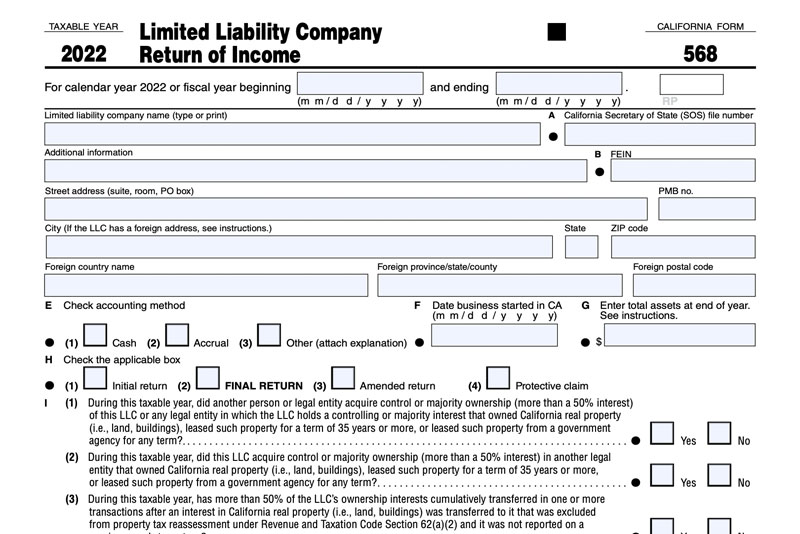

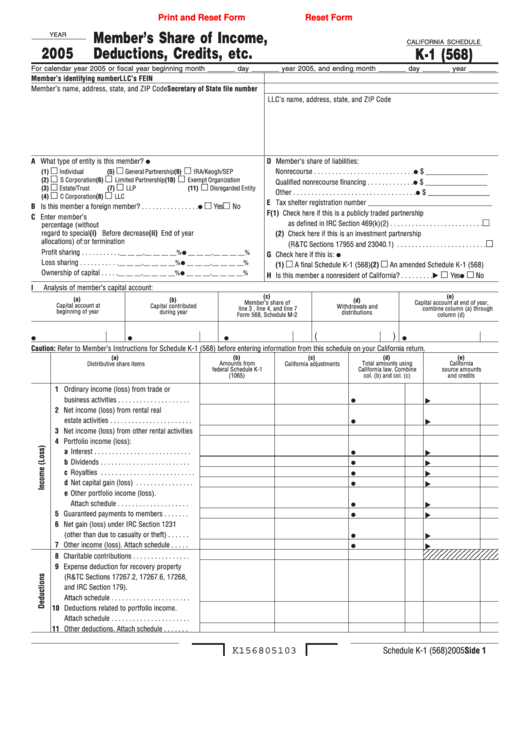

Does A Single Member Llc Need To File Form 568

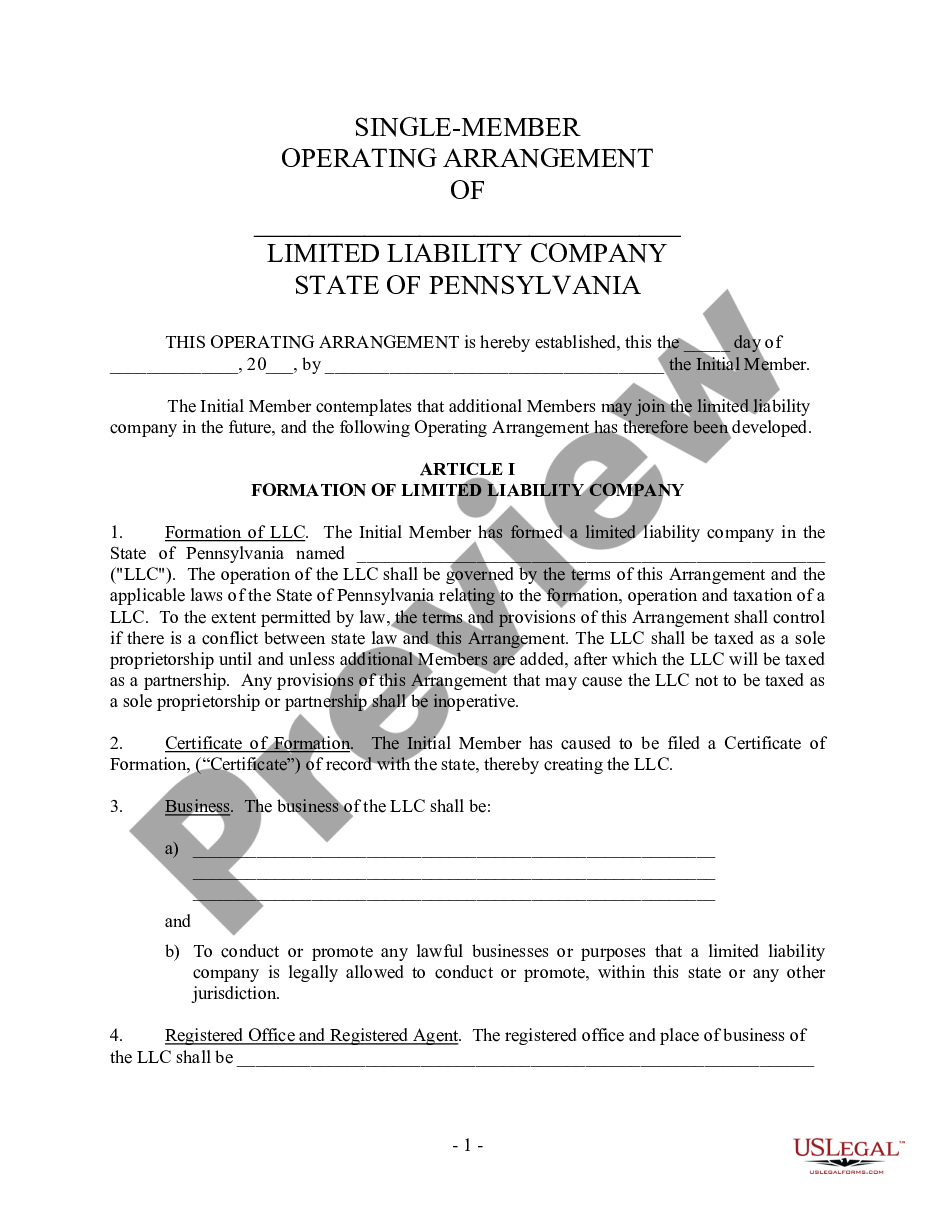

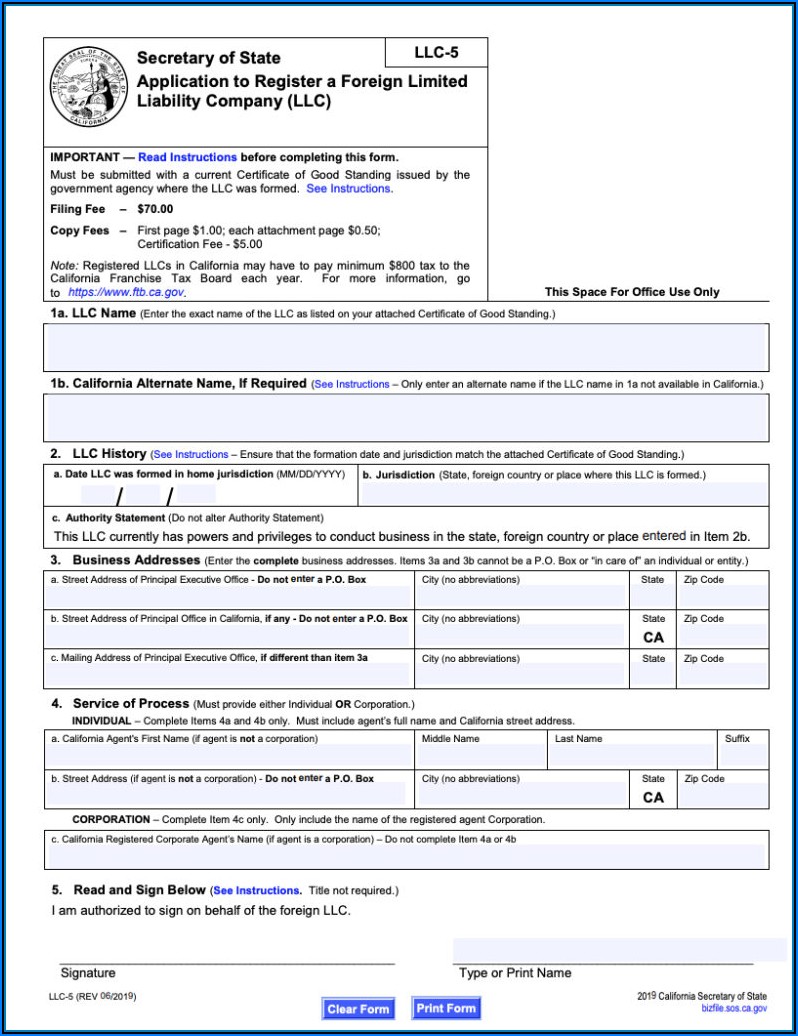

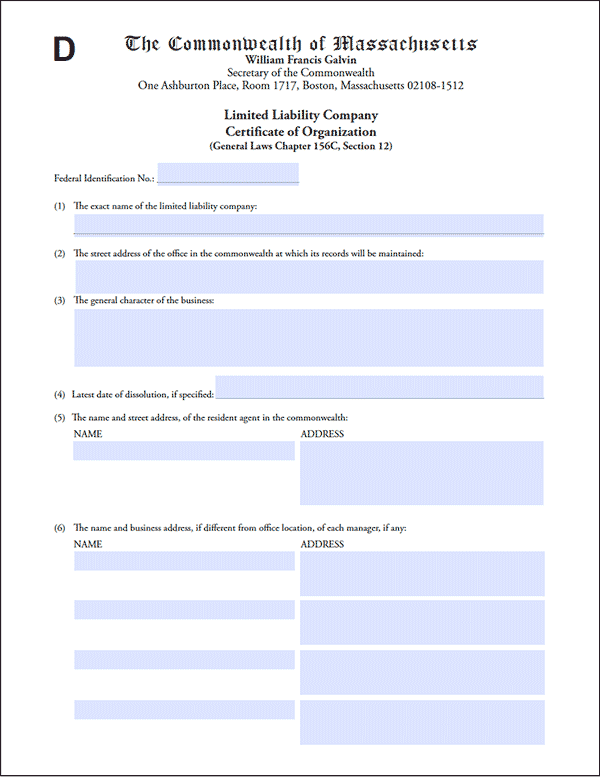

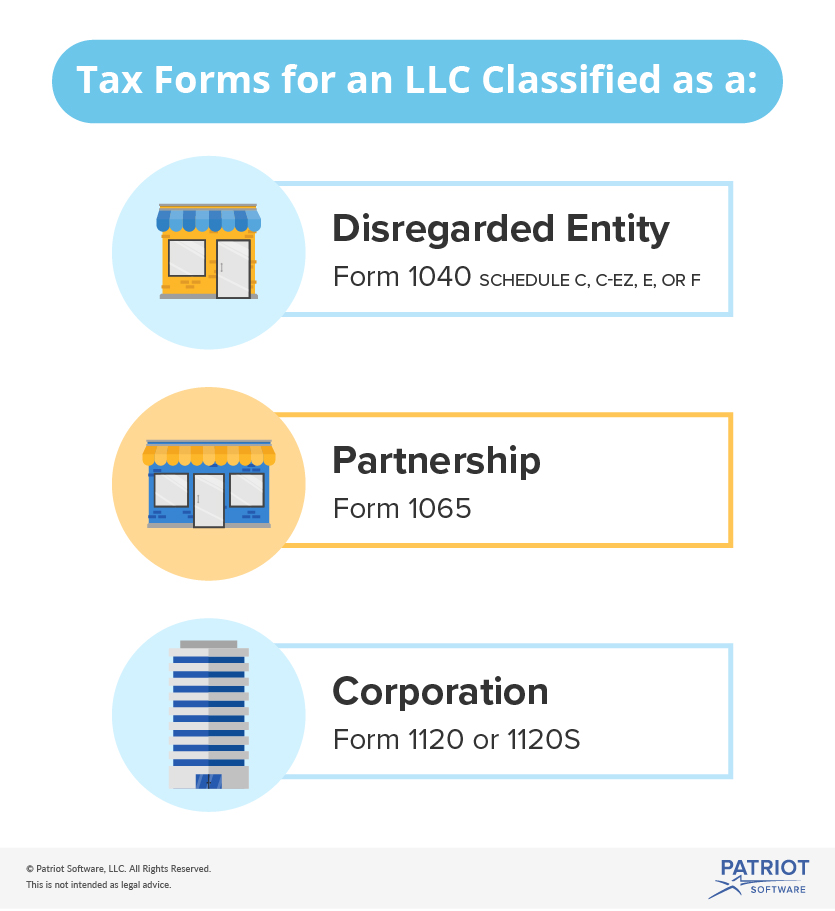

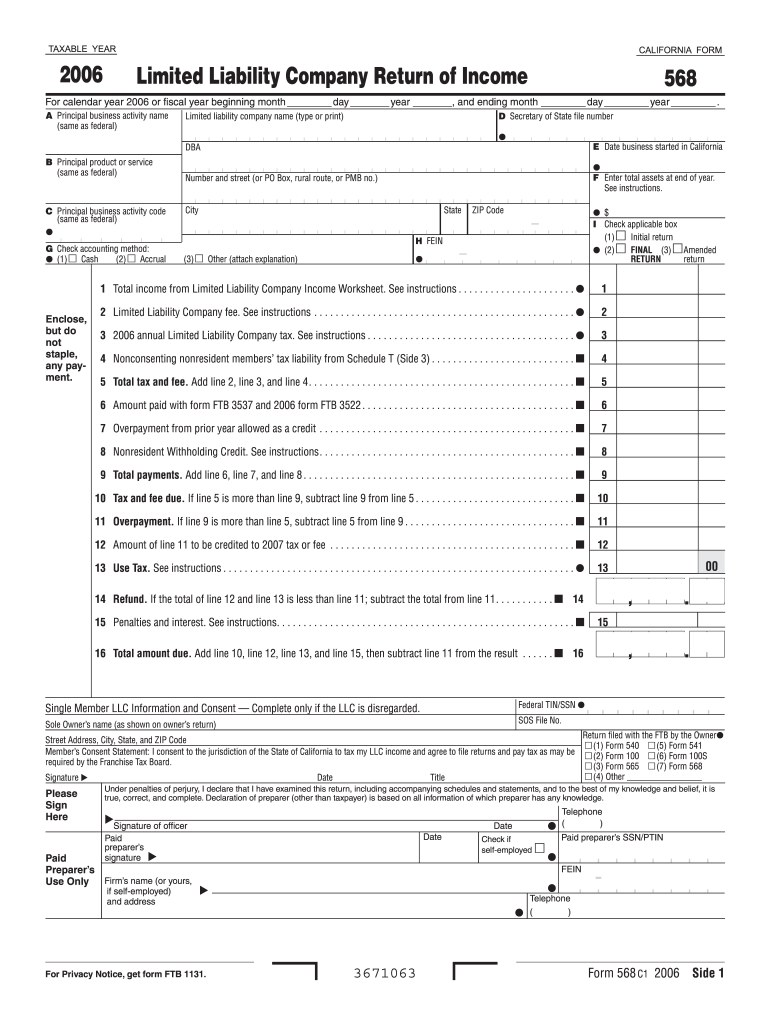

Does A Single Member Llc Need To File Form 568 - Web your llc in california will need to file form 568 each year. Web california defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. However, in california, smllcs are considered separate legal. Schedule d (568), capital gain or loss. Web intuit help intuit. Web file limited liability company return of income (form 568) by the original return due date. Most states require the federal 1065 and state to be installed to access the smllc forms from the individual. Ad top 5 llc services online (2023). Web (llc), payment for automatic extension for llcs. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Web a single member limited liability company (smllc) is considered disregarded for federal income tax purposes. The llc fee and franchise tax will be taken into consideration. However, you cannot use form 568 to. Web please remind your. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Ad let us help you open your llc and start your business journey. Web your llc in california will need to file form 568 each year. However, you cannot use form 568 to. Web form 568. We make it easy to incorporate your llc. The llc fee and franchise tax will be taken into consideration. Schedule d (568), capital gain or loss. However, you cannot use form 568 to. Web (llc), payment for automatic extension for llcs. In the 1065 package, you do. Web your llc in california will need to file form 568 each year. The llc fee and franchise tax will be taken into consideration. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. If your llc files on an extension, refer to payment for automatic extension for. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. If you are married, you and your spouse are considered one owner and can elect to be treated as an smllc. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to. Web a single member limited liability company. Most states require the federal 1065 and state to be installed to access the smllc forms from the individual. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Web for income. Solved • by intuit • 3 • updated 1 year ago. In the 1065 package, you do. Web a single member limited liability company (smllc) is considered disregarded for federal income tax purposes. However, you cannot use form 568 to. Web an llc will need an ein if it has any employees or if it will be required to file. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web proseries basic doesn't support single member llcs. However, you cannot use form 568 to. Common questions about partnership ca form 568 for single member llcs. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Per the ca ftb limited liability. Web (llc), payment for automatic extension for llcs. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Web california defines a single member. Pay the llc fee (if applicable) additionally, we. Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and elects to be. Web please remind your smllc clients that a disregarded smllc is required to: Schedule d (568), capital gain or loss. However,. File a tax return (form 568) pay the llc annual tax. Per the ca ftb limited liability. Web california defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c (per the irs. Common questions about partnership ca form 568 for single member llcs. The llc fee and franchise tax will be taken into consideration. However, you cannot use form 568 to. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Web a single member limited liability company (smllc) is considered disregarded for federal income tax purposes. Expert guidance for the best way to open your llc. Most states require the federal 1065 and state to be installed to access the smllc forms from the individual. Web your llc in california will need to file form 568 each year. Web solved•by intuit•97•updated august 22, 2023. Web please remind your smllc clients that a disregarded smllc is required to: In the 1065 package, you do. If your llc has one owner, you’re a single member limited liability company (smllc). Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Ad top 5 llc services online (2023). However, in california, smllcs are considered separate legal. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to. If you are married, you and your spouse are considered one owner and can elect to be treated as an smllc.Pennsylvania Single Member Limited Liability Company LLC Operating

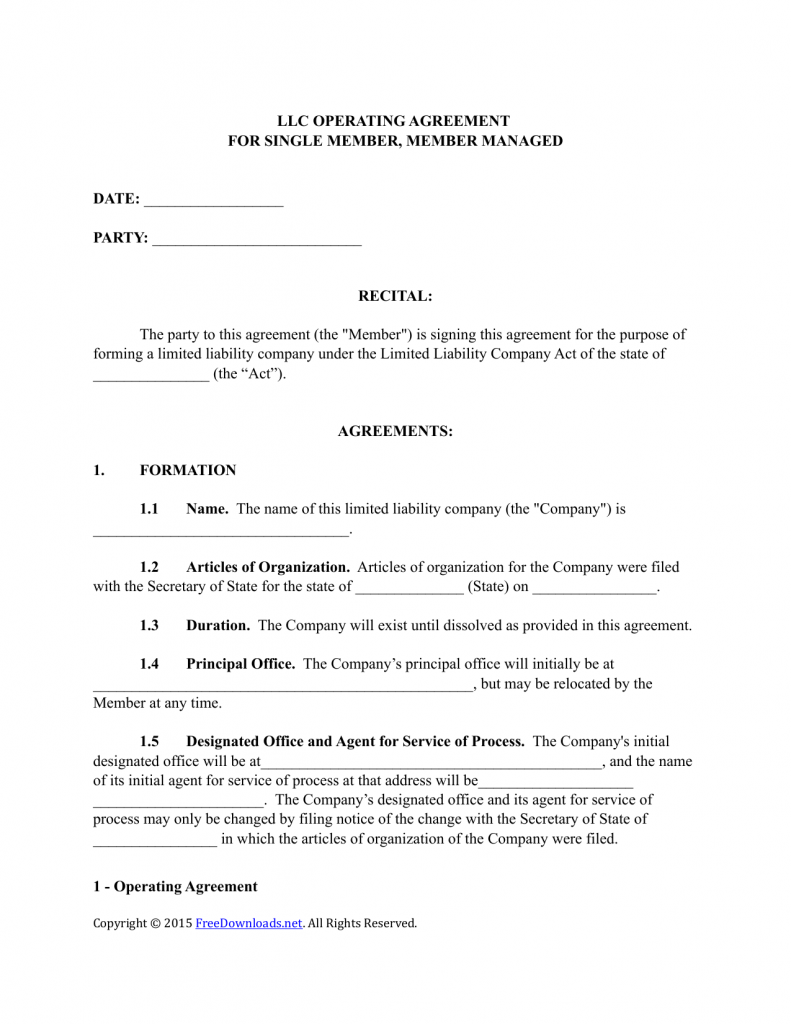

Download Single Member LLC Operating Agreement Template PDF RTF

Blog Articles for Launching and Growing Your Business

CA FTB 568 20202022 Fill out Tax Template Online

Fillable California Schedule K1 (568) Member'S Share Of

Delaware Llc Conversion Forms Form Resume Examples Bw9j6q797X

massachusetts single member llc filing requirements LLC Bible

Tax Forms for an LLC Federal Forms LLCs Should Know About

Form 568 Limited Liability Company Return of Fill Out and Sign

Do Single Member Llc's Need Operating Agreement Paul Johnson's Templates

Related Post: