Form 5498 In Lacerte

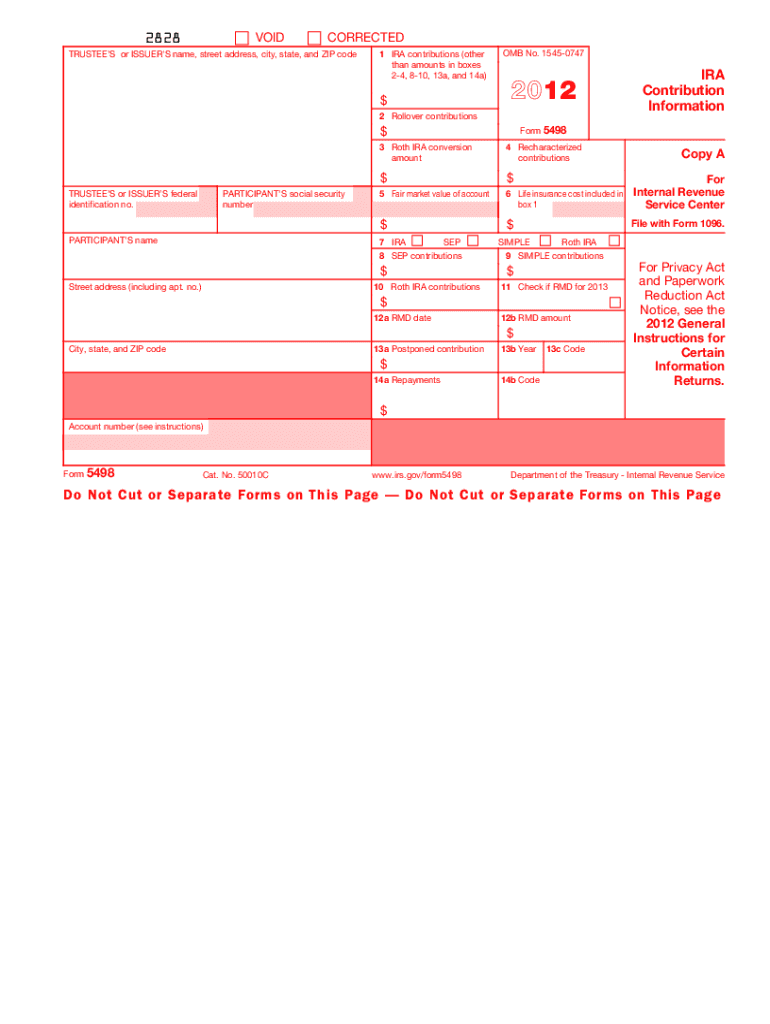

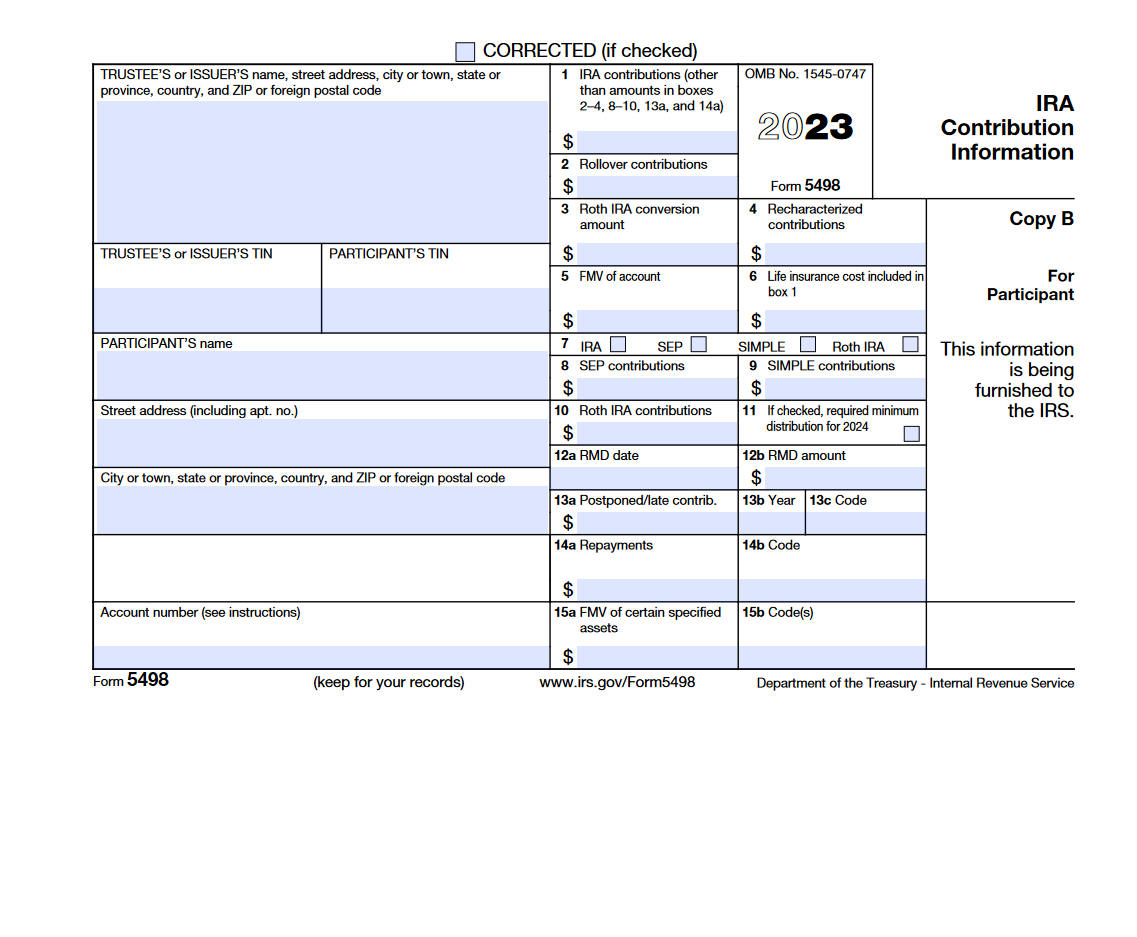

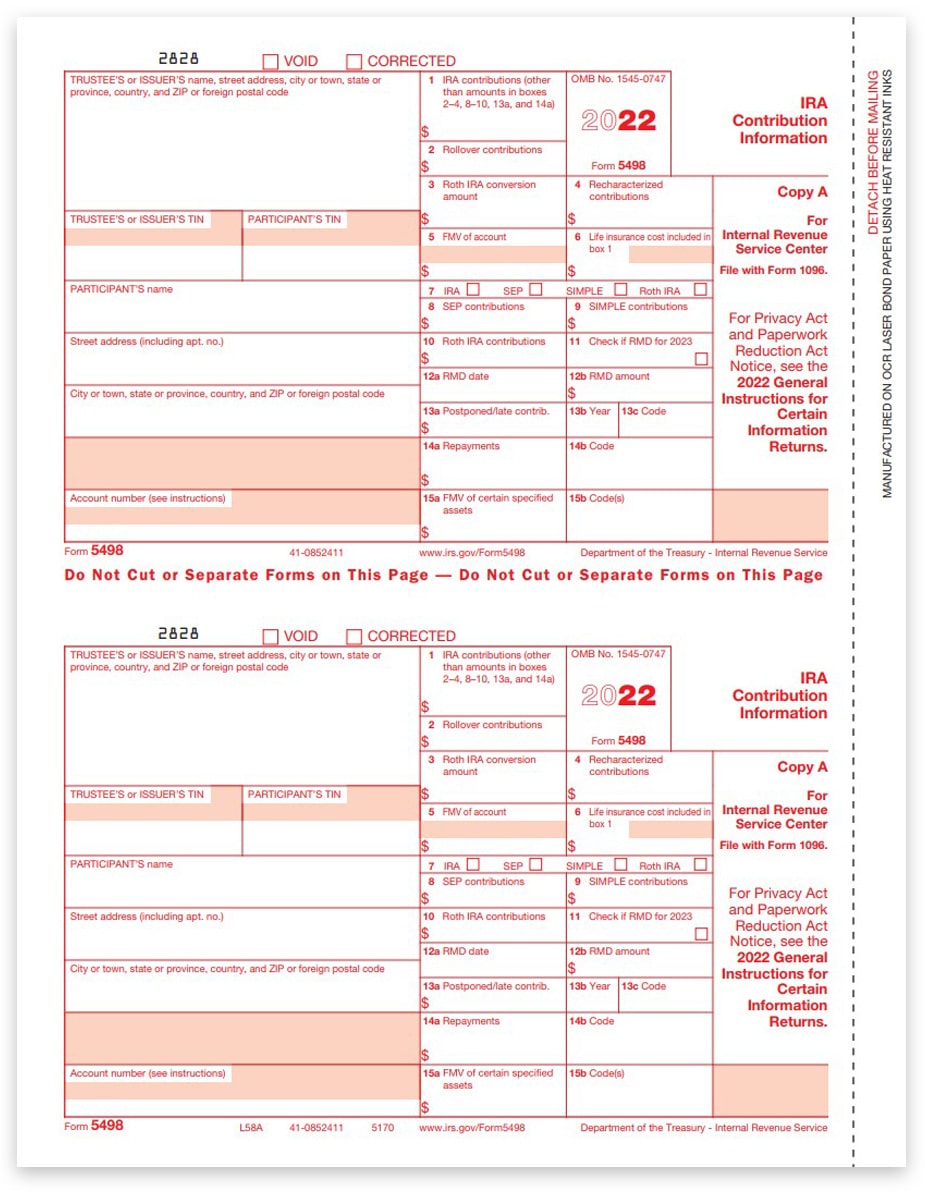

Form 5498 In Lacerte - Web entering information from form 5498 in lacerte. The irs form 5498 exists so that financial institutions can report ira information. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Use the left column for taxpayer information. Select traditional irafrom the left panel. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year. Form 5498 is an informational form. Solved•by intuit•1427•updated 1 year ago. Web where does the information on form 5498 go in turbotax? Go to screen 24, adjustments to income. Web this is not a tax form: Web where does the information on form 5498 go in turbotax? The 5498 is for 2019 and shows funds as rollover contributions in box 2. but you should confirm this is confirming exactly what the. Web follow these steps: Web the end of may is normally when the previous year’s irs form 5498. Proseries doesn't have a 5498 worksheet. Web when you make contributions to an ira, it’s likely that you will receive a form 5498 from the organization that manages your retirement account. Ad lacerte tax is your trusted leader in innovative solutions to taxpayer problems since 1978. When you save for retirement with an individual retirement arrangement (ira), you probably receive. Web filing form 5498 with the irs. Web where does the information on form 5498 go in turbotax? You don't enter this form into turbotax; This feature works on individual. Web what do i do with form 5498? Web filing form 5498 with the irs. Go to screen 24, adjustments to income. Select traditional irafrom the left panel. Web form 5498 is information only and does not go on a tax return. Solved•by intuit•1427•updated 1 year ago. Web this is not a tax form: Solved•by intuit•1427•updated 1 year ago. Use the left column for taxpayer information. Web filing form 5498 with the irs. Form 5498 is an informational form. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year. You don't enter this form into turbotax; Web form 5498 is information only and does not go on a tax return. Ad lacerte tax is your trusted leader in innovative solutions to taxpayer problems since 1978. Web intuit help intuit. Select traditional irafrom the left panel. Web this is not a tax form: Web you use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as they are telling you,. Web the information on form 5498 is submitted to the internal revenue service by the. Go to screen 24, adjustments to income. Web intuit help intuit entering information from form 5498 in proconnect tax solved • by intuit • 45 • updated over 1 year ago form 5498 is an informational form. Form 5498 is an informational form. Stock or other ownership interest in a corporation not readily tradable on an established securities market. Web. Go to screen 24, adjustments to income. Web intuit help intuit entering information from form 5498 in proconnect tax solved • by intuit • 45 • updated over 1 year ago form 5498 is an informational form. Ad lacerte tax is your trusted leader in innovative solutions to taxpayer problems since 1978. Stock or other ownership interest in a corporation. Use the left column for taxpayer information. Lacerte tax is #1 in tax document automation according to cpa practice advisor. You don't enter this form into turbotax; Form 5498 is an informational form. What is irs form 5498? Ad lacerte tax is your trusted leader in innovative solutions to taxpayer problems since 1978. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web intuit help intuit entering information from form 5498 in proconnect tax solved • by intuit • 45 • updated over 1 year ago form 5498 is an informational form. Proseries doesn't have a 5498 worksheet. Web where does the information on form 5498 go in turbotax? Solved•by intuit•1427•updated 1 year ago. This feature works on individual. The irs form 5498 exists so that financial institutions can report ira information. The 5498 is for 2019 and shows funds as rollover contributions in box 2. but you should confirm this is confirming exactly what the. But for 2019, the deadline has been moved to july 15. Web you use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as they are telling you,. Lacerte tax is #1 in tax document automation according to cpa practice advisor. Select traditional irafrom the left panel. You don't enter this form into turbotax; You need to report the information for form 5498 in proseries. Web form 5498 is information only and does not go on a tax return. Web entering information from form 5498 in lacerte. Use the left column for taxpayer information. Web follow these steps:Form 5498 IRA Contribution Information Instructions and Guidelines

IRS Form 5498. IRA Contribution Information Forms Docs 2023

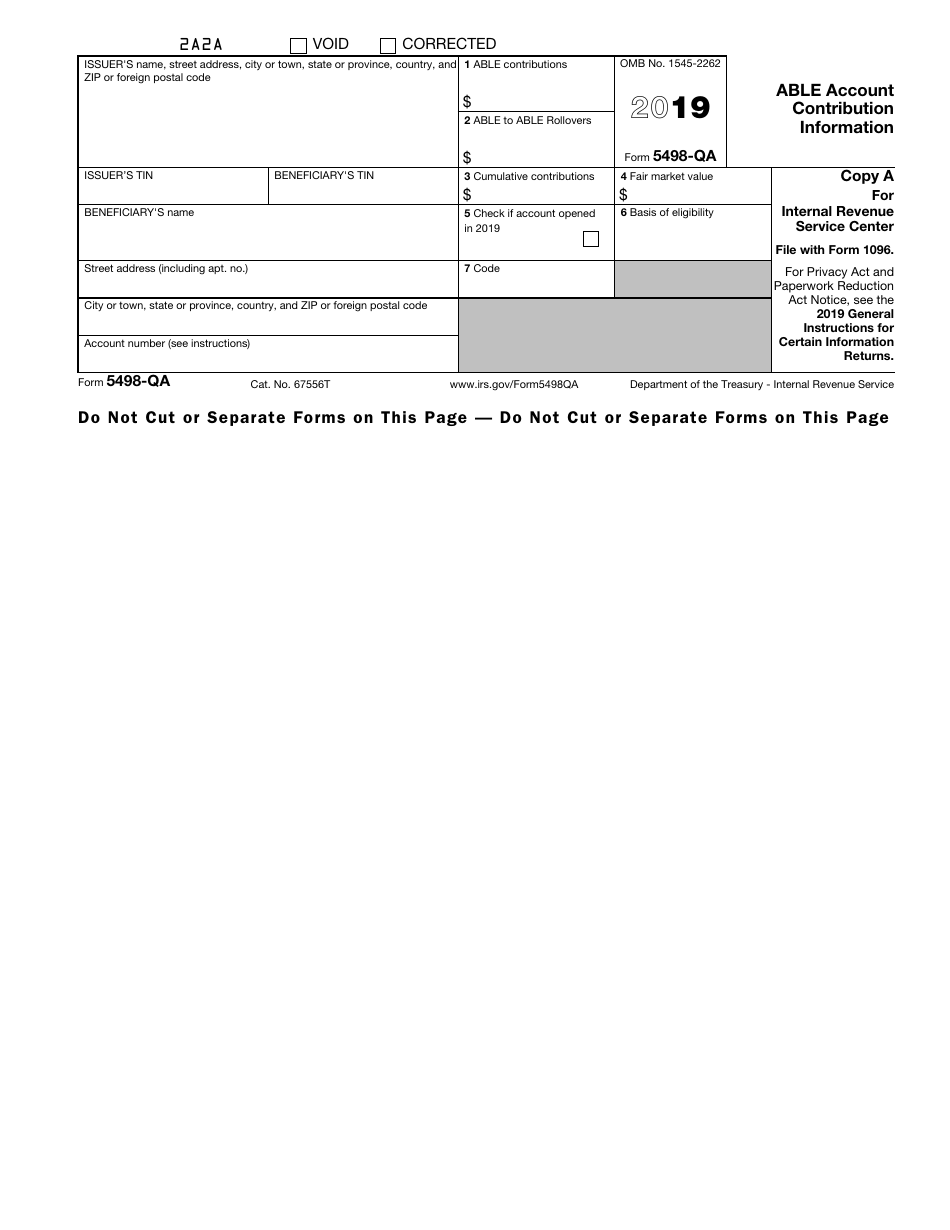

IRS Form 5498QA Download Fillable PDF or Fill Online Able Account

5498 Tax Forms for IRA Contributions, Participant Copy B

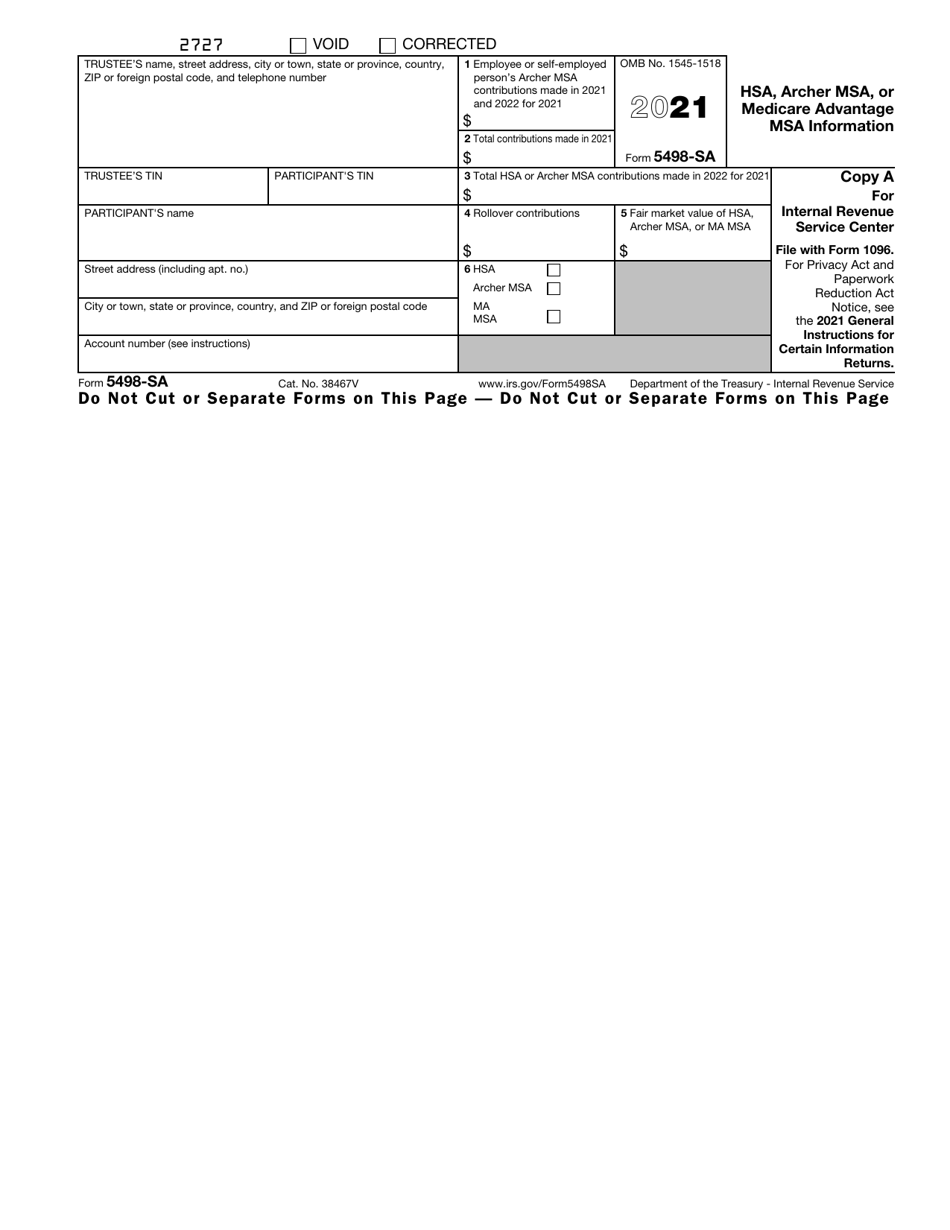

IRS 5498SA 2016 Fill out Tax Template Online US Legal Forms

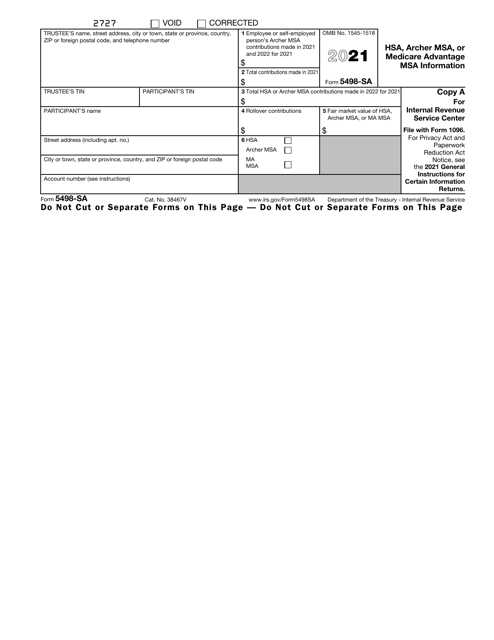

IRS Form 5498SA Download Fillable PDF or Fill Online Hsa, Archer Msa

IRS Form 5498SA Download Fillable PDF or Fill Online Hsa, Archer Msa

What is IRS Form 5498? A Complete Guide

5498 Tax Forms for IRA Contributions, IRS Copy A

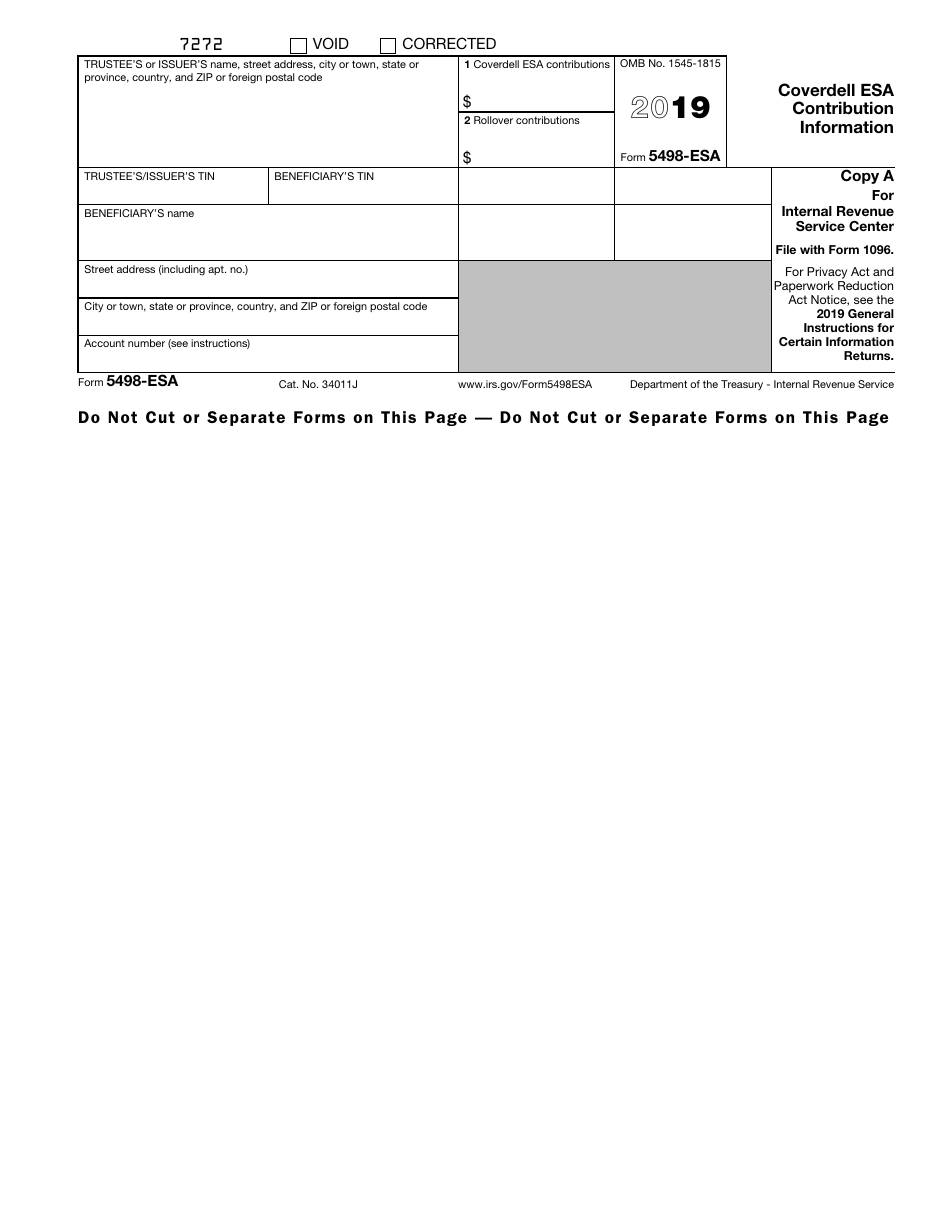

IRS Form 5498ESA 2019 Fill Out, Sign Online and Download Fillable

Related Post: