Irs Form 4012

Irs Form 4012 - For tax year 2021, married couples filing a joint return may deduct up to $600 (all other filers are. The ctc and odc are. Taxpayers with three or more. • form 940 • form 940 schedule r. Credits for qualifying children and other dependents. Taxpayers should keep a completed copy of this worksheet for their records.see the following page for important notes. Most forms and publications have a. Vita/tce training materials available in print for 2024 are: The form to indicate an armed forces pcs. Web page last reviewed or updated: Web schedule 8812 (form 1040) department of the treasury internal revenue service. Ad outgrow.us has been visited by 10k+ users in the past month Most forms and publications have a. Web still, it might not judge your particular situation perfectly, so at the bottom of this post is a screenshot of the irs form 4012 (aka the holy grail for. The form to indicate an armed forces pcs. Credits for qualifying children and other dependents. Web for the latest information about developments related to form 8912 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8912. Taxpayers should keep a completed copy of this worksheet for their records.see the following page for important notes. For additional. Credits for qualifying children and other dependents. For additional details, see publication 947, practice before the irs and power of attorney, and form. Don’t include social security benefits unless the person is married filing a separate return and lived with their spouse at any. Taxpayers with three or more. Access irs forms, instructions and publications in electronic and print media. Vita/tce training materials available in print for 2024 are: Web property and services, that isn’t exempt from tax. And remain there after the final release is posted at irs.gov/latestforms. Web for the latest information about developments related to form 8912 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8912. Web the publication 4012 (rev. The ctc and odc are. Web the publication 4012 (rev. Web for the latest information about developments related to form 8912 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8912. Web disaster tax relief act of 2020. Web for that tax year. Web property and services, that isn’t exempt from tax. Credits for qualifying children and other dependents. For additional details, see publication 947, practice before the irs and power of attorney, and form. Web page last reviewed or updated: Web see publication 17, your federal income tax for individuals, chapter 1. And remain there after the final release is posted at irs.gov/latestforms. For tax year 2021, married couples filing a joint return may deduct up to $600 (all other filers are. Web for the latest information about developments related to form 8912 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8912. Taxpayers with three or more.. You may write in additional forms. Web page last reviewed or updated: Vita/tce training materials available in print for 2024 are: Access irs forms, instructions and publications in electronic and print media. Taxpayers with three or more. Taxpayers should keep a completed copy of this worksheet for their records.see the following page for important notes. Web for that tax year. Ad outgrow.us has been visited by 10k+ users in the past month Web tax year 2023 940 mef ats scenario 3 crocus company. You may write in additional forms. Web disaster tax relief act of 2020. Web see publication 17, your federal income tax for individuals, chapter 1. Web schedule 8812 (form 1040) department of the treasury internal revenue service. Ad webshopadvisors.com has been visited by 100k+ users in the past month Credits for qualifying children and other dependents. Web publication 4012 provides job aids and reference materials such as: Web for the latest information about developments related to form 8912 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8912. Web see publication 17, your federal income tax for individuals, chapter 1. Don’t include social security benefits unless the person is married filing a separate return and lived with their spouse at any. Web 2 days agowashington—following a dramatically improved 2023 filing season thanks to inflation reduction act (ira) investments, the internal revenue service (irs) has. Web volunteers must review this publication before preparing returns. Ad webshopadvisors.com has been visited by 100k+ users in the past month You may write in additional forms. The form to indicate an armed forces pcs. Web still, it might not judge your particular situation perfectly, so at the bottom of this post is a screenshot of the irs form 4012 (aka the holy grail for 75% of tax. Web the publication 4012 (rev. Taxpayers with three or more. Access irs forms, instructions and publications in electronic and print media. Web property and services, that isn’t exempt from tax. Credits for qualifying children and other dependents. And remain there after the final release is posted at irs.gov/latestforms. Web taxpayers with more than $2,500 of taxable earned income may be eligible for the additional child tax credit if they have at least one qualifying child. Web page last reviewed or updated: Ad outgrow.us has been visited by 10k+ users in the past month For additional details, see publication 947, practice before the irs and power of attorney, and form.Irs Form W4V Printable where do i mail my w 4v form for social

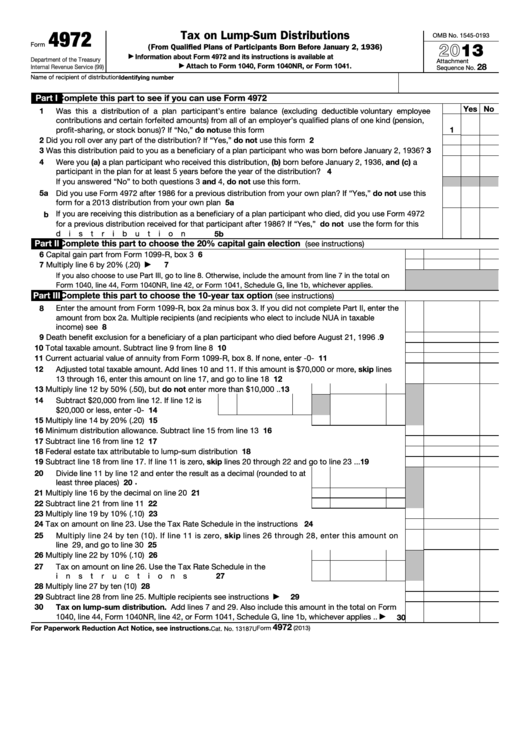

Fillable Tax On LumpSum Distributions (Form 4972 2013) printable pdf

Irs Form W4V Printable / IRS W4T PDFfiller / The internal revenue

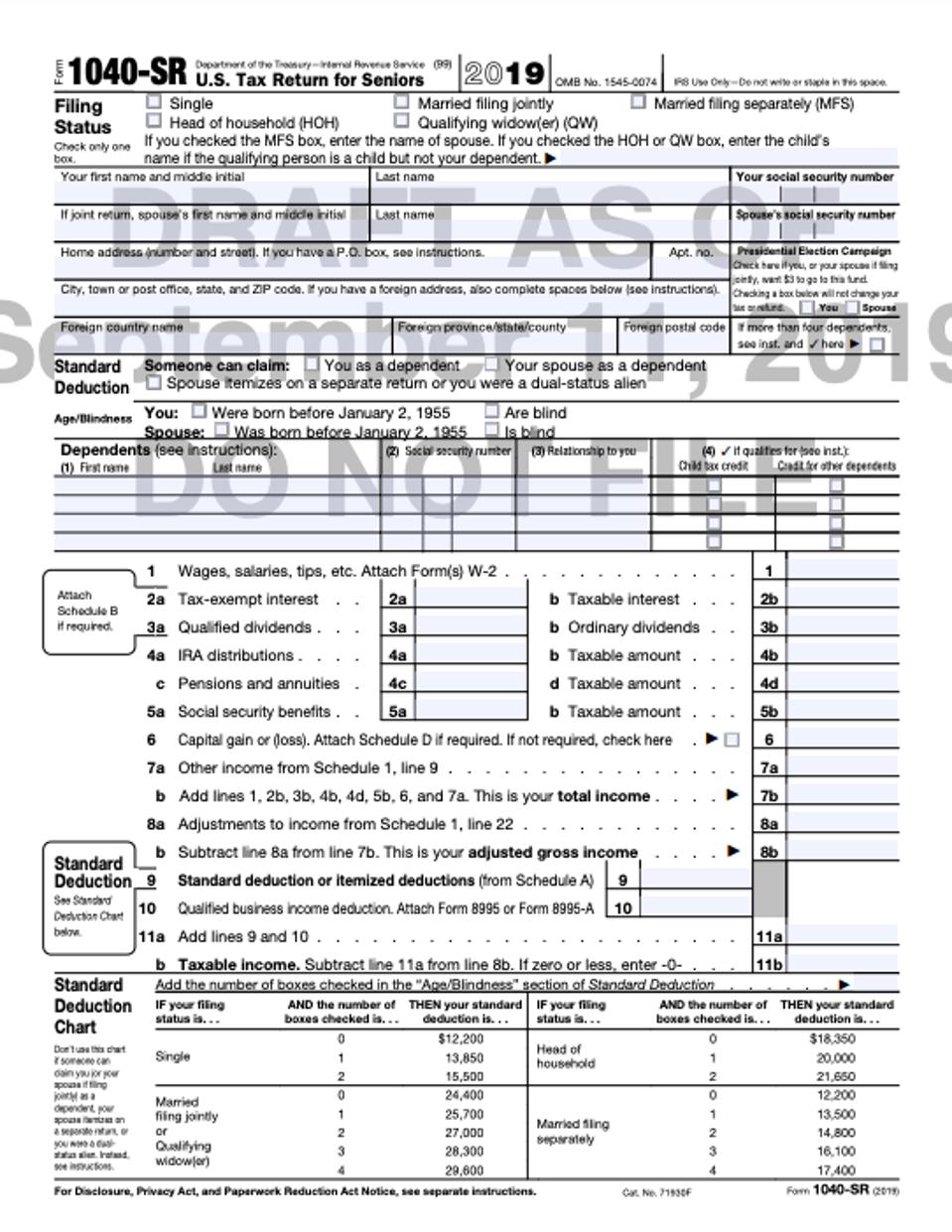

IRS Releases Updated Version Of Tax Form Just For Seniors

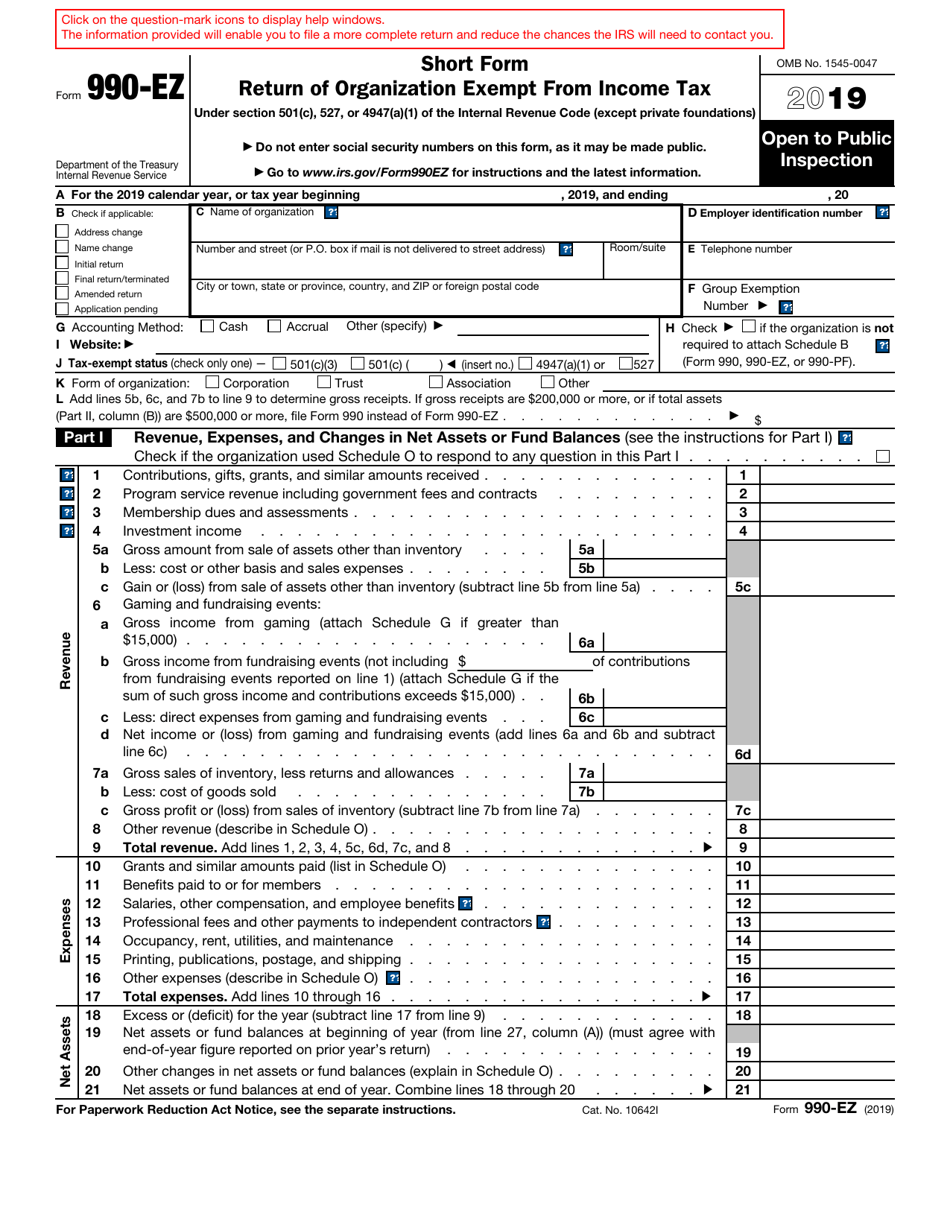

irs pub 4012 2022 Fill Online, Printable, Fillable Blank

Irs 1040 Form The 2018 Form 1040 How It Looks & What It Means For

4012 For 2017 Returns Irs Tax Forms Internal Revenue Service

Irs Tax Forms For 2021 Printable Calendar Template Printable

Irs Form W4V Printable Printable W4v Form Master of

IRS Form 1040 Download Fillable PDF or Fill Online U.S. Individual

Related Post: