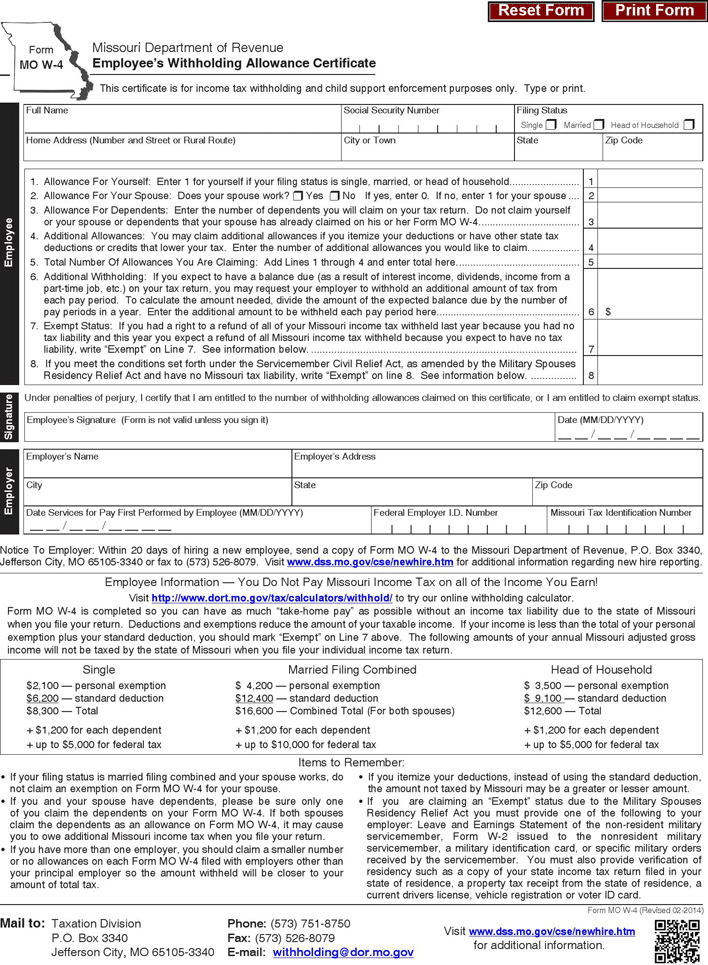

Missouri Tax Withholding Form

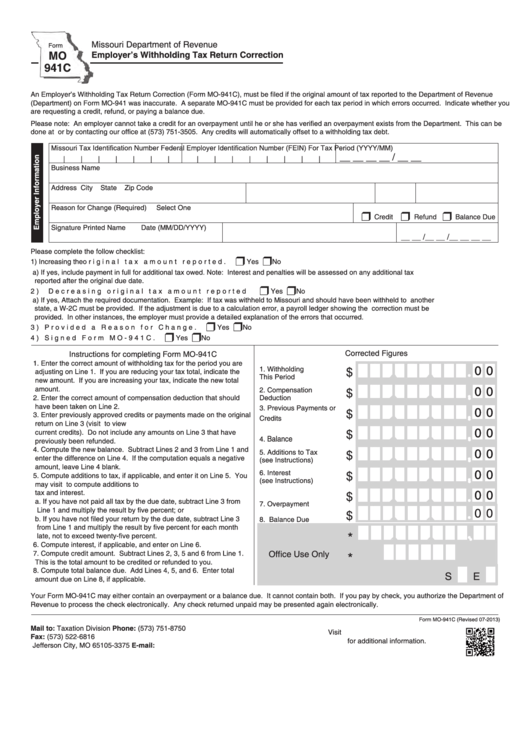

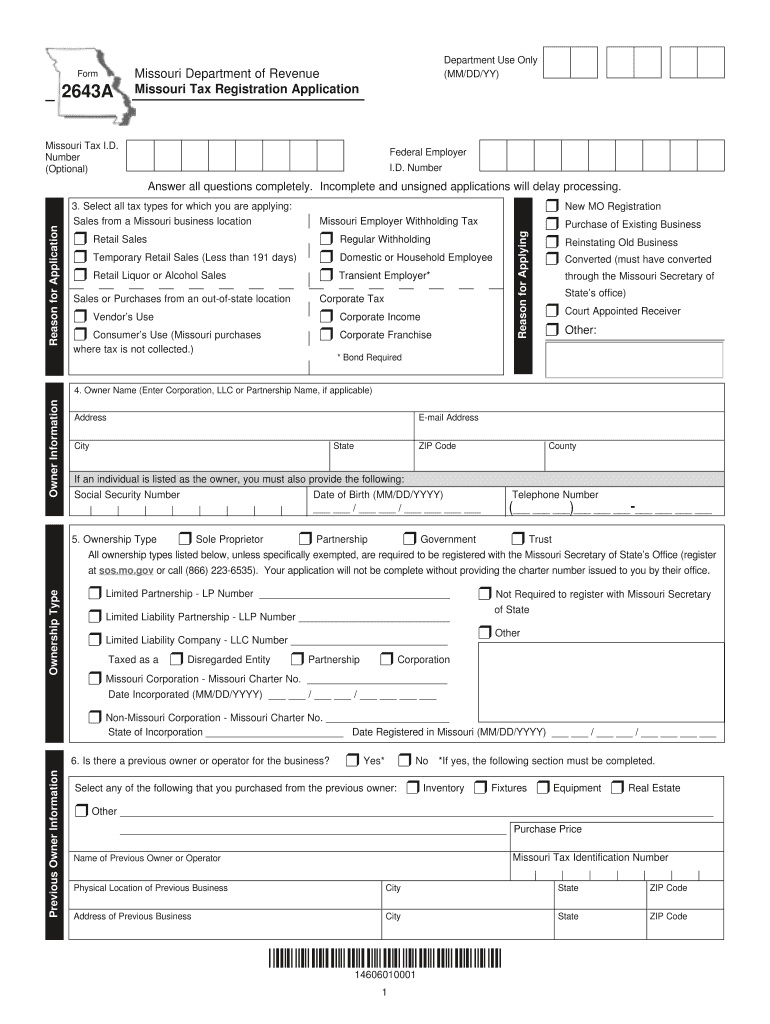

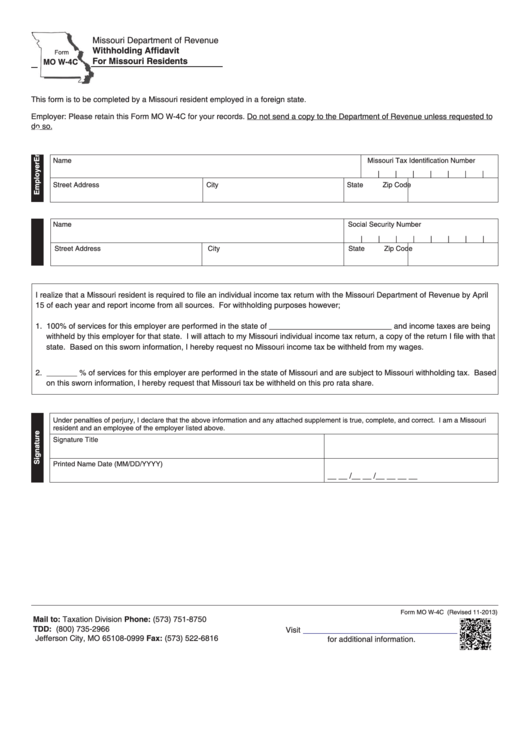

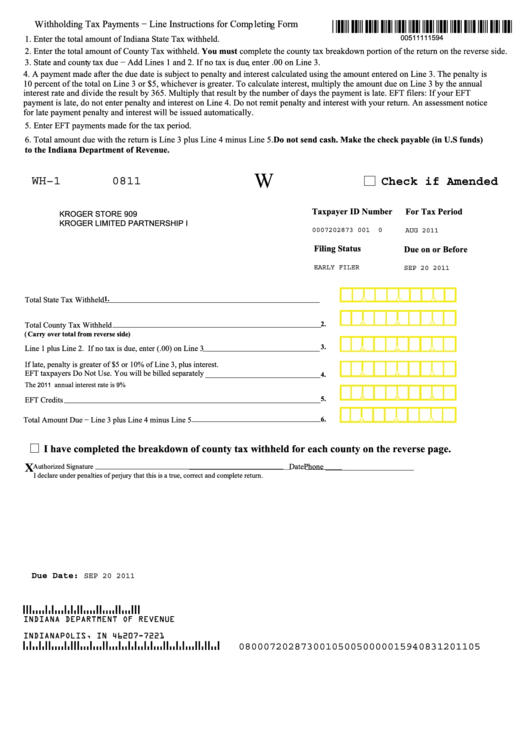

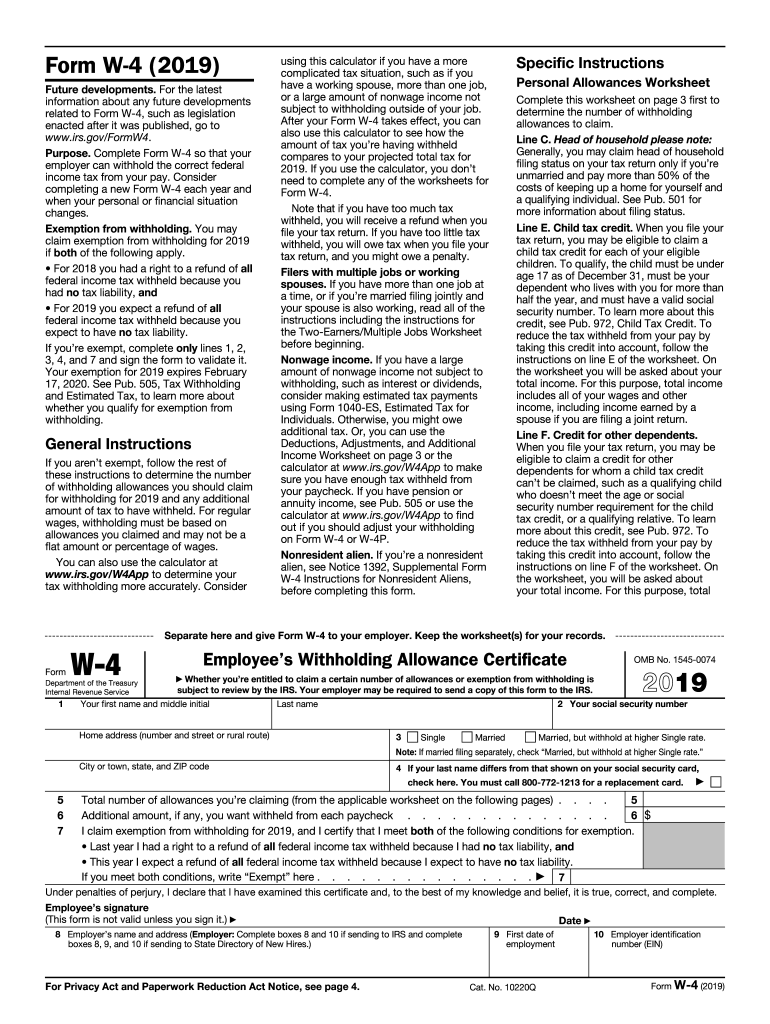

Missouri Tax Withholding Form - Employee’s withholding certificate mail to: Withholding tax per payroll period missouri — divide the employee’s annual missouri withholding. Department use only (mm/dd/yy) employer’s return of income taxes withheld. Web tax year revision date; If too little is withheld, you will generally owe tax when you file your tax. Web this certificate is for income tax withholding and child support enforcement purposes only. Within 20 days of hiring a new employee, a copy of the. Ad signnow.com has been visited by 100k+ users in the past month The annual standard deduction amount for employees claiming. 2,790 2,820 79 51 23 2,820 2,850 81 53 25 2,850 2,880 83 55 26 2,880 2,910 84 56 28 2,910 2,940 86 58 29 2,940. Employee’s withholding certificate mail to: 20, 2023 — following a dramatically improved 2023 filing season thanks to inflation reduction act (ira) investments, the internal revenue service has targeted. In each tax year beginning. Related missouri individual income tax forms: Web change the entries on the form. 260 if you pay daily,. Related missouri individual income tax forms: Within 20 days of hiring a new employee, send a copy. Web 2021 missouri income tax withholding table. Ad pdffiller.com has been visited by 1m+ users in the past month If the payroll is daily: Department use only (mm/dd/yy) employer’s return of income taxes withheld. Web annual missouri withholding tax. Web this certificate is for income tax withholding and child support enforcement purposes only. In each tax year beginning. 2,790 2,820 79 51 23 2,820 2,850 81 53 25 2,850 2,880 83 55 26 2,880 2,910 84 56 28 2,910 2,940 86 58 29 2,940. Web change the entries on the form. If too little is withheld, you will generally owe tax when you file your tax. A substitute form is acceptable provided state wage and tax information is. Web the missouri department of revenue online withholding tax calculator is provided as a service for employees, employers, and tax professionals. Web this certificate is for income tax withholding and child support enforcement purposes only. 260 if you pay daily,. Web 2021 missouri income tax withholding table. Web most taxpayers are required to file a yearly income tax return in. Do not send to the department of revenue. Web annual missouri withholding tax. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web change the entries on the form. Web this certificate is for income tax withholding. Within 20 days of hiring a new employee, a copy of the. And the filing status is: Within 20 days of hiring a new employee, send a copy. Web the income tax withholding formula for the state of missouri includes the following changes: Web revised statutes of missouri, missouri law. This certificate is for voluntary withholding of missouri state. Department use only (mm/dd/yy) employer’s return of income taxes withheld. Web you can print other missouri tax forms here. The annual standard deduction amount for employees claiming. Web annual missouri withholding tax. The annual standard deduction amount for employees claiming. In each tax year beginning. Web this certificate is for income tax withholding and child support enforcement purposes only. Web this certificate is for income tax withholding and child support enforcement purposes only. Funding — income tax refund, designating authorized amount, when — contributions. And the filing status is: Web this form is to be provided to the administrator of your retirement plan. Web the missouri department of revenue online withholding tax calculator is provided as a service for employees, employers, and tax professionals. If the payroll is daily: Web request for mail order forms may be used to order one copy or several. Web the income tax withholding formula for the state of missouri includes the following changes: A substitute form is acceptable provided state wage and tax information is included. And the filing status is: Web annual missouri withholding tax. 260 if you pay daily,. 262 if you pay daily,. Web this certificate is for income tax withholding and child support enforcement purposes only. Do not send to the department of revenue. Withholding tax per payroll period missouri — divide the employee’s annual missouri withholding. Web the missouri department of revenue online withholding tax calculator is provided as a service for employees, employers, and tax professionals. Web tax year revision date; You must provide the contact information for the individual filing this return. Web this certificate is for income tax withholding and child support enforcement purposes only. Within 20 days of hiring a new employee, send a copy. Ad signnow.com has been visited by 100k+ users in the past month If too little is withheld, you will generally owe tax when you file your tax. If the payroll is daily: 20, 2023 — following a dramatically improved 2023 filing season thanks to inflation reduction act (ira) investments, the internal revenue service has targeted. Employee’s withholding certificate mail to: Web revised statutes of missouri, missouri law.Fillable Form Mo 941c Employer'S Withholding Tax Return Correction

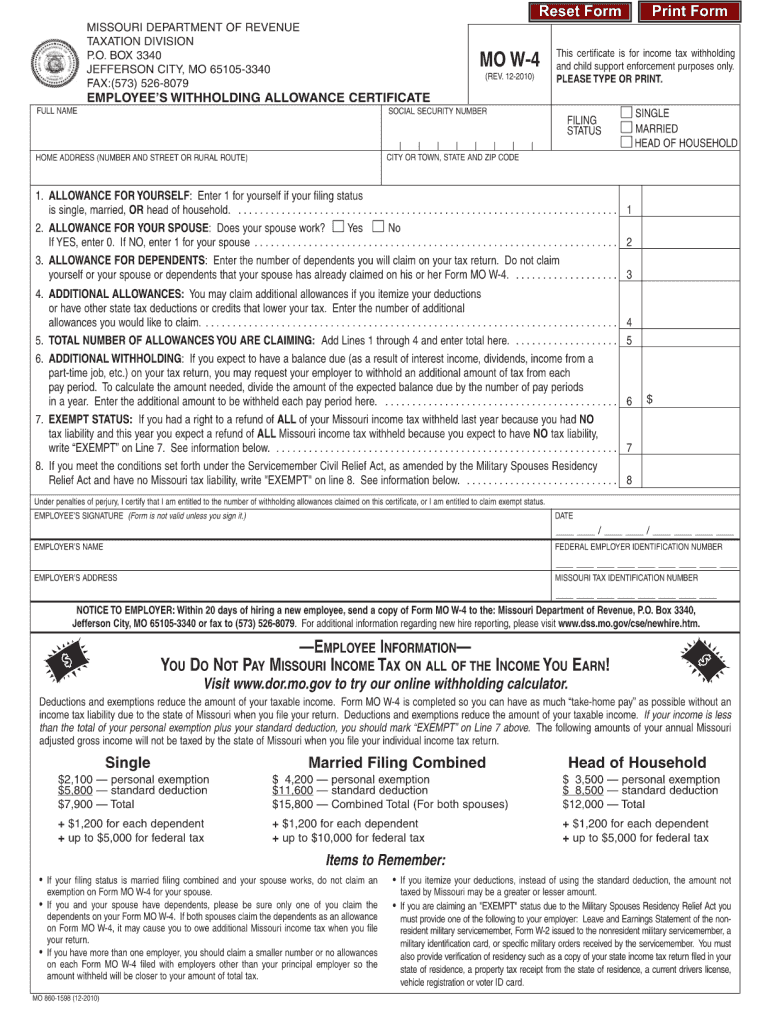

Mo W4 Form 2021 W4 Form 2021

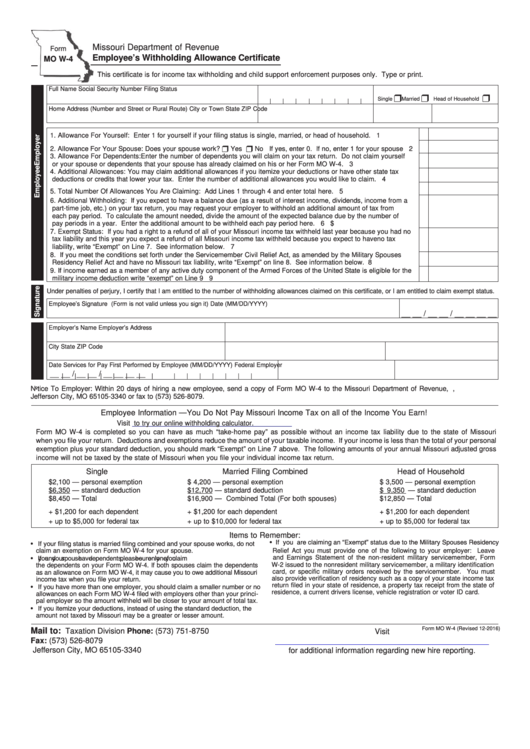

Missouri State Tax Form W4 2022 W4 Form

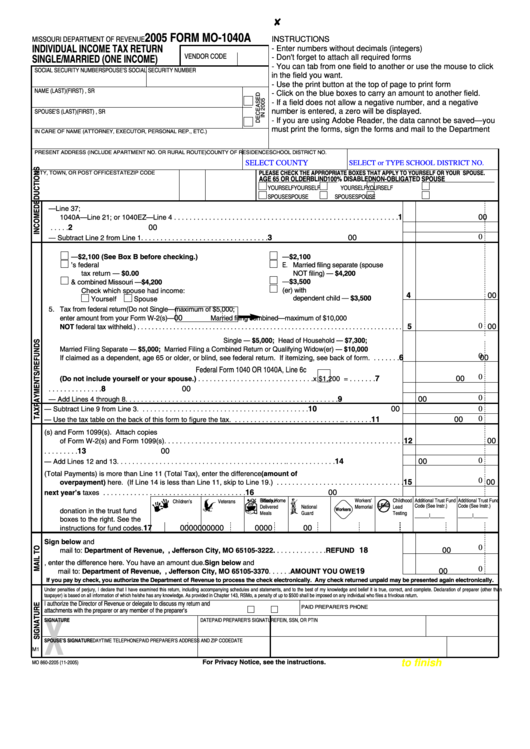

Fillable Form Mo1040a Missouri Individual Tax Return Single

State Tax Withholding Forms Template Free Download Speedy Template

Missouri State Withholding 2021 Form 2022 W4 Form

Fillable Form Mo W4c Withholding Affidavit For Missouri Residents

Mo State Tax Withholding Form

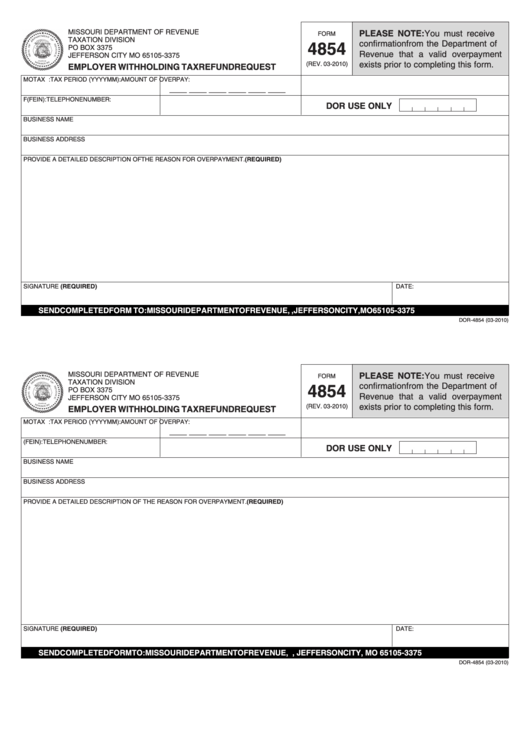

Fillable Form 4854 Employer Withholding Tax Refund Request Missouri

Missouri State Withholding Tax Form 2022

Related Post: