Ca Form 3586

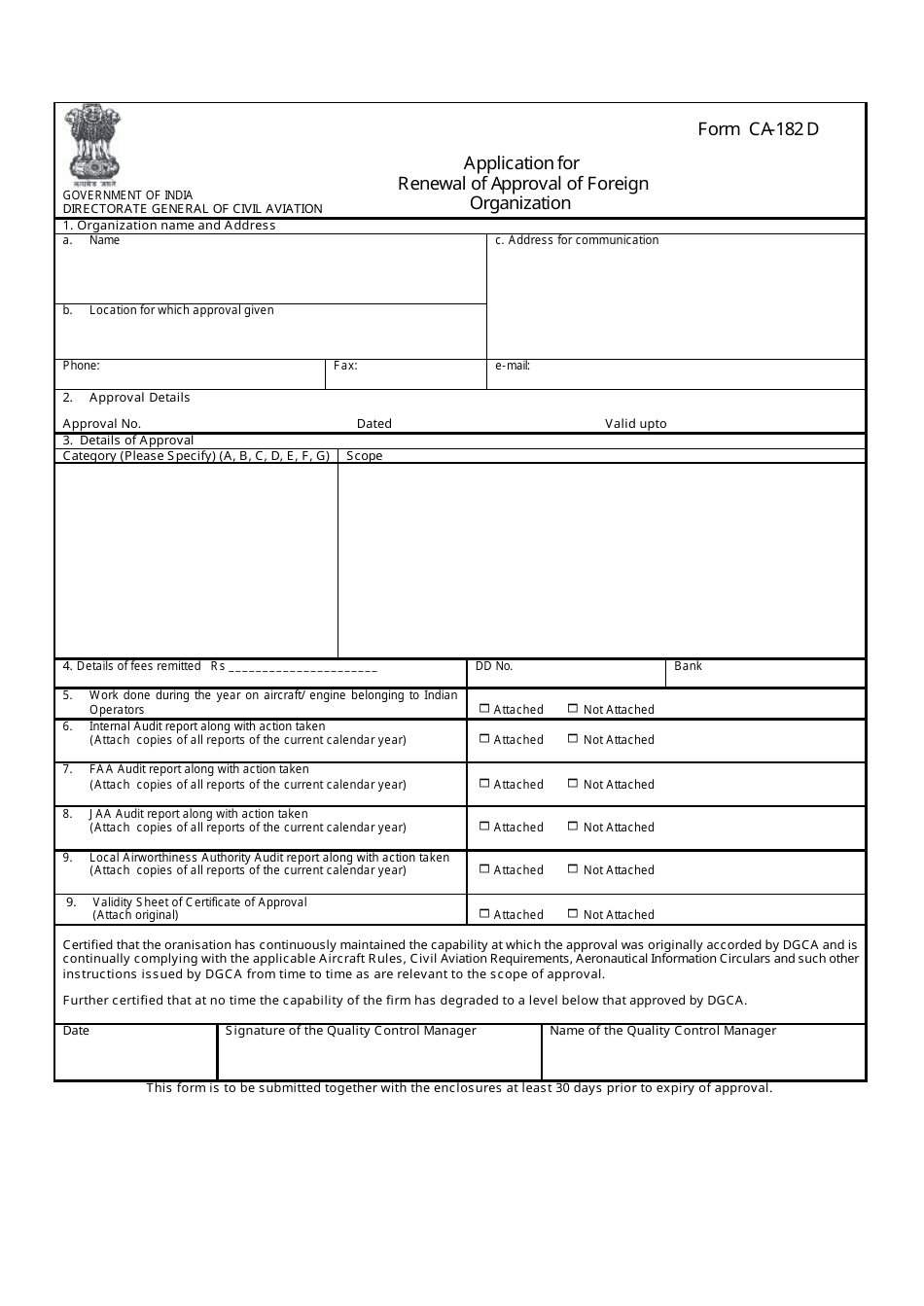

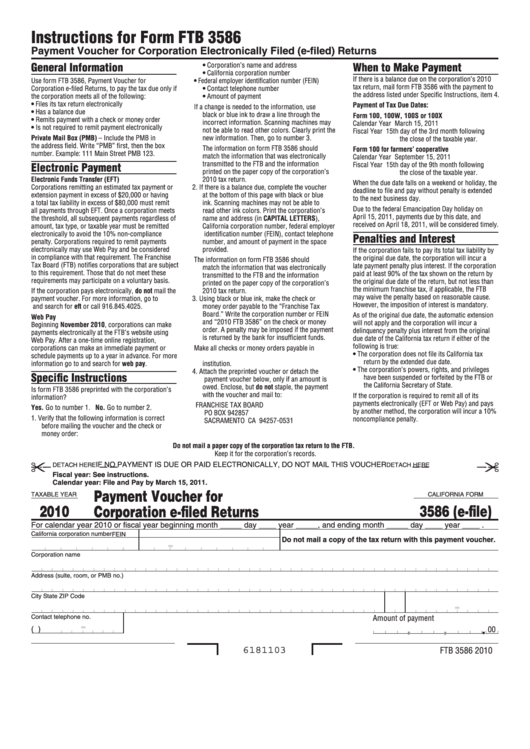

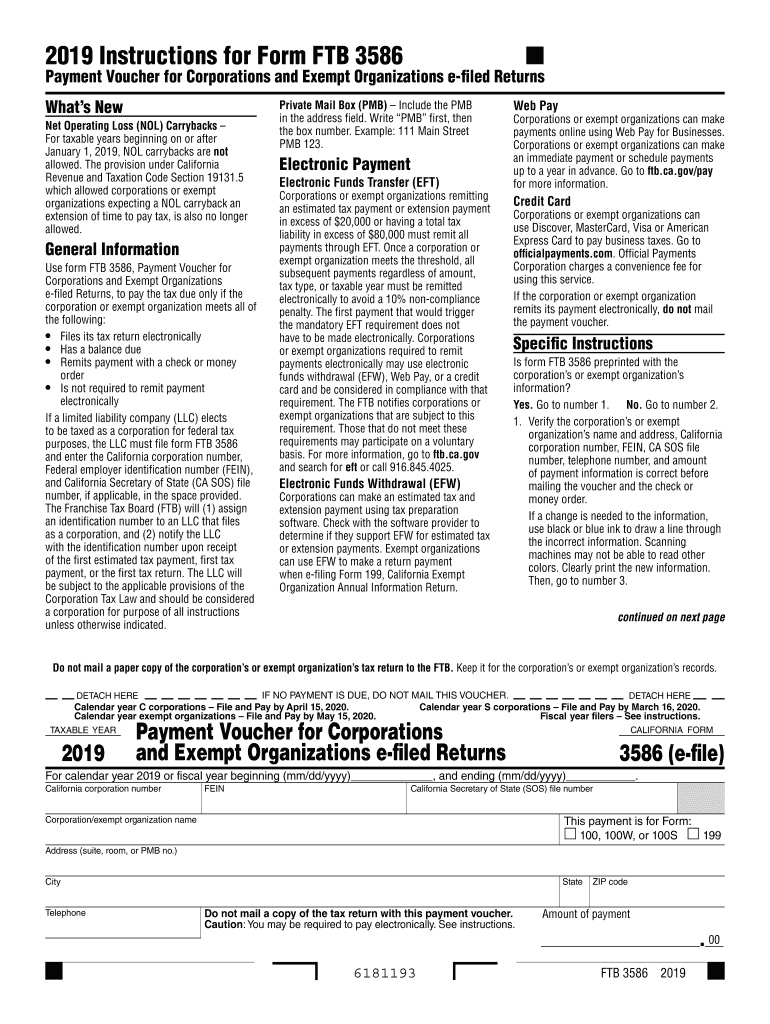

Ca Form 3586 - Use get form or simply click on the template. California estimates tax vouchers for the $800 minimum are produced by. Files its tax return electronically has a. Web use form ftb 3586, payment voucher for corporation e‐filed returns, to pay the tax due only if the corporation meets all of the following: Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the. Web the information on form ftb 3586 should match the information that was electronically transmitted to the ftb and the information printed on the paper copy of the corporation’s. Ca form 3539 (corp) payment for automatic extension for corporations and exempt organizations. Open the document with our advanced pdf editor. Use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt. Use get form or simply click on the template preview to open it in the editor. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the. Use get form or simply click on the template preview to open it in the editor. Files its tax return electronically has a. Web use form ftb 3586, payment voucher. California estimates tax vouchers for the $800 minimum are produced by. Use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt. California estimates tax vouchers for the $800 minimum are produced by. Web the information on form ftb 3586 should match the information that was electronically transmitted to the ftb and the information printed on the paper copy of the corporation’s. Make a payment for a balance due calculated on. Web use form ftb 3586, payment voucher for corporations and exempt. Fill in the info needed in ca ftb 3586, making use of fillable. Web use form ftb 3586, payment voucher for corporation e‐filed returns, to pay the tax due only if the corporation meets all of the following: Ca form 3539 (corp) payment for automatic extension for corporations and exempt organizations. Start completing the fillable fields and. This form is. Make a payment for a balance due calculated on. Web notice of proposed assessment (npa) or form 3834 payment. This form is for income earned in tax year 2021, with tax returns. Web you just need to follow these elementary instructions: Start completing the fillable fields and. This form is for income earned in tax year 2021, with tax returns. Web you just need to follow these elementary instructions: Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐fled returns, to pay the tax due only if the corporation or exempt organization meets all of the. Pay a notice of proposed assessment. California estimates. Web what is california tax form 3586? Make a payment for a balance due calculated on. Files its tax return electronically has a. Web notice of proposed assessment (npa) or form 3834 payment. Start completing the fillable fields and. Fill in the info needed in ca ftb 3586, making use of fillable. California estimates tax vouchers for the $800 minimum are produced by. This form is for income earned in tax year 2022, with tax returns. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation. This form is for income earned in tax year 2021, with tax returns. California estimates tax vouchers for the $800 minimum are produced by. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the. Web you just need to follow. This form is for income earned in tax year 2022, with tax returns. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by. Ca form 3539 (corp) payment for automatic extension for corporations and exempt organizations. This form is for income earned in tax year 2022, with tax returns. Electronically if a limited liability company (llc) elects to be taxed as a corporation for federal tax purposes, the llc must file form ftb 3586 and. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐fled returns, to pay the tax due only if the corporation or exempt organization meets all of the. Use get form or simply click on the template. Web use form ftb 3586, payment voucher for corporation e‐filed returns, to pay the tax due only if the corporation meets all of the following: Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the. Web you just need to follow these elementary instructions: Web notice of proposed assessment (npa) or form 3834 payment. Make a payment for a balance due calculated on. Files its tax return electronically has a. Use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt. Fill in the info needed in ca ftb 3586, making use of fillable. Use get form or simply click on the template preview to open it in the editor. This form is for income earned in tax year 2021, with tax returns. Web the information on form ftb 3586 should match the information that was electronically transmitted to the ftb and the information printed on the paper copy of the corporation’s. Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the. Open the document with our advanced pdf editor. Select this payment type to: Web use form ftb 3586, payment voucher for corporations and exempt organizations e‐filed returns, to pay the tax due only if the corporation or exempt organization meets all of the.CA Form CA182 D Download Printable PDF or Fill Online Application for

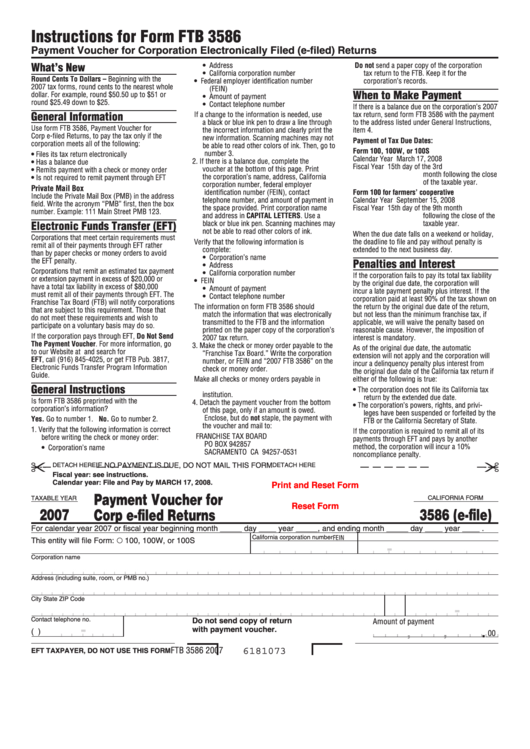

Form Ftb 3586 Payment Voucher For Corporation EFiled Returns

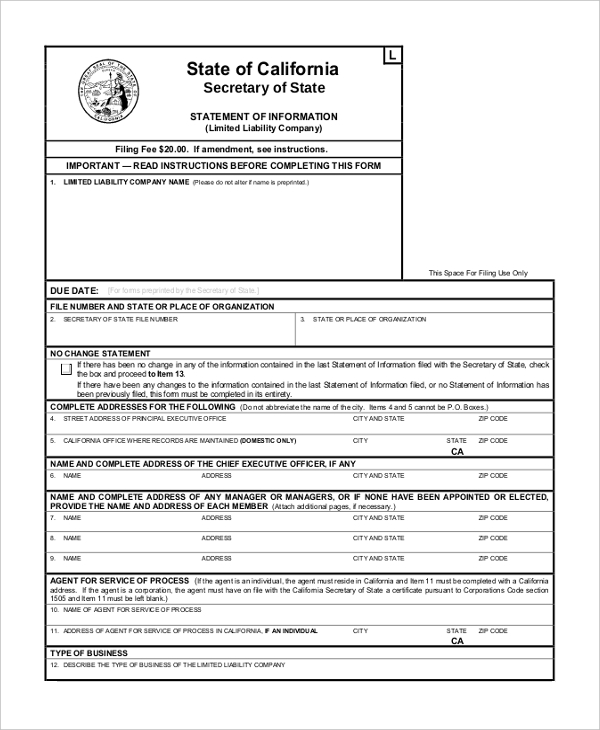

17 printable divorce papers california forms and templates fillable

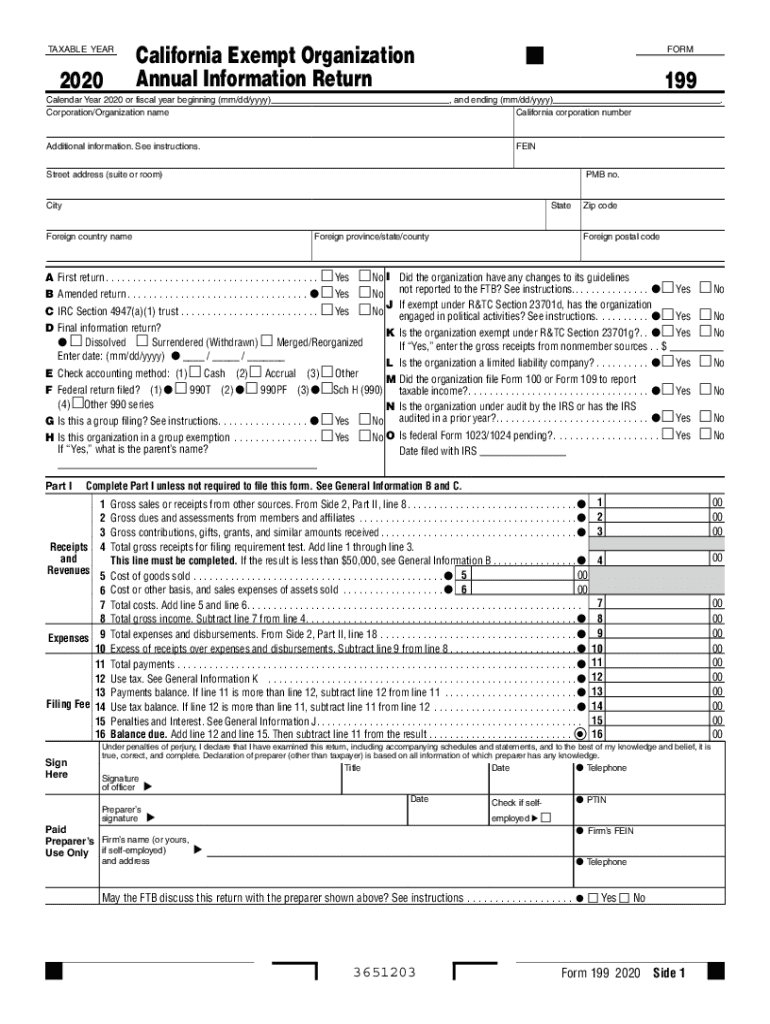

California form 199 Fill out & sign online DocHub

California Form 3586 (EFile) Payment Voucher For Corporation EFiled

Print Ca Form 1032 Form CH730 Download Fillable PDF or Fill Online

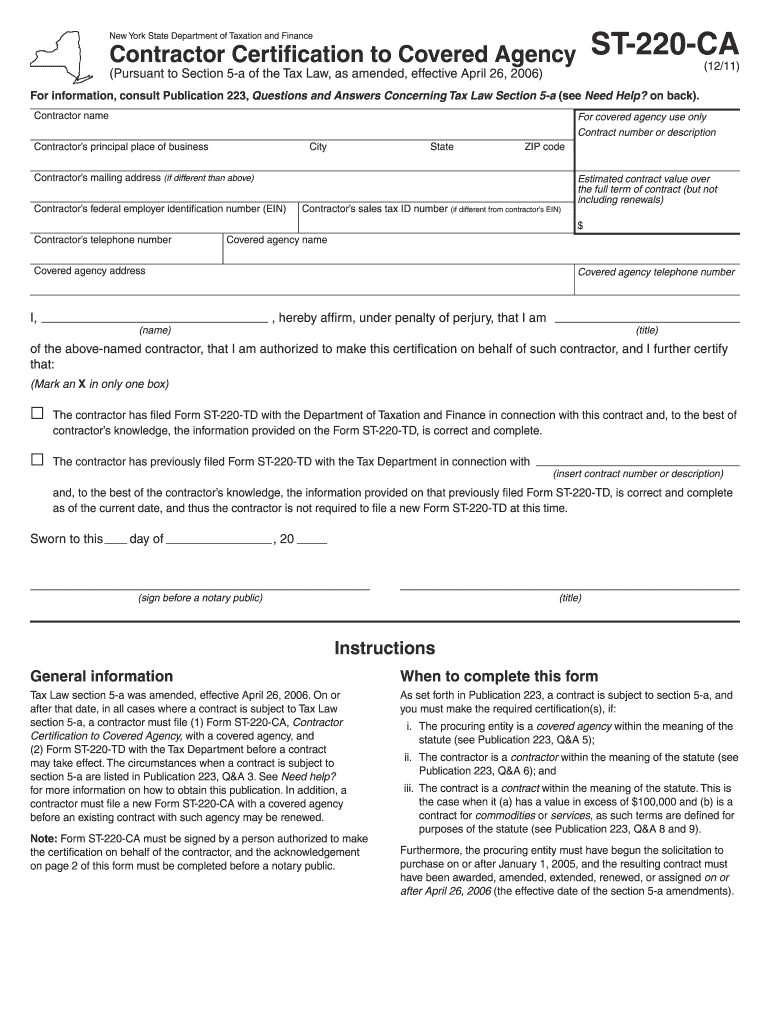

St 220 Ca Fill Out and Sign Printable PDF Template signNow

2002 ca form 199 Fill out & sign online DocHub

California Ag Tax Exemption Form Fill Online, Printable, Fillable

2019 Form CA FTB 3586 Fill Online, Printable, Fillable, Blank pdfFiller

Related Post: