Form 3520 Instructions

Form 3520 Instructions - The due date for filing form 3520 for most. The form provides information about the foreign trust, its u.s. Persons (and executors of estates of u.s. Person’s return (april 15 in the case of an individual). If you and your spouse are filing a joint income tax return for tax year 2021, and you are both. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Owner, as well as between the trust and us beneficiary. • sign the return in the space provided for the preparer's signature, and • give a copy of the return to the. Web form 3520 is one of the most common forms besides the fbar is form 3520. It is essential to disclose the details of. Taxpayer transactions with a foreign trust. The due date for filing form 3520 for most. The instructions for filing form 3520 or foreign gift tax are complicated, even for seasoned accountants. Receipt of certain large gifts or. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both. Web see below the relevant section from form 3520 instructions. It is essential to disclose the details of. Certain transactions conducted with a foreign trust are required to be reported using this form. Web the form 3520 instructions say that if you received an amount from a portion of a foreign trust of which you are treated as the owner,. Complete, edit or print tax forms instantly. Form 3520 is an international reporting forum that requires us persons to report certain foreign. Receipt of certain large gifts or. Web see below the relevant section from form 3520 instructions. Person’s return (april 15 in the case of an individual). Web form 3520 for u.s. Persons (and executors of estates of u.s. The instructions for filing form 3520 or foreign gift tax are complicated, even for seasoned accountants. The due date for filing form 3520 for most. Web information at the bottom of page 6 of form 3520 and must be sure to: The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Persons (and executors of estates of u.s. Web form 3520 for u.s. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both. Web the irs tax. The due date for filing form 3520 for most. Owner, including recent updates, related forms and instructions on how to file. Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts: The form 3520 is used to report certain foreign gifts (and inheritances) as well as.. Web see below the relevant section from form 3520 instructions. Certain transactions with foreign trusts, ownership of foreign trusts under the rules of sections 671 through 679, and. Web 4 tips when filing form 3520. Individual income tax return) on or before the original due date of the u.s. Web form 3520 is one of the most common forms besides. The form 3520 is used to report certain foreign gifts (and inheritances) as well as. Web the form 3520 instructions say that if you received an amount from a portion of a foreign trust of which you are treated as the owner, please complete lines 24. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts.. Certain transactions conducted with a foreign trust are required to be reported using this form. Web 4 tips when filing form 3520. Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts: Individual income tax return) on or before the original due date of the u.s.. Person’s return (april 15 in the case of an individual). The form 3520 is used to report certain foreign gifts (and inheritances) as well as. Web 4 tips when filing form 3520. Web see below the relevant section from form 3520 instructions. Taxpayer transactions with a foreign trust. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web form 3520 is one of the most common forms besides the fbar is form 3520. Receipt of certain large gifts or. Web the form 3520 instructions say that if you received an amount from a portion of a foreign trust of which you are treated as the owner, please complete lines 24. Web form 3520 for u.s. The due date for filing form 3520 for most. The form 3520 is used to report certain foreign gifts (and inheritances) as well as. Taxpayer transactions with a foreign trust. Taxpayer transactions with a foreign trust. Ad download or email irs 3520 & more fillable forms, register and subscribe now! Person’s return (april 15 in the case of an individual). Not all trust owners need to file. Individual income tax return) on or before the original due date of the u.s. Owner, as well as between the trust and us beneficiary. The instructions for filing form 3520 or foreign gift tax are complicated, even for seasoned accountants. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Department of the treasury internal revenue service. Persons (and executors of estates of u.s. Certain transactions conducted with a foreign trust are required to be reported using this form. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both.Irs form 3520 Fill out & sign online DocHub

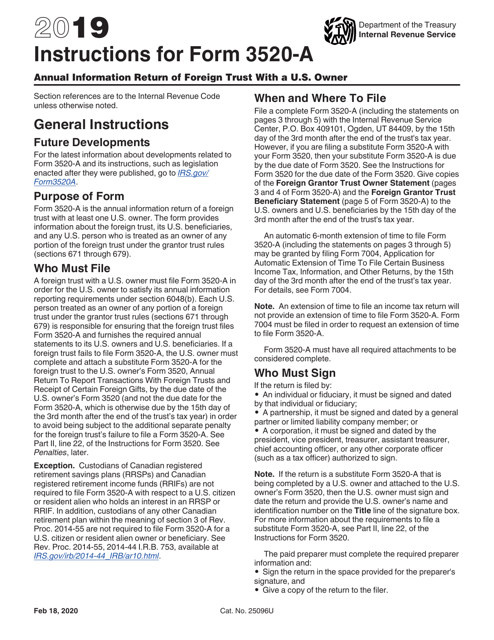

Fillable Online Instructions for Form 3520 (2020) Internal Revenue

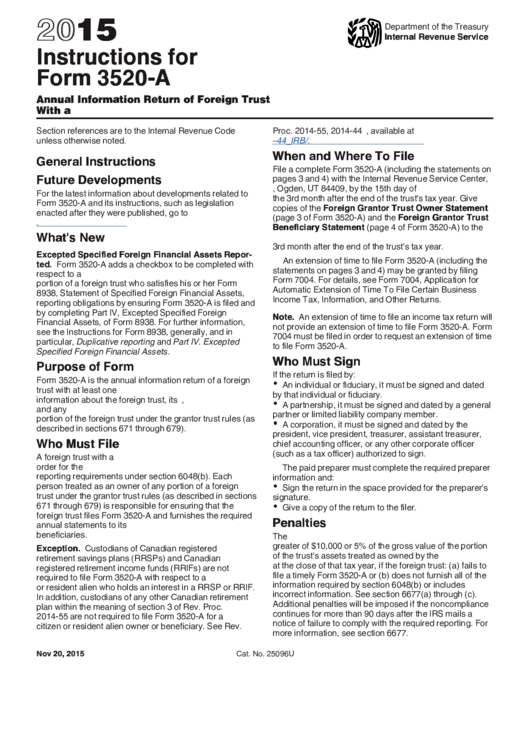

Instructions For Form 3520A Annual Information Return Of Foreign

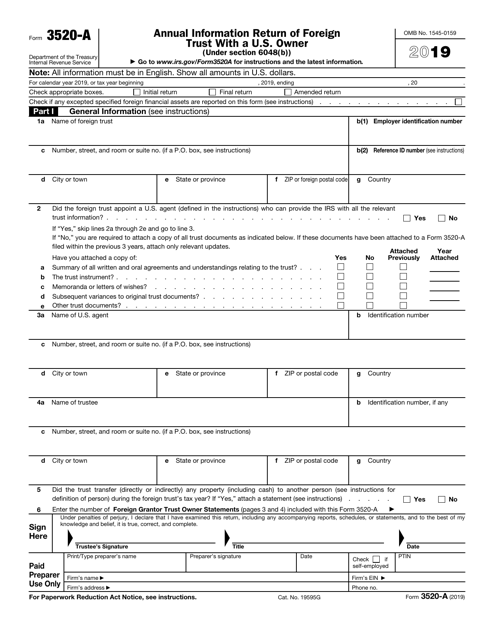

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Download Instructions for IRS Form 3520A Annual Information Return of

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

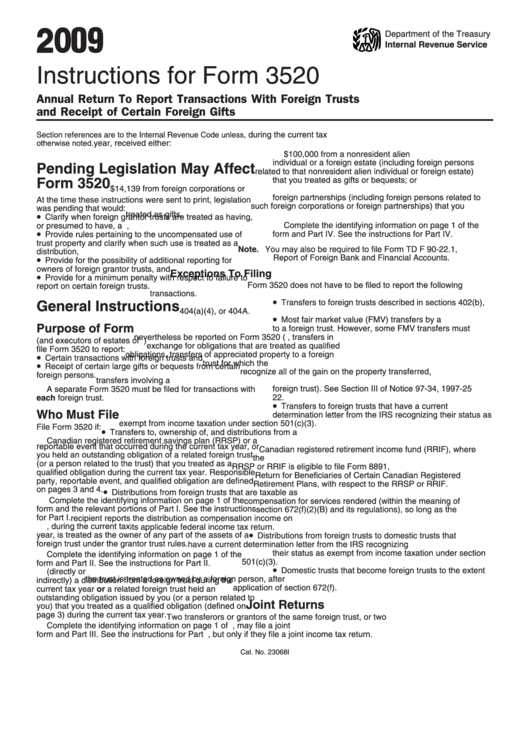

Instructions For Form 3520 Annual Return To Report Transactions With

Download Instructions for IRS Form 3520A Annual Information Return of

Form 3520 Reporting Foreign Trusts and Gifts for US Citizens

Instructions For Form 3520 Annual Return To Report Transactions With

Related Post: