Form 1040 Recovery Rebate Credit Worksheet

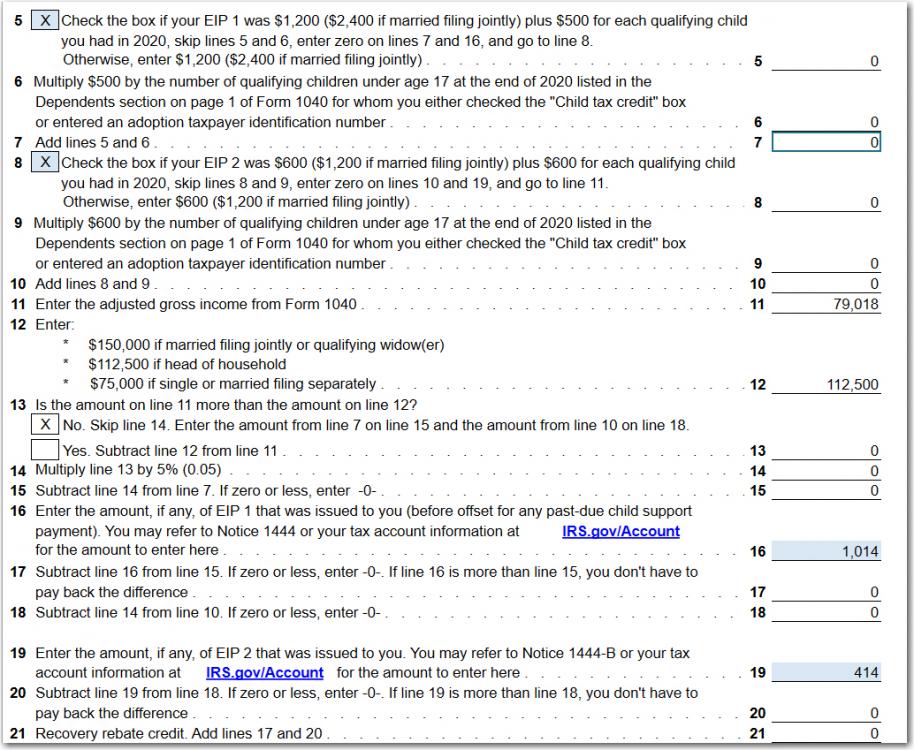

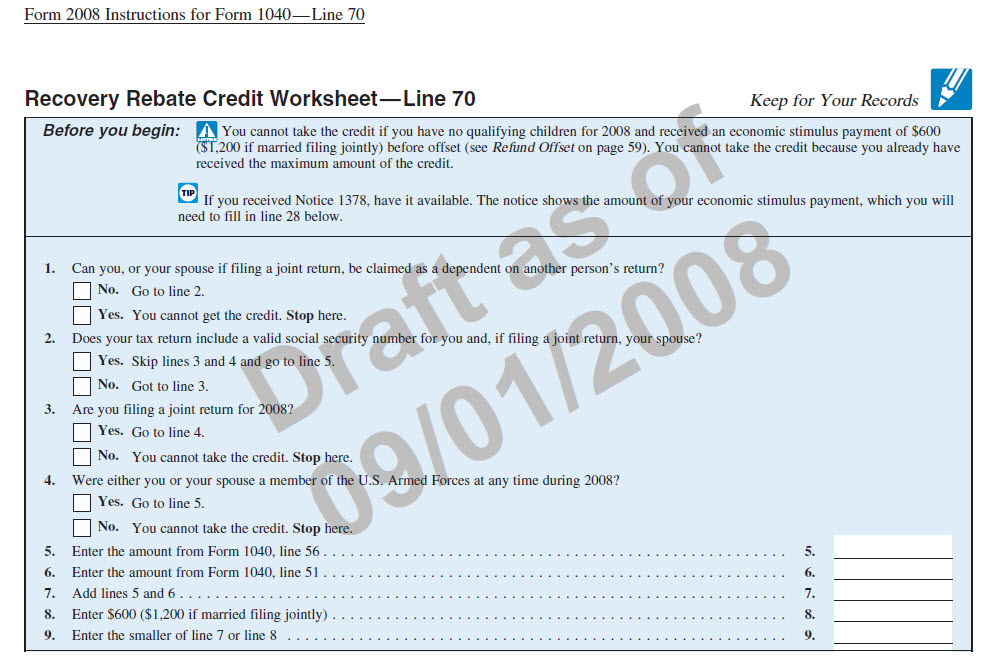

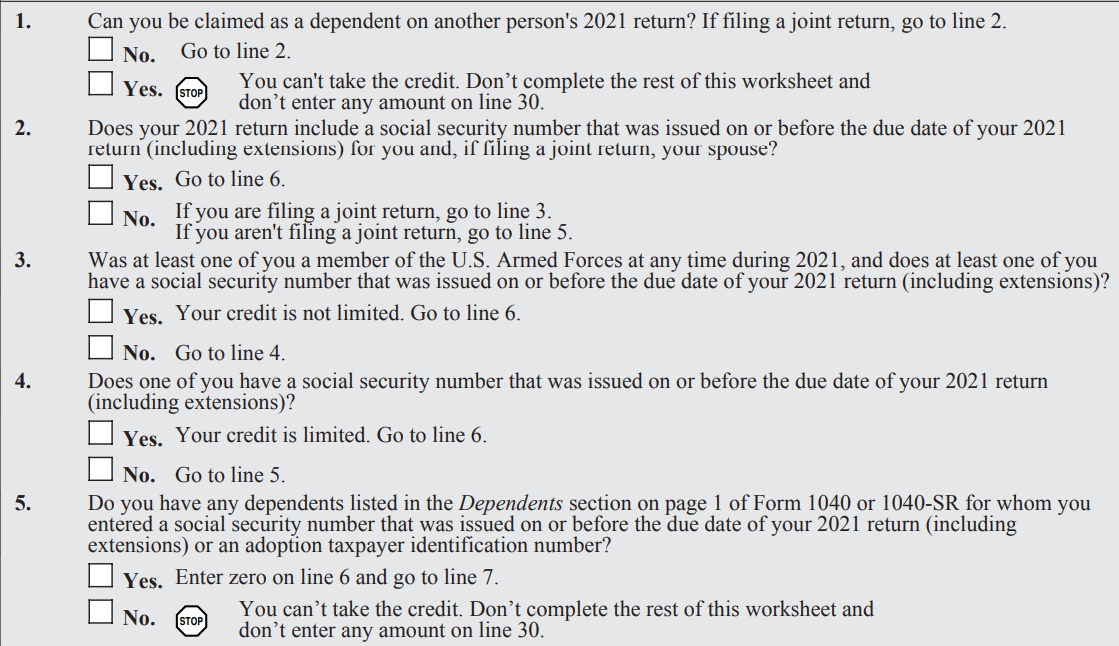

Form 1040 Recovery Rebate Credit Worksheet - See the instructions for line 30 to find out if you can take this credit and for definitions and other. Web recovery rebate credit worksheet explained. You will record the amount. So, even if you pay more tax in 2020 than in 2019, you won’t be required to. Web the recovery rebate credit worksheet can help determine if you are eligible for the credit. Web if you need to return to the the recovery rebate credit worksheet, from the main menu of the tax return (form 1040) select: Web go to the credits > recovery rebate credit worksheet. Web recovery rebate credits are paid to taxpaying taxpayers who are eligible in advance. As the irs indicated, they are reconciling refunds with stimulus payments and the recovery rebate credit claimed on your. Any eligible individual who did not receive any and/or the full amount of the recovery rebate (aka. So, even if you pay more tax in 2020 than in 2019, you won’t be required to. Web if you need to return to the the recovery rebate credit worksheet, from the main menu of the tax return (form 1040) select: Web the recovery rebate credit amount is figured just like the third economic impact (stimulus) payment, except that it. Web the recovery rebate credit was added to 2020 individual tax returns in order to reconcile the economic impact (stimulus) payments issued in 2020. Web more details about the recovery rebate credit are available here at irs.gov. Web if you need to return to the the recovery rebate credit worksheet, from the main menu of the tax return (form 1040). If you're eligible for the recovery rebate credit, you will need the. Any eligible individual who did not receive any and/or the full amount of the recovery rebate (aka. Web the recovery rebate credit amount appears on line 30 of form 1040. Web the recovery rebate credit amount is figured just like the third economic impact (stimulus) payment, except that. Any eligible individual who did not receive any and/or the full amount of the recovery rebate (aka. Web 2020 nmi recovery rebate credit worksheet—line 30. Web if you need to return to the the recovery rebate credit worksheet, from the main menu of the tax return (form 1040) select: Web the recovery rebate credit, as part of the cares act,. Web the recovery rebate credit worksheet can help determine if you are eligible for the credit. See the instructions for line 30 to find out if you can take this credit and for definitions and other. Web recovery rebate credits are paid to taxpaying taxpayers who are eligible in advance. Web if a taxpayer didn't receive these full payments in. If you're eligible for the recovery rebate credit, you will need the. Web the recovery rebate credit, as part of the cares act, makes it possible for any eligible individual who did not receive an economic impact payment (or eip) to claim the missing. As the irs indicated, they are reconciling refunds with stimulus payments and the recovery rebate credit. Any eligible individual who did not receive any and/or the full amount of the recovery rebate (aka. Web recovery rebate credits are paid to taxpaying taxpayers who are eligible in advance. See the instructions for line 30 to find out if you can take this credit and for definitions and other. So, even if you pay more tax in 2020. As the irs indicated, they are reconciling refunds with stimulus payments and the recovery rebate credit claimed on your. Web if you need to return to the the recovery rebate credit worksheet, from the main menu of the tax return (form 1040) select: Web enter the amount in your tax preparation software or in the form 1040 recovery rebate credit. As the irs indicated, they are reconciling refunds with stimulus payments and the recovery rebate credit claimed on your. You will record the amount. Web recovery rebate credits are paid to taxpaying taxpayers who are eligible in advance. Web if you did not receive the full amount of eip3 before december 31, 2021, claim the 2021 recovery rebate credit (rrc). Web recovery rebate credits are paid to taxpaying taxpayers who are eligible in advance. Any eligible individual who did not receive any and/or the full amount of the recovery rebate (aka. Web if you did not receive the full amount of eip3 before december 31, 2021, claim the 2021 recovery rebate credit (rrc) on your 2021 form 1040, u.s. Web. Web more details about the recovery rebate credit are available here at irs.gov. Web if a taxpayer didn't receive these full payments in advance, they may be eligible to claim them on their 2021 individual returns using the recovery rebate credit worksheet. As the irs indicated, they are reconciling refunds with stimulus payments and the recovery rebate credit claimed on your. Web the recovery rebate credit was added to 2020 individual tax returns in order to reconcile the economic impact (stimulus) payments issued in 2020. Web the recovery rebate credit amount appears on line 30 of form 1040. So, even if you pay more tax in 2020 than in 2019, you won’t be required to. Web enter the amount in your tax preparation software or in the form 1040 recovery rebate credit worksheet to calculate your credit. If you're eligible for the recovery rebate credit, you will need the. Web the recovery rebate credit, as part of the cares act, makes it possible for any eligible individual who did not receive an economic impact payment (or eip) to claim the missing. Web if you did not receive the full amount of eip3 before december 31, 2021, claim the 2021 recovery rebate credit (rrc) on your 2021 form 1040, u.s. Web recovery rebate credit worksheet explained. Web 2020 nmi recovery rebate credit worksheet—line 30. Web the recovery rebate credit worksheet can help determine if you are eligible for the credit. Web go to the credits > recovery rebate credit worksheet. You will record the amount. Web if you need to return to the the recovery rebate credit worksheet, from the main menu of the tax return (form 1040) select: See the instructions for line 30 to find out if you can take this credit and for definitions and other. Web the recovery rebate credit amount is figured just like the third economic impact (stimulus) payment, except that it uses your client's tax year 2021 information to. It is calculated on the recovery rebate credit worksheet. Web recovery rebate credits are paid to taxpaying taxpayers who are eligible in advance.Recovery Rebate Credit Worksheet ATX Line 30 COVID19 ATX Community

Recovery Rebate Credit Worksheet « Tax Guru Kertetter Letter

A PSA of sorts the Recovery Rebate Credit on your 2020 tax return

What You Need to Know About Filling Out Your Recovery Rebate Credit

Recovery Rebate Credit Worksheet « Tax Guru Kertetter Letter

Recovery Rebate Credit Worksheet Explained Support

What is the Recovery Rebate Credit? CD Tax & Financial

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

How do I claim the Recovery Rebate Credit on my tax return?

Related Post: