Form 9465 Instructions

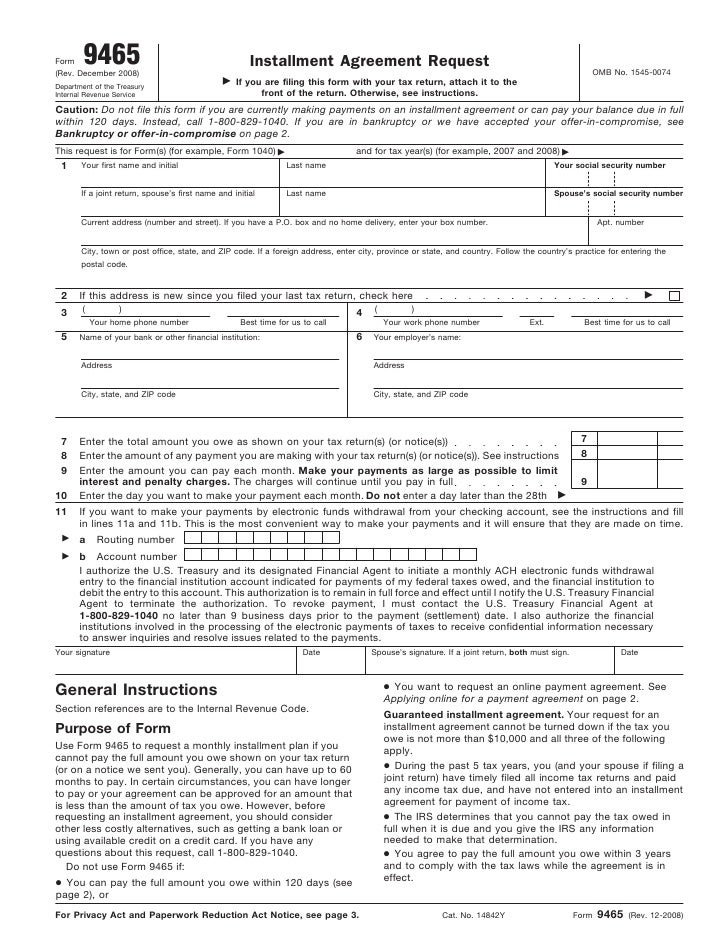

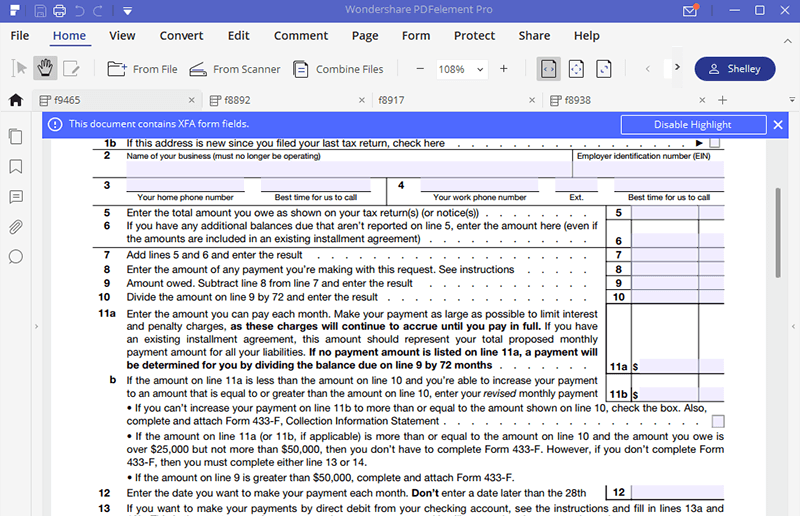

Form 9465 Instructions - The irs encourages you to pay a portion of the. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Business name and employer identification number. Web use form 9465 if you’re an individual: You can also find the mailing address, which. Guaranteed installment agreement.you’re eligible for a guaranteed installment agreement if the tax you owe isn’t more than $10,000 and:. Web it allows taxpayers to make smaller, more manageable payments over time. Web per the irs instructions for form 9465: Complete, edit or print tax forms instantly. Web the user fee for requesting an installment agreement using form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account. The irs encourages you to pay a portion of the. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Guaranteed installment agreement.you’re eligible for a guaranteed installment agreement if the tax you owe isn’t more than $10,000 and:. Business name and employer identification number. Ad fill. Web irs form 9465, installment agreement request, is a federal form that an individual taxpayer may use when requesting permission to pay down their tax liabilities. Web federal form 9465 instructions. Web where to file your taxes for form 9465. Web how to file form 9465 & address to send to. Web it allows taxpayers to make smaller, more manageable. This irs program allows those taxpayers to pay the government back over time rather. An installment agreement allows the taxpayer to break down their tax debt into. Web instructions how to fill out form 9465 the irs offers detailed instructions online to help you complete form 9465. Web use irs form 9465 installment agreement request to request a monthly installment. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. An installment agreement allows the taxpayer to break down their tax debt into. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. If. Web who should use this form? Web instructions how to fill out form 9465 the irs offers detailed instructions online to help you complete form 9465. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. Form 9465, installment agreement request instructions. Business name and. Form 9465, installment agreement request instructions. You must either pay by mail or online through the irs. Ad fill your 9465 installment agreement request online, download & print. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). The. This irs program allows those taxpayers to pay the government back over time rather. •who is or may be responsible for a trust fund recovery. Web general instructions purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax. Web instructions how to fill. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Business name and employer identification number. If you are filing. Use form 9465 if you’re an individual: Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web instructions how to fill out form 9465 the irs offers detailed instructions online to help you complete form 9465. Web use form 9465 to request a monthly installment agreement (payment plan) if you. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). •who is or may be responsible for a trust fund recovery. Business name and employer identification number. The irs encourages you to pay a portion of the. Ad get. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. Ad fill your 9465 installment agreement request online, download & print. If you are filing form 9465. Web the form 9465 continuous use (cu) version 25.1 schemas and business rules package, which contained tax year updates, were made available on october 12,. Web general instructions purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax. Web federal form 9465 instructions. December 2018) department of the treasury internal revenue service. Web irs form 9465, installment agreement request, is a federal form that an individual taxpayer may use when requesting permission to pay down their tax liabilities. Ad get ready for tax season deadlines by completing any required tax forms today. Web where to file your taxes for form 9465. Business name and employer identification number. Form 9465, installment agreement request instructions. Web who should use this form? •who is or may be responsible for a trust fund recovery. If you are filing form 9465 with your return, attach it to the front of your return when you file. Use form 9465 if you’re an individual: Web the user fee for requesting an installment agreement using form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account. You can also find the mailing address, which. You must either pay by mail or online through the irs. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).Irs Installment Agreement Form 9465 Instructions Erin Anderson's Template

IRS Form 9465 Instructions for How to Fill it Correctly File

Form 9465 Installment Agreement Request Meaning, Overview

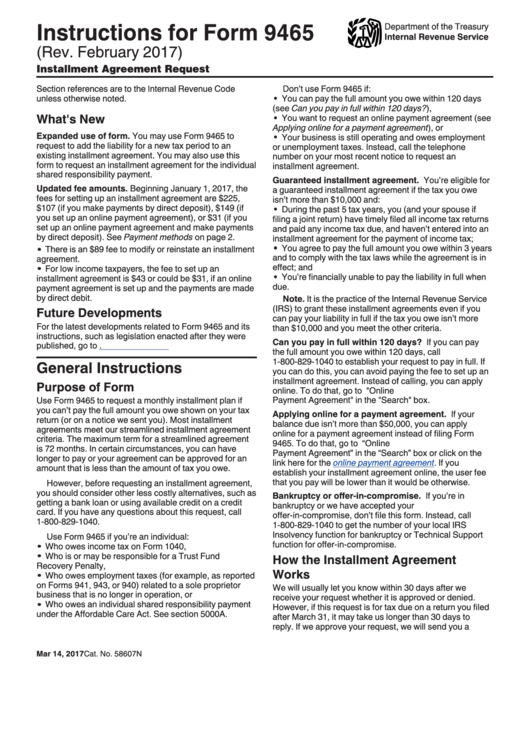

Instructions For Form 9465 Installment Agreement Request printable

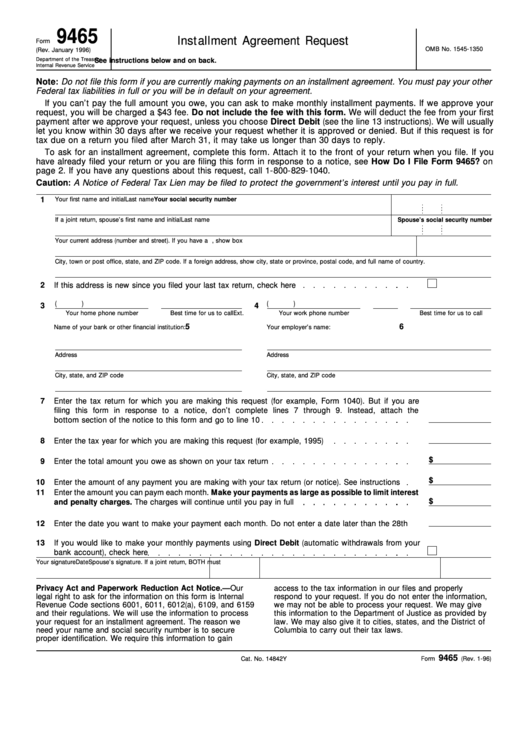

Printable Form 9465 Printable Forms Free Online

How to Use Form 9465 Instructions for Your IRS Payment Plan Irs

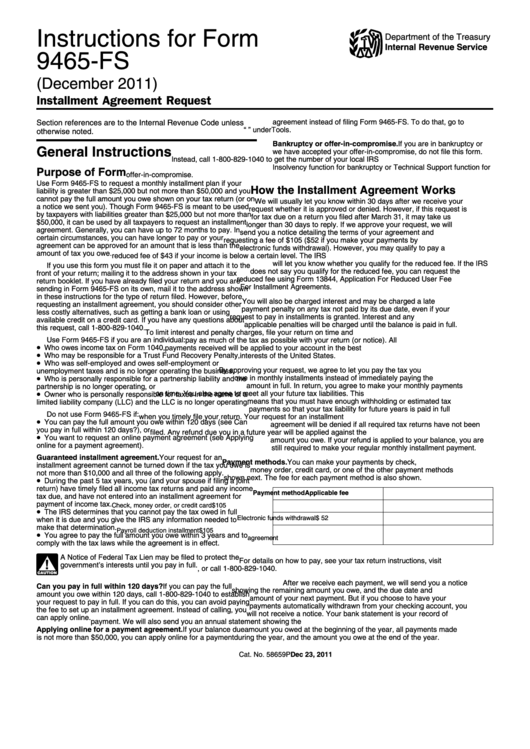

Instructions For Form 9465Fs Installment Agreement Request printable

Who Can Use IRS Form 9465?

IRS Form 9465 Instructions Your Installment Agreement Request

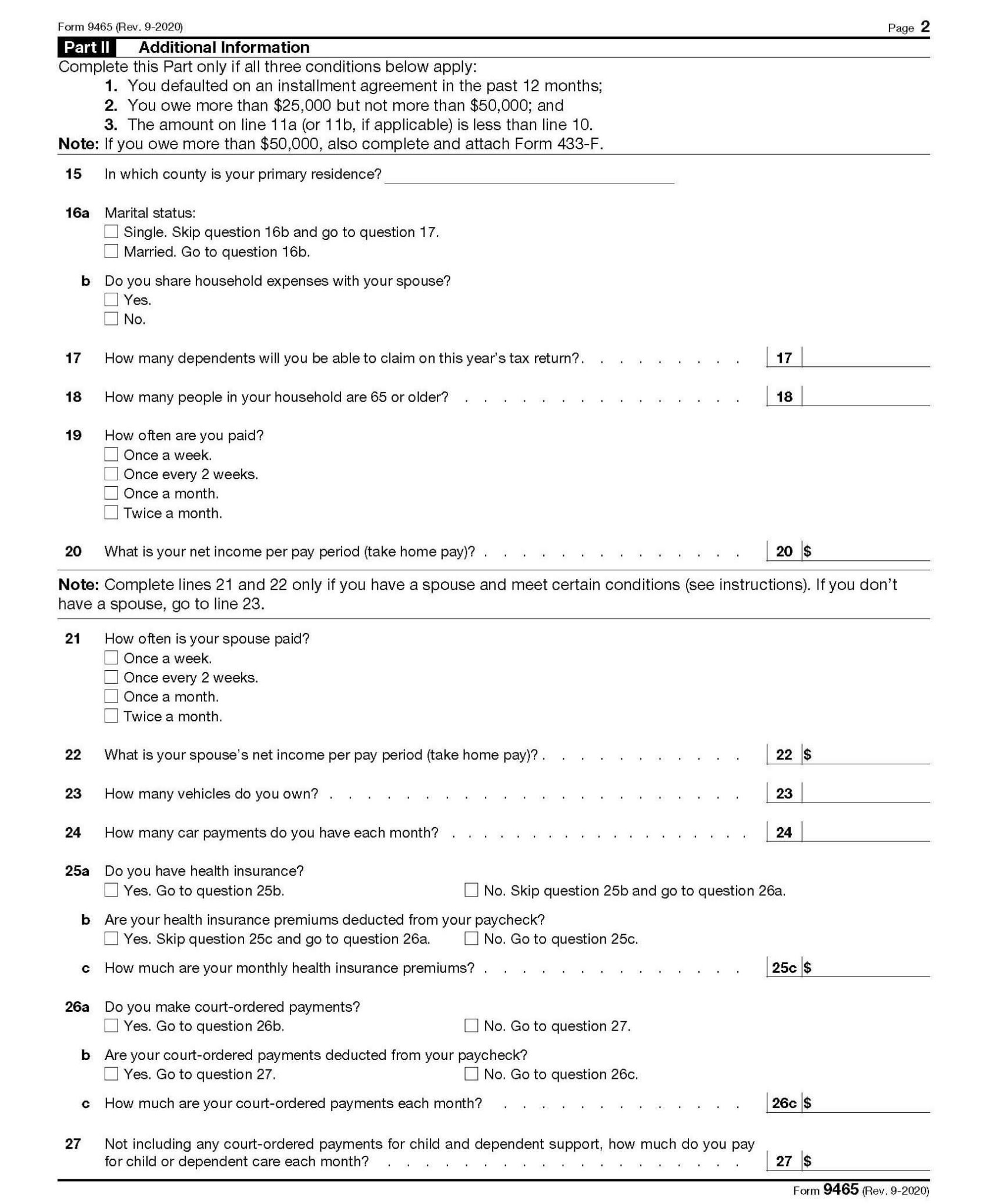

Form 9465Installment Agreement Request

Related Post:

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)