Tyson 401K Hardship Withdrawal Form

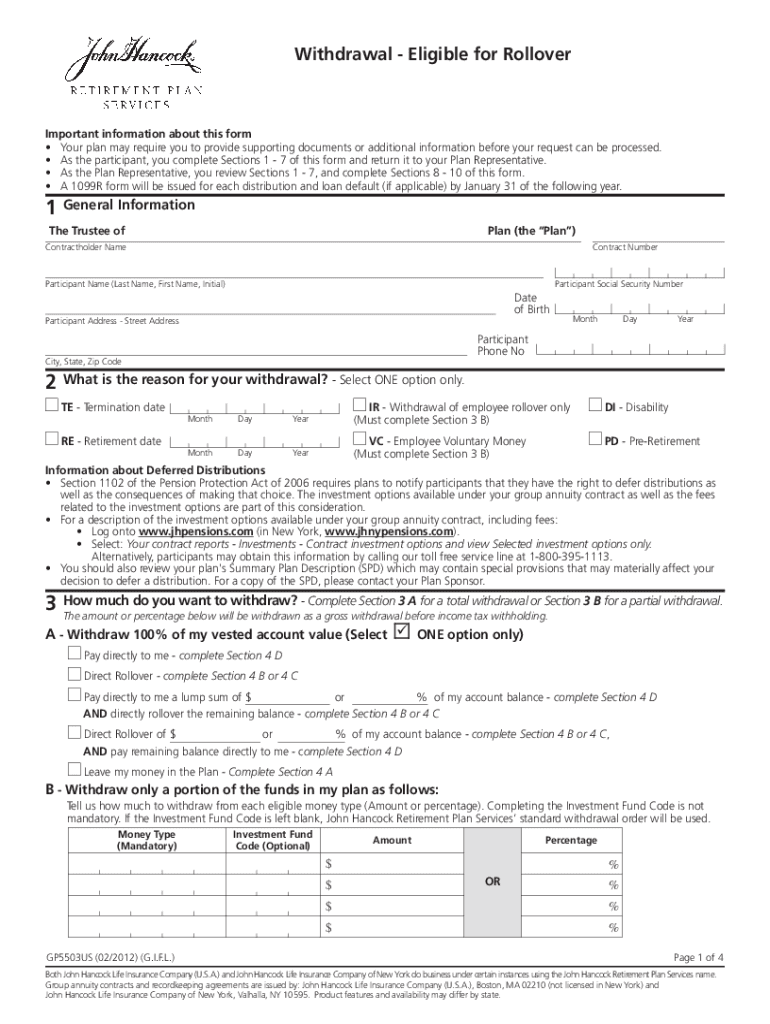

Tyson 401K Hardship Withdrawal Form - Web for a distribution from a 401 (k) plan to be on account of hardship, it must be made on account of an immediate and heavy financial need of the employee and the amount must. Access our most popular forms below, or select all forms to see a complete list. Web more information about tyson foods, inc. Web some retirement plans, such as 401 (k) and 403 (b) plans, may allow participants to withdraw from their retirement accounts because of a financial hardship,. This includes any distribution of any rollover account balance and. 3) after you have registered your account you will. Information about hardship distributions, early withdrawals and loans from. The following addresses have been detected on the 401k submissions: For example, some 401 (k). Web a hardship withdrawal from your 401(k) savings can be made if you have an immediate and heavy financial need. Page last reviewed or updated: Available services and applications include workday,. Review your plan document to determine if it allows. How to find the mistake: Web more information about tyson foods, inc. If you are an employer and: Web hardship withdrawals are limited to bona fide financial emergencies as determined by the plan committee. Web for a distribution from a 401 (k) plan to be on account of hardship, it must be made on account of an immediate and heavy financial need of the employee and the amount must. Web a hardship. Web for a distribution from a 401 (k) plan to be on account of hardship, it must be made on account of an immediate and heavy financial need of the employee and the amount must. Web more information about tyson foods, inc. Available services and applications include workday,. Web 2) click here to register your account and set up a. How to find the mistake: Page last reviewed or updated: Allowable reasons as defined by irs safe harbor hardship regulations. If you are an employer and: Ad we've got what you are craving to eat. For example, some 401 (k). Allowable reasons as defined by irs safe harbor hardship regulations. The money must be used for one of the following reasons, as. If you are an employer and: Sign in to my account. This includes any distribution of any rollover account balance and. See the full line of tyson® products now. Web you can't take a hardship withdrawal at all until you've first withdrawn all other funds, and taken all nontaxable plan loans, available to you under all retirement plans potentially. Web 2) click here to register your account and set up a. This includes any distribution of any rollover account balance and. Web some 401(k) plans may allow hardship distributions of certain kinds of contributions made to the plan before 1989. 3) after you have registered your account you will. Sign in to my account. Web more information about tyson foods, inc. See the full line of tyson® products now. Once you’ve completed a year of service with the company, tyson will contribute to your retirement savings in. Web for a distribution from a 401 (k) plan to be on account of hardship, it must be made on account of an immediate and heavy financial need of the employee and the amount. Web legal forms & services. Review your plan document to determine if it allows. Web • available distributions from your retirement plan(s). Web hardship withdrawals are limited to bona fide financial emergencies as determined by the plan committee. In general, there are four types. The money must be used for one of the following reasons, as. Review your plan document to determine if it allows. Most forms can be completed online, or you can download a pdf where. Web many 401 (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. How. Employers are not required to allow hardship. Web you can't take a hardship withdrawal at all until you've first withdrawn all other funds, and taken all nontaxable plan loans, available to you under all retirement plans potentially. A hardship withdrawal cannot be applied for until all other asset. Ad we've got what you are craving to eat. If you are an employer and: Allowable reasons as defined by irs safe harbor hardship regulations. Information about hardship distributions, early withdrawals and loans from. How to find the mistake: Page last reviewed or updated: Web to qualify for a 401 (k) hardship withdrawal, you must have a 401 (k) plan that permits hardship withdrawals. In general, there are four types. The following addresses have been detected on the 401k submissions: Web for a distribution from a 401 (k) plan to be on account of hardship, it must be made on account of an immediate and heavy financial need of the employee and the amount must. All team members can log in with any device and have immediate access to the tools you need to do your job. Web 2) click here to register your account and set up a username and password to use to access your account going forward. Web • available distributions from your retirement plan(s). Web some retirement plans, such as 401 (k) and 403 (b) plans, may allow participants to withdraw from their retirement accounts because of a financial hardship,. Web more information about tyson foods, inc. Most forms can be completed online, or you can download a pdf where. The money must be used for one of the following reasons, as.John hancock forms and applications Fill out & sign online DocHub

Tsp hardship withdrawal form 2007 Fill out & sign online DocHub

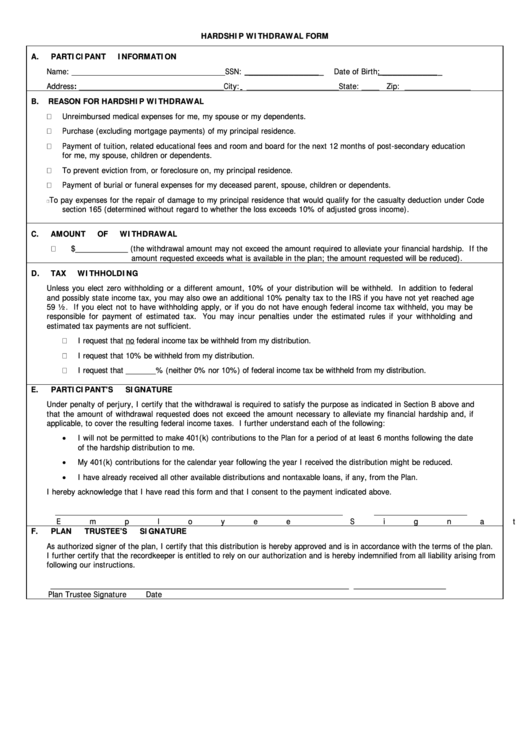

Hardship withdrawal 401 k form Fill out & sign online DocHub

Hardship Withdrawal Form printable pdf download

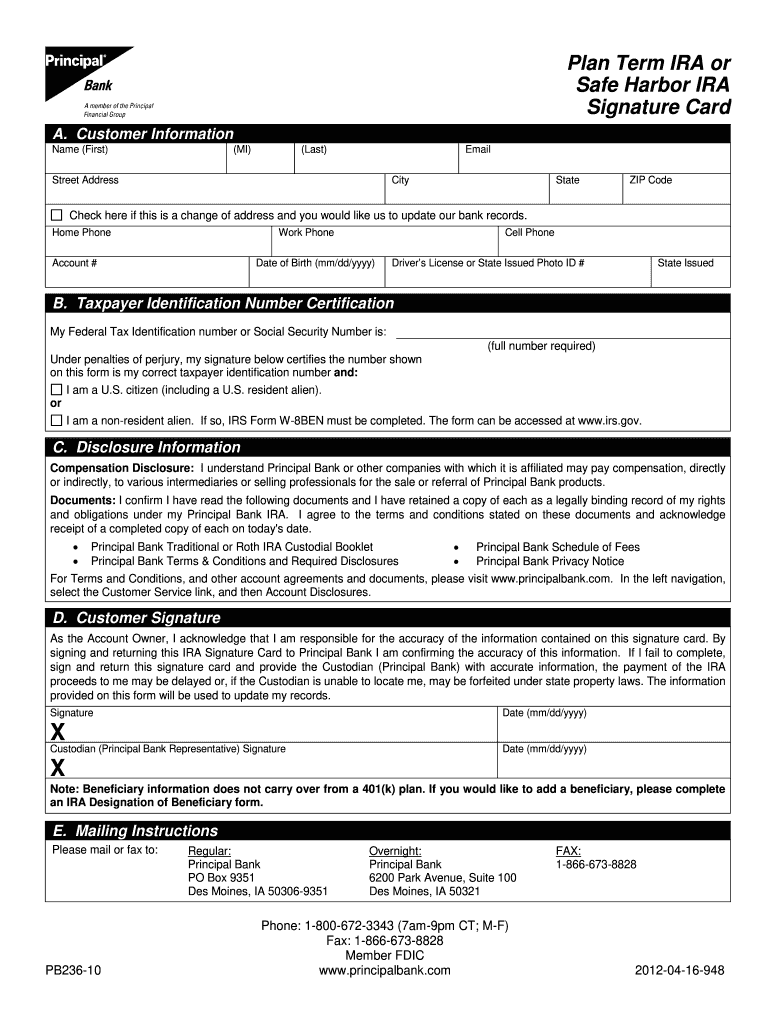

Principal 401k Withdrawal Terms And Conditions Fill Online, Printable

Paychex 401k Hardship Withdrawal Form Universal Network

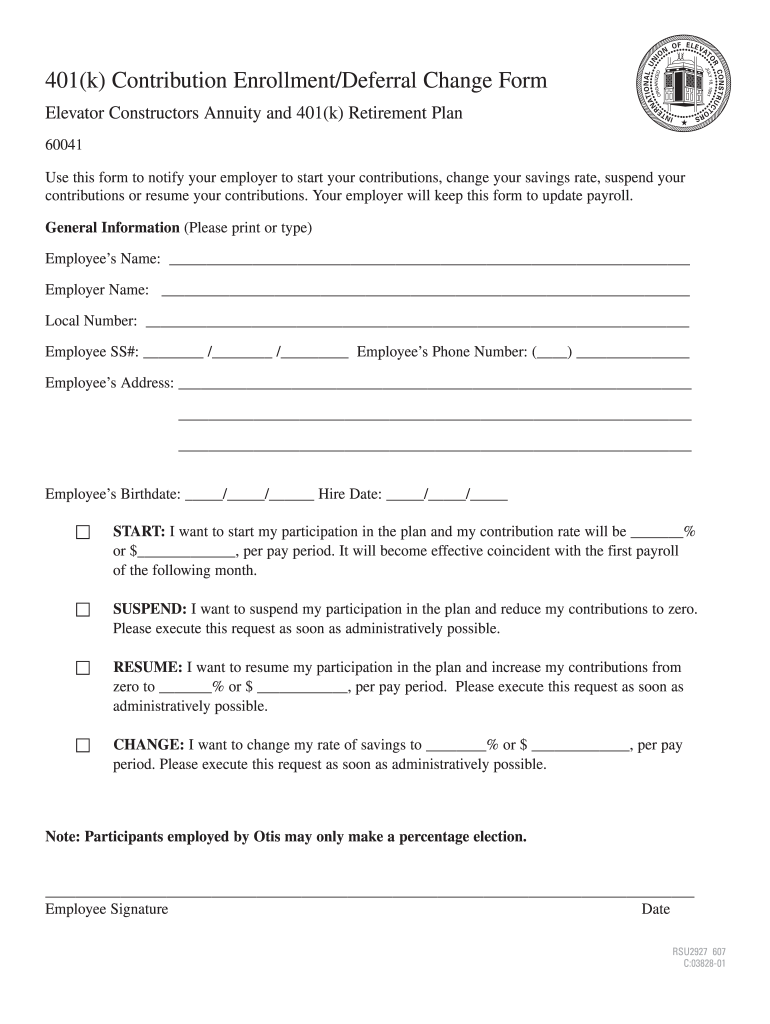

401k contribution change form Fill out & sign online DocHub

Vanguard Hardship Withdrawal Form Fill Online, Printable, Fillable

401k Withdrawal Form For Taxes Universal Network

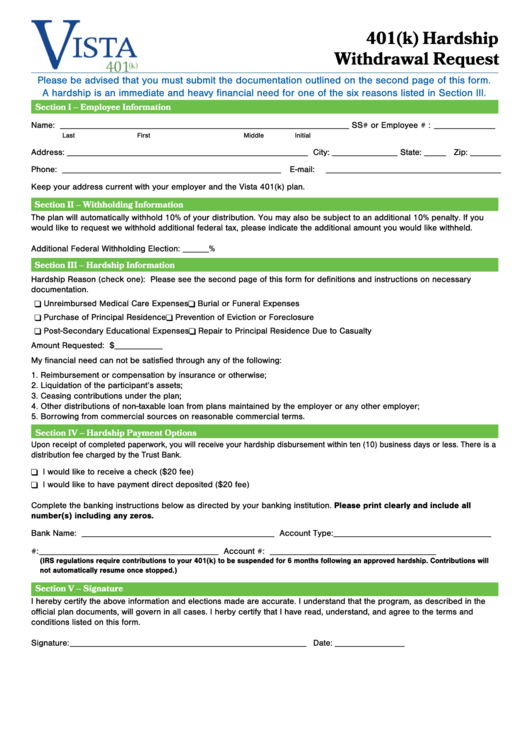

401(K) Hardship Withdrawal Form printable pdf download

Related Post: