2021 to december 2021, taxpayers may.8812 Instructions Tax Form Fill Out and Sign Printable PDF Template

Irs instructions form 8812 Fill out & sign online DocHub

Irs Printable Tax Form 8812 With Instructions Printable Forms Free Online

Form 8812 for 2017 Fill out & sign online DocHub

Irs Printable Tax Form 8812 With Instructions Printable Forms Free Online

Worksheet 8812

8812 Credit Limit Worksheet A

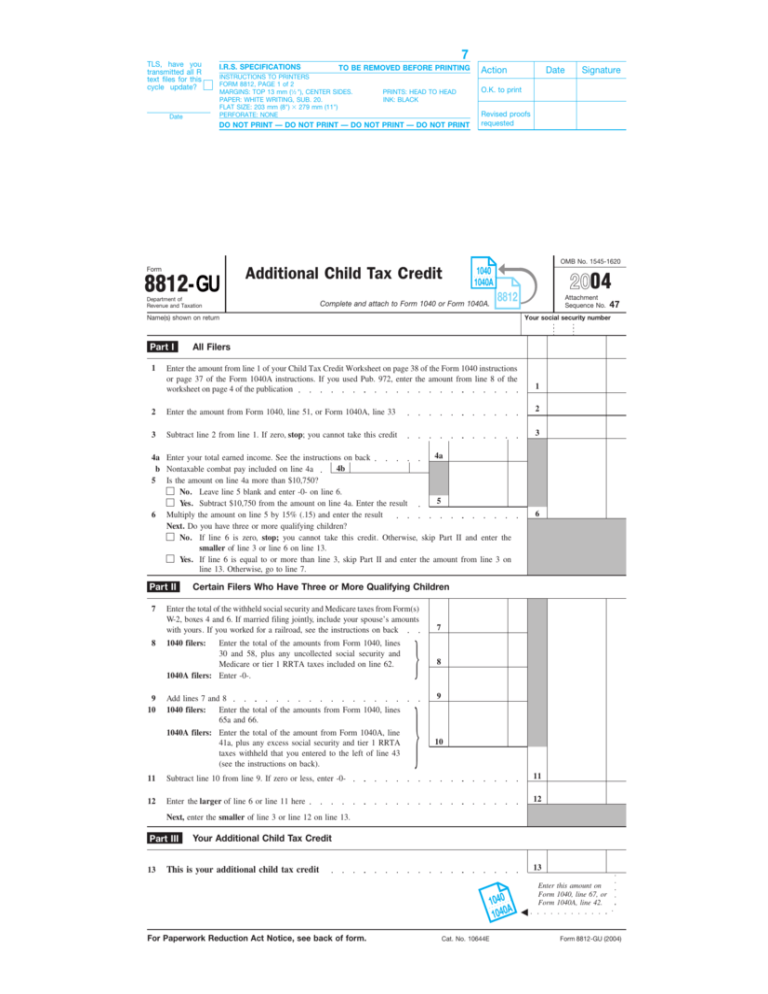

Form 8812GU Additional Child Tax Credit, 2004

Form 8812 Credit Limit Worksheet A

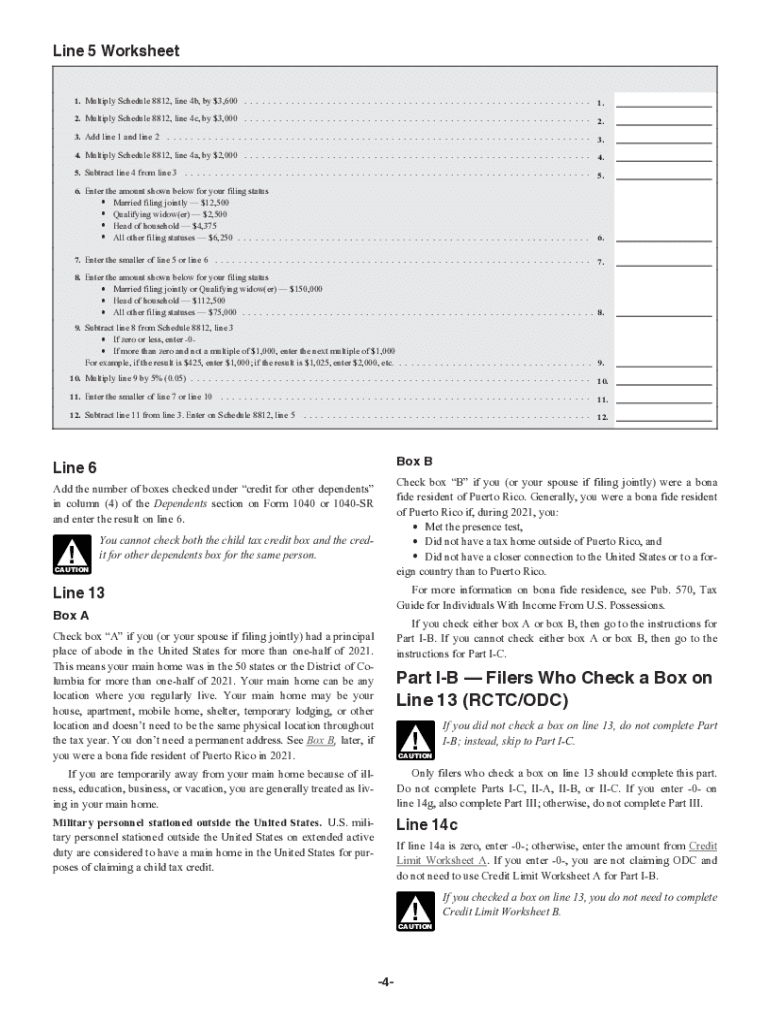

Line 5 Worksheet Schedule 8812

Related Post: