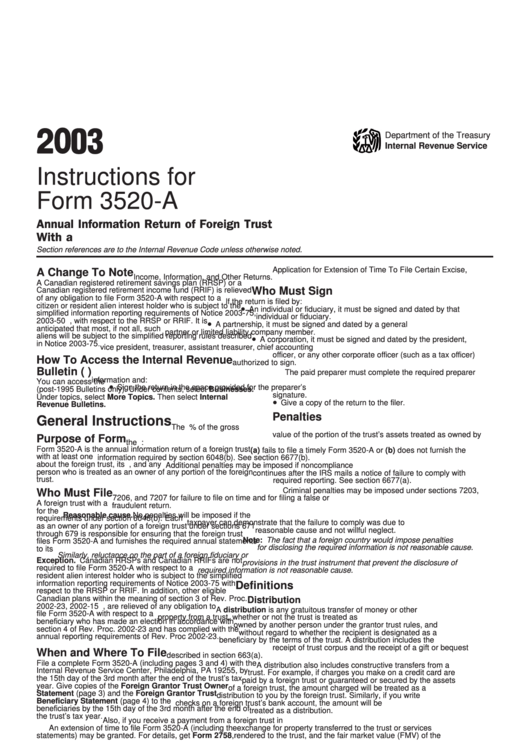

Form 3520-A Instructions

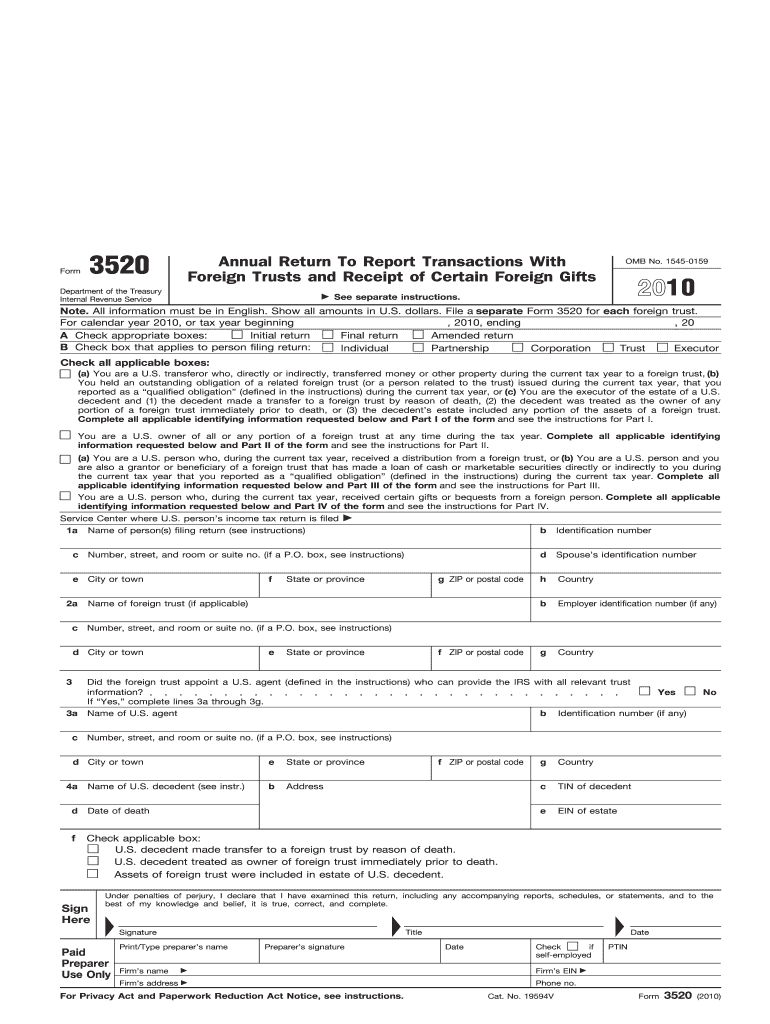

Form 3520-A Instructions - Show all amounts in u.s. The form provides information about the foreign trust, its u.s. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. There are three main types of transactions with a foreign trust you need to report on: Web form 3520 for u.s. The filing of form 3520 can be an intricate process, and it is typically recommended to speak with an international tax professional to assist in the. Persons (and executors of estates of u.s. Web for instructions and the latest information. Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts: The instructions for filing form 3520 or foreign gift tax are complicated, even for seasoned accountants. Drazen_ / getty images three types of taxes can potentially come. Get ready for tax season deadlines by completing any required tax forms today. The filing of form 3520 can be an intricate process, and it is typically recommended to speak with an international tax professional to assist in the. Web form 3520 for u.s. Web the trust, its u.s. The form provides information about the foreign trust, its u.s. File a separate form 3520 for. Show all amounts in u.s. Owner, is an example of a tax document that must be filed every year by taxpayers who are the. All information must be in english. Decedents) file form 3520 with the irs to report: Web receiving a trust distribution from a foreign trust, having ownership of a foreign trust, and other various transactions with a foreign trust let’s walk through the basics of form. The instructions for filing form 3520 or foreign gift tax are complicated, even for seasoned accountants. Web for instructions and the. Web form 3520 for u.s. Web the trust, its u.s. Web 4 tips when filing form 3520. Persons (and executors of estates of u.s. Get ready for tax season deadlines by completing any required tax forms today. Owner (under section 6048(b)) department of the treasury internal revenue service go to. The form provides information about the foreign trust, its u.s. Persons (and executors of estates of u.s. The filing of form 3520 can be an intricate process, and it is typically recommended to speak with an international tax professional to assist in the. File a separate form. Decedents) file form 3520 to report: The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Person who is treated as an owner of any portion of the foreign trust. Web the trust, its u.s. The form provides information about the foreign trust, its u.s. Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts: Decedents) file form 3520 with the irs to report: File a separate form 3520 for. Get ready for tax season deadlines by completing any required tax forms today. Certain transactions with foreign trusts. Taxpayer transactions with a foreign trust. Persons (and executors of estates of u.s. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Certain transactions with foreign trusts. Decedents) file form 3520 to report: Web form 3520 for u.s. All information must be in english. Persons (and executors of estates of u.s. Person who is treated as an owner of any portion of the foreign trust. Web 4 tips when filing form 3520. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Web income taxes the value of the foreign gift or bequest when irs form 3520 is due photo: The form provides information about the foreign trust, its u.s. Web the trust, its u.s. Web for instructions. Certain transactions with foreign trusts, ownership of foreign trusts. Ownership of foreign trusts under the rules of. Drazen_ / getty images three types of taxes can potentially come. Web 4 tips when filing form 3520. Taxpayer transactions with a foreign trust. Web for instructions and the latest information. All information must be in english. Foreign gifts and bequests in general, a foreign gift or bequest is any amount received from a. Person who is treated as an owner of any portion of the foreign trust. Web income taxes the value of the foreign gift or bequest when irs form 3520 is due photo: Owner, is an example of a tax document that must be filed every year by taxpayers who are the. File a separate form 3520 for. Decedents) file form 3520 with the irs to report: Web the trust, its u.s. Web form 3520 for u.s. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. There are three main types of transactions with a foreign trust you need to report on: Owner (under section 6048(b)) department of the treasury internal revenue service go to. The form provides information about the foreign trust, its u.s. The form provides information about the foreign trust, its u.s.Form 3520 Blank Sample to Fill out Online in PDF

IRS Creates “International Practice Units” for their IRS Revenue Agents

Form 3520A Annual Information Return of Foreign Trust with a U.S

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Form 3520A Annual Information Return of Foreign Trust with a U.S

Instructions For Form 3520A Annual Information Return Of Foreign

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Form 3520A Annual Information Return of Foreign Trust with a U.S

Form 3520 Fill Out and Sign Printable PDF Template signNow

Related Post: