Form 1040 Line 15A

Form 1040 Line 15A - Line 15b make the percentage allocation of your income on line 15a by dividing the. Web certain specified assets require completion of boxes 15a and 15b. These assets and their corresponding codes are as follows: Then, report $0 as the taxable portion of the distribution on line 15b of. Web for 2019, none of the qualified 2016 disaster distribution is included in income. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). If distribution codes j, q, or t are used in box 7 on screen 1099r, located under the retirement folder, and the ira/sep/simple. For official irs tax form instructions, go to forms and instructions. This year line 1 is expanded and there are new lines 1a through 1z. 13 capital gain or (loss). These assets and their corresponding codes are as follows: Ad save time and money with professional tax planning & preparation services. Stock or other ownership interest. Web on 1040, line 15a would be 5500 and line 15b would be 50. Then, report $0 as the taxable portion of the distribution on line 15b of. These assets and their corresponding codes are as follows: I know the form is not really clear, but if you are converting a nondeuctible ira into roth ira, the. Web education credits from form 8863, line 19. Line 15b make the percentage allocation of your income on line 15a by dividing the. If distribution codes j, q, or t are. Attach form 4797 14 15a total ira distributions 15a. If using form 1040a, it goes on line 11a. I know the form is not really clear, but if you are converting a nondeuctible ira into roth ira, the. Web usually, if the amount is fully taxable, line 15a is left blank and the total distribution is entered on line 15b.. Web schedule a (form 940) for 2020: Ad save time and money with professional tax planning & preparation services. Attach form 4797 14 15a total ira distributions 15a. Ad discover helpful information and resources on taxes from aarp. I know the form is not really clear, but if you are converting a nondeuctible ira into roth ira, the. Web line 15a total the figures entered in each of the columns (a, b, and c) from lines 7 through 14b. If not required, check here 13 14 other gains or (losses). Ad our experienced tax attorneys will handle it all. Ad save time and money with professional tax planning & preparation services. Exceptions to this are listed in the. Pay the lowest amount of taxes possible with strategic planning and preparation Line 15b make the percentage allocation of your income on line 15a by dividing the. Web if you use form 1040 to file your taxes, you report conversions from a traditional ira on line 15, entering the total amount on line 15a and the taxable portion. I know. Calculate the taxable portion of your roth ira withdrawal using form 8606. But if either you or your spouse was born before january 2, 1951, multiply line 2 by 7.5% (.075) instead. Line 15b make the percentage allocation of your income on line 15a by dividing the. Form 1040, lines 15a and 15b double. Web on line 15a of form. Web on line 15a of form 1040 or line 11a of form 1040a, report the entire amount of the distribution. Form 1040, lines 15a and 15b double. Some amounts that in prior years were reported on. I know the form is not really clear, but if you are converting a nondeuctible ira into roth ira, the. Enter your status, income,. If distribution codes j, q, or t are used in box 7 on screen 1099r, located under the retirement folder, and the ira/sep/simple. Then, report $0 as the taxable portion of the distribution on line 15b of. Stock or other ownership interest. For official irs tax form instructions, go to forms and instructions. Ad discover helpful information and resources on. Enter your status, income, deductions and credits and estimate your total taxes. 15a contains the correct amount while 15b has a much smaller amount. Web line 15a total the figures entered in each of the columns (a, b, and c) from lines 7 through 14b. Web schedule a (form 940) for 2020: Line 15b make the percentage allocation of your. Attach schedule d if required. Attach schedule 8812, if required. Web can you tell me how to fix form 1040 line 15a and 15b? Attach form 4797 14 15a total ira distributions 15a. Stock or other ownership interest. Calculate the taxable portion of your roth ira withdrawal using form 8606. Web on line 15a of form 1040 or line 11a of form 1040a, report the entire amount of the distribution. Line 15b make the percentage allocation of your income on line 15a by dividing the. Some amounts that in prior years were reported on. Et the support you need to resolve your tax issues today. Ad our experienced tax attorneys will handle it all. Then, report $0 as the taxable portion of the distribution on line 15b of. 13 capital gain or (loss). Web if you use form 1040 to file your taxes, you report conversions from a traditional ira on line 15, entering the total amount on line 15a and the taxable portion. Web if you're using form 1040, it goes on line 15a; Ad save time and money with professional tax planning & preparation services. Form 1040, lines 15a and 15b double. Enter your status, income, deductions and credits and estimate your total taxes. Ad discover helpful information and resources on taxes from aarp. Web the estate or trust must report the extraterritorial income exclusion on line 15a of form 1041, page 1.Irs Form 1040 Plus Schedules C And Se Schedule C Self Employment

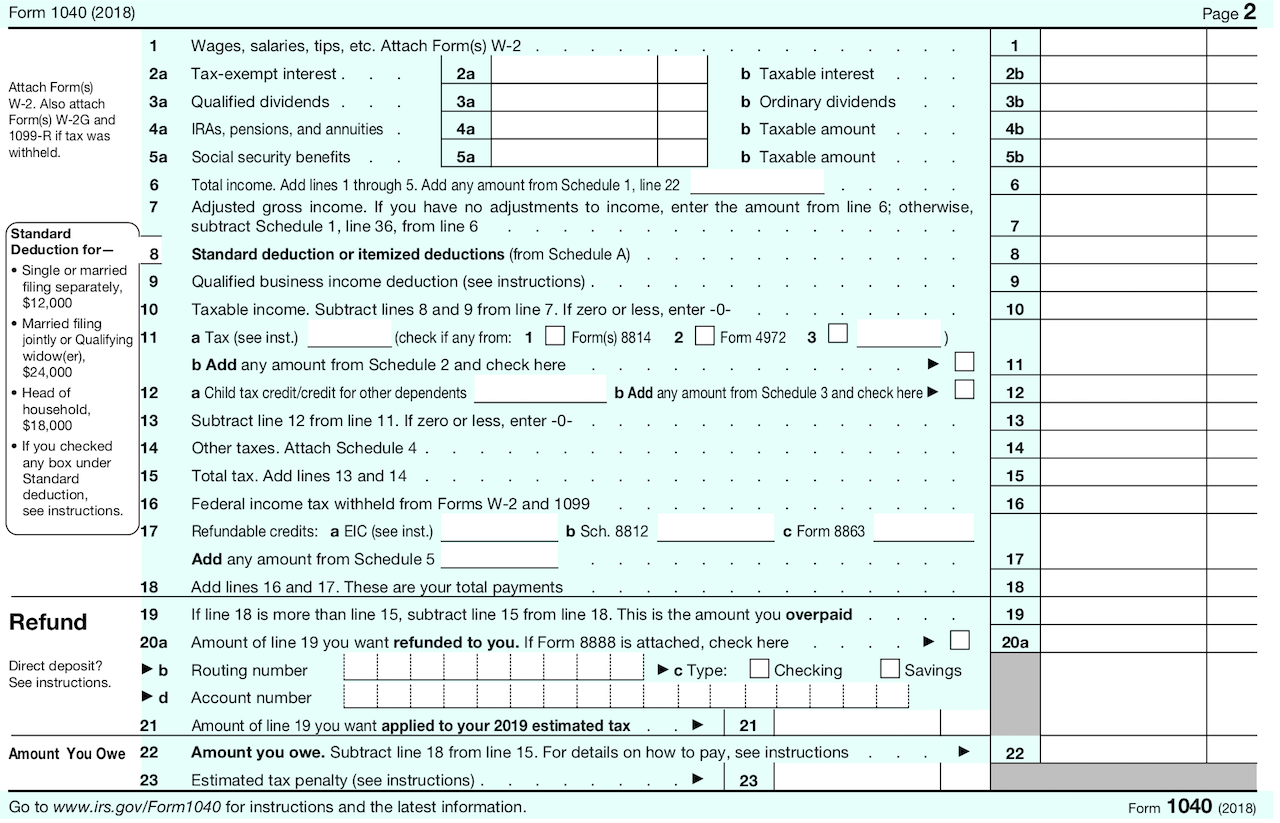

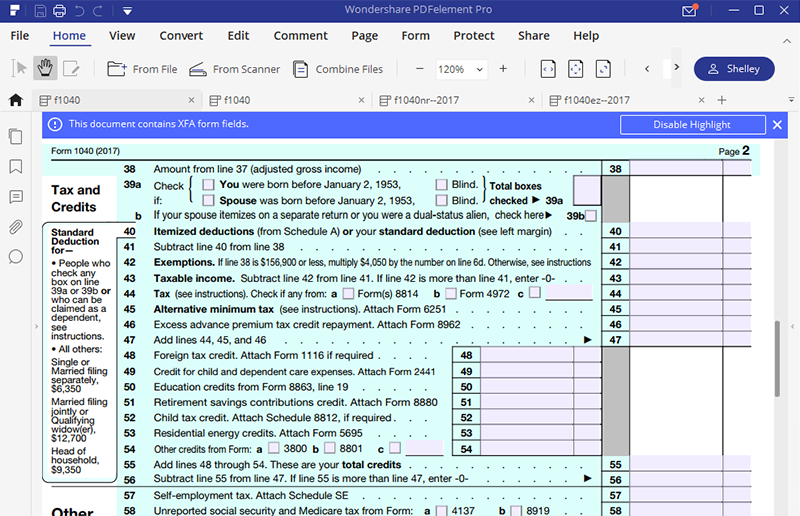

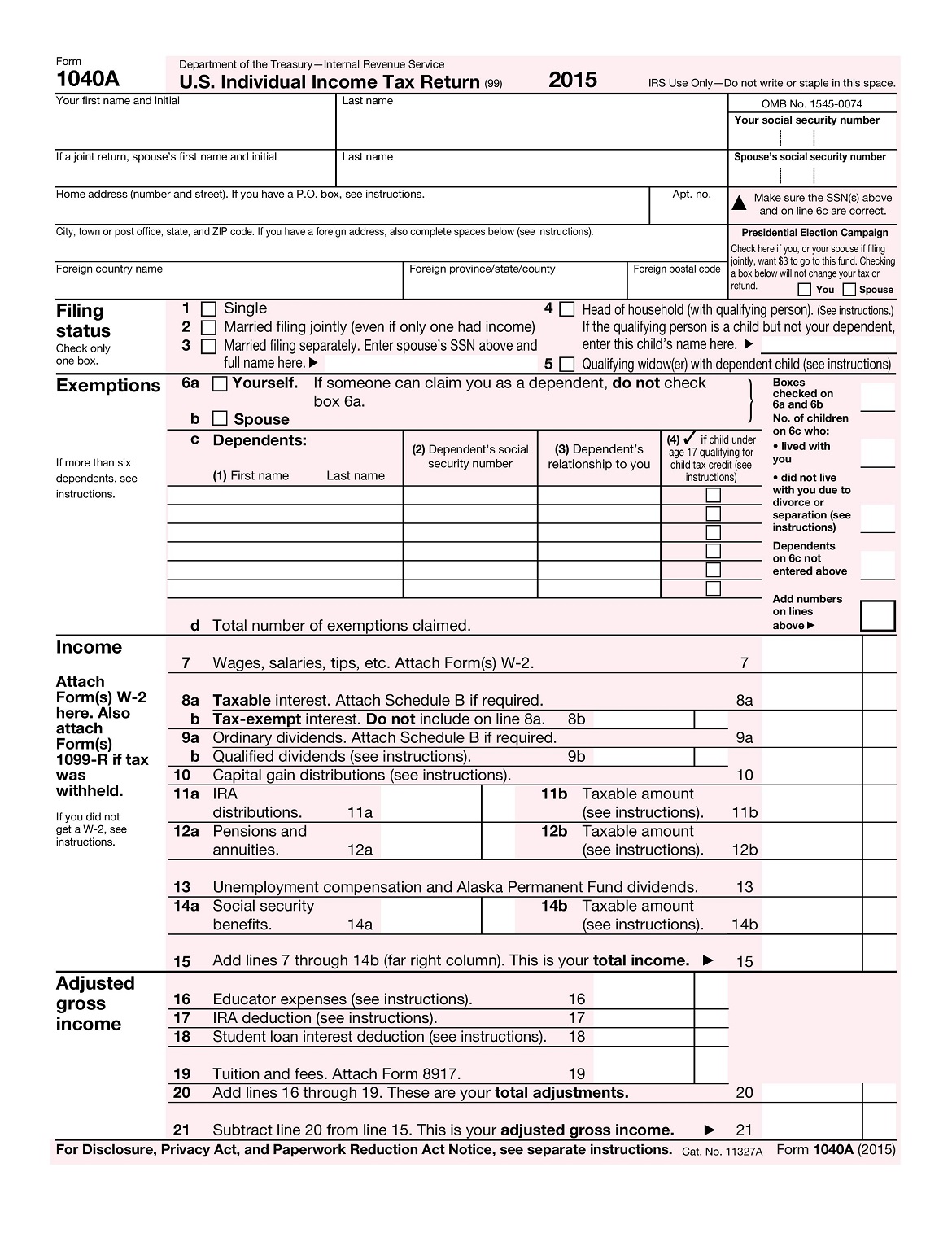

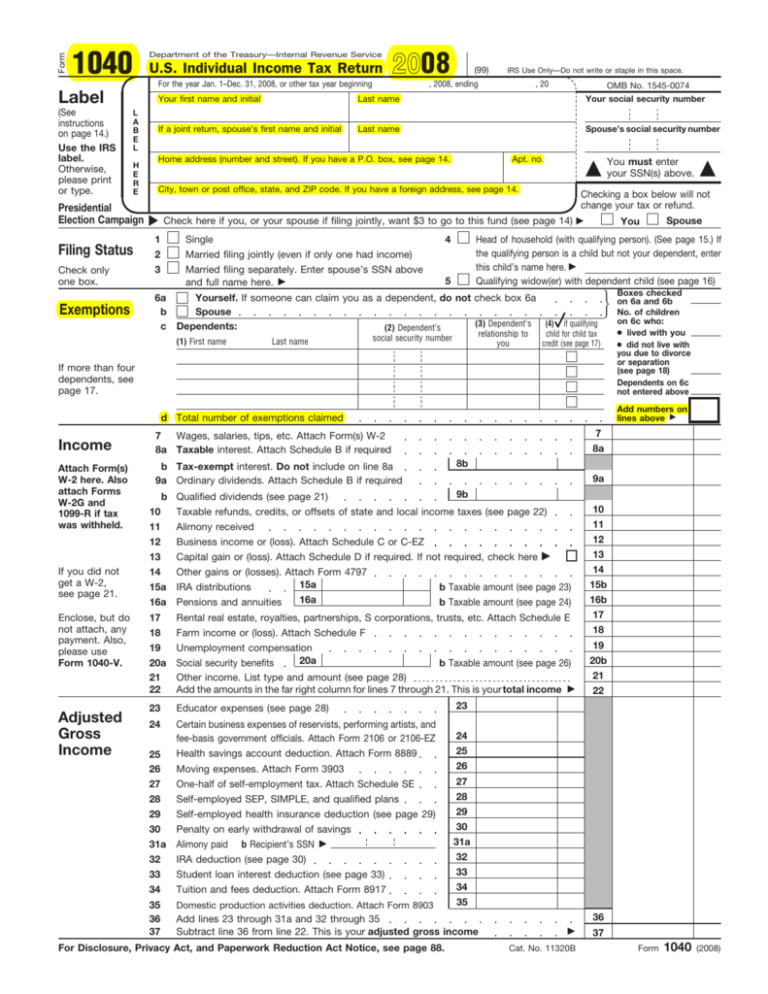

Irs Form 1040 Line 15a And 15b Form Resume Examples

Irs Form 1040 Line 15a And 15b Form Resume Examples

IRS Form 1040 How To Fill It Wisely 1040 Form Printable

1040a 2016 Printable Form Master of Documents

Irs Form 1040 Line 15a And 15b Form Resume Examples

Irs Form 1040 Line 15a And 15b Form Resume Examples

Earth and Space News 2015 Form 1040A Mailing Addresses Where to Mail

1040 U S Individual Tax Return Filing Status 2021 Tax Forms

How to report a 1099 R rollover to your self directed 401k YouTube

Related Post: