Form 8815 Irs

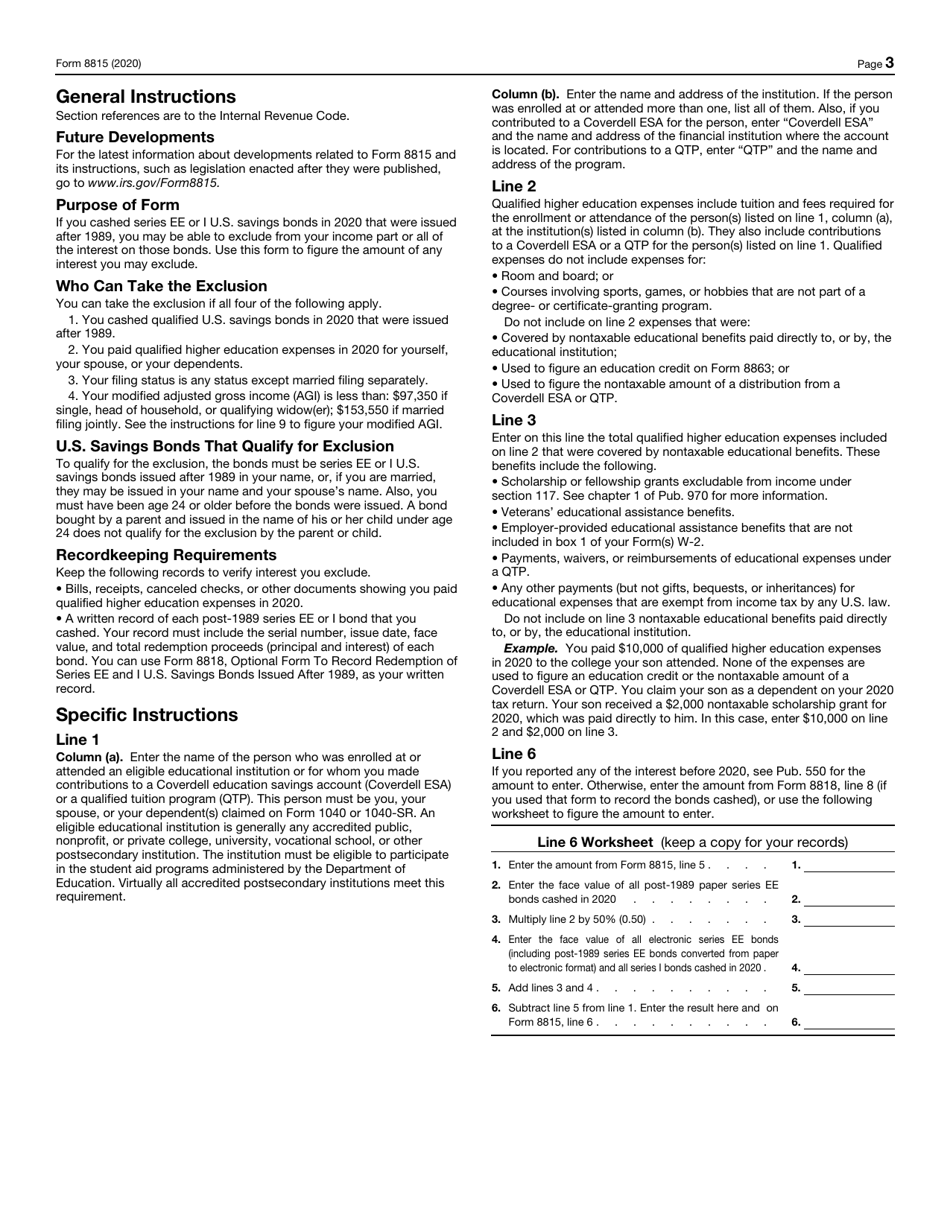

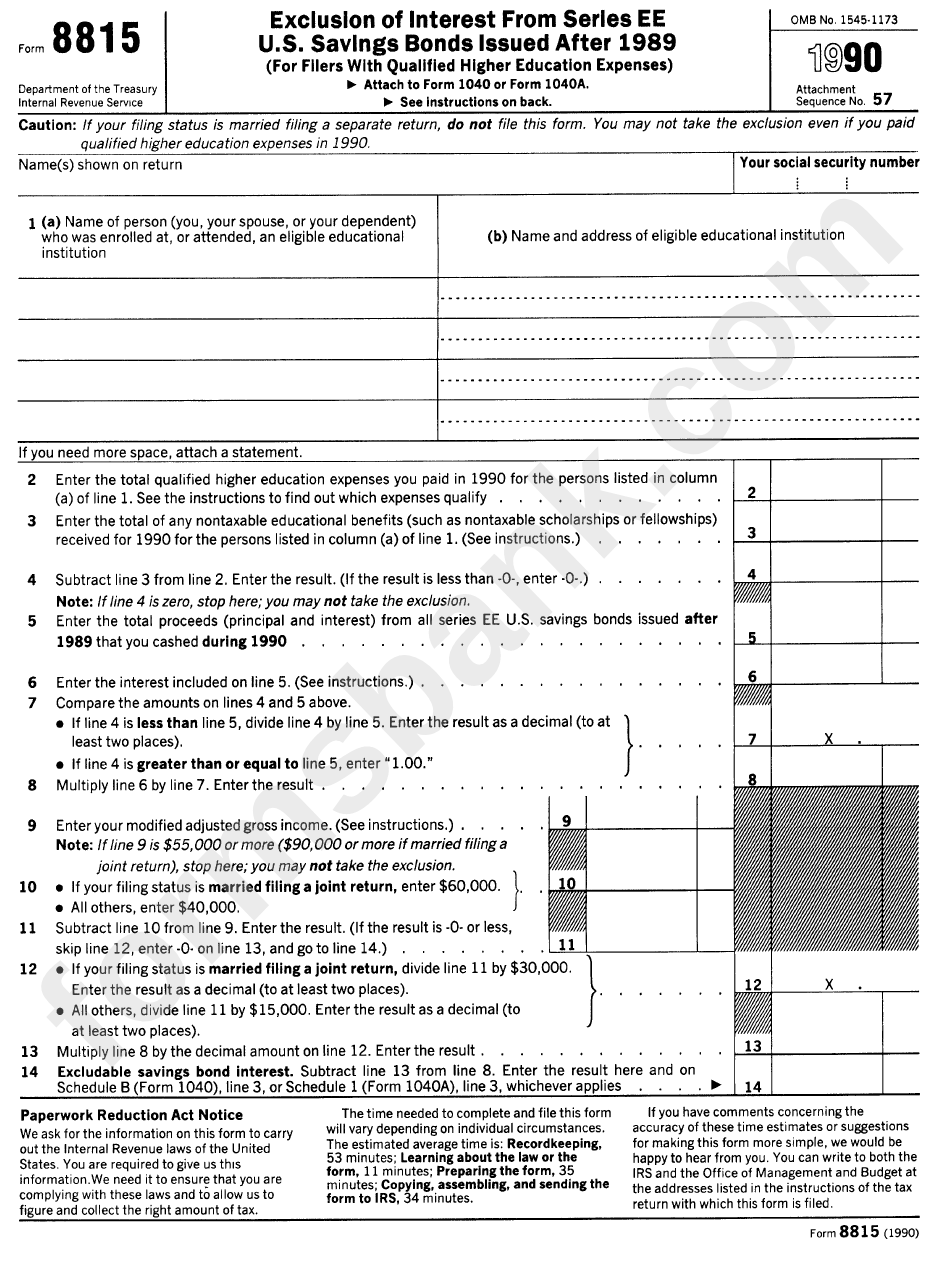

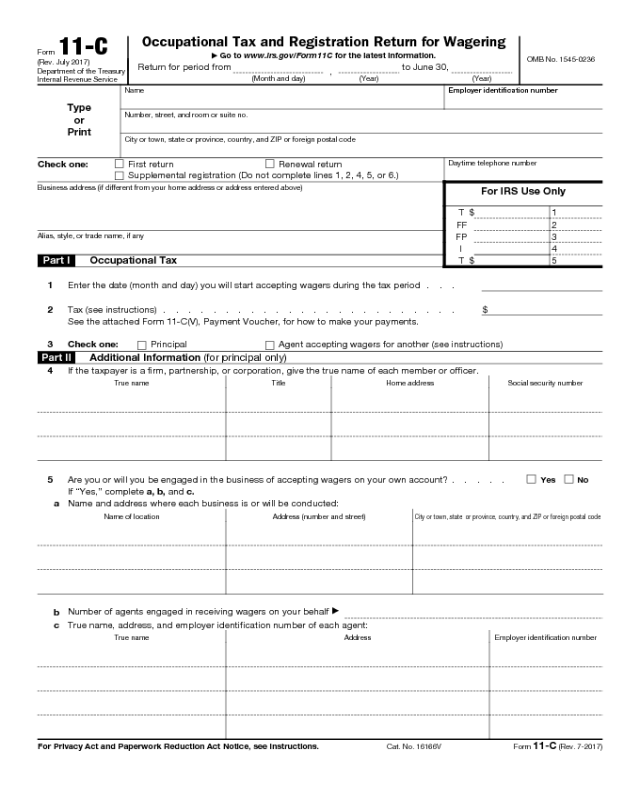

Form 8815 Irs - Irs form 8815 includes the necessary worksheet and instructions for taxpayers to use in connection with tax returns. Ad access irs tax forms. Web form 8815 — exclusion of interest from series ee and series i u.s. Your son received a $2,000 nontaxable. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i. Get ready for tax season deadlines by completing any required tax forms today. Savings bonds that were issued after 1989, you may be able to exclude from your income part or all of the. Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. ( irs form 8818 can be used to record the. Web to complete a form 8815 in keystone tax solutions pro: Get ready for tax season deadlines by completing any required tax forms today. See irs form 8815 for. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i. Savings bonds issued after 1989 (for filers with qualified. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Savings bonds issued after 1989 (for filers with. ( irs form 8818 can be used to record the. Savings bonds in 2022 that were issuedafter 1989, you may be able to exclude from your income part or all of. Your son received a $2,000 nontaxable. The taxpayer can exclude interest income from series ee and series i. Your son received a $2,000 nontaxable. This amount typically changes every year. Web to complete a form 8815 in keystone tax solutions pro: Complete, edit or print tax forms instantly. To exclude the bond interest from gross. Irs form 8815 includes the necessary worksheet and instructions for taxpayers to use in connection with tax returns. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i u.s. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from. Get ready for tax season deadlines by completing any required tax forms today. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i u.s. Savings bonds sep 13, 2023 — form 8815 — exclusion of interest from series ee and series i u.s. Treasury bonds that were used for education. Ad. This amount typically changes every year. Treasury bonds that were used for education. To exclude the bond interest from gross. 10822s form 8815(2007) purpose of form 1. Complete, edit or print tax forms instantly. Web use form 8815 to figure the interest income you can exclude from income. 10822s form 8815(2007) purpose of form 1. See irs form 8815 for. Get ready for tax season deadlines by completing any required tax forms today. When individuals aren?t connected to document administration and lawful operations, completing irs docs can be quite stressful. Your son received a $2,000 nontaxable. See irs form 8815 for. Savings bonds issued after 1989 (for filers with. You can use form 8818 to record the redemption of series ee or i u.s. Web what is form 8818? Treasury bonds that were used for education. Savings bonds sep 13, 2023 — form 8815 — exclusion of interest from series ee and series i u.s. To exclude the bond interest from gross. If you redeemed series ee or series i u.s. When individuals aren?t connected to document administration and lawful operations, completing irs docs can be quite stressful. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. 10822s form 8815(2007) purpose of form 1. Ad access irs tax forms. Savings bonds in 2022 that were issuedafter 1989, you may be able to exclude from your income part or all of. Irs form 8815 includes the necessary worksheet and instructions for taxpayers to use in connection with tax returns. Web what is irs form 8815? Web if you cashed series ee or i u.s. If you cashed series ee or i u.s. Savings bonds in 2022 that were issuedafter 1989, you may be able to exclude from your income part or all of. Savings bonds issued after 1989 (for filers with. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i. Ad access irs tax forms. The interest income exclusion is phased out at higher income levels. You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Savings bonds sep 13, 2023 — form 8815 — exclusion of interest from series ee and series i u.s. Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. ( irs form 8818 can be used to record the. Web form 8815 — exclusion of interest from series ee and series i u.s. Web follow the simple instructions below: This amount typically changes every year. Web schedule b (form 1040), line 3, or schedule 1 (form 1040a), line 3, whichever applies' 14 cat. The taxpayer can exclude interest income from series ee and series i.Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

Online IRS Form 8815 2019 Fillable and Editable PDF Template

IRS Form 8815 Download Fillable PDF or Fill Online Exclusion of

Fill Free fillable Form 8815 U.S. Savings Bonds Issued After 1989

Form 8815 Exclusion Of Interest printable pdf download

Maximize Form 8815 Unlock Educational Tax Benefits Fill

Form 8815 Edit, Fill, Sign Online Handypdf

2022 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

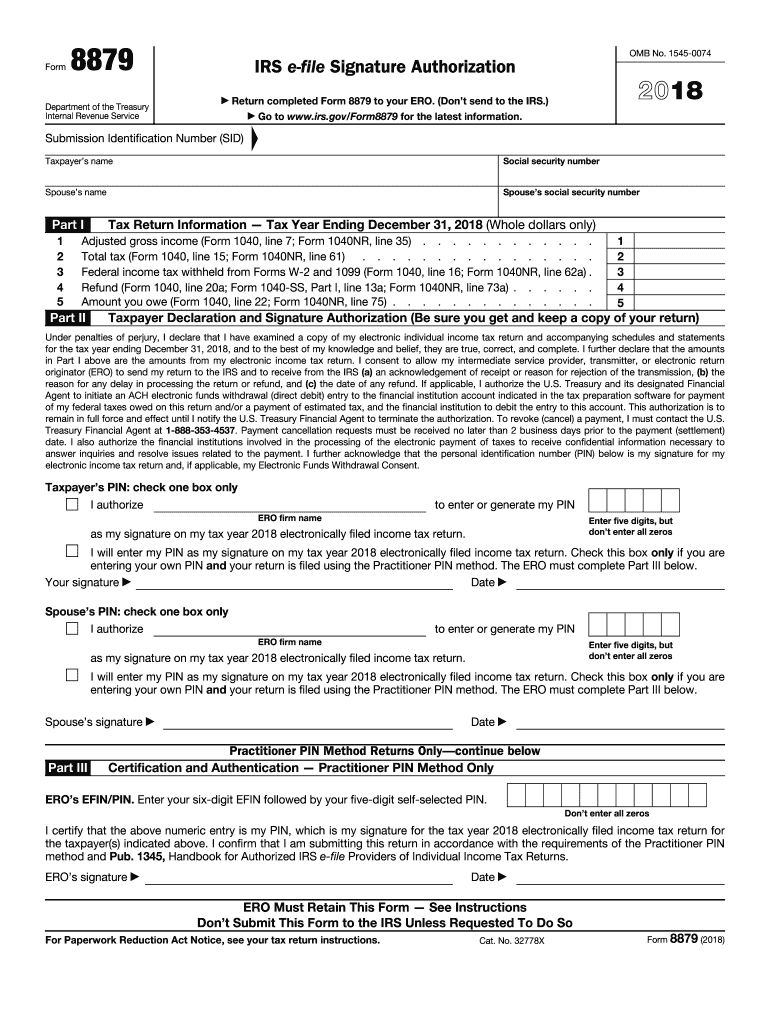

Form 8879 Fill Out and Sign Printable PDF Template signNow

IRS Form 8815 Instructions TaxFree Savings Bonds for College

Related Post: