Form 4952 Irs

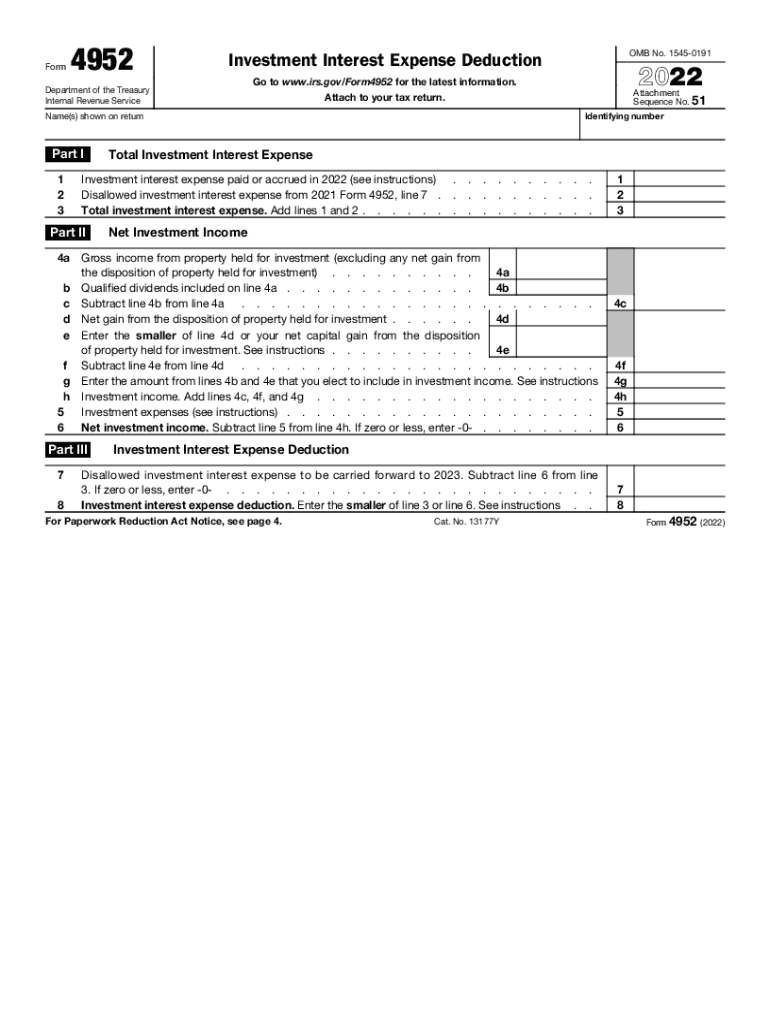

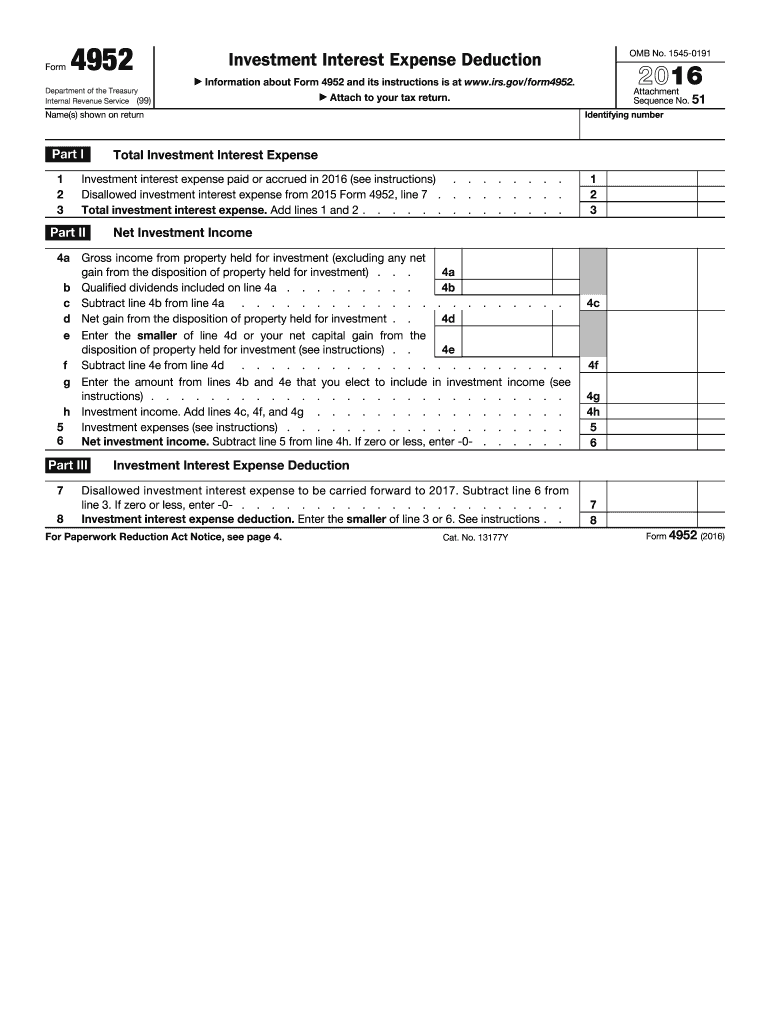

Form 4952 Irs - Ad we help get taxpayers relief from owed irs back taxes. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction a go to www.irs.gov/form4952 for the latest information. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Use form 4952 to figure the amount of investment interest expense you can deduct for 2022 and the amount you can carry forward to future years. This form is for income earned in tax year. This form is used by. A taxpayer may elect to include any amount of qualified dividends as. Web form 4952 investment interest expense deduction department of the treasury internal revenue service. Web a taxpayer filing form 8952 in december of 2021 with one worker would look to compensation paid to the worker in 2020 because 2020 is the most recently completed. Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. Web form 4952 is an irs tax form determining the investment interest expense that may be either deducted or carried forward to a future tax year. Ad we help get taxpayers relief from owed irs back taxes. Web more about the federal form 4952 we last updated federal form 4952 in december 2022 from the federal internal revenue service. Web. This form is for income earned in tax year. Ad we help get taxpayers relief from owed irs back taxes. Use form 4952 to figure the amount of investment interest expense you can deduct for 2022 and the amount you can carry forward to future years. Web use form 4952 to figure the amount of investment interest expense you can. Ad download or email irs 4952 & more fillable forms, register and subscribe now! Web investment (margin) interest deduction is claimed on form 4952 investment interest expense deduction and the allowable deduction will flow to schedule a (form 1040). The amt is a separate tax that is imposed in addition to your regular tax. Investment interest expenditure deduction, which is. Web for purposes of irs form 4952, qualified dividend income is not considered investment income. The internal revenue service (irs) distributes form 4952: Web use form 4952 to figure the amount of investment interest expense you can deduct for 2010 and the amount you can carry forward to future years. Web purpose of form use form 6251 to figure the. The amt is a separate tax that is imposed in addition to your regular tax. Web purpose of form use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction a go to www.irs.gov/form4952 for the latest information. Web form 4952. Web form 4952 is an irs tax form determining the investment interest expense that may be either deducted or carried forward to a future tax year. The internal revenue service (irs) distributes form 4952: This form is used by. Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on how. Pwbm estimates based on irs statistics of income data from form 1120 schedule c, form 8991, form 8993, form 965, and form 1118. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment interest. Web for purposes of irs form 4952, qualified. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2010 and the amount you can carry forward to future years. Pwbm estimates based on irs statistics of income data from form 1120 schedule c, form 8991, form 8993, form 965, and form 1118. Web investment (margin) interest deduction is claimed on form 4952. The first part of the. Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment. Ad download or email irs 4952 & more fillable forms, register and subscribe now! Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Ad we help get taxpayers relief from owed irs back taxes. Pwbm estimates based on irs. Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Web investment (margin) interest deduction is claimed on form 4952 investment interest expense deduction and the allowable deduction will flow to schedule a (form 1040). The internal revenue service (irs) distributes form 4952: This form is for income earned in tax year. Pwbm estimates based on irs statistics of income data from form 1120 schedule c, form 8991, form 8993, form 965, and form 1118. Web purpose of form use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). A taxpayer may elect to include any amount of qualified dividends as. Web for purposes of irs form 4952, qualified dividend income is not considered investment income. Investment interest expense deduction is a tax form distributed by the internal revenue service (irs) used to determine the amount of investment. Ad download or email irs 4952 & more fillable forms, register and subscribe now! Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. The amt is a separate tax that is imposed in addition to your regular tax. Web a taxpayer filing form 8952 in december of 2021 with one worker would look to compensation paid to the worker in 2020 because 2020 is the most recently completed. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2010 and the amount you can carry forward to future years. This form is used by. The first part of the. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on how to file. Web more about the federal form 4952 we last updated federal form 4952 in december 2022 from the federal internal revenue service.Form 4952 Fill Out and Sign Printable PDF Template signNow

Irs form 4952 pdf download 2016 Fill out & sign online DocHub

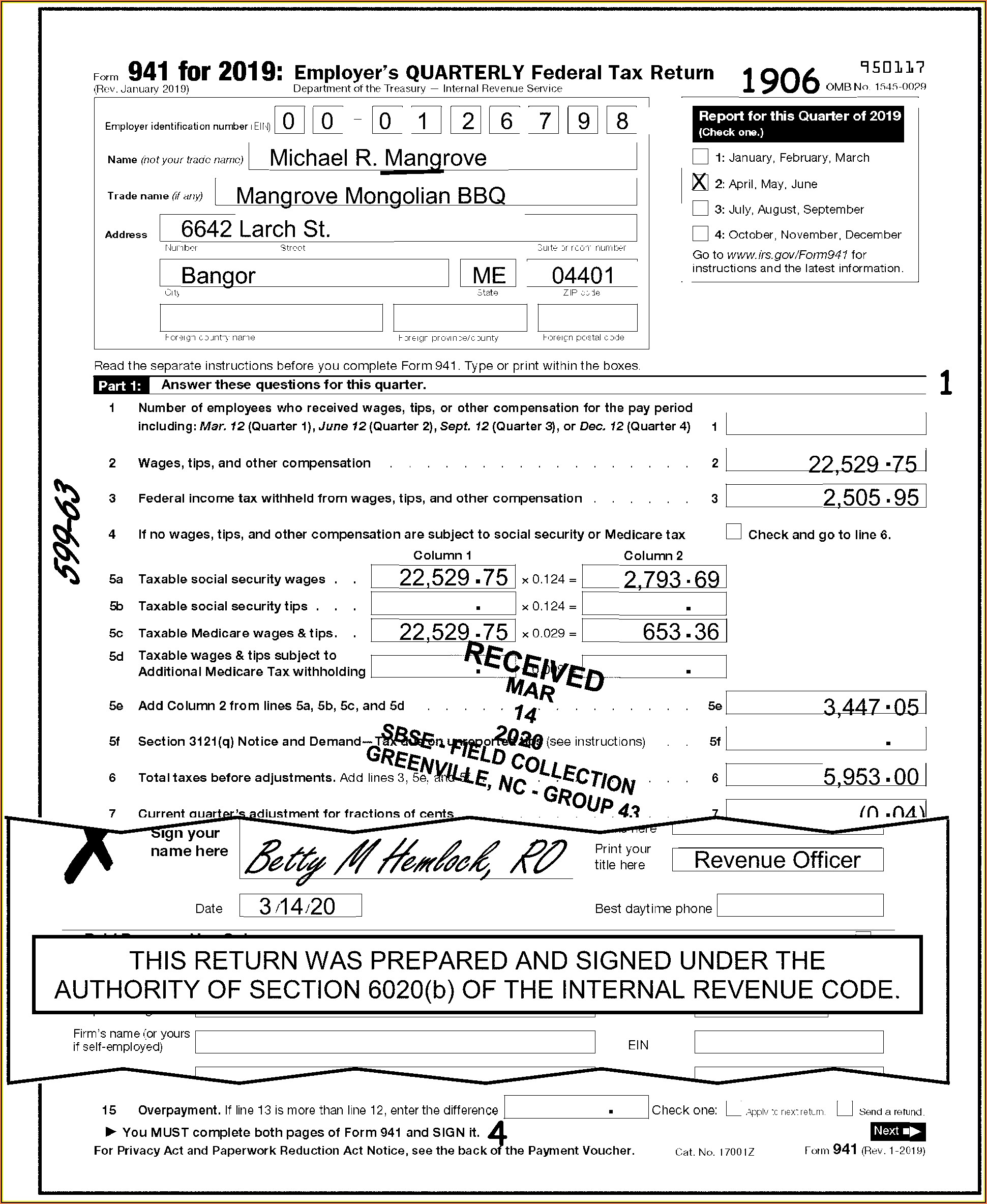

Irs.gov Forms 941c Form Resume Examples 0g27pRz9Pr

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Form 4952 Investment Interest Expense Deduction (2015) Free Download

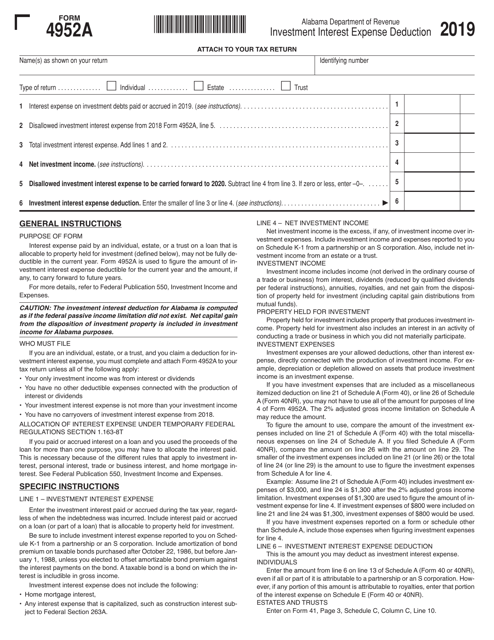

Form 4952A Download Printable PDF or Fill Online Investment Interest

Form 4952 Finance Reference

Form 4952Investment Interest Expense Deduction

AICPA Letter to IRS on Form 4952 Regarding Investment Interest

Fill Free fillable Investment Interest Expense Deduction 4952 PDF form

Related Post: