Instructions For Form 6781

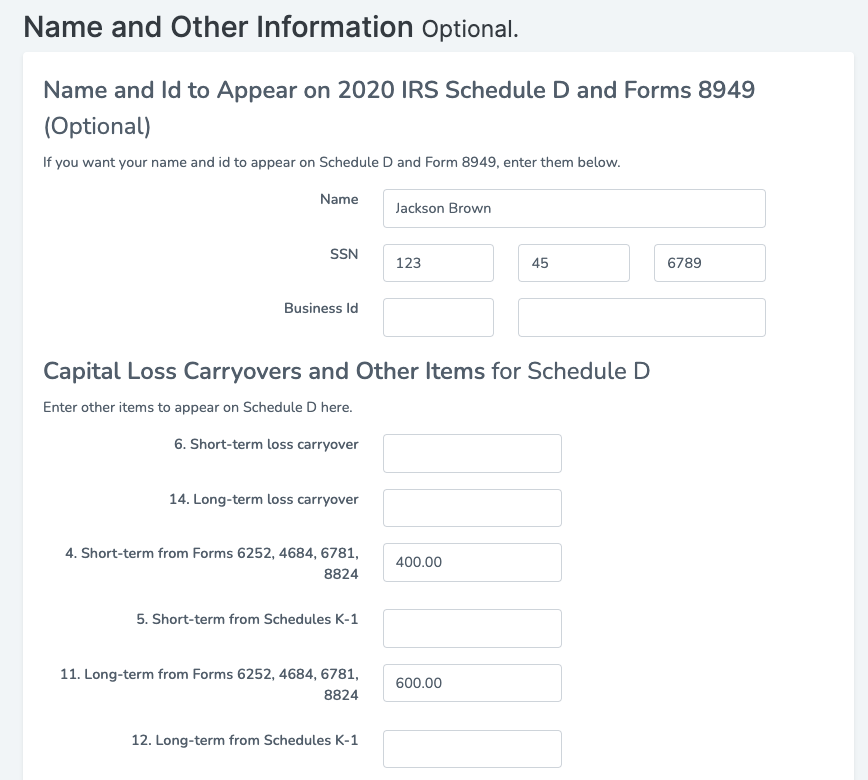

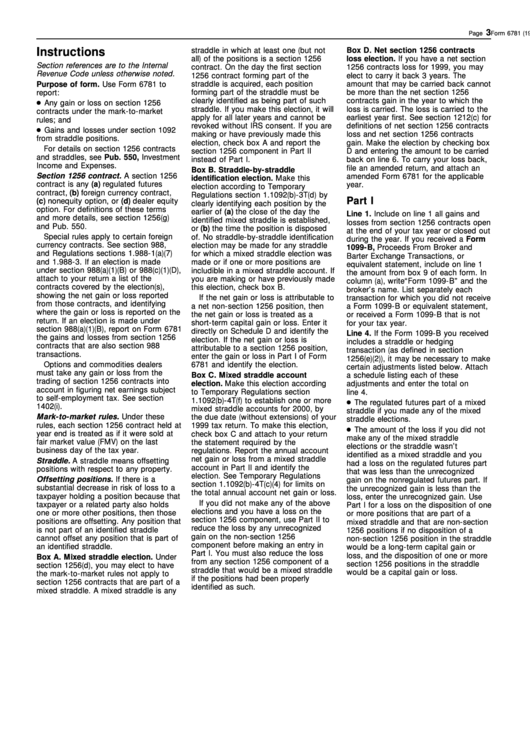

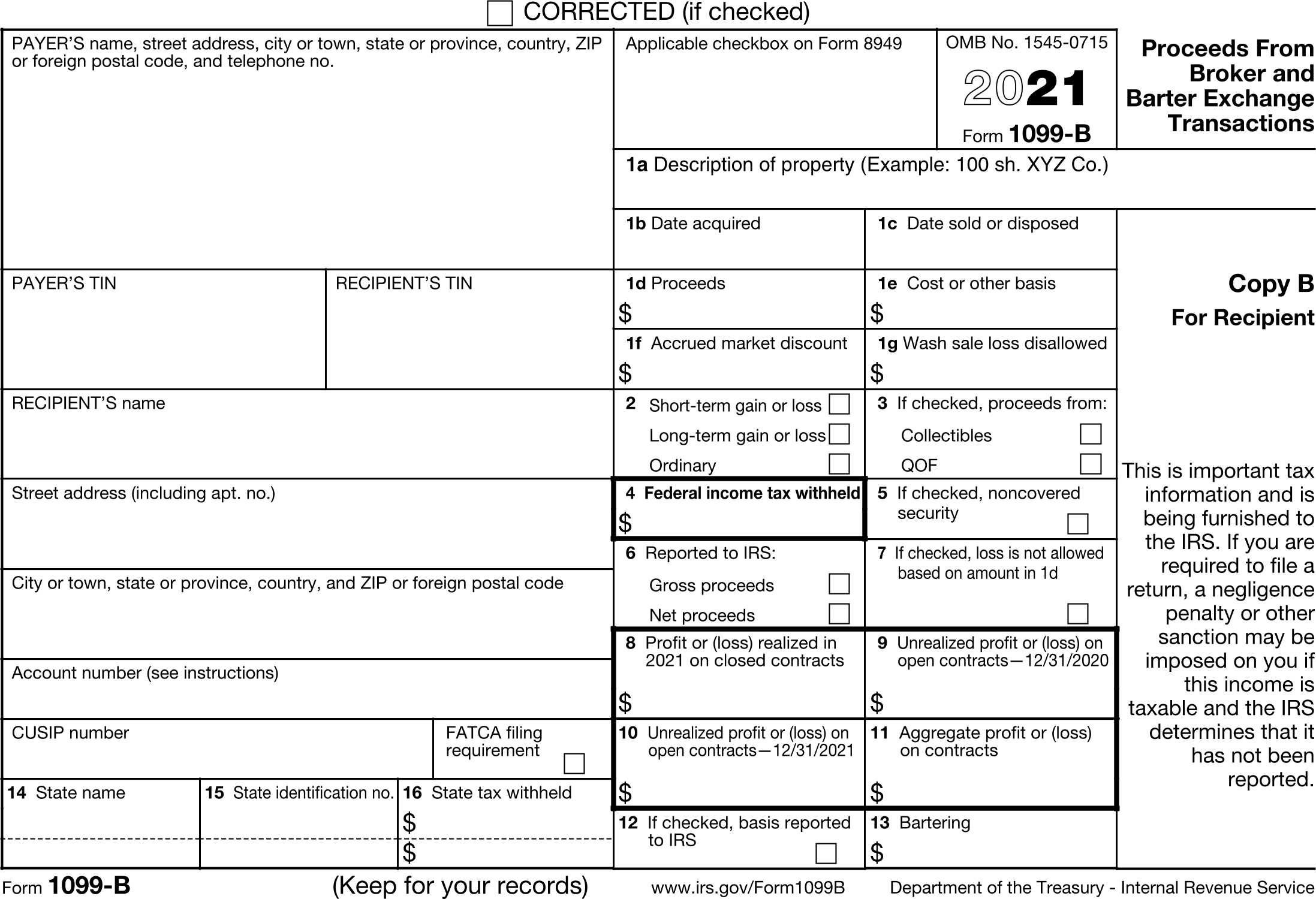

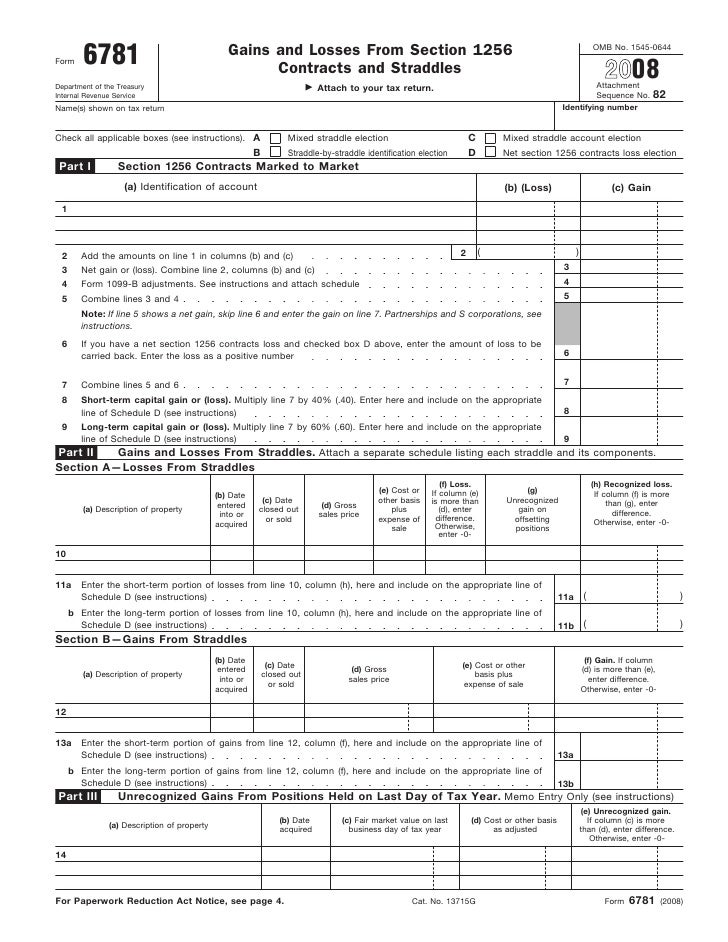

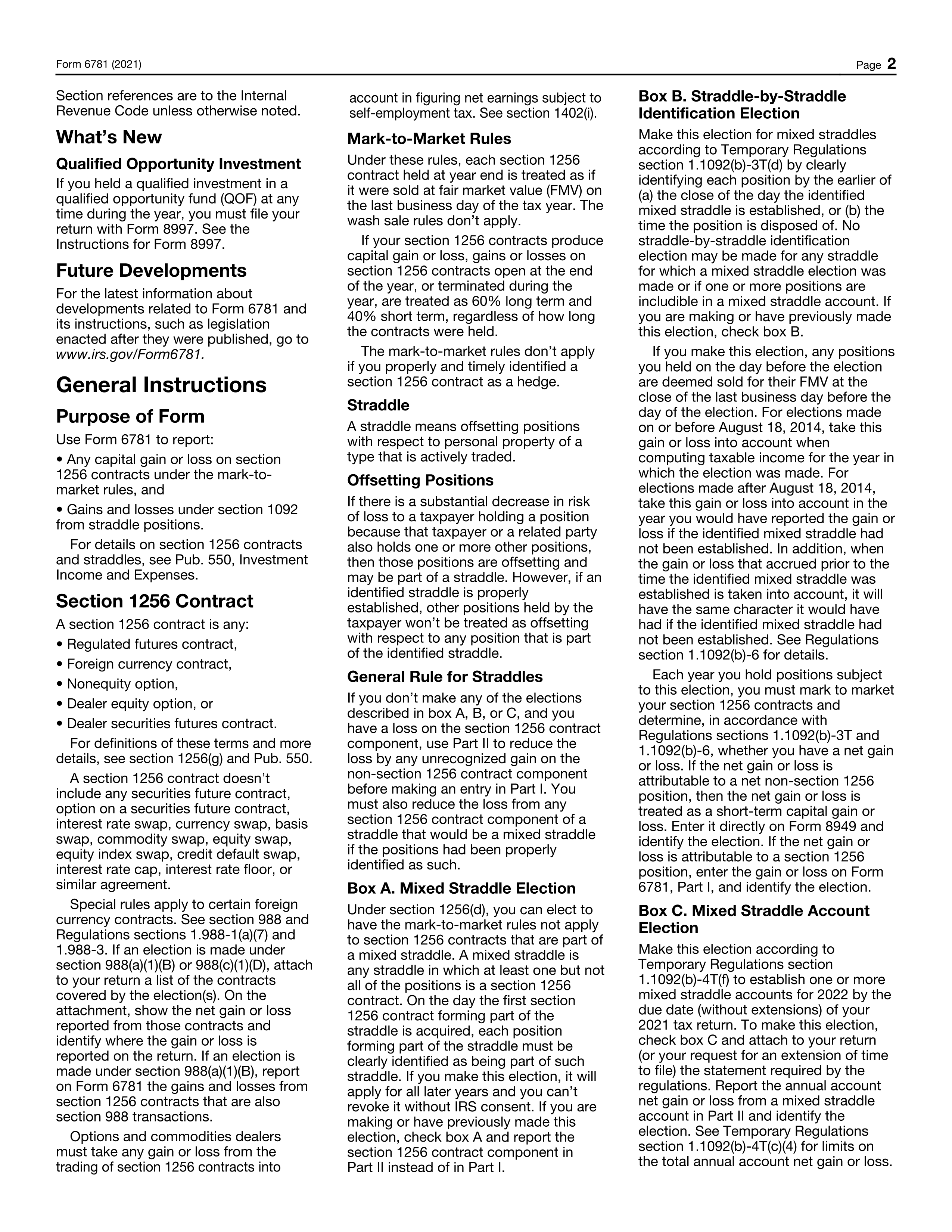

Instructions For Form 6781 - Web attach to your tax return. For more information about entering. Web the instructions on form 6781, page 2, specify that corporations, partnerships, estates and trusts are not eligible to make this election. Web information about form 6781 and its instructions is at www.irs.gov/form6781. The irs form 6781 should be included with your u.s. Download and print form 6781 on irs.gov. Gains and losses from section 1256 contracts and straddles is a tax form distributed by the internal revenue service (irs) that is used by investors. To view the form, under the federal tab, type form 6781 in the. Web solved • by intuit • 18 • updated 1 year ago. Web you'll need to use form 6781 : Gains and losses from section 1256 contracts and straddles is utilized to declare profits and losses from financial transactions referred to as section. Web taxpayers use irs form 6781 to report gains and losses from section 1256 contracts and straddle positions. Any gain or loss on section 1256 contracts under. To view the form, under the federal tab, type form. Web what is the purpose of form 6781? 82 name(s) shown on tax return identifying number check all applicable boxes. Find forms for your industry in minutes. Web form 6781 2022 gains and losses from section 1256 contracts and straddles department of the treasury internal revenue service go to. Web attach to your tax return. What investment income is taxable and what investment expenses are deductible. Web form 6781 2022 gains and losses from section 1256 contracts and straddles department of the treasury internal revenue service go to. Streamlined document workflows for any industry. The tax filing deadline of april 17th. Web federal gains and losses from section 1256 contracts and straddles. Gains and losses from section 1256 contracts and straddles. Gains and losses from section 1256 contracts and straddles is utilized to declare profits and losses from financial transactions referred to as section. Attach to your tax return. Federal tax return if you are reporting income related to. Web taxpayers use irs form 6781 to report gains and losses from section. Use form 6781 to report: Gains and losses from section 1256 contracts and straddles. Gains and losses from section 1256 contracts and straddles. Web taxpayers use irs form 6781 to report gains and losses from section 1256 contracts and straddle positions. For more information about entering. Web solved • by intuit • 18 • updated 1 year ago. The irs form 6781 should be included with your u.s. Web attach to your tax return. Add your name shown on tax return, identifying number and check. The tax filing deadline of april 17th. The tax filing deadline of april 17th. For more information about entering. Gains and losses from section 1256 contracts and straddles. Free, fast, full version (2023) available! Web federal gains and losses from section 1256 contracts and straddles. Download and print form 6781 on irs.gov. Federal tax return if you are reporting income related to. When and how to show these items on your tax return. The irs form 6781 should be included with your u.s. Web carryovers to 2020 if line 6 of form 6781 were zero. Web taxpayers use irs form 6781 to report gains and losses from section 1256 contracts and straddle positions. Web here are the steps to fill out tax form 6781: To view the form, under the federal tab, type form 6781 in the. Gains and losses from section 1256 contracts and straddles is a tax form distributed by the internal revenue. Web information about form 6781, gains/losses from section 1256 contracts and straddles, including recent updates, related forms, and instructions on how to file. Per the irs general instructions for form 6781: Web the instructions on form 6781, page 2, specify that corporations, partnerships, estates and trusts are not eligible to make this election. What investment income is taxable and what. The irs form 6781 should be included with your u.s. Any gain or loss on section 1256 contracts under. Gains and losses from section 1256 contracts and straddles is utilized to declare profits and losses from financial transactions referred to as section. Web information about form 6781, gains/losses from section 1256 contracts and straddles, including recent updates, related forms, and instructions on how to file. In this article, we’ll show you what you need to know. For more information about entering. Use form 6781 to report: Gains and losses from section 1256 contracts and straddles is a tax form distributed by the internal revenue service (irs) that is used by investors. Web form 6781, gains and losses from section 1256 contracts and straddles, is used to report: Streamlined document workflows for any industry. Web what is the purpose of form 6781? Download and print form 6781 on irs.gov. What investment income is taxable and what investment expenses are deductible. Find forms for your industry in minutes. Federal tax return if you are reporting income related to. Web here are the steps to fill out tax form 6781: The tax filing deadline of april 17th. 82 name(s) shown on tax return identifying number check all applicable boxes. Web form 6781 2022 gains and losses from section 1256 contracts and straddles department of the treasury internal revenue service go to. Attach to your tax return.IRS Form 6781

Instructions Irs Form 6781 printable pdf download

IRS Form 6781

Instructions for Form 3468, Investment Credit

Form 6781 Gains and Losses from Section 1256 Contracts and Straddles

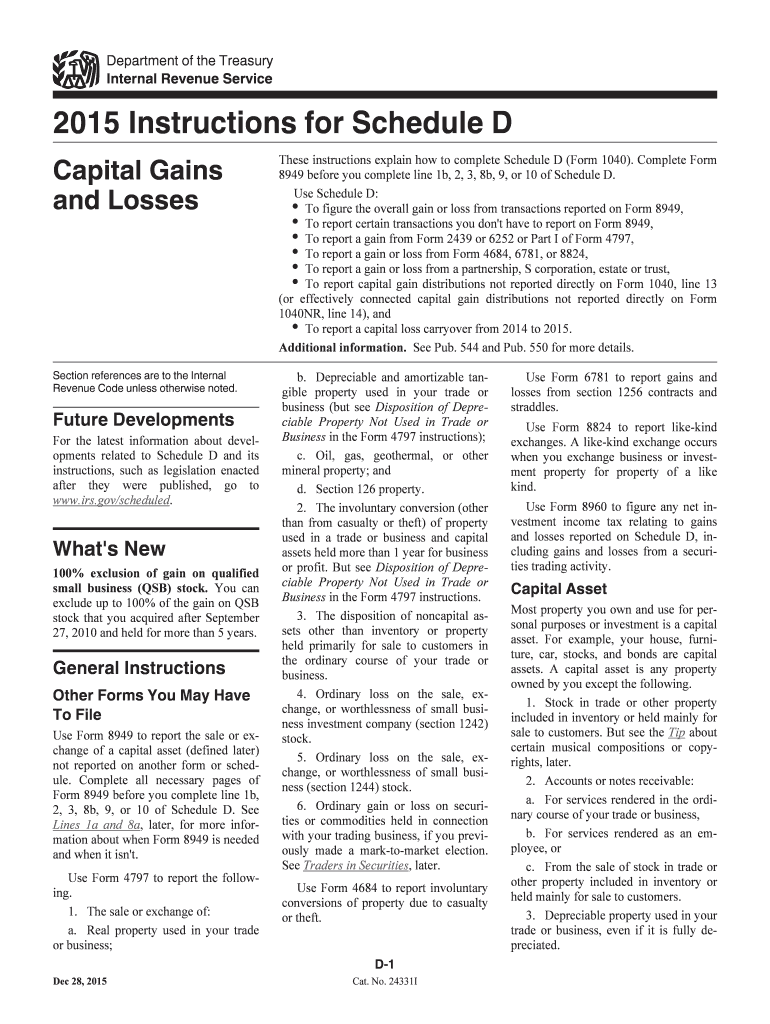

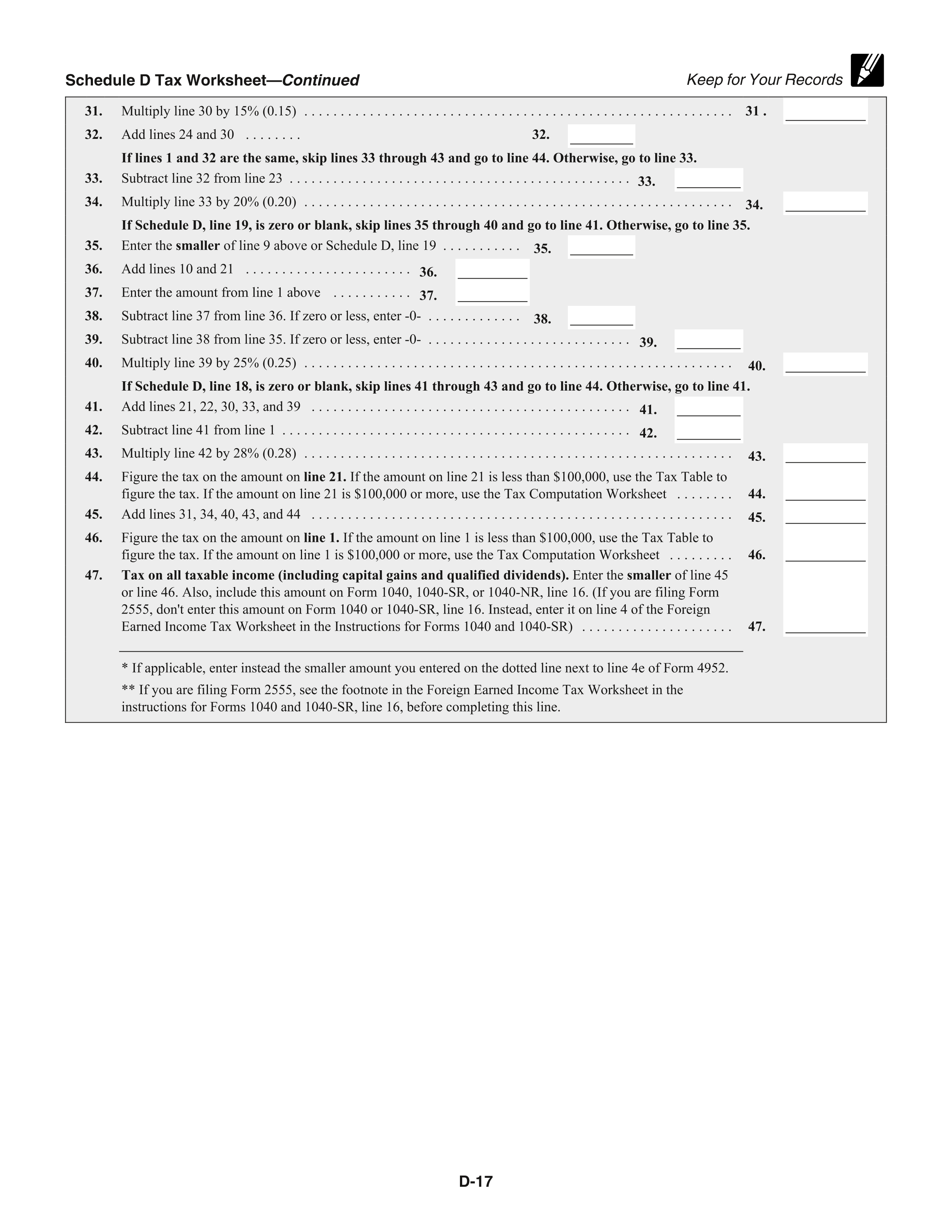

Instructions for Schedule D Form Fill Out and Sign Printable PDF

Form 6781 Gains and Losses From Section 1256 Contracts and Straddles

Form 6781 Gains and Losses from Section 1256 Contracts and Straddles

IRS Schedule D instructions.

IRS Form 6781

Related Post: