Form 5471 Schedule O

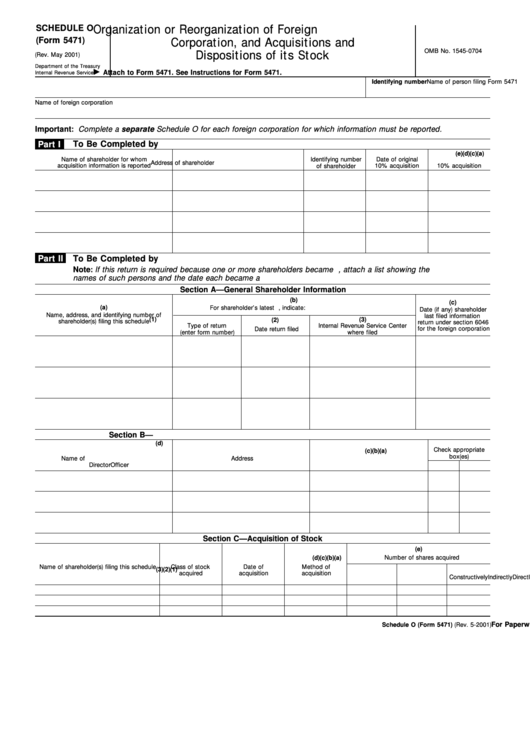

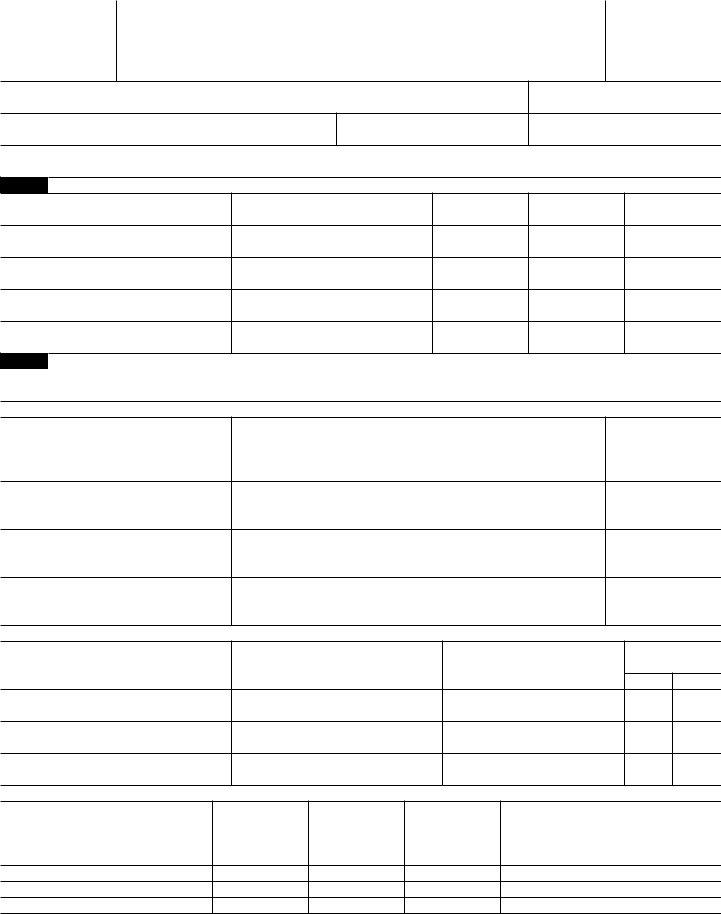

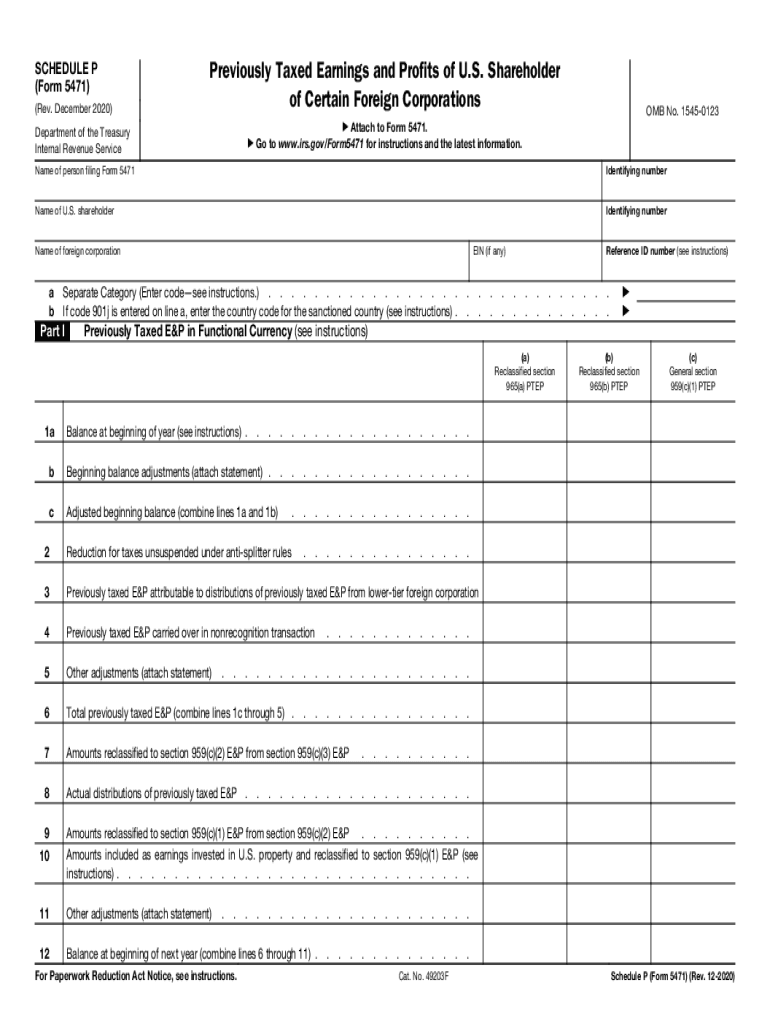

Form 5471 Schedule O - Web how to generate form 5471 in proconnect tax. Ad access irs tax forms. Web schedule o, part i, organization or reorg of foreign corporation, and acquisitions and dispositions of its stock. Web schedule o (form 5471) instructions schedule o. Changes to separate schedule o. Shareholder of certain foreign corporations foreign. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. The december 2021 revision of separate. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. Ad our friendly tax attorneys are here to help. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. Get ready for tax season deadlines by completing any required tax forms today. Web form 5471 (schedule p) previously taxed earnings and profits of u.s. Web changes to separate schedule e (form 5471).. Schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition. Web for example, you might need to complete form 5471 schedule o. Shareholder of certain foreign corporations 1220 12/04/2020 form 5471 (schedule o) organization. No changes have been made to schedule m (form 5471). Web schedule o, part i, organization or. Web changes to separate schedule e (form 5471). Get ready for tax season deadlines by completing any required tax forms today. Web instructions for form 5471(rev. Web attach to form 5471. This article will help you generate form 5471 and. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. January 2021) (use with the december 2020 revision. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. This is the sixth of a series of articles designed. Name of person filing form 5471. Web schedule o is used to report the organization or reorganization of a foreign corporation and the. Web changes to separate schedule m (form 5471). Web we last updated the organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock in february 2023, so this is the latest version of. “organization or reorganization of foreign corporation, and acquisitions and. Web schedule o of form 5471 is used to report the organization or reorganization of. Web changes to separate schedule m (form 5471). What is 5471 schedule o form? This article will help you generate form 5471 and. The december 2021 revision of separate. Shareholder of certain foreign corporations foreign. Ad our friendly tax attorneys are here to help. Ad access irs tax forms. Solved•by intuit•4•updated december 14, 2022. Shareholder of certain foreign corporations foreign. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Shareholder of certain foreign corporations 1220 12/04/2020 form 5471 (schedule o) organization. Changes to separate schedule o. Use the december 2018 revision. Web schedule o (form 5471) instructions schedule o. Web attach to form 5471. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Changes to separate schedule o. Shareholder of certain foreign corporations 1220 12/04/2020 form 5471 (schedule o) organization. Web schedule o of form 5471 is used to report the organization or reorganization of a foreign corporation and the. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Name of person filing form 5471. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. This article will take a deep. Web attach to form 5471. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web we last updated the organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock in february 2023, so this is the latest version of. Our experienced tax attorneys will handle it all. Schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition. Persons with respect to certain foreign corporations. Web schedule o of form 5471 is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Shareholder of certain foreign corporations foreign. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Ein (if any) reference id number (see. Solved•by intuit•4•updated december 14, 2022. This is the sixth of a series of articles designed. This article will help you generate form 5471 and. The december 2021 revision of separate. Web changes to separate schedule e (form 5471).20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Substantial Compliance Form 5471 HTJ Tax

IRS Form 5471 Returns for U.S. Persons WRT Foreign Companies

Fillable Form 5471 (Schedule O), (Rev. May 2001) Organization Or

Forms 1118 And 5471

IRS Issues Updated New Form 5471 What's New?

INVESTING IN A FOREIGN CORPORATION TAX PLAN SCHEDULE O FORM 5471 YouTube

Form 5471 Schedule O ≡ Fill Out Printable PDF Forms Online

5471 Schedule P Form Fill Out and Sign Printable PDF Template signNow

Form 5471 Schedule O Papers Organization Stock Illustration 2106683516

Related Post: