Form 15111 Instructions

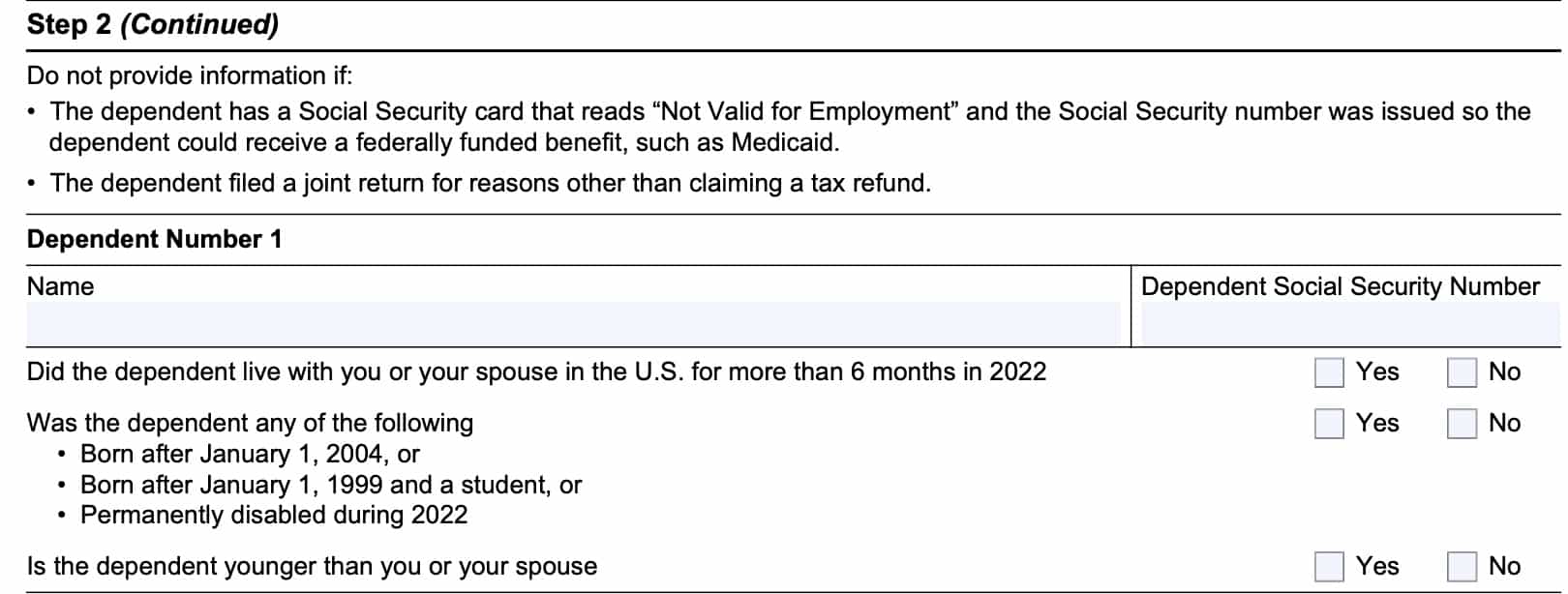

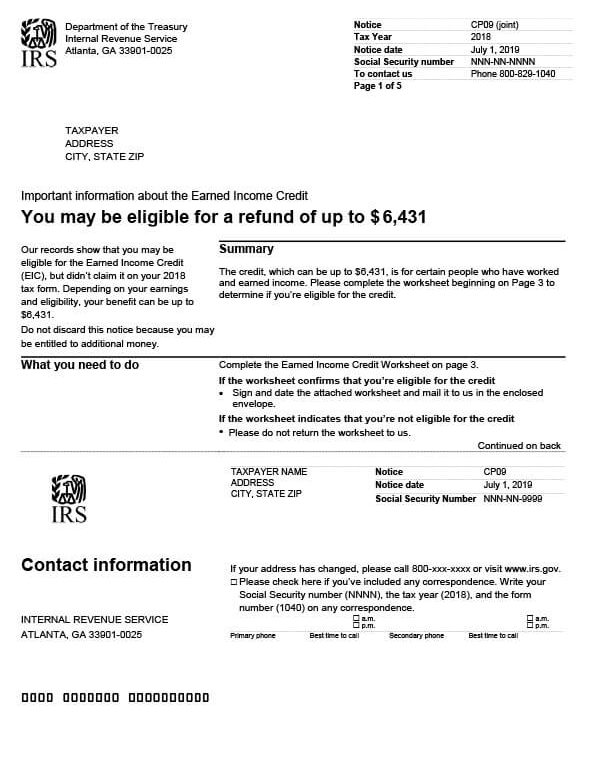

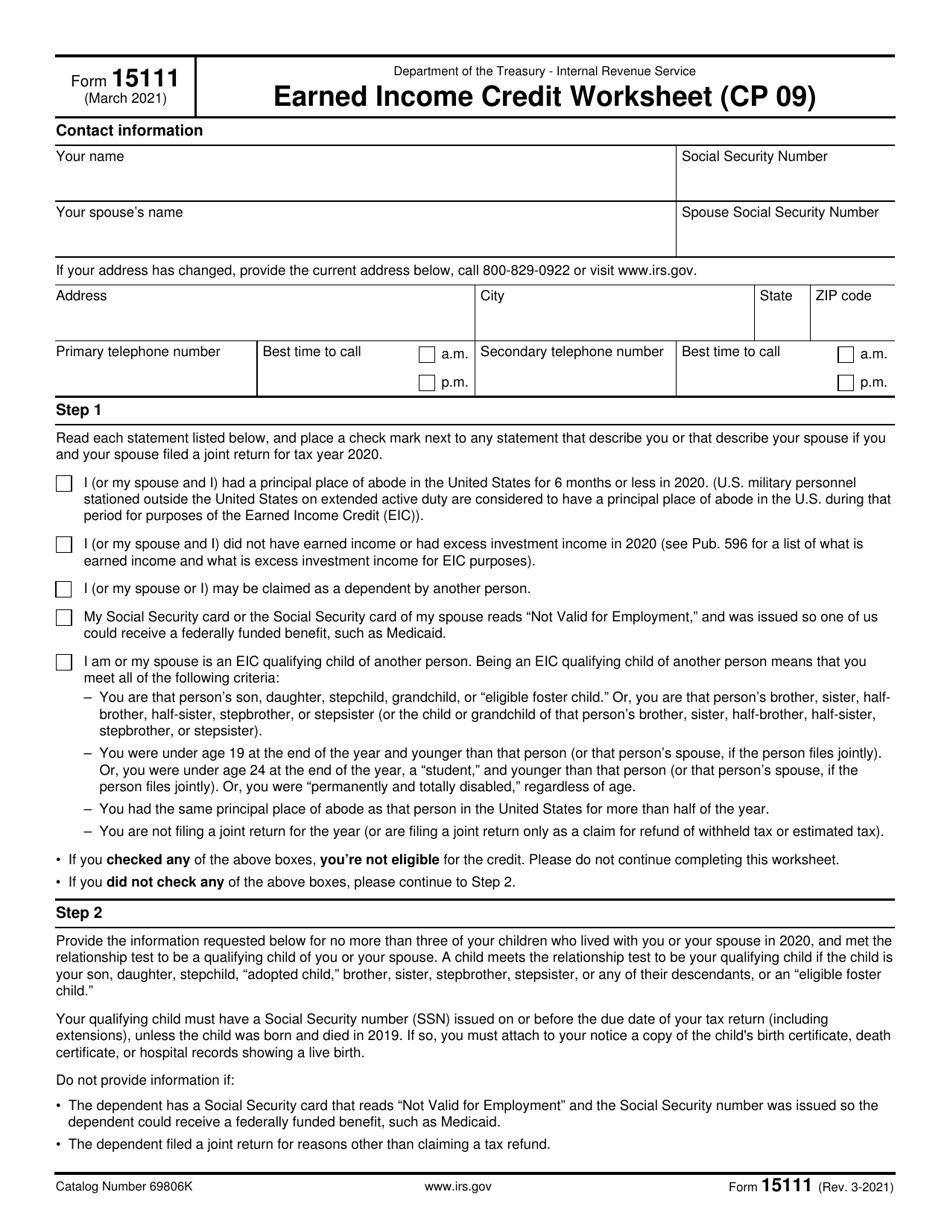

Form 15111 Instructions - Web step 1 read each statement listed below, and place a check mark next to any statement that describe you or that describe your spouse if you and your spouse filed a joint return. Web this notice urges taxpayers to read its instructions carefully and to fill out the additional child tax credit worksheet that’s attached to form 15110. Web get instructions on how to claim the eitc for past tax years. Our service offers you an extensive library. Gather all the necessary documents and information. Browse irs forms related forms form 4: Web what you need to do read your notice carefully. Find information on how to avoid common errors. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. This worksheet will guide you. Web the premium tax return (form m11) may be filed electronically using tritech software. Start by carefully reading all the instructions provided on the form. Start completing the fillable fields and carefully. Your child must have a social security number valid for. Are you still seeking a fast and efficient tool to complete form 15111 at a reasonable price? If you amend your return to include the earned income credit, there is no reason to send back irs form 15111. Web what you need to do read your notice carefully. Web get instructions on how to claim the eitc for past tax years. Information if we audit or deny your. Complete the eic eligibility form 15112,. Web within the cp09 notice, the irs includes an earned income credit worksheet (form 15111) on pages 3 through 5 of your notice. Web up to $40 cash back how to fill out form 15111? Web home understanding your cp08 notice what this notice is about this notice says you may qualify for the additional child tax credit and be. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. Web fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Web get instructions on how to. Information if we audit or deny your. If you amend your return to include the earned income credit, there is no reason to send back irs form 15111. Your child must have a social security number valid for. Which form to file property, casualty and title insurance companies use form m11 to. It will explain the steps needed to determine. Web home understanding your cp08 notice what this notice is about this notice says you may qualify for the additional child tax credit and be entitled to some. Web up to $40 cash back how to fill out form 15111? Use get form or simply click on the template preview to open it in the editor. You can view a. Web the premium tax return (form m11) may be filed electronically using tritech software. Our service offers you an extensive library. Web up to $40 cash back how to fill out form 15111? Browse irs forms related forms form 4: It will explain the steps needed to determine your qualifications. It will explain the steps needed to determine your qualifications. Web home understanding your cp08 notice what this notice is about this notice says you may qualify for the additional child tax credit and be entitled to some. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. If you amend your return to include. Your child must have a social security number valid for. Browse irs forms related forms form 4: Web home understanding your cp08 notice what this notice is about this notice says you may qualify for the additional child tax credit and be entitled to some. Web step 1 read each statement listed below, and place a check mark next to. Web what you need to do read your notice carefully. Use get form or simply click on the template preview to open it in the editor. Our service offers you an extensive library. Web step 1 read each statement listed below, and place a check mark next to any statement that describe you or that describe your spouse if you. Our service offers you an extensive library. Web this notice urges taxpayers to read its instructions carefully and to fill out the additional child tax credit worksheet that’s attached to form 15110. Gather all the necessary documents and information. Web what you need to do read your notice carefully. Are you still seeking a fast and efficient tool to complete form 15111 at a reasonable price? Browse irs forms related forms form 4: Web fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return. Ad browse & discover thousands of business & investing book titles, for less. Use get form or simply click on the template preview to open it in the editor. If you amend your return to include the earned income credit, there is no reason to send back irs form 15111. Information if we audit or deny your. Web get instructions on how to claim the eitc for past tax years. Find information on how to avoid common errors. Your child must have a social security number valid for. Start completing the fillable fields and carefully. Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your spouse filed a joint. Which form to file property, casualty and title insurance companies use form m11 to. Web step 1 read each statement listed below, and place a check mark next to any statement that describe you or that describe your spouse if you and your spouse filed a joint return. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. Start by carefully reading all the instructions provided on the form.Every Which Way But Loose

IRS Form 15111 Instructions Earned Credit Worksheet

Editable IRS Form Instruction 6251 2019 2020 Create A Digital

Irs Form 1065 K1 Leah Beachum's Template

Cms 1500 Claim Form Instructions Form Resume Examples Wk9ynn0Y3D

Form 15111? (CA) IRS

What Is Irs Cancellation Of Debt

IRS Notice CP09 Tax Defense Network

IRS Form 15111 Download Fillable PDF or Fill Online Earned

Form Instructions Fill Out and Sign Printable PDF Template signNow

Related Post: