1099 Form 이란

1099 Form 이란 - Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. 모기지 렌더가 납세자의 빚을 탕감해 주기로 했거나 집이 숏세일이 되었다면 받을 수 있는 폼으로 납세자는 탕감된 부채를 과세 수익으로 irs에 보고해야. Web you'll receive a form 1099 if you earned money from a nonemployer source. Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. When you might get one from venmo, paypal, others. 정보 신고서 수취 시스템 (iris) 납세자 포털(영어)은 납세자들이 무료로 양식 1099 시리즈들을 온라인으로 신고하는 시스템 입니다. Ad amazon.com has been visited by 1m+ users in the past month Form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of. Web page last reviewed or updated: Form 1099是任何个人或者组织(付钱方)给了纳税人(收钱方)钱之后都一定要向美国国家税务局(internal revenue service, irs)汇报收到钱的. Web 1099 폼(form)이란, a라는 개인이 b라는 업체와 독립계약자 거래를 체결한 후 그해에 대가를 지급받았다면 대가를 지급한 b업체가 그해에 a에게 지급한 금액을 비즈니스. When you might get one from venmo, paypal, others. 모기지 렌더가 납세자의 빚을 탕감해 주기로 했거나 집이 숏세일이 되었다면 받을 수 있는 폼으로 납세자는 탕감된 부채를 과세 수익으로 irs에 보고해야. The payer fills out the 1099 and sends. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web you are not required to file information return (s) if any of the following situations apply: You are engaged in a trade. When you might get one from venmo, paypal, others. Web form 1099를 발행하는 대상을 개인에서 법인에까지 확대한다는 내용이었다. 정보 신고서 수취 시스템 (iris) 납세자 포털(영어)은 납세자들이 무료로 양식 1099 시리즈들을 온라인으로 신고하는 시스템 입니다. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an. 그러나 현재 이들의 공통점은 둘 다 하나의 조직에 속해 있다는. The payer fills out the 1099 and sends copies to you and the. Here are some common types of 1099 forms: You are not engaged in a trade or business. Web you'll receive a form 1099 if you earned money from a nonemployer source. The irs compares reported income. Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Form 1099 is one of several irs tax. Web you'll receive a form 1099 if you earned money from a nonemployer source. You are engaged in a trade. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. The irs compares reported income. Web 1099 form 이란? Web you are not required to file information return (s) if any of the following situations apply: Web page last reviewed or updated: Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. Web 1099 폼(form)이란, a라는 개인이 b라는 업체와 독립계약자 거래를 체결한 후 그해에 대가를 지급받았다면. Web iris 를 통해 양식 1099들 전자 제출. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web the majority of 1099 forms are due to you, the payee, by january 31. Web you'll receive a form. Web page last reviewed or updated: Web professionals from the kpmg information reporting & withholding tax practice will discuss: 그러나 현재 이들의 공통점은 둘 다 하나의 조직에 속해 있다는. Web 1099 form 이란? Web 1099 폼(form)이란, a라는 개인이 b라는 업체와 독립계약자 거래를 체결한 후 그해에 대가를 지급받았다면 대가를 지급한 b업체가 그해에 a에게 지급한 금액을 비즈니스. Web you'll receive a form 1099 if you earned money from a nonemployer source. Web iris 를 통해 양식 1099들 전자 제출. Web page last reviewed or updated: 모기지 렌더가 납세자의 빚을 탕감해 주기로 했거나 집이 숏세일이 되었다면 받을 수 있는 폼으로 납세자는 탕감된 부채를 과세 수익으로 irs에 보고해야. Form 1099 is one of several irs tax forms (see the. 이전에는 1년에 600달러 이상의 소득을 수령하는 독립계약자 혹은 개인 하청업자들에게. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. The payer fills out the 1099 and sends copies to you and the. That should give you plenty of time to make sure those 1099 forms are accurate in reporting. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. 정보 신고서 수취 시스템 (iris) 납세자 포털(영어)은 납세자들이 무료로 양식 1099 시리즈들을 온라인으로 신고하는 시스템 입니다. You are not engaged in a trade or business. Web you are not required to file information return (s) if any of the following situations apply: Web page last reviewed or updated: Web professionals from the kpmg information reporting & withholding tax practice will discuss: Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. Web iris 를 통해 양식 1099들 전자 제출. You are engaged in a trade. Form 1099是任何个人或者组织(付钱方)给了纳税人(收钱方)钱之后都一定要向美国国家税务局(internal revenue service, irs)汇报收到钱的. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. When you might get one from venmo, paypal, others. 그러나 현재 이들의 공통점은 둘 다 하나의 조직에 속해 있다는. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of. The irs compares reported income. Web form 1099를 발행하는 대상을 개인에서 법인에까지 확대한다는 내용이었다.Forms 1099 The Basics You Should Know Kelly CPA

1099 Int Form Fillable Pdf Template Download Here!

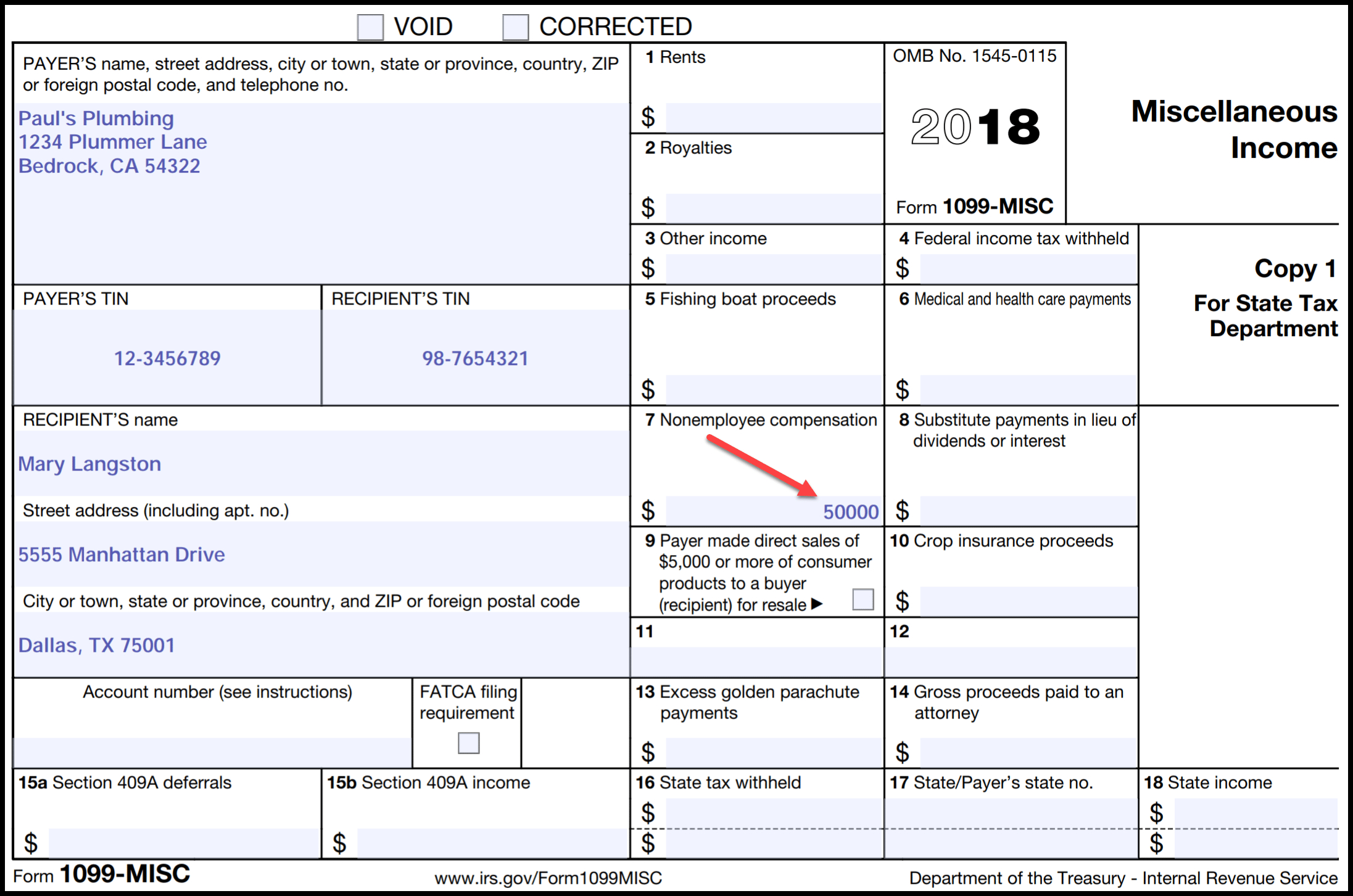

1099MISC Form Sample

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

Free Printable 1099 Misc Forms Free Printable

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

1099 Form Independent Contractor Pdf / Irs Form 1099 Misc Fill Out

[TAX]세금보고 1099 Form과 종류 아이테크코리아

What is a 1099Misc Form? Financial Strategy Center

Related Post:

![[TAX]세금보고 1099 Form과 종류 아이테크코리아](https://i1.wp.com/www.itechkorea.com/wp-content/uploads/2020/03/Form-1099-INT.jpg?resize=800%2C533&ssl=1)