Ca Tax Withholding Form

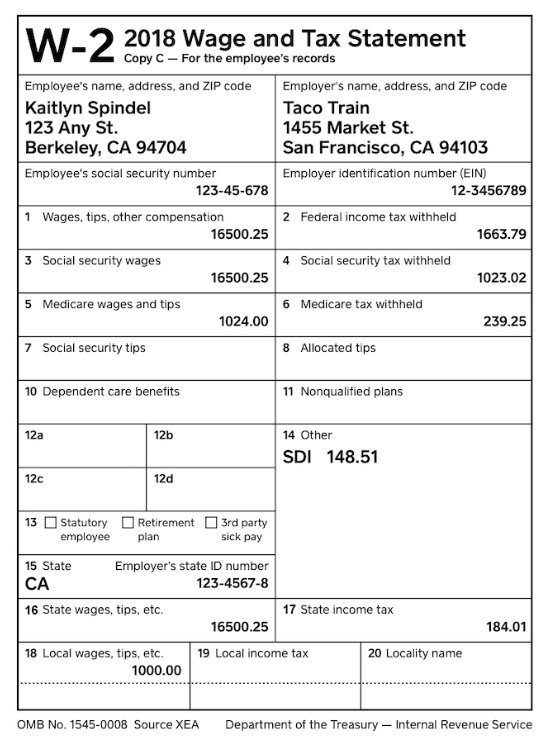

Ca Tax Withholding Form - Download avalara rate tables each month or find rates with the sales tax rate calculator. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Because your tax situation may change from year to year, you may want to. * california taxable income enter line 19 of 2022 form 540 or form 540nr. Web the single, married, and head of household income tax withholdings have changed. Web earnings withholding calculator. Pdffiller allows users to edit, sign, fill and share all type of documents online. Web cal employee connect (cec): Qualifying surviving spouse/rdp with dependent child. Web simplified income, payroll, sales and use tax information for you and your business Use the calculator or worksheet to determine the number of. Wage and tax statement faqs. Enter month of year end: Web simplified income, payroll, sales and use tax information for you and your business Irs further postpones tax deadlines for most california. Web earnings withholding calculator. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Pdffiller allows users to edit, sign, fill and share all type of documents online. Enter the amount from form 593, line 36, amount withheld from. Qualifying surviving spouse/rdp with dependent child. Check here if this is an amended return. Because your tax situation may change from year to year, you may want to. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Enter month of year end: Enter the amount from form 593, line 36, amount withheld from. Download avalara rate tables each month or find rates with the sales tax rate calculator. Web the single, married, and head of household income tax withholdings have changed. Your withholding is subject to review by the. Enter month of year end: Because your tax situation may change from year to year, you may want to. Web california extends due date for california state tax returns. Report the sale or transfer as required. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Employers engaged in a trade or business who. Irs further postpones tax deadlines for most california. Web 2021 california resident income tax return 540. Web to claim the withholding credit you must file a california tax return. Pdffiller allows users to edit, sign, fill and share all type of documents online. Divide this annual withholding amount by the number of pay periods in a year to calculate the tax withholding per pay period. Web tax withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The annual personal exemption credit has changed from $134.20 to $136.40. Your withholding is subject to review by the. * how often is the employee paid? Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Irs further postpones tax deadlines for most california. Ad download avalara sales tax rate tables by state or search tax rates by individual address. The annual personal exemption credit has changed from $134.20 to $136.40. * california taxable income enter line 19 of 2022 form 540 or form 540nr. Web earnings withholding calculator. Web california extends due date for california state tax returns. Irs further postpones tax deadlines for most california. Qualifying surviving spouse/rdp with dependent child. Download avalara rate tables each month or find rates with the sales tax rate calculator. Web cal employee connect (cec): Web tax withholding election form (mycalpers 1289), sign and submit it to calpers as soon as possible. Irs further postpones tax deadlines for most california. Employers engaged in a trade or business who. Ad download avalara sales tax rate tables by state or search tax rates by individual address. Web use form 590, withholding exemption certificate, to certify an exemption. Enter the amount from form 593, line 36, amount withheld from. You must file a de 4 to determine the appropriate california pit withholding. Use the calculator or worksheet to determine the number of. Qualifying surviving spouse/rdp with dependent child. Employers engaged in a trade or business who. Web to claim the withholding credit you must file a california tax return. Web cal employee connect (cec): Your withholding is subject to review by the. Web the single, married, and head of household income tax withholdings have changed. Web employers are required to withhold mandatory employee payroll deductions to pay into state payroll taxes for state disability insurance (sdi) and personal income tax (pit). Report the sale or transfer as required. Check here if this is an amended return. Divide this annual withholding amount by the number of pay periods in a year to calculate the tax withholding per pay period. * california taxable income enter line 19 of 2022 form 540 or form 540nr. Enter month of year end: Web tax withholding election form (mycalpers 1289), sign and submit it to calpers as soon as possible. Web 2021 california resident income tax return 540. Employee's withholding certificate form 941; Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Because your tax situation may change from year to year, you may want to.1+ California State Tax Withholding Forms Free Download

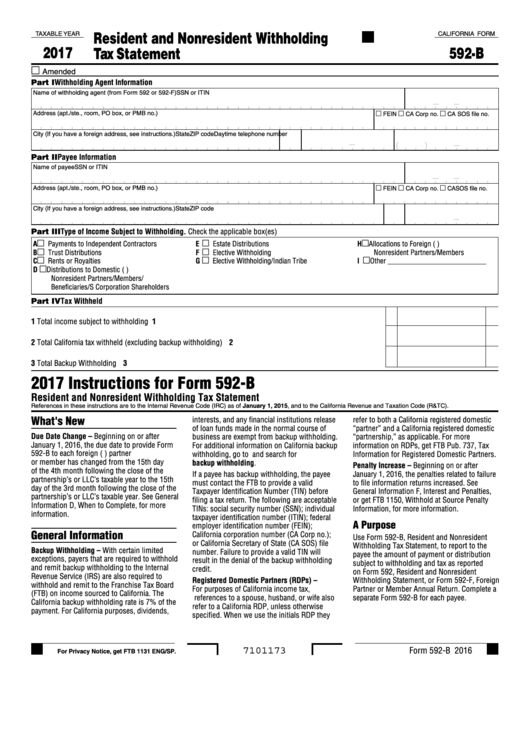

California Withholding Tax Form 592

Ca De 4 Printable Form California Employee's Withholding Allowance

California Tax Regular Withholding Allowances ??????? Tripmart

California Personal Tax Withholding Form

Ca Tax Withholding Form 2022 Triply

CA FTB 592F 2021 Fill out Tax Template Online US Legal Forms

California Tax Withholding Form Escrow

Ftb 589 Fill out & sign online DocHub

California Tax Withholding Form 2022

Related Post: