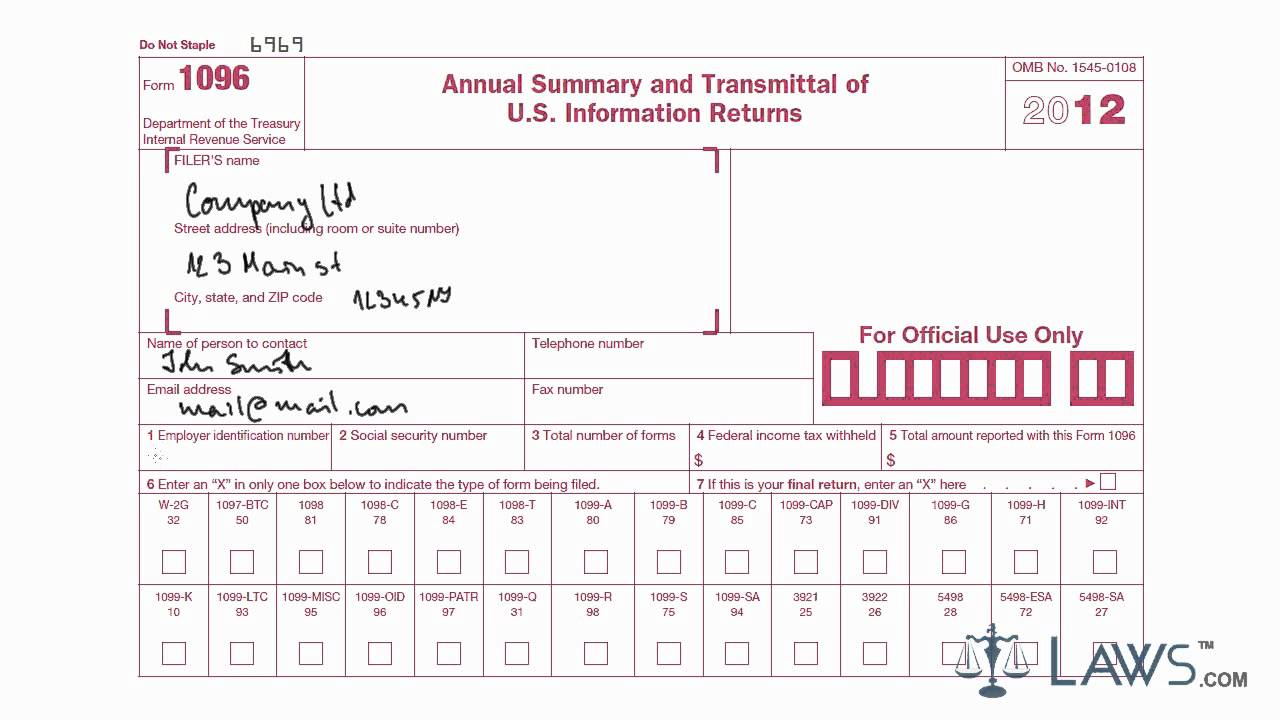

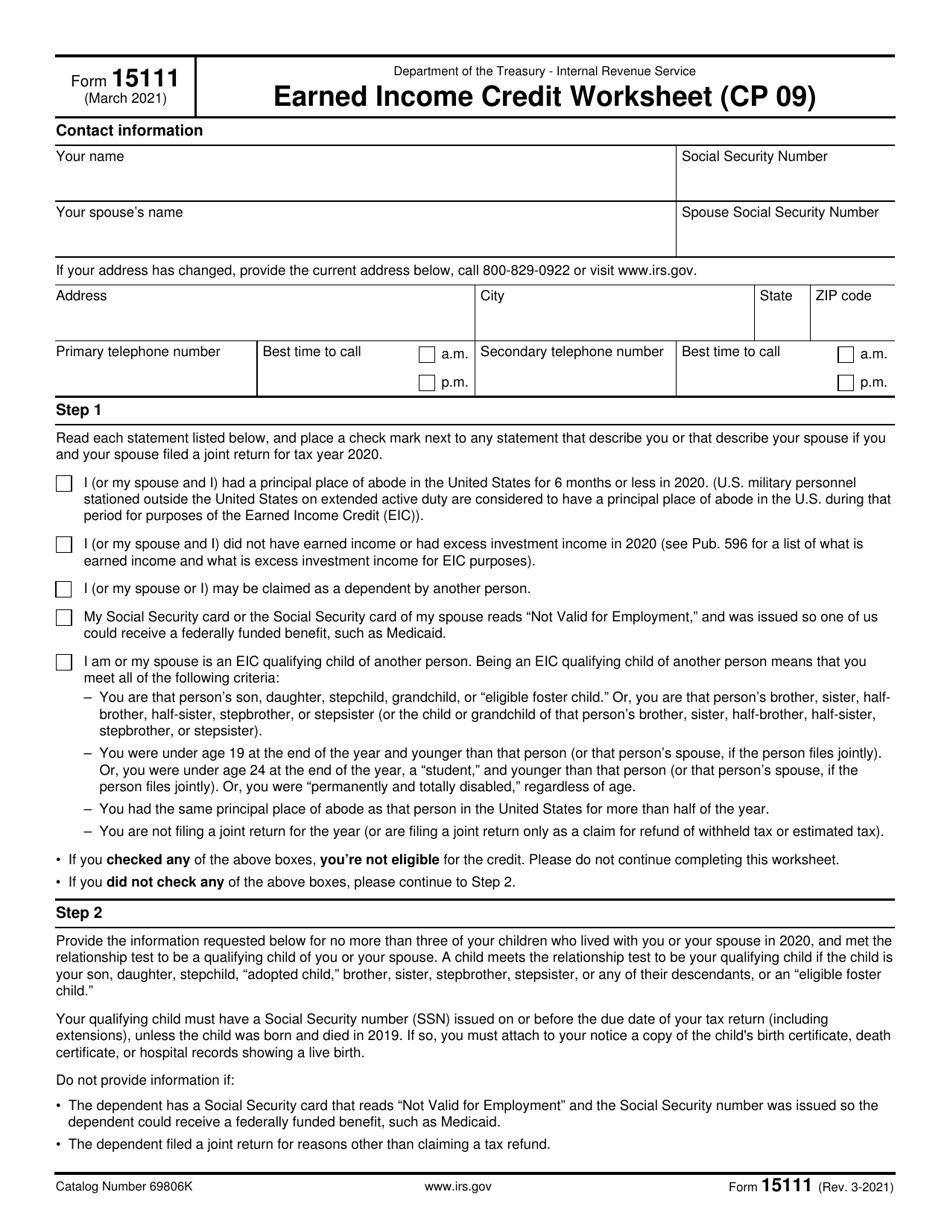

What Is Form 15111 Used For

What Is Form 15111 Used For - Web to see if you can claim the earned income tax credit (eitc), you’ll need to complete the worksheet ( form 15111) on pages 3 through 5 of your irs cp09 notice. Earned income credit worksheet (cp 09) contact information. If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Web use a form 15111 template to make your document workflow more streamlined. Mail the signed worksheet in the envelope provided with your notice. Web the myriad tunnels under gaza are best known as passageways used to smuggle goods from egypt and launch attacks into israel. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. But there exists a second. Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. You can view a sample form 15111 worksheet on the irs website. But there exists a second. Web step 1 read each statement listed below, and place a check mark next to any statement that describe you or that describe your spouse if you and your spouse filed a joint return. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. This worksheet will guide you. Web. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Earned income credit worksheet (cp 09) contact information. Web expert does your taxes. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. Form 15111 is a us treasury form. Web complete earned income credit worksheet on form 15111, earned income credit (cp09)pdf of the notice. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check. Show details how it works open the form 15111 instructions and follow. Web use a form 15111 template to make your document workflow more streamlined. You can view a sample form 15111 worksheet on the irs website. Web what is a 15111 form from irs? If you qualify, you can use the credit to reduce the. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. Mail the signed worksheet in the envelope provided with your notice. Web the house has been without a speaker for nearly two weeks, paralyzing the chamber. Earned income credit worksheet (cp 09) contact information. Form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Web within. Web a cp09 letter is sent to taxpayers when the internal revenue service determines you may be eligible to claim the earned income tax credit, if you did not do. Web the house has been without a speaker for nearly two weeks, paralyzing the chamber. But there exists a second. Earned income credit worksheet (cp 09) contact information. Web the. This worksheet will guide you. Web the myriad tunnels under gaza are best known as passageways used to smuggle goods from egypt and launch attacks into israel. If you qualify, you can use the credit to reduce the. It says to fill out form 15111 and send it back in the envelope provided by them. Web the irs includes a. Web use a form 15111 template to make your document workflow more streamlined. Web to see if you can claim the earned income tax credit (eitc), you’ll need to complete the worksheet ( form 15111) on pages 3 through 5 of your irs cp09 notice. Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the. Web a cp09 letter is sent to taxpayers when the internal revenue service determines you may be eligible to claim the earned income tax credit, if you did not do. Form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Complete earned income credit worksheet on. If the worksheet confirms you're eligible for the credit, sign and. This worksheet will guide you. Web within the cp09 notice, the irs includes an earned income credit worksheet (form 15111) on pages 3 through 5 of your notice. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Web the irs provide tax assistance. Web complete earned income credit worksheet on form 15111, earned income credit (cp09)pdf of the notice. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check. An expert does your return, start to finish Web the myriad tunnels under gaza are best known as passageways used to smuggle goods from egypt and launch attacks into israel. Web form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Web a cp09 letter is sent to taxpayers when the internal revenue service determines you may be eligible to claim the earned income tax credit, if you did not do. Mail the signed worksheet in the envelope provided with your notice. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. If the worksheet confirms you’re eligible for the credit, sign and date the form 15111 pdf. Earned income credit worksheet (cp 09) contact information. It says to fill out form 15111 and send it back in the envelope provided by them. My fiance got a letter from the irs stating that she qualifies for eitc. Form 15111 is a us treasury form that is a questionnaire of the dependents on your return to see if they qualify for eic. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Web use a form 15111 template to make your document workflow more streamlined. Web step 1 read each statement listed below, and place a check mark next to any statement that describe you or that describe your spouse if you and your spouse filed a joint return. Kenny holston/the new york times. This worksheet will guide you. Web what is a 15111 form from irs? Web if you received an irs cp 09 letter, you may have also received irs form 15111, earned income credit worksheet.Form 15111? (CA) IRS

Sample of completed 1099int 205361How to calculate 1099int

IRS Form 15111 Download Fillable PDF or Fill Online Earned

Fill Free fillable Form 15111 Earned Credit Worksheet (CP 09

Sample Forms For Authorized Drivers Resources And Forms For Auto

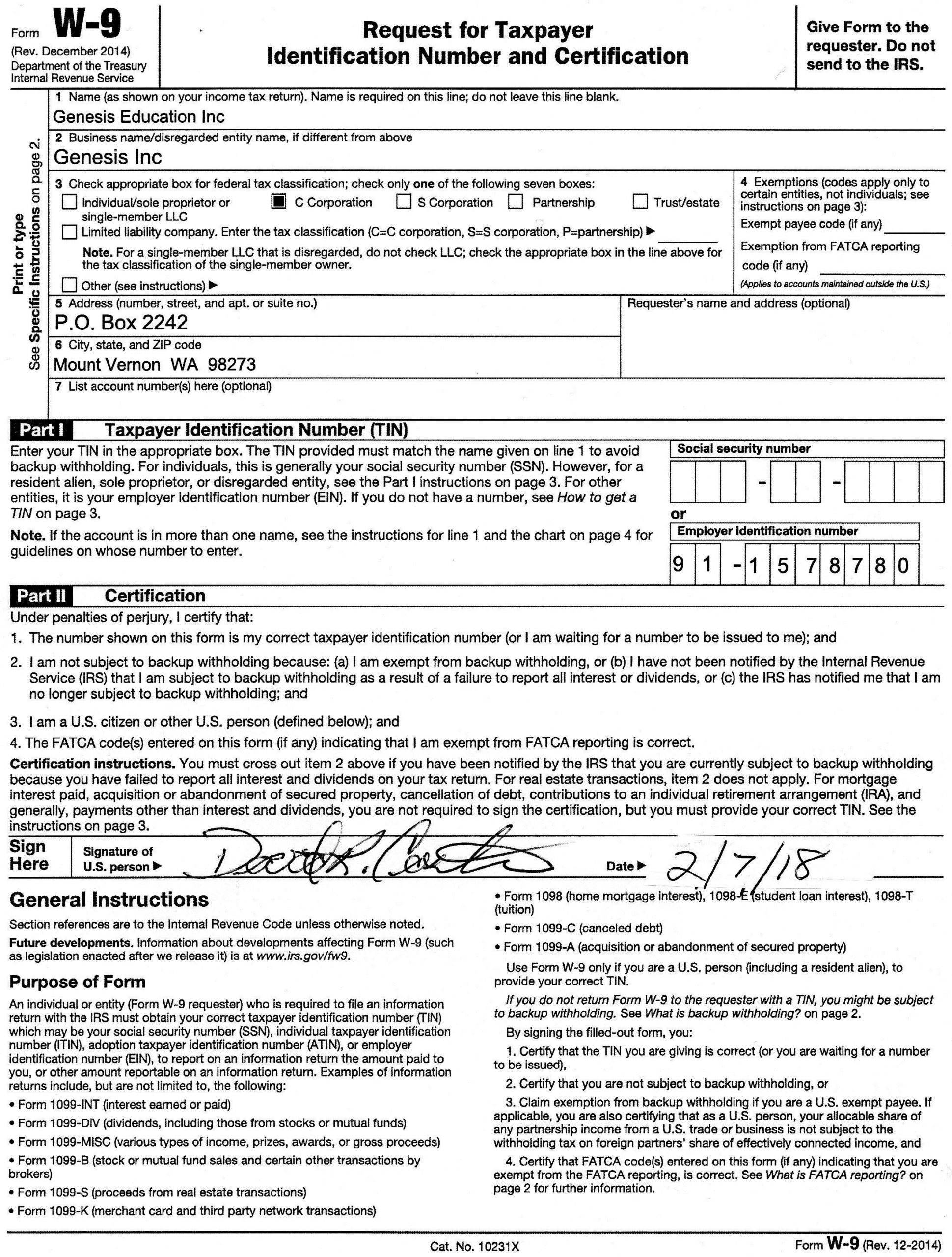

Printable Form W 9 2021 Calendar Template Printable

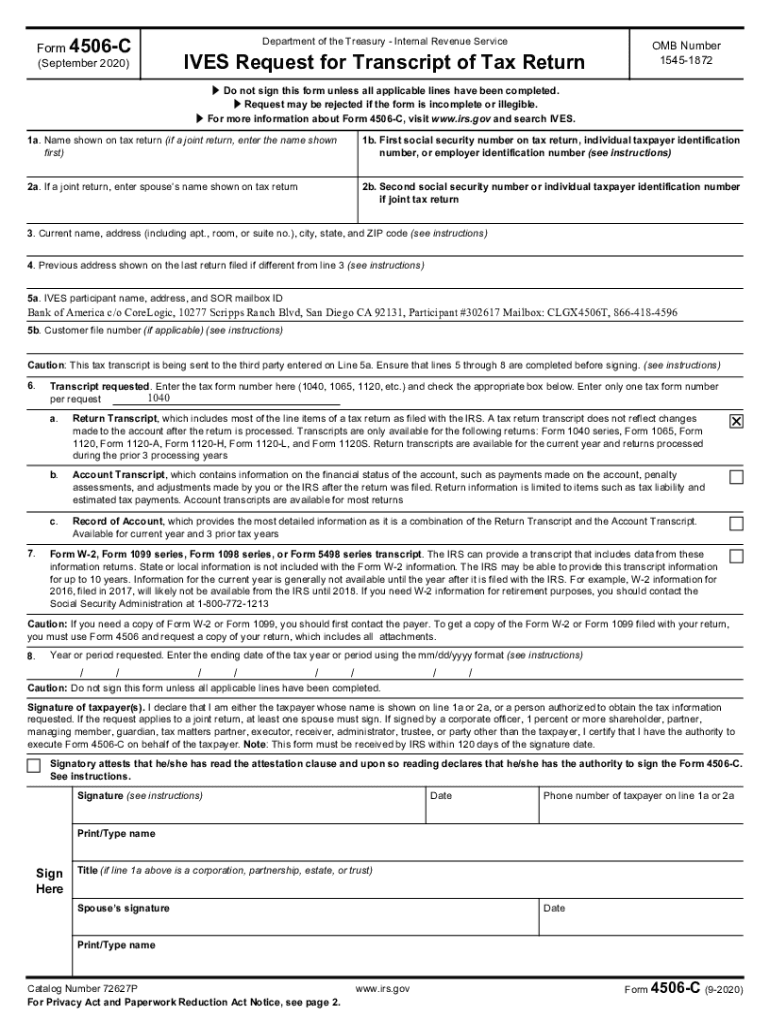

4506 C Fillable Form Fill and Sign Printable Template Online US

BIR Form 1701 Download

I9 Form Sample amulette

Fill Free fillable Form 15111 Earned Credit Worksheet (CP 09

Related Post: