Form 886 H Eic

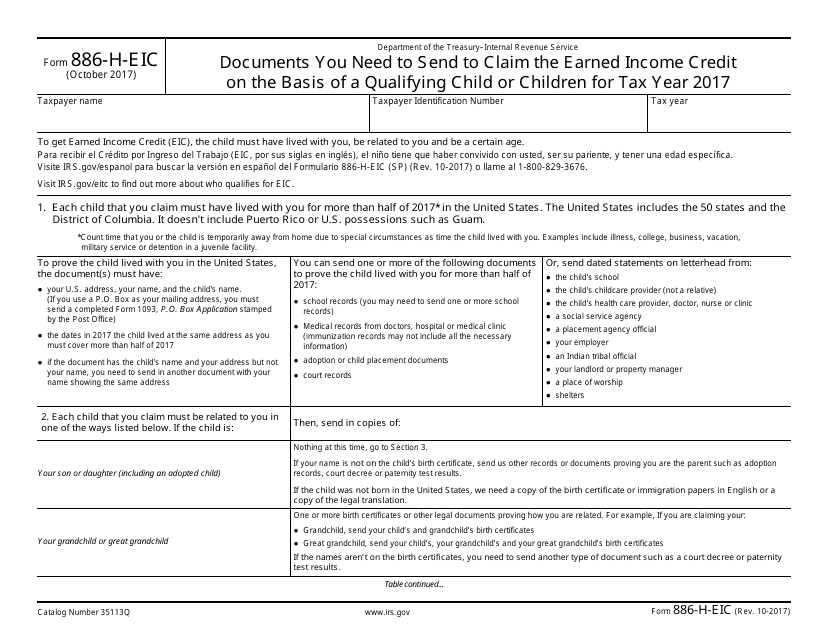

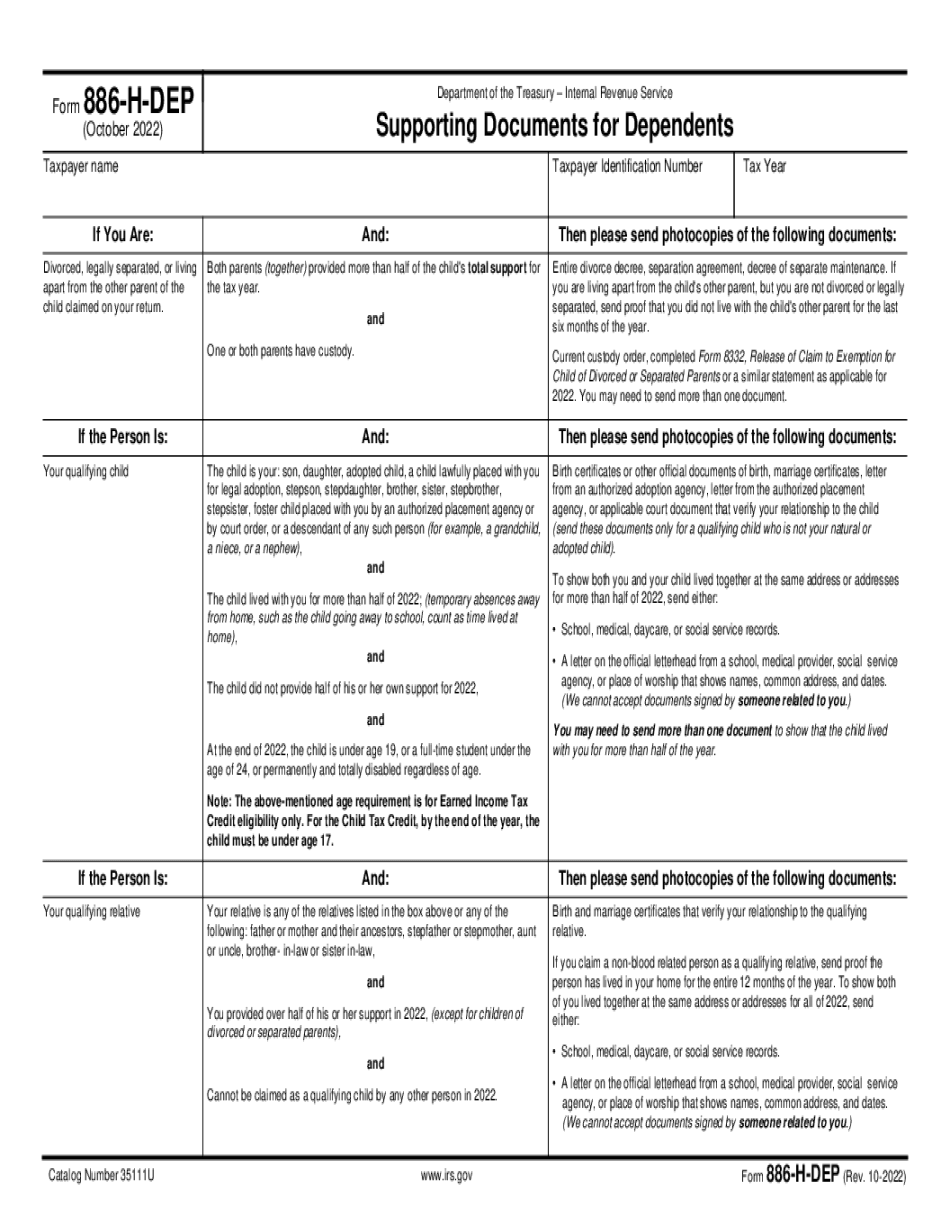

Form 886 H Eic - Save or instantly send your ready documents. Use a new checklist for each child listed on your. Contact a low income taxpayer. Fill in every fillable field. Along with this form, you may have to. Web current custody order, completed form 8332, release of claim to exemption for child of divorced or separated parents or a similar statement as applicable for 2022. Web select the get form button to start editing and enhancing. Documents you need to send to claim the. Documentos que necesita enviar para reclamar el crédito tributario por ingreso del trabajo en base a un hijo o hijos. Turn on the wizard mode on the top toolbar to acquire more pieces of advice. Use this checklist as you prepare the response to your audit letter by going through the toolkit. Documents you need to send to claim the earned income credit on the basis of a. Documentos que necesita enviar para reclamar el crédito tributario por ingreso del trabajo en base a un hijo o hijos. Easily fill out pdf blank, edit, and. Web select the get form button to start editing and enhancing. Easily fill out pdf blank, edit, and sign them. This tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income. Web form 886 h eic pdf details. Use a new checklist for. Web current custody order, completed form 8332, release of claim to exemption for child of divorced or separated parents or a similar statement as applicable for 2022. Documentos que necesita enviar para reclamar el crédito tributario por ingreso del trabajo en base a un hijo o hijos. Use a new checklist for each child listed on your. Documents you need. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web form 886 h eic pdf details. Documents you need to send to claim the earned income credit on the basis of a. To claim a child as a qualifying child for eitc, you must show the child is. Complete, edit or print tax forms instantly. Documents you need to send to claim the earned income credit on the basis of a qualifying child or children 1022 02/10/2023 form 8863: Save or instantly send your ready documents. Documentos que necesita enviar para reclamar el crédito tributario por ingreso del trabajo en base a un hijo o hijos. To claim. Web complete form 886 h eic online with us legal forms. Easily fill out pdf blank, edit, and sign them. Web form 886 h eic pdf details. Documents you need to send to claim the earned income credit on the basis of a qualifying child or children 1022 02/10/2023 form 8863: Save or instantly send your ready documents. Web form 886 h eic pdf details. Use a new checklist for each child listed on your. Documents you need to send to claim the earned income credit on the basis of a qualifying child or children 1022 02/10/2023 form 8863: Fill in every fillable field. Easily fill out pdf blank, edit, and sign them. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Complete, edit or print tax forms instantly. Save or instantly send your ready documents. This tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income. Web current custody order, completed form 8332, release of claim to exemption for child of divorced or separated parents or a similar statement as applicable for 2022. Easily fill out pdf blank, edit, and sign them. Easily fill out pdf blank, edit, and sign them. Web form 886 h eic pdf details. Use a new checklist for each child listed. Web select the get form button to start editing and enhancing. Documents you need to send to claim the earned income credit on the basis of a. Web current custody order, completed form 8332, release of claim to exemption for child of divorced or separated parents or a similar statement as applicable for 2022. Documentos que necesita enviar para reclamar. Save or instantly send your ready documents. Fill in every fillable field. Use a new checklist for each child listed on your. Web select the get form button to start editing and enhancing. Use this checklist as you prepare the response to your audit letter by going through the toolkit. Easily fill out pdf blank, edit, and sign them. Turn on the wizard mode on the top toolbar to acquire more pieces of advice. Save or instantly send your ready documents. Web current custody order, completed form 8332, release of claim to exemption for child of divorced or separated parents or a similar statement as applicable for 2022. Web form 886 h eic pdf details. Along with this form, you may have to. Documentos que necesita enviar para reclamar el crédito tributario por ingreso del trabajo en base a un hijo o hijos. Documents you need to send to claim the earned income credit on the basis of a qualifying child or children 1022 02/10/2023 form 8863: Documents you need to send to claim the earned income credit on the basis of a. Documents you need to send to claim the. Contact a low income taxpayer. This tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. To claim a child as a qualifying child for eitc, you must show the child is.️Form 886 A Worksheet Instructions Free Download Gmbar.co

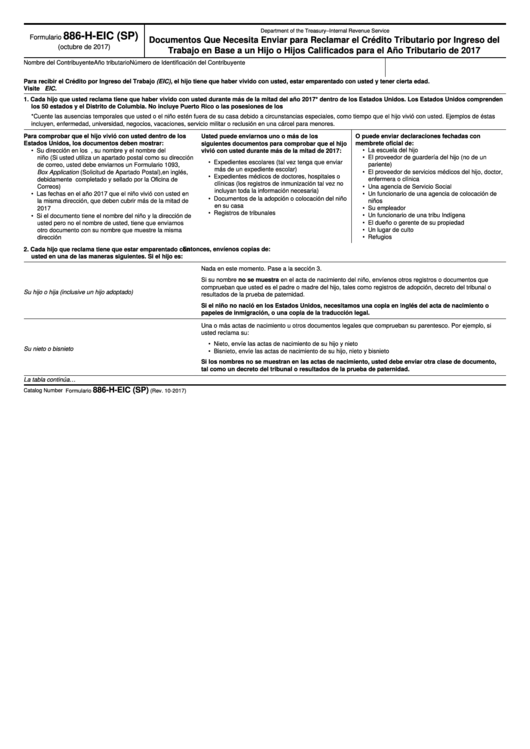

Fillable Formulario 886HEic (Sp) Documentos Que Necesita Enviar

IRS Form 886HEIC Fill Out, Sign Online and Download Fillable PDF

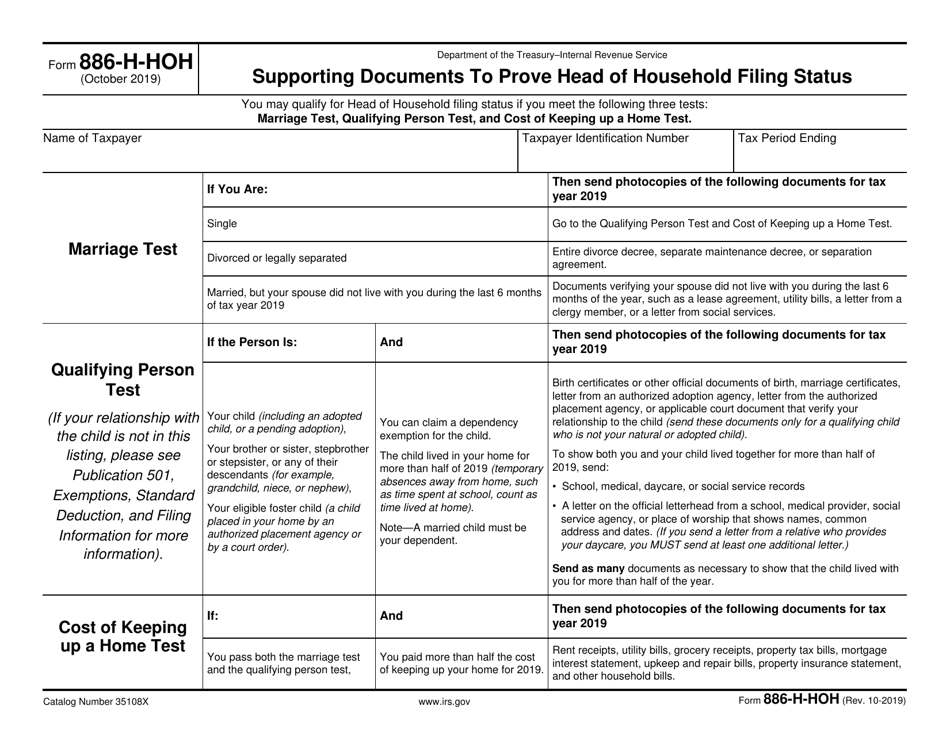

IRS Form 886HHOH Fill Out, Sign Online and Download Fillable PDF

Fill Free fillable Form 886HDEP Supporting Documents for

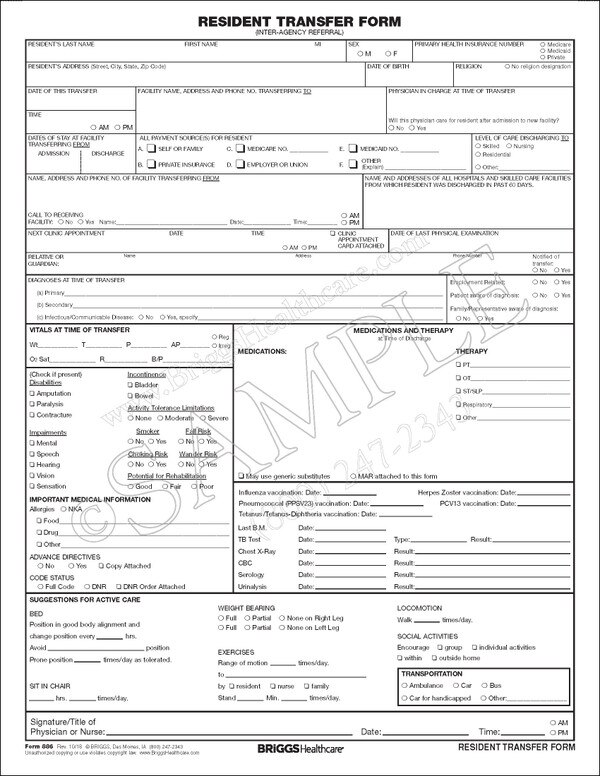

Resident Transfer form 886

IRS Form 886HEIC 2018 Fill and Sign Printable Template Online US

Form 886HDEP for Burbank California Fill Exactly for Your City

Form 886 H Eic ≡ Fill Out Printable PDF Forms Online

Fill Free fillable IRS PDF forms

Related Post: