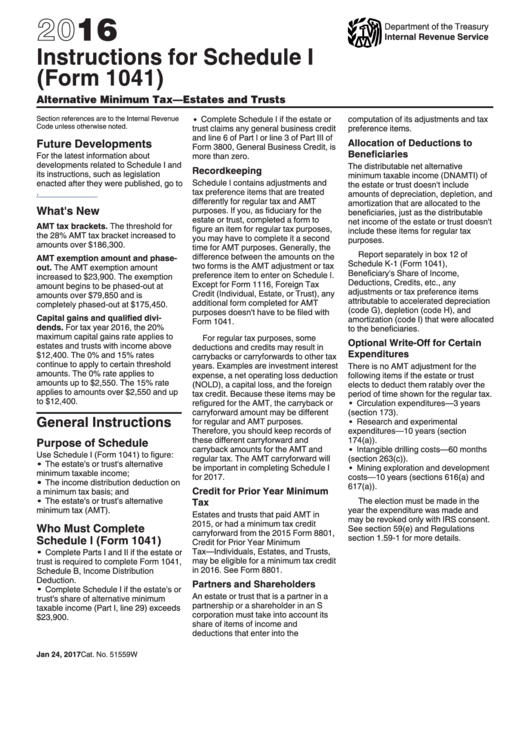

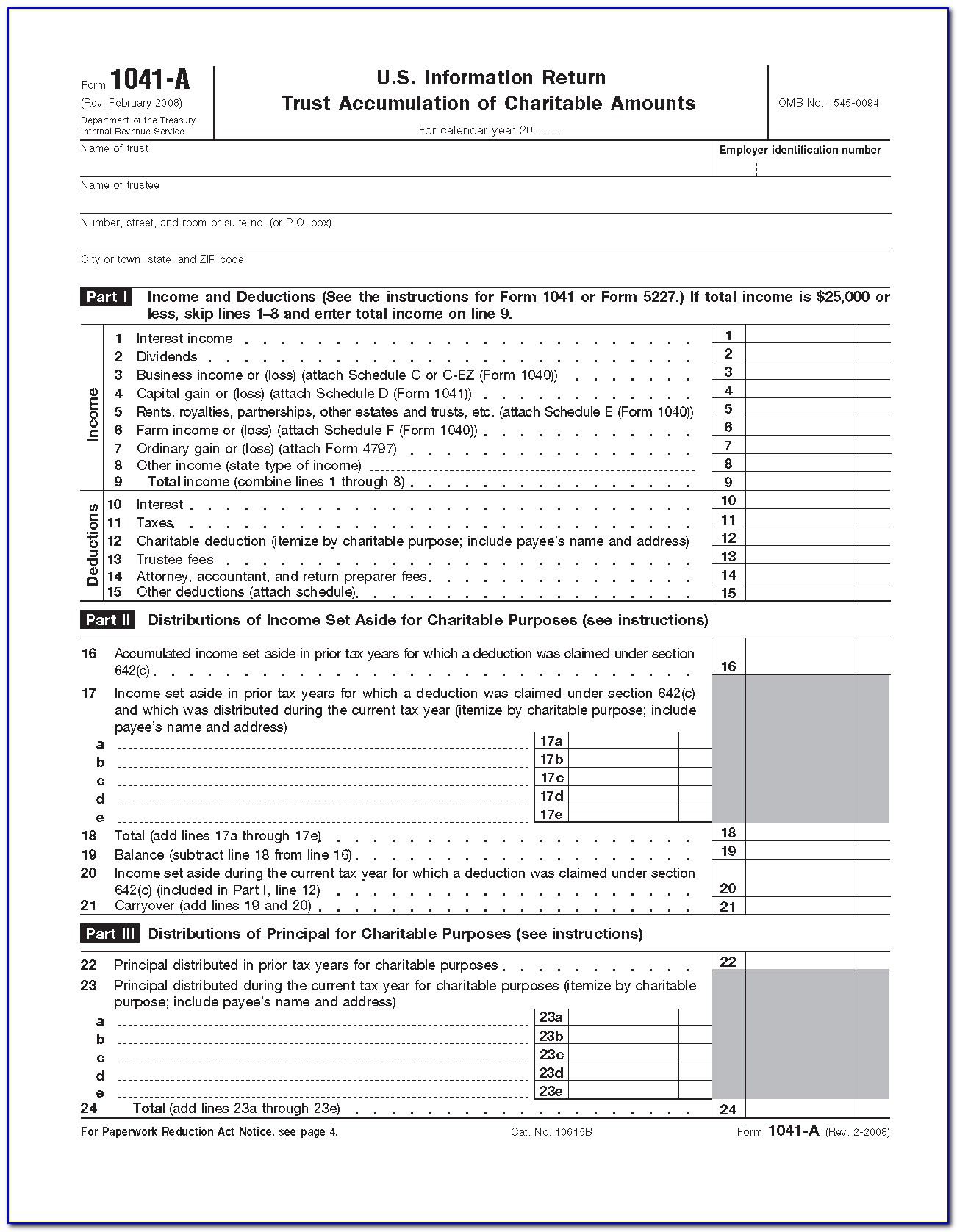

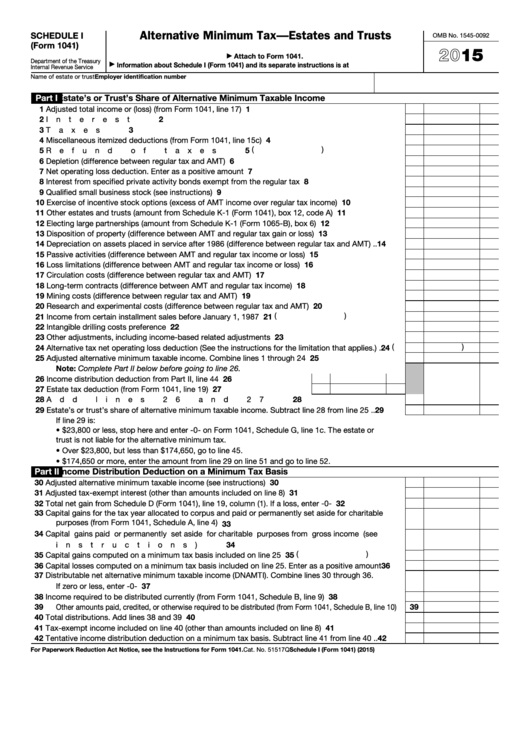

Schedule I Form 1041

Schedule I Form 1041 - Income tax return for estates and trusts. Web this document is filed annually and reports income, deductions, gains, losses, and any applicable credits or tax liabilities. Web written by a turbotax expert • reviewed by a turbotax cpa. The estate or trust must complete schedule b. Web attach schedule i (form 1041) if any of the following apply. For instructions and the latest information. Complete schedule i if the estate's or trust's share of alternative minimum taxable income (part i,. Income distribution deduction on a minimum tax basis. You can then subtract any tax payments that have. Connect with our cpas or other tax experts who can help you navigate your tax situation. Alternative minimum tax—estates and trusts. Web who must complete schedule i (form 1041) complete parts i and ii if the estate or trust is required to complete form 1041, schedule b, income distribution deduction. An estate or trust can. California conforms to the federal repeal of the amt depletion adjustment for. Web schedule i (form 1041) department of the treasury. Web solved • by turbotax • 585 • updated january 13, 2023. Web how to fill out form 1041 for the 2021 tax year. Web instructions for this form are on our website at tax.ohio.gov. California conforms to the federal repeal of the amt depletion adjustment for. Web who must complete schedule i (form 1041) • complete parts i and. Department of the treasury—internal revenue service. Web solved • by turbotax • 585 • updated january 13, 2023. Web attach schedule i (form 1041) if any of the following apply. Connect with our cpas or other tax experts who can help you navigate your tax situation. Income tax return for estates and trusts. Ad file form 1041 with confidence with taxact's tax planning & form checklists. For instructions and the latest. For instructions and the latest information. Visit taxact to file your form 1041 with expert guidance. Web who must complete schedule i (form 1041) complete parts i and ii if the estate or trust is required to complete form 1041, schedule b,. The estate or trust claims a credit on line 2b, 2c, or 2d of schedule. The irs 1041 form for 2022 is updated to reflect the. Alternative minimum tax—estates and trusts. Web this document is filed annually and reports income, deductions, gains, losses, and any applicable credits or tax liabilities. Web solved • by turbotax • 585 • updated january. Web department of the treasury—internal revenue service. Web solved • by turbotax • 585 • updated january 13, 2023. Web you’ll subtract deductions from income and then use schedule g of form 1041 to calculate the tax owed. Web who must complete schedule i (form 1041) • complete parts i and ii if the estate or trust is required to. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month. Web written by a turbotax expert • reviewed by a turbotax cpa. You can then subtract any tax payments that have. Updated for tax year 2022 • december 1, 2022 9:00 am. Web estates and trusts use schedule i (form 1041) to figure: California conforms to the federal repeal of the amt depletion adjustment for. Web get the instructions to federal schedule i (form 1041), line 5 for more information. Web solved • by turbotax • 585 • updated january 13, 2023. Web you’ll subtract deductions from income and then use schedule g of form 1041 to calculate the tax owed. Complete, edit. Alternative minimum tax—estates and trusts. Web this document is filed annually and reports income, deductions, gains, losses, and any applicable credits or tax liabilities. Web who must complete schedule i (form 1041) • complete parts i and ii if the estate or trust is required to complete form 1041, schedule b, income distribution deduction. The estate or trust must complete. Ad complete irs tax forms online or print government tax documents. For instructions and the latest information. Visit taxact to file your form 1041 with expert guidance. Complete schedule i if the estate's or trust's share of alternative minimum taxable income (part i,. Web written by a turbotax expert • reviewed by a turbotax cpa. The estate or trust must complete schedule b. Income distribution deduction on a minimum tax basis. Complete, edit or print tax forms instantly. The estate or trust claims a credit on line 2b, 2c, or 2d of schedule. Income tax return for estates and trusts is generally used to report the income, gains,. Web you’ll subtract deductions from income and then use schedule g of form 1041 to calculate the tax owed. Web written by a turbotax expert • reviewed by a turbotax cpa. Ad file form 1041 with confidence with taxact's tax planning & form checklists. Ad complete irs tax forms online or print government tax documents. Web attach schedule i (form 1041) if any of the following apply. Web how to fill out form 1041 for the 2021 tax year. For instructions and the latest information. Web this document is filed annually and reports income, deductions, gains, losses, and any applicable credits or tax liabilities. Web instructions for this form are on our website at tax.ohio.gov. California conforms to the federal repeal of the amt depletion adjustment for. Web who must complete schedule i (form 1041) • complete parts i and ii if the estate or trust is required to complete form 1041, schedule b, income distribution deduction. See instructions.3 4 enter amount from schedule a, line 4 (minus any allocable section 1202 exclusion).4. For instructions and the latest. California conforms to the federal repeal of the amt depletion adjustment for. Alternative minimum tax—estates and trusts.Instructions For Schedule I (Form 1041) 2016 printable pdf download

2020 Form IRS 1041 Schedule I Fill Online, Printable, Fillable, Blank

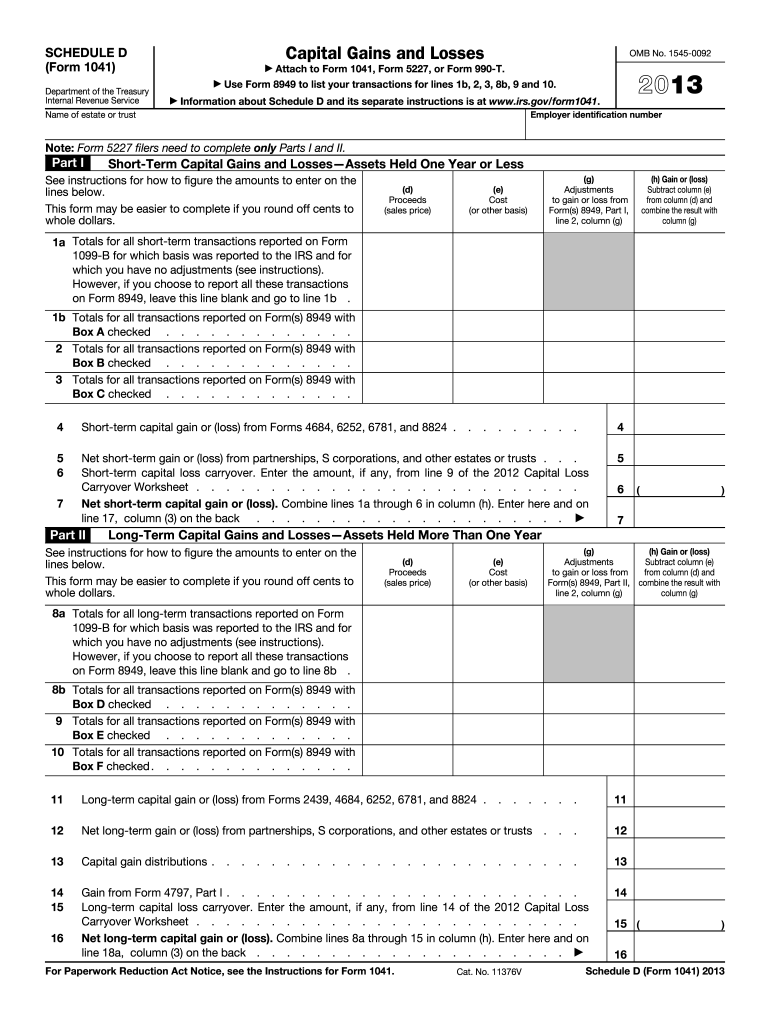

2013 Form IRS 1041 Schedule DFill Online, Printable, Fillable, Blank

Form 1041 (Schedule I) Alternative Minimum Tax Estates and Trusts

Irs Form 1041 Schedule B prosecution2012

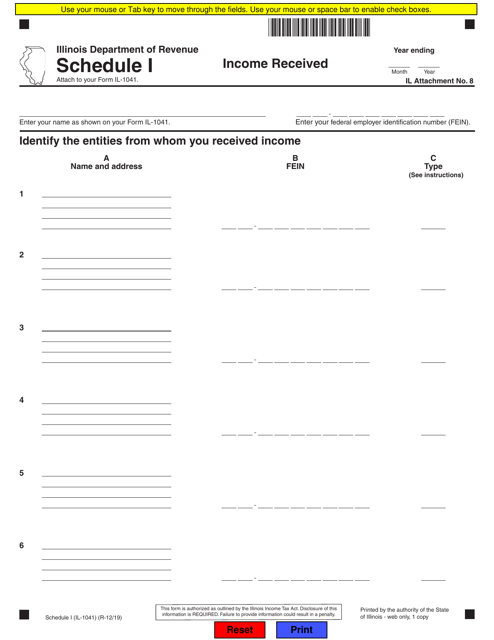

Form IL1041 Schedule I Download Fillable PDF or Fill Online

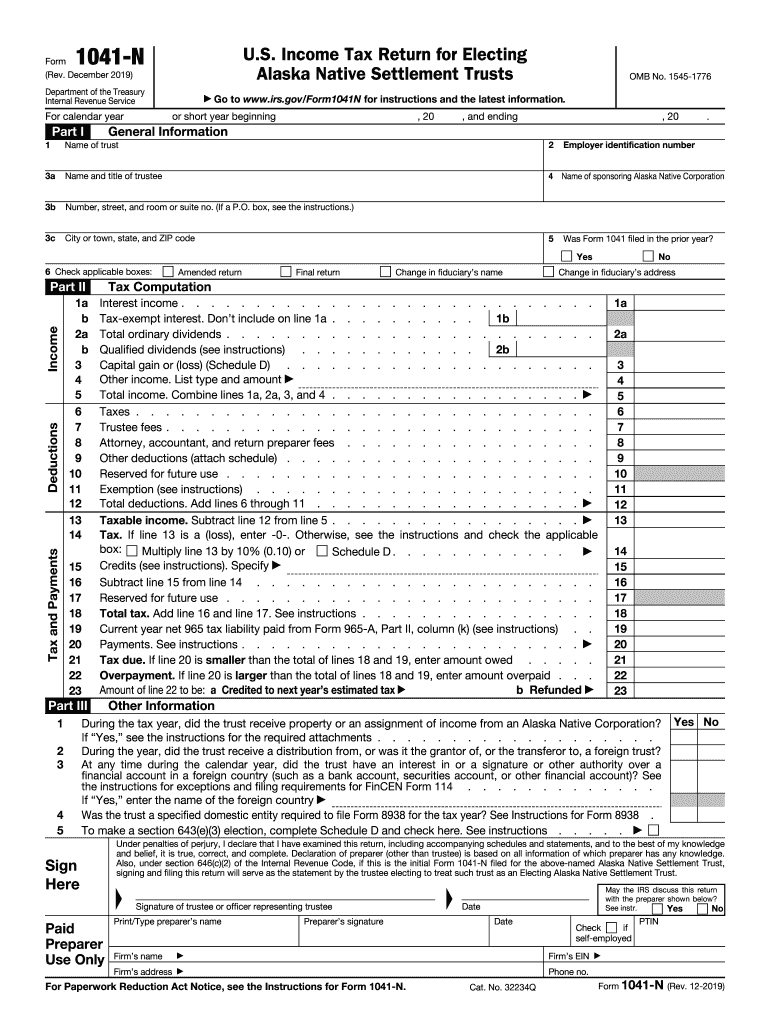

Form 1041 Fill Out and Sign Printable PDF Template signNow

Irs Forms 1041 Instructions Form Resume Examples erkKpJRDN8

Fillable Schedule I (Form 1041) Alternative Minimum TaxEstates And

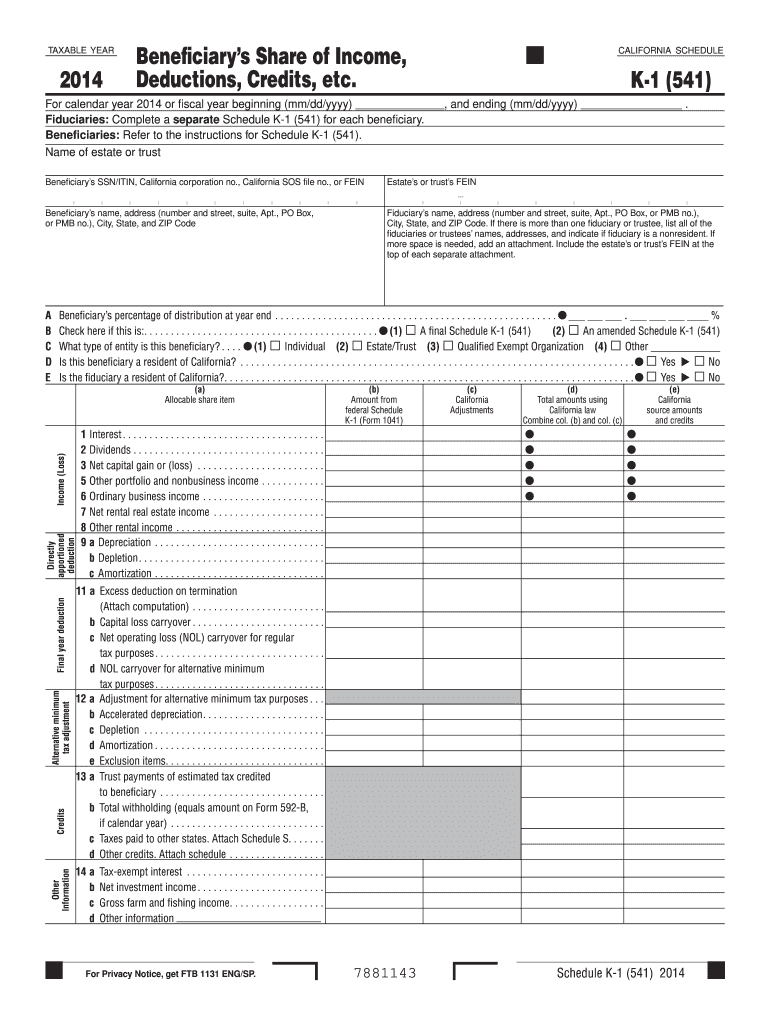

About Schedule K1 (Form 1041)Internal Revenue Service Fill out

Related Post: