California Form 540 Renter's Credit

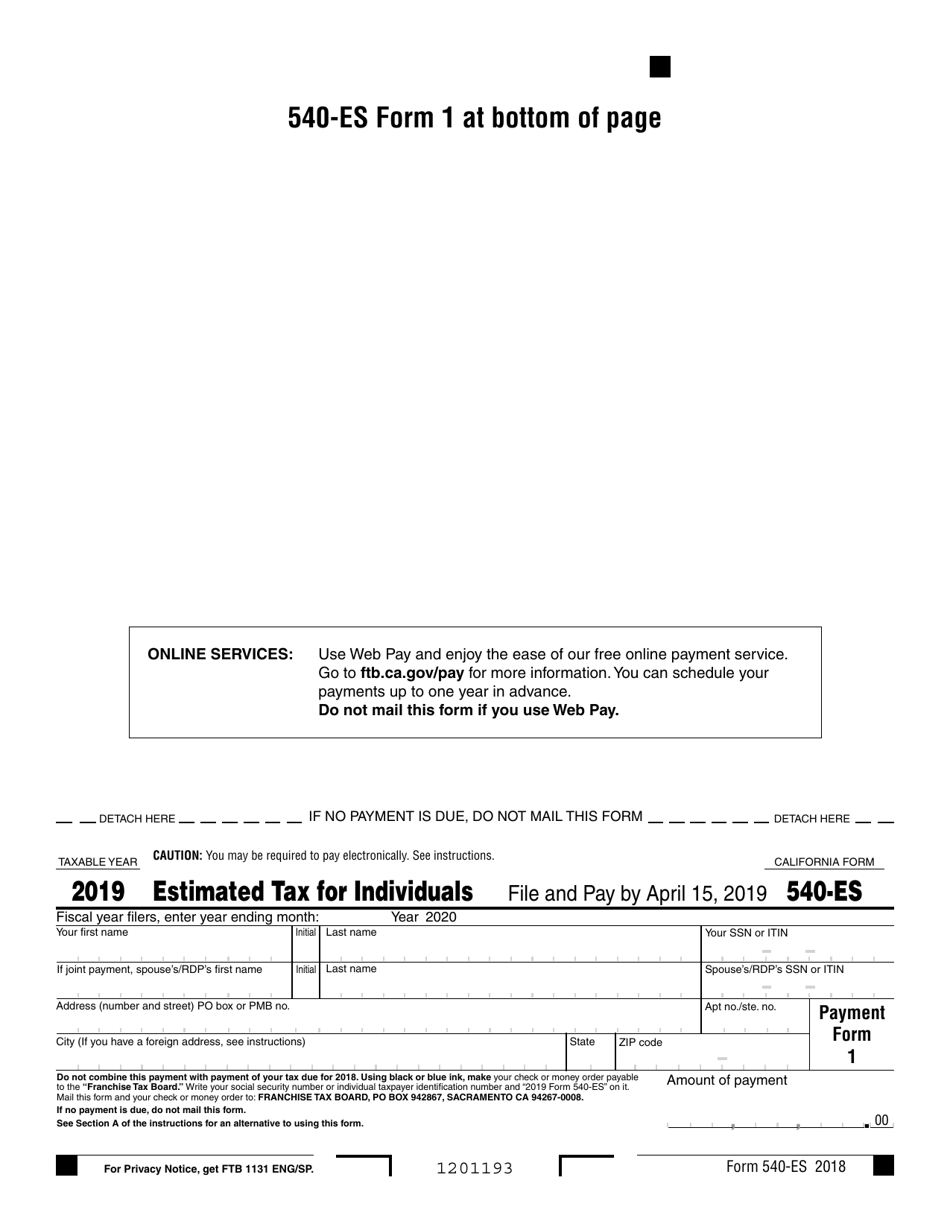

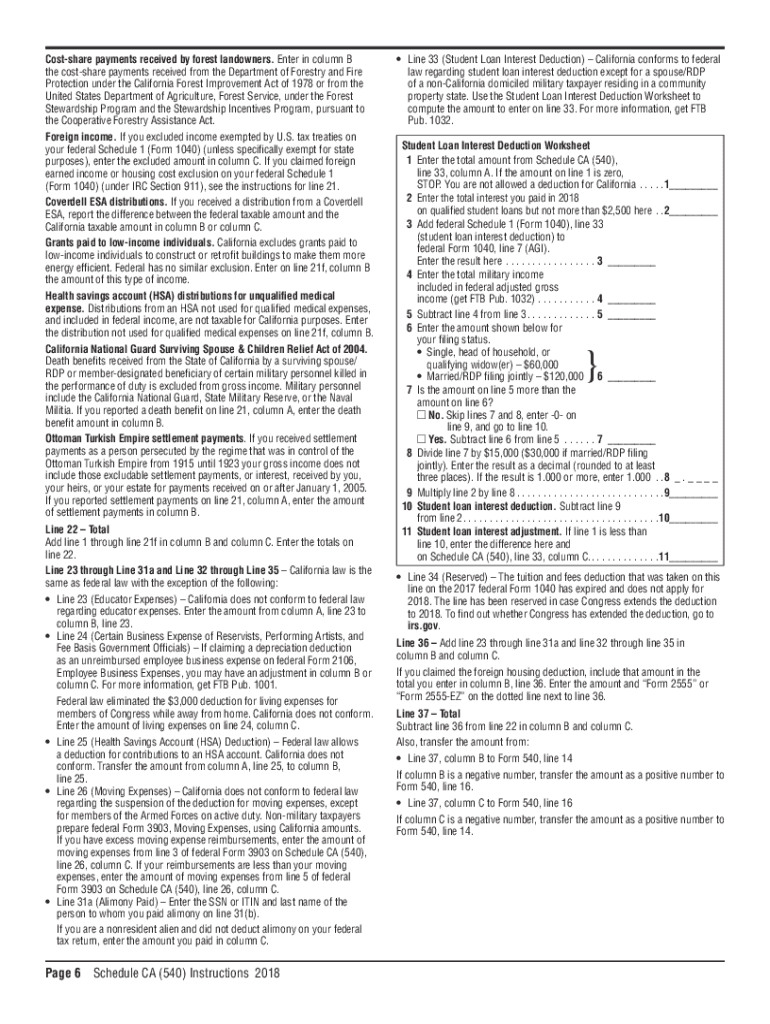

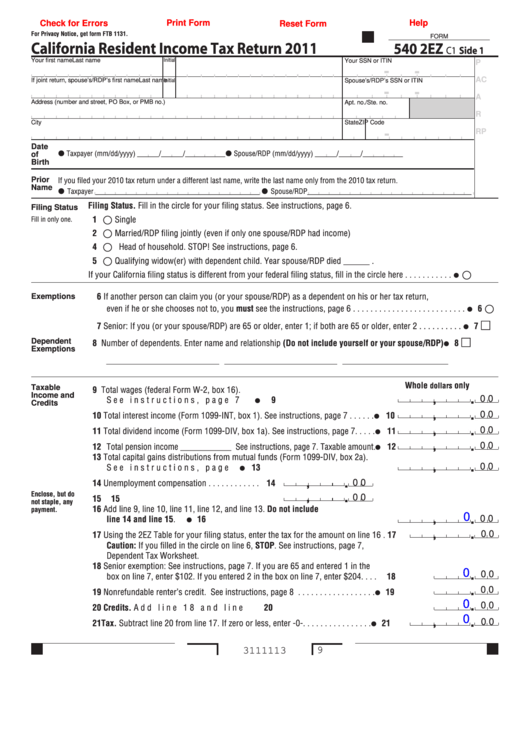

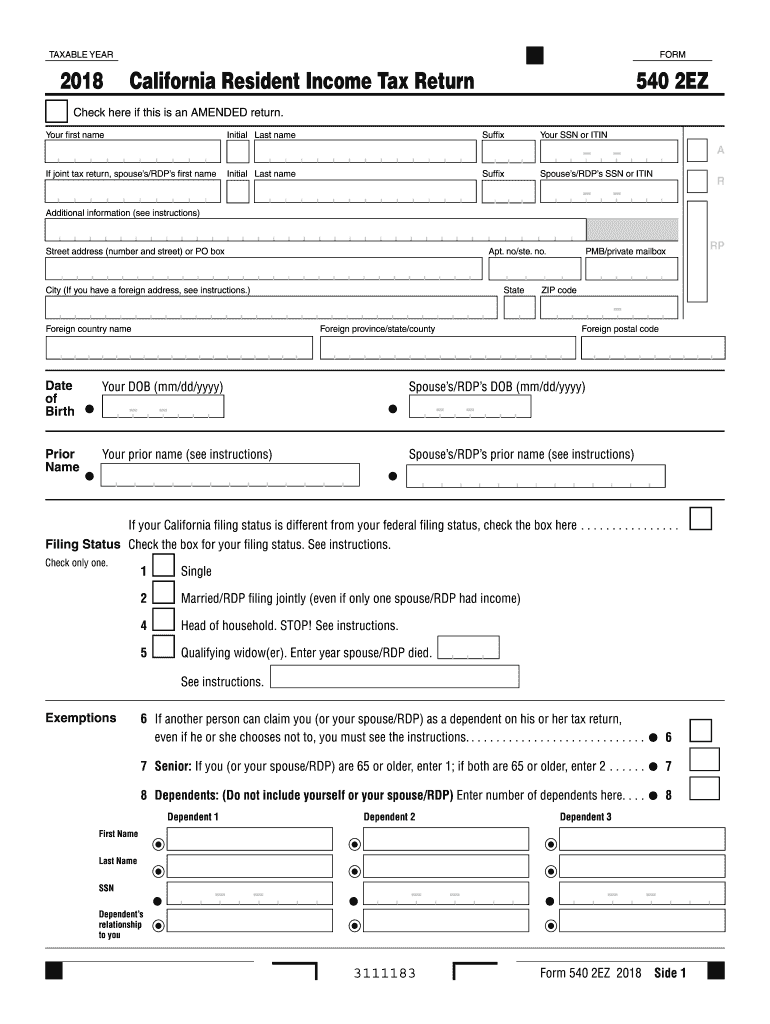

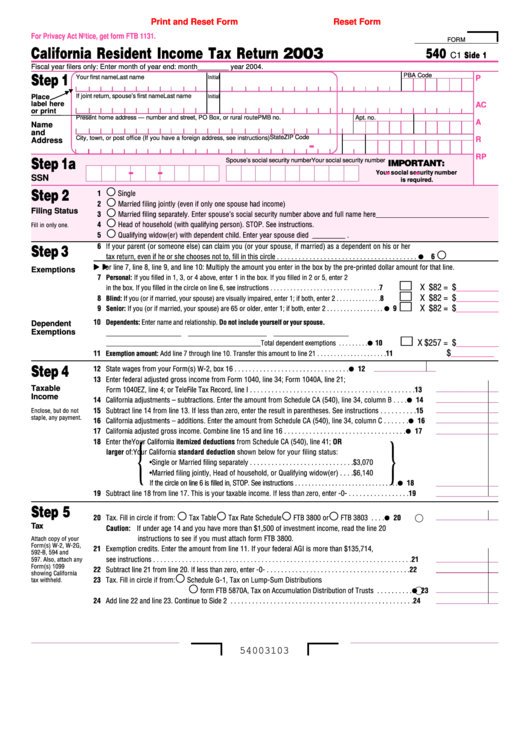

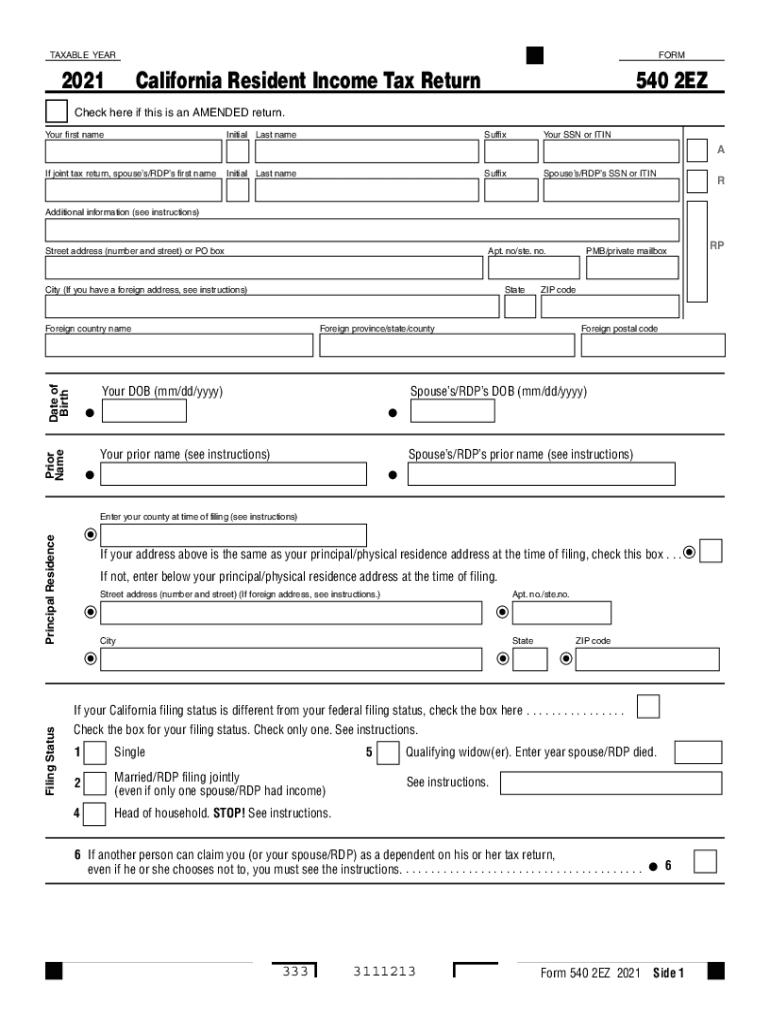

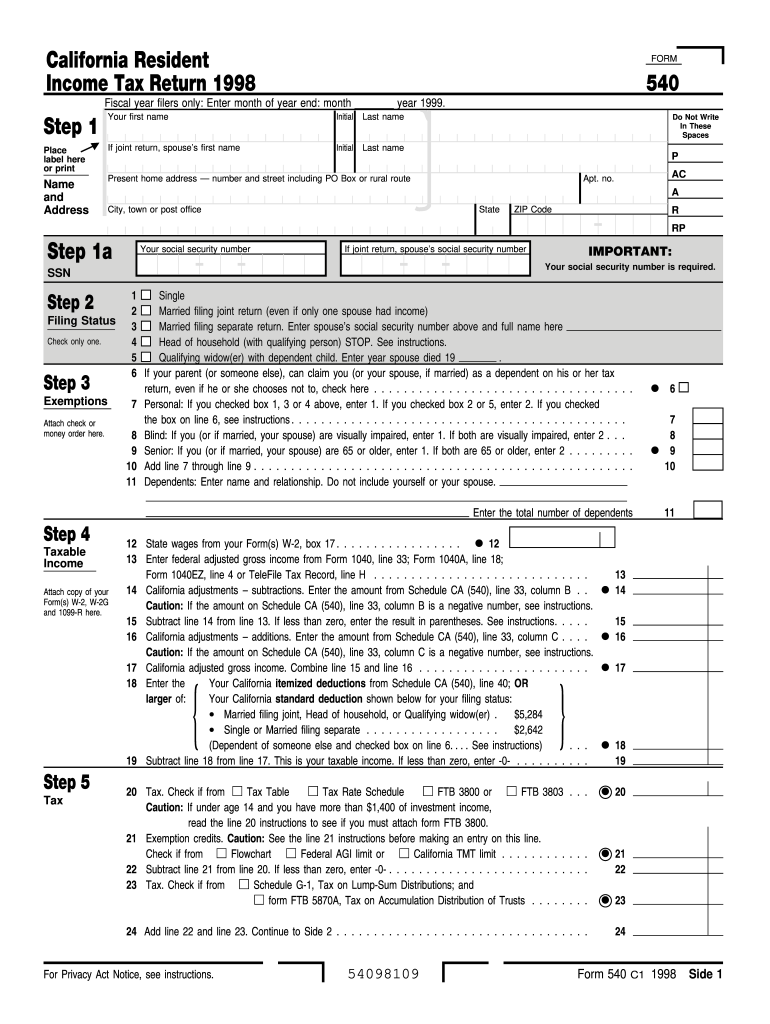

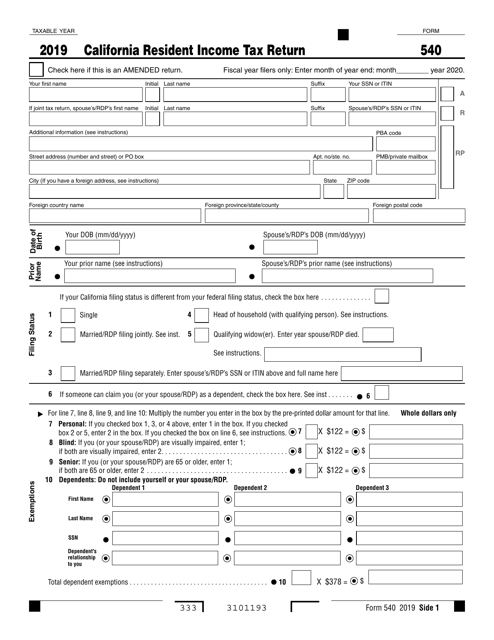

California Form 540 Renter's Credit - These are awarded only on the state level—there is. Get ready for tax season deadlines by completing any required tax forms today. To qualify for the ca renter's credit: Nonrefundable renter’s credit qualification record; Web january 1, 2021, taxpayers should file california form ftb 3913, moving expense deduction, to claim moving expense deductions. Web april 10, 2022 · 5 min read a proposal in the state senate would increase california's renters' tax credit from $60 to $500 for eligible single tax filers, and more for those who. File either a california form 540 (complete line 31), 540a (line 19), or 540 2ez (line 13) tax return. Web depending upon the ca main form used, the output will appear on line 46 of the form 540 or line 19 of form 540 2ez. To claim the renter’s credit for california, all of the following criteria must be met: Web california allows a nonrefundable renter's credit for certain individuals. Complete, edit or print tax forms instantly. By intuit• 133•updated june 16, 2023. Web taxable year form 2022 california resident income tax return 540 check here if this is an amended return. $98,440 or less if you are married/rdp filing jointly,. It was an acquired habit, the result of. Ad edit, sign and print tax forms on any device with signnow. Web instructions for form 540; Enter month of year end:. Complete, edit or print tax forms instantly. Nonrefundable renter’s credit qualification record; Web if you paid rent for at least six months in 2021 on your principal residence located in california you may qualify to claim the nonrefundable renter’s credit which may reduce. Complete, edit or print tax forms instantly. See the california instructions for the. By intuit• 133•updated june 16, 2023. To claim the renter’s credit for california, all of the. Web if you paid rent for at least six months in 2021 on your principal residence located in california you may qualify to claim the nonrefundable renter’s credit which may reduce. Web depending upon the ca main form used, the output will appear on line 46 of the form 540 or line 19 of form 540 2ez. These are your. Web before you begin complete your federal income tax return (form 1040, form 1040a, or form 1040ez) before you begin your california form 540. Attach the completed form ftb 3913 to. The property was not tax exempt 3. The taxpayer must be a resident of california for the entire year if filing form 540, or at. To claim the renter’s. Web to claim the renter’s credit for california, all of the following criteria must be met: Web january 1, 2021, taxpayers should file california form ftb 3913, moving expense deduction, to claim moving expense deductions. Taxpayers can report this credit directly on all california personal state tax main forms. Web california allows a nonrefundable renter's credit for certain individuals. Ad. Web instructions for form 540; Web california allows a nonrefundable renter's credit for certain individuals. Web if you paid rent for at least six months in 2021 on your principal residence located in california you may qualify to claim the nonrefundable renter’s credit which may reduce. Web taxable year form 2022 california resident income tax return 540 check here if. Form 540 (line 28), form 540a (line. It was an acquired habit, the result of. Web by intuit• 7•updated june 14, 2023. Web if you paid rent for six months or more on your main home located in california, you may qualify to claim the credit on your tax return. File either a california form 540 (complete line 31), 540a. Web to claim the renter’s credit for california, all of the following criteria must be met: The taxpayer must be a resident of california for the entire year if filing form 540, or at least. Web instructions for form 540; Ad edit, sign and print tax forms on any device with signnow. Web if you paid rent for at least. Taxpayers can report this credit directly on all california personal state tax main forms. Web to claim the renter’s credit for california, all of the following criteria must be met: File either a california form 540 (complete line 31), 540a (line 19), or 540 2ez (line 13) tax return. Web if you paid rent for six months or more on. Web where to report nonrefundable renters’ credit? It was an acquired habit, the result of. If you pay rent on your primary residence, you might be able to claim a tax credit. Enter month of year end:. Web am i eligible for a state renter's tax credit? Web california allows a nonrefundable renter's credit for certain individuals. The taxpayer must be a resident of california for the entire year if filing form 540, or at least. Ad download or email 540 2ez & more fillable forms, register and subscribe now! You paid rent in california for at least 1/2 the year 2. Get ready for tax season deadlines by completing any required tax forms today. $49,220 or less if your filing status is single or married/registered domestic partner (rdp) filing separately 3.2. File either a california form 540 (complete line 31), 540a (line 19), or 540 2ez (line 13) tax return. Ad edit, sign and print tax forms on any device with signnow. See the california instructions for the. These are awarded only on the state level—there is. Complete, edit or print tax forms instantly. The taxpayer must be a resident of california for the entire year if filing form 540, or at. Web instructions for form 540; Web april 10, 2022 · 5 min read a proposal in the state senate would increase california's renters' tax credit from $60 to $500 for eligible single tax filers, and more for those who. Web records (don’t send the form to the ftb with your tax return).Form 540ES Download Fillable PDF or Fill Online Estimated Tax for

2016 california resident tax return form 540 2ez Earned

2018 Form CA Schedule CA (540) InstructionsFill Online, Printable

Printable Pdf File Form Californian 540 Tax Return Printable Forms

Ca 540 2ez Fillable Form Printable Forms Free Online

Printable Ca Form 540 Resident Tax Return Pdf Formswift

California 540 Nr Form Fillable Pdf Printable Forms Free Online

20212023 Form CA FTB 540 2EZ Fill Online, Printable, Fillable, Blank

1998 Form 540 California Resident Tax Return Fill out & sign

Form 540 Download Fillable PDF or Fill Online California Resident

Related Post: