Form 706 Gs D 1

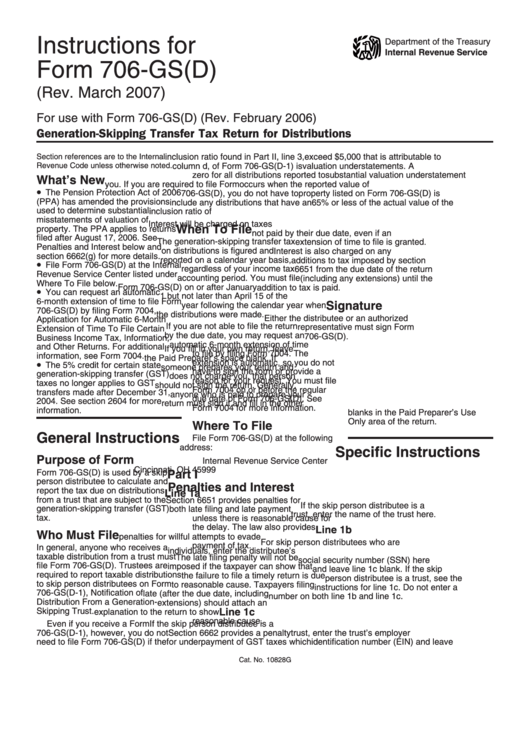

Form 706 Gs D 1 - The date of distribution is the date the title to the property. Use for distributions made after december 31, 2010. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Web answer the following is a list of forms available in ultratax/1041 that are not included in the electronic file, but allow the return to be filed electronically because the forms are filed. A skip person is someone. See distributions subject to gst tax, later, for a. Web (d) time and manner of filing return —(1) in general. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Web answer the following is a list of forms available in ultratax/1041 that are not included in the electronic file, but allow the return to be filed electronically because. A skip person is someone. The date of distribution is the date the title to the property. See distributions subject to gst tax, later, for a. Use for distributions made after december 31, 2010. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code. The date of distribution is the date the title to the property. Web (d) time and manner of filing return —(1) in general. Web answer the following is a list of forms available in ultratax/1041 that are not included in the electronic file, but allow the return to be filed electronically because the forms are filed. Use for distributions made. The date of distribution is the date the title to the property. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Use for distributions made after december 31, 2010. Web answer the following is a list of forms. Web (d) time and manner of filing return —(1) in general. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. A skip person is someone. Web answer the following is a list of forms available in ultratax/1041 that. A skip person is someone. Web answer the following is a list of forms available in ultratax/1041 that are not included in the electronic file, but allow the return to be filed electronically because the forms are filed. See distributions subject to gst tax, later, for a. Web (d) time and manner of filing return —(1) in general. The date. The date of distribution is the date the title to the property. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Web (d) time and manner of filing return —(1) in general. Use for distributions made after december. Web answer the following is a list of forms available in ultratax/1041 that are not included in the electronic file, but allow the return to be filed electronically because the forms are filed. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc),. See distributions subject to gst tax, later, for a. Web answer the following is a list of forms available in ultratax/1041 that are not included in the electronic file, but allow the return to be filed electronically because the forms are filed. A skip person is someone. The date of distribution is the date the title to the property. Web. The date of distribution is the date the title to the property. A skip person is someone. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Use for distributions made after december 31, 2010. Web answer the following. Web answer the following is a list of forms available in ultratax/1041 that are not included in the electronic file, but allow the return to be filed electronically because the forms are filed. Use for distributions made after december 31, 2010. The date of distribution is the date the title to the property. See distributions subject to gst tax, later, for a. Web (d) time and manner of filing return —(1) in general. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. A skip person is someone.Instructions For Form 706Gs(D) printable pdf download

Form 706 United States Estate (and GenerationSkipping Transfer) Tax

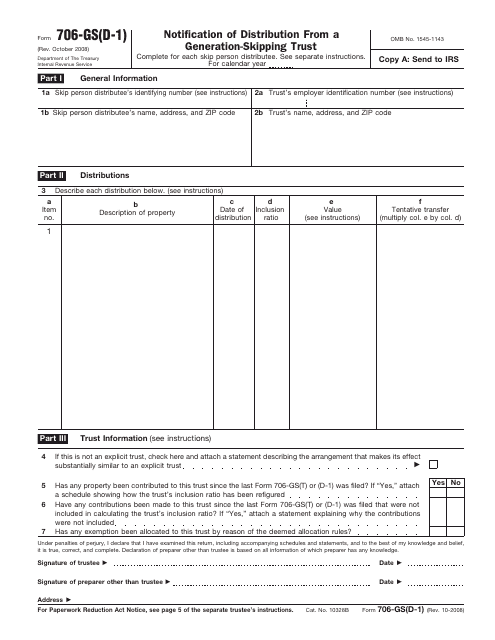

Form 706GS(D1) Arbitrage Rebate, Yield Reduction and Penalty in

3.11.106 Estate and Gift Tax Returns Internal Revenue Service

IRS Form 706GS(D1) Download Fillable PDF or Fill Online Notification

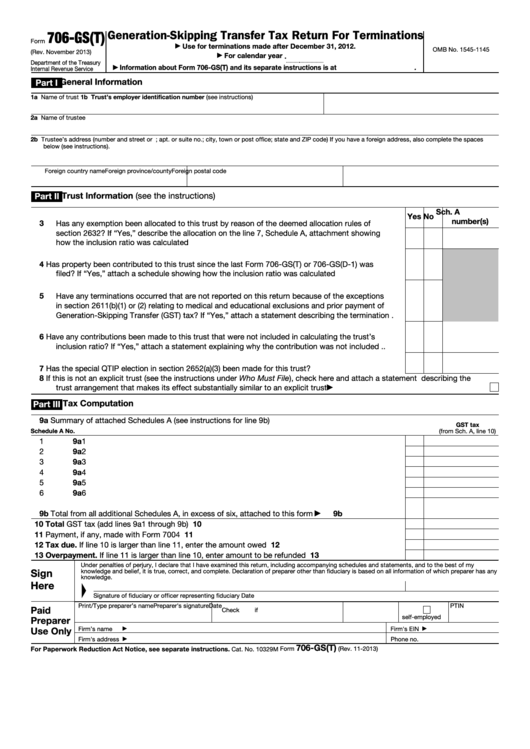

Fillable Form 706Gs(T) GenerationSkipping Transfer Tax Return For

Instructions For Form 706Gs(D1) 2016 printable pdf download

Instructions For Form 706Gs(T) (Rev. February 2011) printable pdf

Fill Free fillable IRS form 706GS(D) 2019 PDF form

Form 706GS(D) GenerationSkipping Transfer Tax Return for

Related Post: