Form 1120 Schedule M 3 Instructions

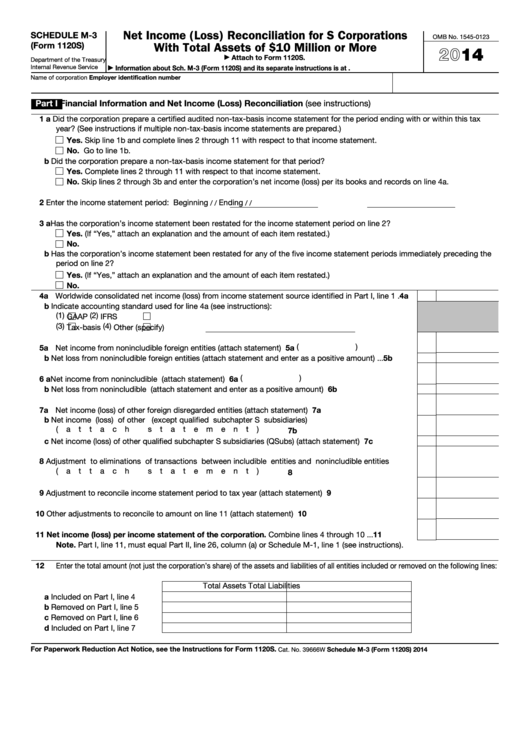

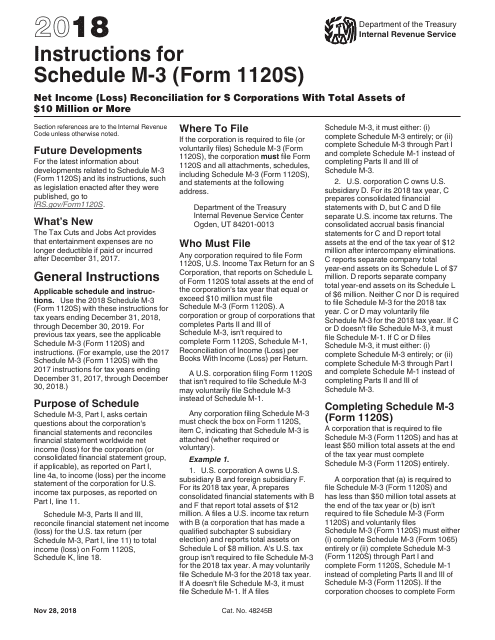

Form 1120 Schedule M 3 Instructions - Web general information what is the purpose of schedule m? Life insurance companies with total assets of $10 million or more. Analysis of unappropriated retained earnings per books. December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. Net income (loss) reconciliation for corporations with total assets of $10 million or more. 2 federal income tax per books. That reports on schedule l of form 1120s. Complete lines 2a through 11 with respect to that income statement. 1 net income (loss) per books. “who must file any corporation required to file form 1120s. Net income (loss) reconciliation for corporations with total assets of $10 million or more. Life insurance companies with total assets of $10 million or more. That reports on schedule l of form 1120s. Analysis of unappropriated retained earnings per books. Net income (loss) reconciliation for corporations with total assets of $10 million or more. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. Analysis of unappropriated retained earnings per books. Life insurance companies with total assets of $10 million or more. Any domestic corporation or group of corporations required to file. December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. 2 federal income tax per books. Life insurance companies with total assets of $10 million or more. Complete lines 2a through 11 with respect to that income statement. Reconciliation of income \⠀䰀漀猀猀尩 per books with income per return. That reports on schedule l of form 1120s. 1 net income (loss) per books. “who must file any corporation required to file form 1120s. Complete lines 2a through 11 with respect to that income statement. 2 federal income tax per books. Net income (loss) reconciliation for corporations with total assets of $10 million or more. “who must file any corporation required to file form 1120s. Reconciliation of income \⠀䰀漀猀猀尩 per books with income per return. 2 federal income tax per books. Analysis of unappropriated retained earnings per books. 1 net income (loss) per books. That reports on schedule l of form 1120s. Reconciliation of income \⠀䰀漀猀猀尩 per books with income per return. “who must file any corporation required to file form 1120s. Complete lines 2a through 11 with respect to that income statement. Web general information what is the purpose of schedule m? Any domestic corporation or group of corporations required to file form 1120 that reports on form. Reconciliation of income \⠀䰀漀猀猀尩 per books with income per return. 2 federal income tax per books. December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets. Analysis of unappropriated retained earnings per books. That reports on schedule l of form 1120s. Complete lines 2a through 11 with respect to that income statement. Any domestic corporation or group of corporations required to file form 1120 that reports on form. Web go to line 1c. 2 federal income tax per books. Reconciliation of income \⠀䰀漀猀猀尩 per books with income per return. Complete lines 2a through 11 with respect to that income statement. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. Life insurance companies with total assets of $10 million or more. Any domestic corporation or group of corporations required to file form 1120 that reports on form. Net income (loss) reconciliation for corporations with total assets of $10 million or more. Analysis of unappropriated retained earnings per books. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. Reconciliation of income \⠀䰀漀猀猀尩 per. That reports on schedule l of form 1120s. Net income (loss) reconciliation for corporations with total assets of $10 million or more. 1 net income (loss) per books. “who must file any corporation required to file form 1120s. Reconciliation of income \⠀䰀漀猀猀尩 per books with income per return. Web general information what is the purpose of schedule m? December 2019) department of the treasury internal revenue service net income (loss) reconciliation for corporations with total assets of. Any domestic corporation or group of corporations required to file form 1120 that reports on form. 2 federal income tax per books. Web go to line 1c. Complete lines 2a through 11 with respect to that income statement. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions”. Analysis of unappropriated retained earnings per books. Life insurance companies with total assets of $10 million or more.Fillable Schedule M3 (Form 1120s) Net (Loss) Reconciliation

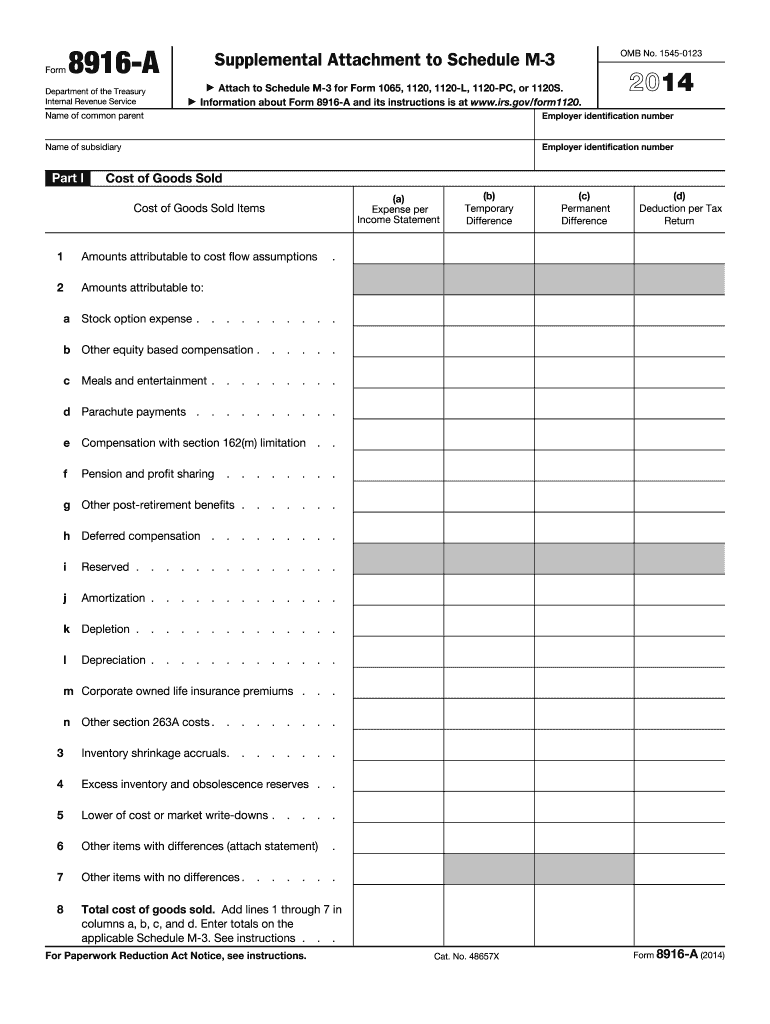

Download Instructions for IRS Form 1120S Schedule M3 Net (Loss

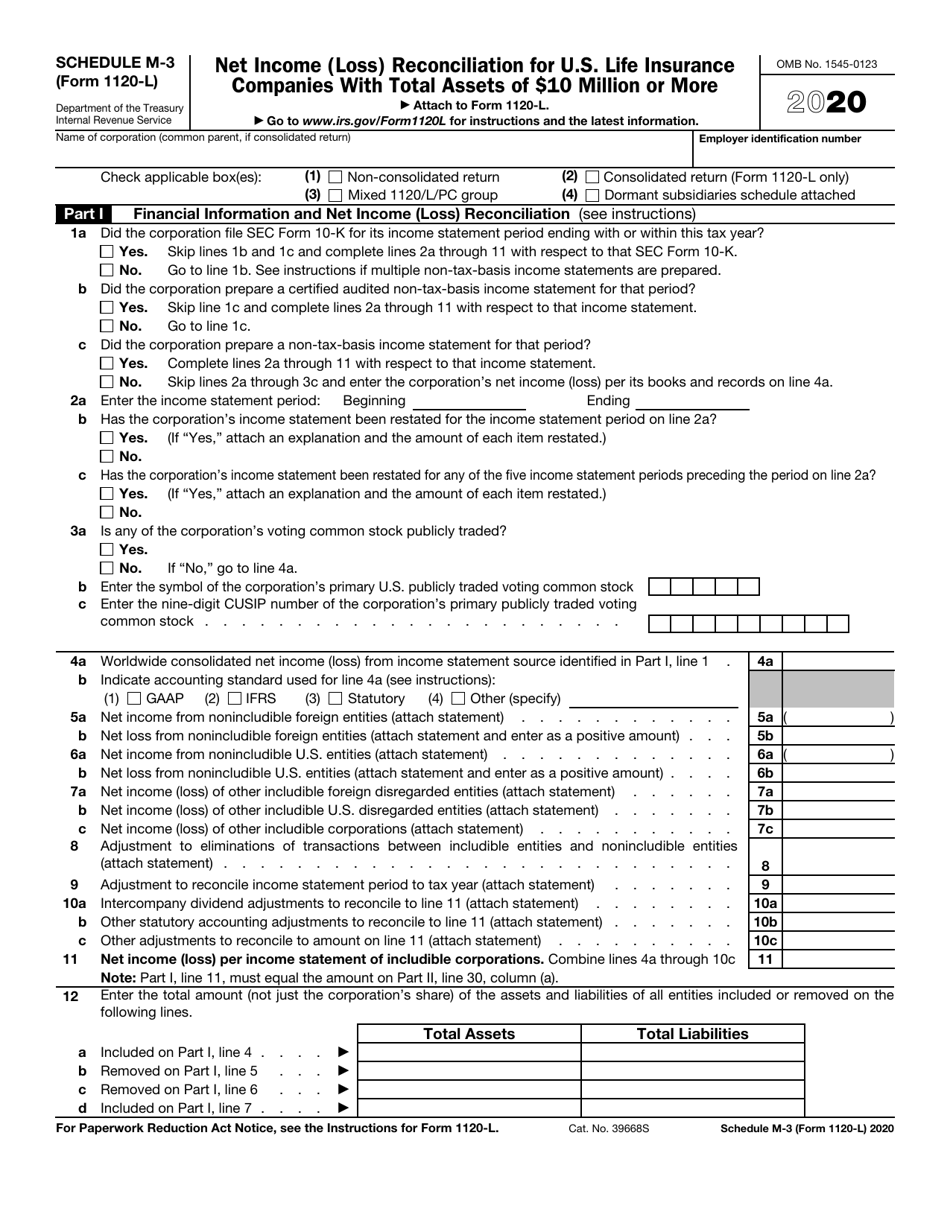

Form 1120L (Schedule M3) Net Reconciliation for U.S. Life

IRS Form 1120L Schedule M3 Download Fillable PDF or Fill Online Net

U.S Corporation Tax Return, Form 1120 Meru Accounting

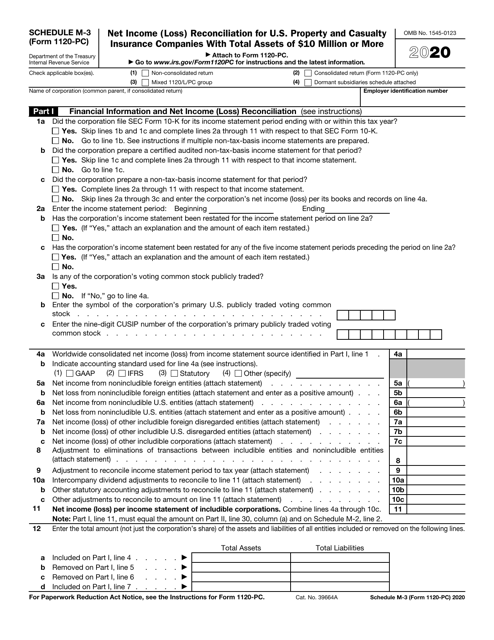

IRS Form 1120PC Schedule M3 Download Fillable PDF or Fill Online Net

Instructions for Schedule M3 (Form 1120L) (2017 IRS.gov Fill

Download Instructions for IRS Form 1120F Schedule M3 Net (Loss

Form 1120 (Schedule M3) Net Reconciliation for Corporations

Download Instructions for IRS Form 1120PC Schedule M3 Net

Related Post: