Form 511 Eic

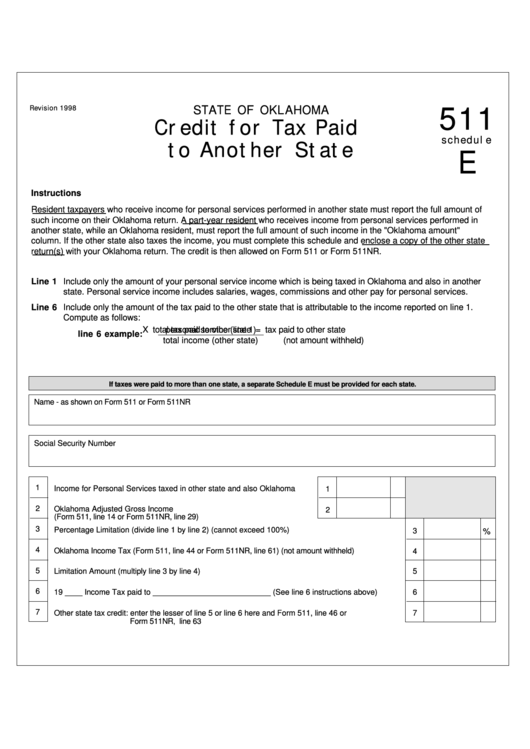

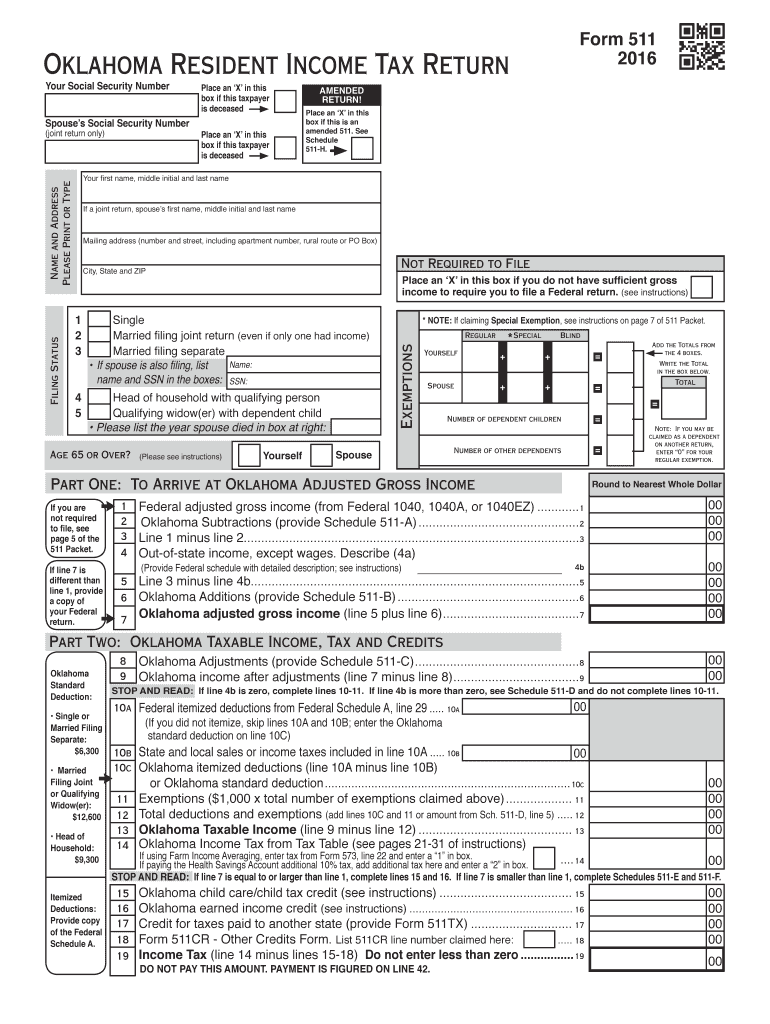

Form 511 Eic - Instead, report the amount of stimulus payments (eip1, eip2, or both) as zero. See instructions on page 2 to. Web the eitc for tax year 2023 (filing by april 2024) ranges from $2 to $7,430. Form 511 can be efiled, or a paper copy can be filed via mail. The service company’s service contract, application, claim. Web 2021 oklahoma resident individual income tax forms and instructions. I (or my spouse and i) did not have earned income or had excess investment income in 2022 (see pub. Web • the oklahoma earned income credit (eic) was made refundable, and the credit amount may be calculated using the same requirements for computing the eic for federal. Name as shown on return: Web for a balance due return with an electronic payment, complete line 6b below. Applicant declaration yes (x) no (x) 1. The due date for an electronic payment is april 20th. I (or my spouse and i) did not have earned income or had excess investment income in 2022 (see pub. The service company’s service contract, application, claim. Name as shown on return: Web oklahoma individual income tax declaration for electronic filing. Web you are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and you didn’t live in the same household as your. I (or my spouse and i) did not have earned income or had excess investment income in 2022 (see pub.. • instructions for completing the form 511: Applicant declaration yes (x) no (x) 1. Instead, report the amount of stimulus payments (eip1, eip2, or both) as zero. 596 for a list of what. Web provide this form and supporting documents with your oklahoma tax return. Since 2003, the city of phoenix human services department has implemented an earned income tax credit (eitc) campaign. Web our proven track record of successful projects is a testament to our ability to adapt and embrace a dynamic and flexible approach to meet the challenges of the future. Instead, report the amount of stimulus payments (eip1, eip2, or both) as. Web contact earned income tax credit campaign. Web form 3911 should be used as a last resort for the suspected fraudulent activity. Web the eitc for tax year 2023 (filing by april 2024) ranges from $2 to $7,430. The earned income credit was claimed for federal tax purposes; • instructions for completing the form 511: This return should not be filed until complete. For more information about the oklahoma income. Renewal of service company permit (v 20201031) section d: Form 511 can be efiled, or a paper copy can be filed via mail. The following diagnostic is generating: Web 2021 oklahoma resident individual income tax forms and instructions. I (or my spouse and i) did not have earned income or had excess investment income in 2022 (see pub. Web period for purposes of the earned income credit (eic)). Web provide this form and supporting documents with your oklahoma tax return. The due date for an electronic payment is. Form 511 can be efiled, or a paper copy can be filed via mail. Web • the oklahoma earned income credit (eic) was made refundable, and the credit amount may be calculated using the same requirements for computing the eic for federal. Web 2021 oklahoma resident individual income tax forms and instructions. Web form 3911 should be used as a. I (or my spouse and i) did not have earned income or had excess investment income in 2022 (see pub. Web provide this form and supporting documents with your oklahoma tax return. This return should not be filed until complete. For more information about the oklahoma income. Web form 511 is the general income tax return for oklahoma residents. Web for tax year 2023 (filing by april 2024), the eitc ranges from $2 to $7,430, depending on your adjusted gross income and the number of qualifying children in your family. Form 511 can be efiled, or a paper copy can be filed via mail. Renewal of service company permit (v 20201031) section d: Since 2003, the city of phoenix. The service company’s service contract, application, claim. Name as shown on return: The due date for an electronic payment is april 20th. Form 511 can be efiled, or a paper copy can be filed via mail. Web you are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and you didn’t live in the same household as your. Web oklahoma individual income tax declaration for electronic filing. Web period for purposes of the earned income credit (eic)). Web the eitc for tax year 2023 (filing by april 2024) ranges from $2 to $7,430. The following diagnostic is generating: 13339m schedule eic (form 1040) 2021 schedule eic (form 1040) 2021 page 2 purpose of schedule after you have figured your earned income credit (eic), use. 596 for a list of what. Renewal of service company permit (v 20201031) section d: Instead, report the amount of stimulus payments (eip1, eip2, or both) as zero. Web for tax year 2023 (filing by april 2024), the eitc ranges from $2 to $7,430, depending on your adjusted gross income and the number of qualifying children in your family. Web our proven track record of successful projects is a testament to our ability to adapt and embrace a dynamic and flexible approach to meet the challenges of the future. For more information about the oklahoma income. See instructions on page 2 to. • instructions for completing the form 511: Web 2021 oklahoma resident individual income tax forms and instructions. Applicant declaration yes (x) no (x) 1.Fillable Form 511 Schedule E Credit For Tax Paid To Another State

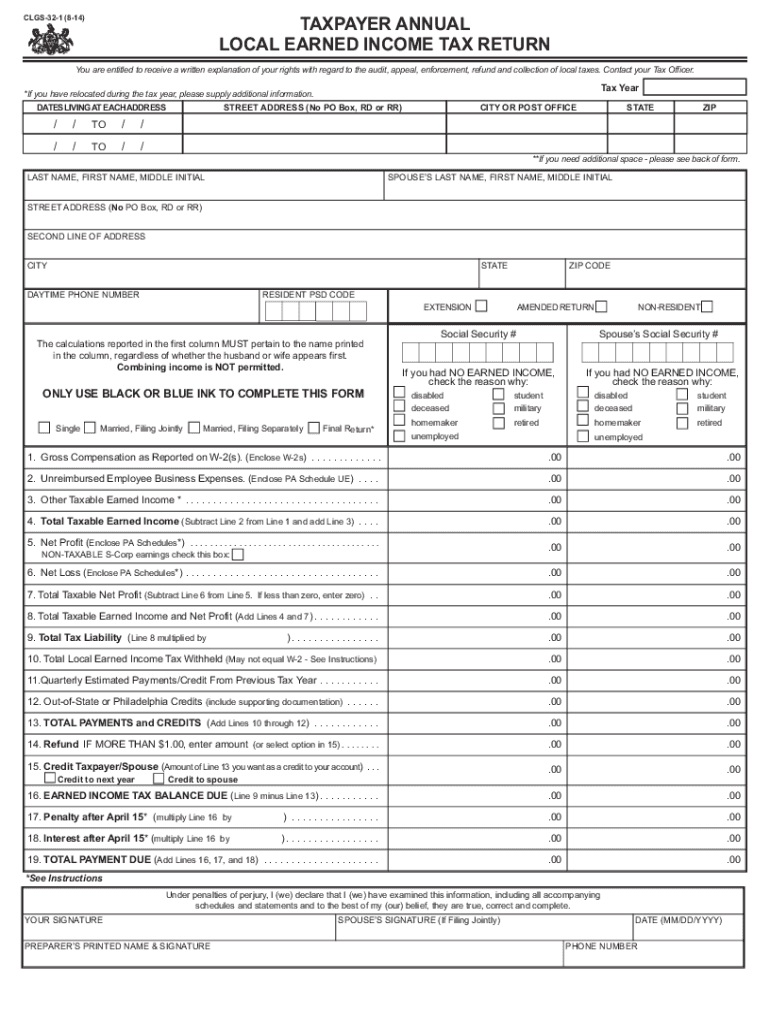

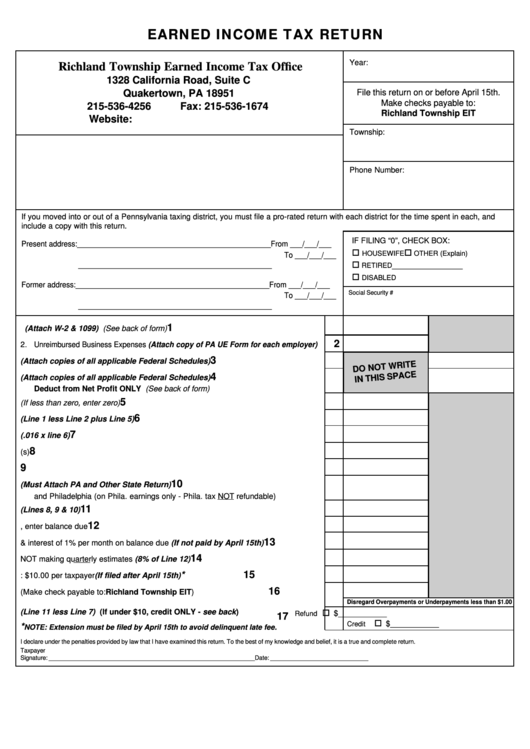

Taxpayer Annual Local Earned Tax Return PA Department Of

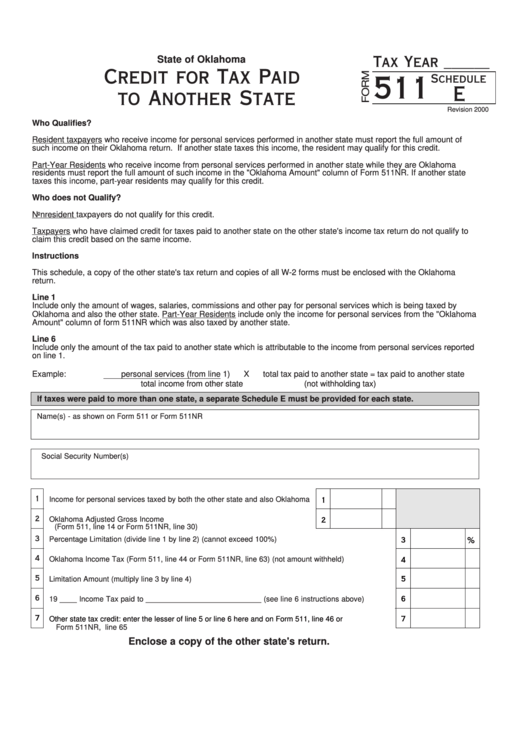

Form 511 Schedule E Credit For Tax Paid To Another State 2000

Tax Form Completing Form 1040 The Face of your Tax Return

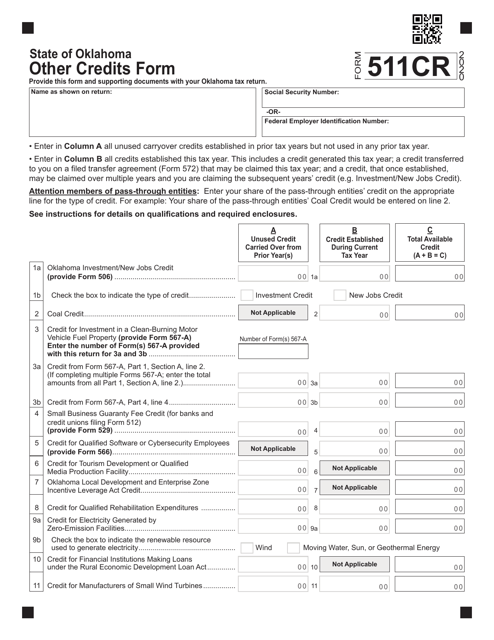

Form 511CR Download Fillable PDF or Fill Online Other Credits Form

Maryland form 511 Intuit Accountants Community

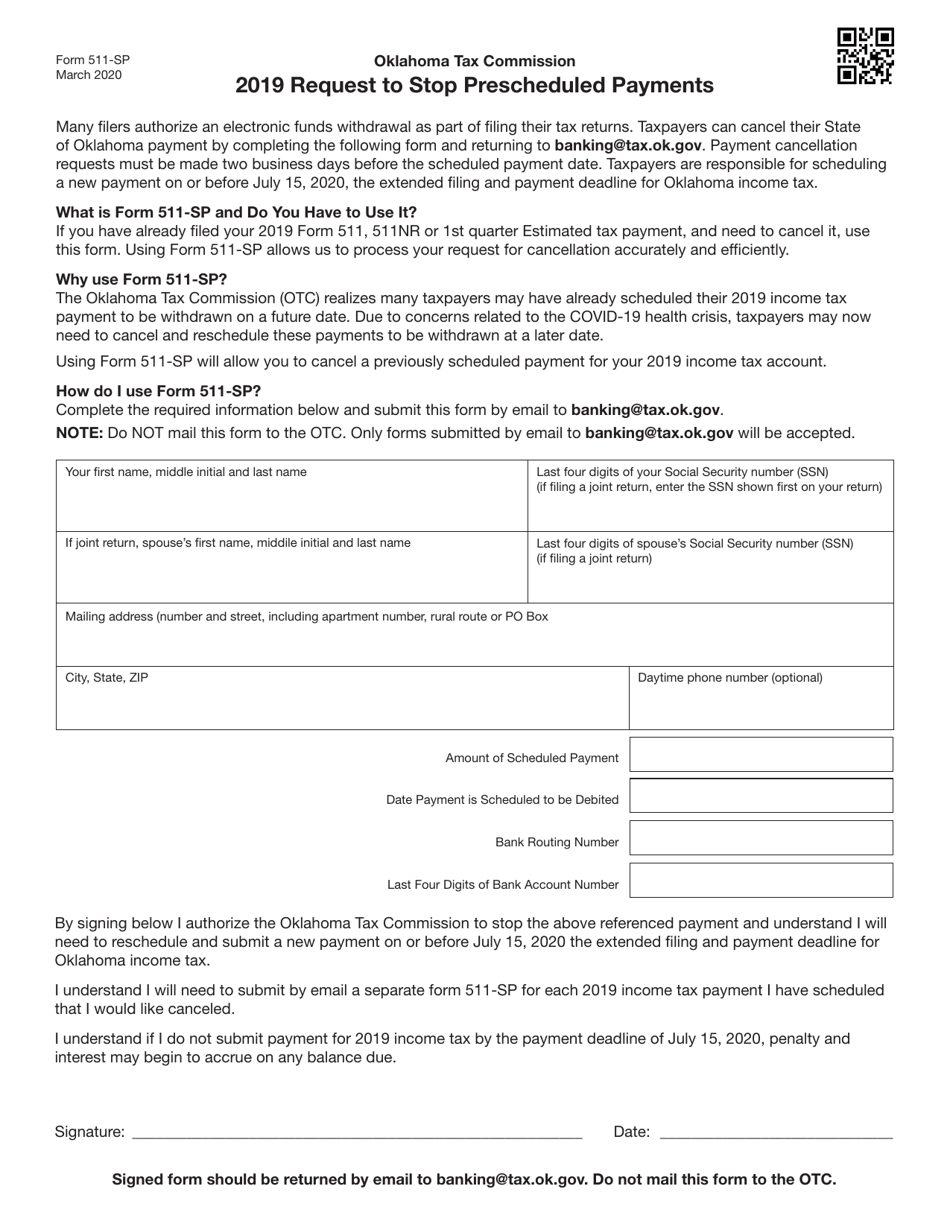

Form 511SP 2019 Fill Out, Sign Online and Download Fillable PDF

Oklahoma form 2014 Fill out & sign online

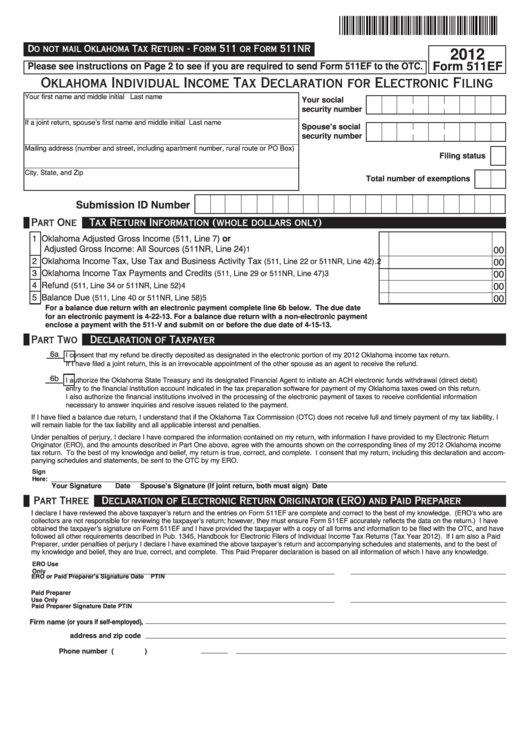

Fillable Form 511ef Oklahoma Individual Tax Declaration For

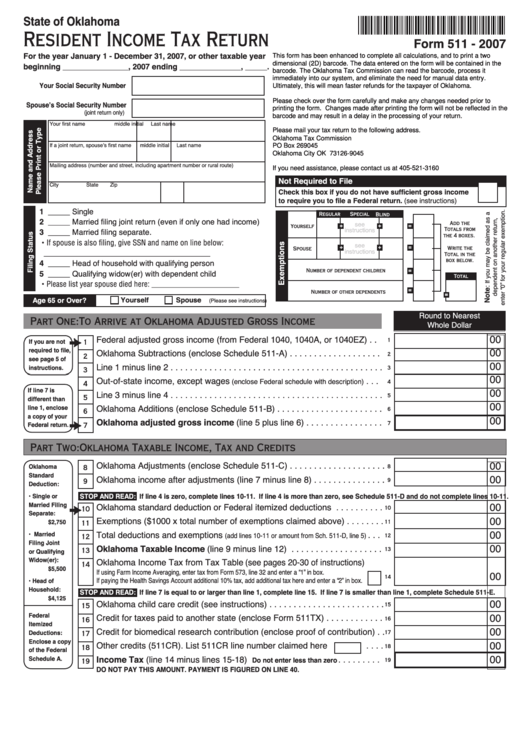

Fillable Form 511 Oklahoma Resident Tax Return 2007

Related Post: