Is Form 7203 Filed With 1120S Or 1040

Is Form 7203 Filed With 1120S Or 1040 - Web cch prosystem fx tax 1120s worksheet form 7203 2021 procedure this article assumes complete input of shareholders has already been at shareholders >. Typically, this amount is limited to their basis, or cost, in. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Maximize revenue with the professional look of our tax folders. Web the irs estimates that 70,000 respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form, for a. Web for information about completing form 7203, which is produced and filed with the individual 1040, see here. Go to the k1 input (1120s) or the k1 input (1065) scroll down below the regular inputs to the basis limitation section. Web • form 940 • form 940 schedule r. Web solved•by turbotax•107•updated january 13, 2023. Web form 7203 is generated for a 1040 return when: S corporation shareholders must include form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder: 501 page is at irs.gov/pub501; Web for example, the form 1040 page is at irs.gov/form1040; Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. Web form 7203 is generated for a 1040 return when: Web form 7203 is generated for a 1040 return when: Form 7203is used to calculate any limits on the deductions you can take for your share of an s corporation's. Web the irs estimates that 70,000 respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form, for. Web for example, the form 1040 page is at irs.gov/form1040; Starting in tax year 2022, the program will no longer. Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. Web solved•by turbotax•107•updated january 13, 2023. Web form 7203 is generated for a 1040 return when: Web when is form 7203 required? Go to screen 20.2, s corporation. Typically, this amount is limited to their basis, or cost, in. 501 page is at irs.gov/pub501; Maximize revenue with the professional look of our tax folders. Ad easy guidance & tools for c corporation tax returns. 501 page is at irs.gov/pub501; Go to the k1 input (1120s) or the k1 input (1065) scroll down below the regular inputs to the basis limitation section. This return is for a single state filer, and uses the most current copies of form 940 and. Typically, this amount is limited. Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. To enter basis limitation info in the individual return: Maximize revenue with the professional look of our tax folders. Web cch prosystem fx tax 1120s worksheet form 7203 2021 procedure this article assumes complete input of shareholders has already been at shareholders >. 501 page. And the schedule a (form. Web the irs estimates that 70,000 respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form, for a. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web form 7203. Maximize revenue with the professional look of our tax folders. Web when is form 7203 required? Web generate form 7203, s corporation shareholder stock and debt basis limitations. Web form 7203 is generated for a 1040 return when: Maximize revenue with the professional look of our tax folders. For increases and decreases to. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Web solved•by turbotax•107•updated january 13, 2023. Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. Form 7203is used to calculate any limits on. Go to screen 20.2, s corporation. And the schedule a (form. To enter basis limitation info in the individual return: Web form 7203 is generated for a 1040 return when: Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Go to the k1 input (1120s) or the k1 input (1065) scroll down below the regular inputs to the basis limitation section. And the schedule a (form. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. To enter basis limitation info in the individual return: Web form 7203 is generated for a 1040 return when: Maximize revenue with the professional look of our tax folders. Web solved•by turbotax•107•updated january 13, 2023. Web when is form 7203 required? This return is for a single state filer, and uses the most current copies of form 940 and. Web • form 940 • form 940 schedule r. Web the irs estimates that 70,000 respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form, for a. Web for example, the form 1040 page is at irs.gov/form1040; Web generate form 7203, s corporation shareholder stock and debt basis limitations. Maximize revenue with the professional look of our tax folders. Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis. For increases and decreases to. S corporation shareholders must include form 7203 (instructions can be found here) with their 2021 tax filing when the shareholder: Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. Go to screen 20.2, s corporation.Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

What is Form 1120S and How Do I File It? Ask Gusto

1120s K1 Self Employment Tax

2023 Form 1120 W Printable Forms Free Online

1120s final return STJBOON

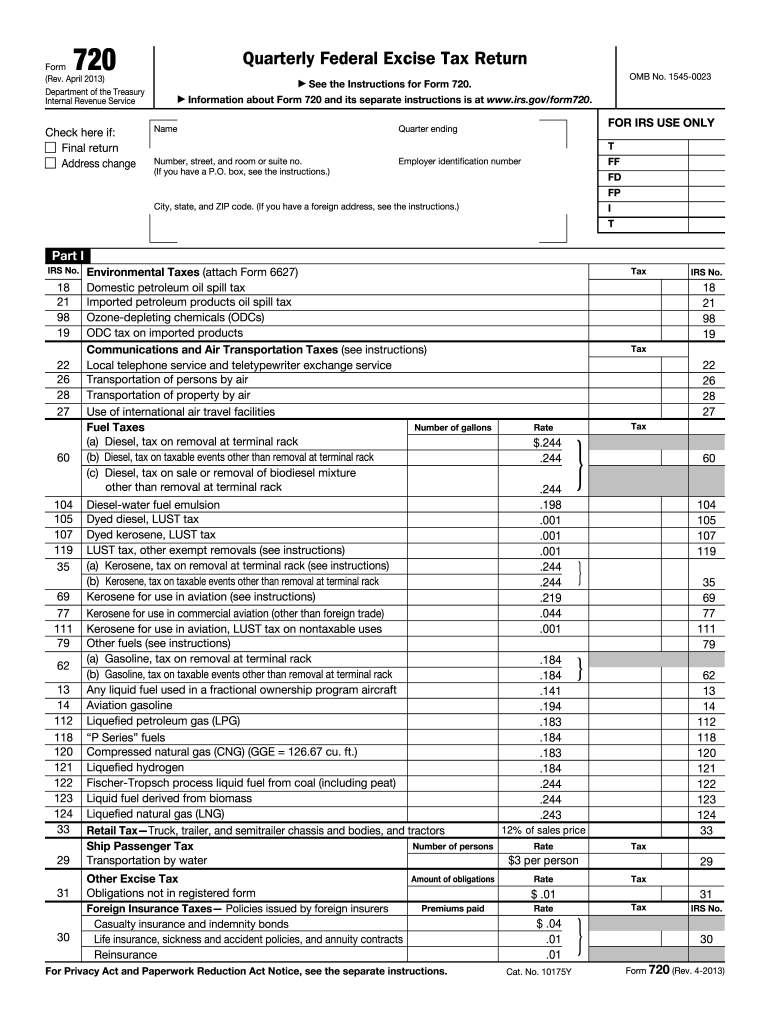

IRS 720 2013 Fill out Tax Template Online US Legal Forms

IRS Tax Form 1120S, U.S. Tax Return for an S Corporation

More Basis Disclosures This Year for S corporation Shareholders Need

What is Form 1120S and How Do I File It? Ask Gusto

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Related Post: