Kansas K40 Form

Kansas K40 Form - Web if you use this form for a tax year other than is intended, it. Web adjusted gross income chart for use tax computation. Try it for free now! With a request to submit your information on the proper form. Enter the total number of exemptions in the total kansas exemptions box. Do not send the kansas department of revenue a copy of your form. Web enter the result here and on line 18 of this form. Must have filed a kansas tax return in. Any partnership or s corporation required to file a kansas income tax return may elect to file a composite. Web important information for the 2019 tax year. To prepay your kansas income tax through. Web adjusted gross income chart for use tax computation. Any partnership or s corporation required to file a kansas income tax return may elect to file a composite. Web you must make estimated tax payments if your estimated kansas income tax after withholding and credits is $500 or more and your withholding and. With a request to submit your information on the proper form. Do not send the kansas department of revenue a copy of your form. Complete, edit or print tax forms instantly. Must have filed a kansas tax return in. Web enter the result here and on line 18 of this form: Web adjusted gross income chart for use tax computation. With a request to submit your information on the proper form. Must have filed a kansas tax return in. Any partnership or s corporation required to file a kansas income tax return may elect to file a composite. Web enter the result here and on line 18 of this form: To prepay your kansas income tax through. With a request to submit your information on the proper form. Web enter the result here and on line 18 of this form. Web you must make estimated tax payments if your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. Instead,. Must have filed a kansas tax return in. Do not send the kansas department of revenue a copy of your form. With a request to submit your information on the proper form. Web if you use this form for a tax year other than is intended, it. Web you must make estimated tax payments if your estimated kansas income tax. Kansas income tax, kansas dept. Web you must make estimated tax payments if your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. Web enter the result here and on line 18 of this form: Must have filed a kansas tax return in. Any partnership or s corporation required. Complete, edit or print tax forms instantly. Any partnership or s corporation required to file a kansas income tax return may elect to file a composite. Web if you use this form for a tax year other than is intended, it. Web you must make estimated tax payments if your estimated kansas income tax after withholding and credits is $500. Enter the total number of exemptions in the total kansas exemptions box. Kansas income tax, kansas dept. Web adjusted gross income chart for use tax computation. Web enter the result here and on line 18 of this form. Try it for free now! Upload, modify or create forms. Web enter the result here and on line 18 of this form: Kansas income tax, kansas dept. Complete, edit or print tax forms instantly. Web adjusted gross income chart for use tax computation. Kansas income tax, kansas dept. Web enter the result here and on line 18 of this form: Web adjusted gross income chart for use tax computation. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Complete, edit or print tax forms instantly. You can download or print current. With a request to submit your information on the proper form. Try it for free now! Web adjusted gross income chart for use tax computation. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Instead, it will be returned to you. Enter the total number of exemptions in the total kansas exemptions box. Web if you use this form for a tax year other than is intended, it. Upload, modify or create forms. Web you must make estimated tax payments if your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. Kansas income tax, kansas dept. Must have filed a kansas tax return in. Do not send the kansas department of revenue a copy of your form. Any partnership or s corporation required to file a kansas income tax return may elect to file a composite. Web enter the result here and on line 18 of this form. Web important information for the 2019 tax year. To prepay your kansas income tax through. Kansas income tax, kansas dept. Complete, edit or print tax forms instantly. Web enter the result here and on line 18 of this form:Kansas k40 form Fill out & sign online DocHub

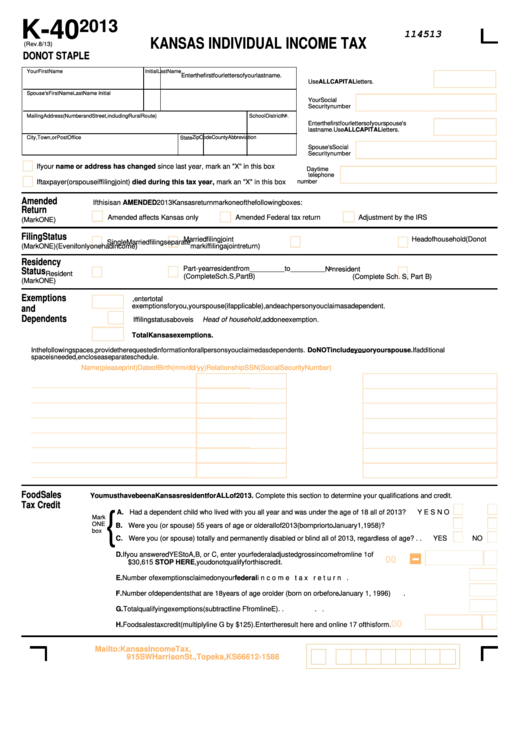

Fillable Form K40 Kansas Individual Tax 2013 printable pdf

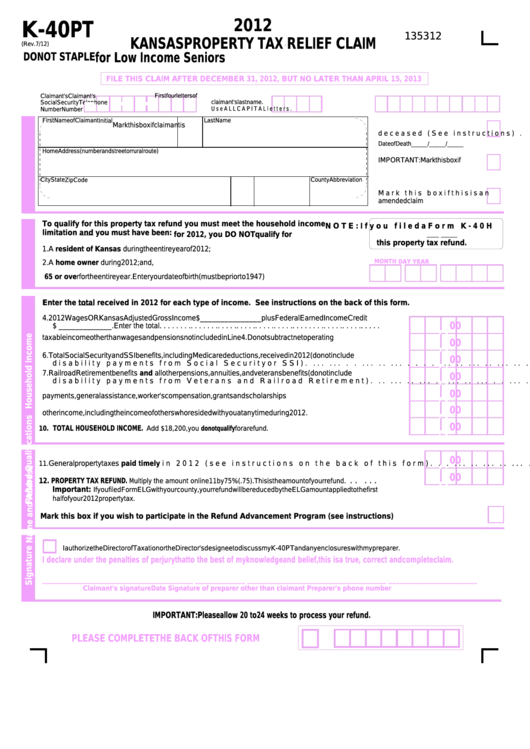

Fillable Form K40 Pt Kansas Property Tax Relief Claim 2012

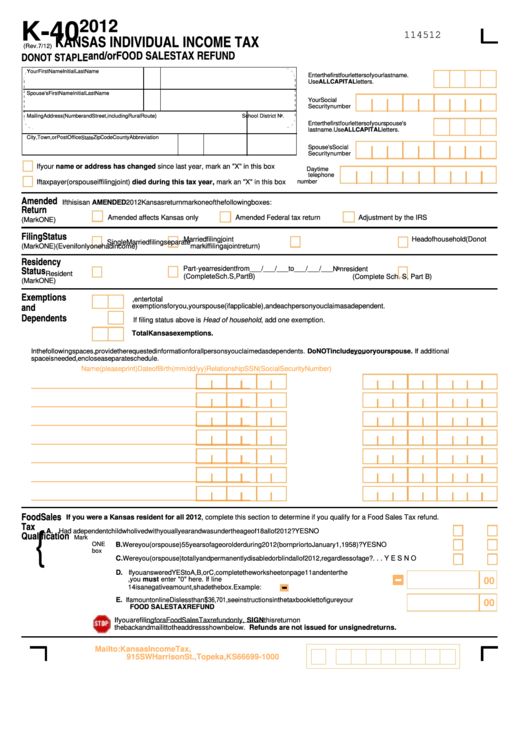

K40 2012 Kansas Individual Tax printable pdf download

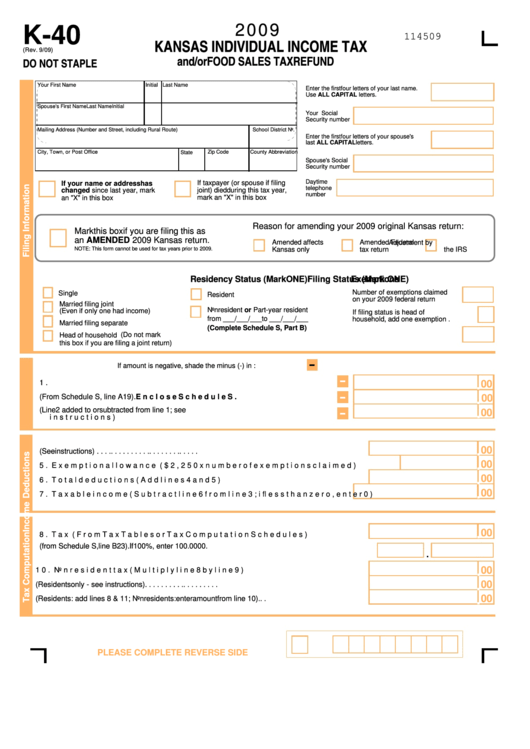

Fillable Form K40 Kansas Individual Tax And/or Food Sales Tax

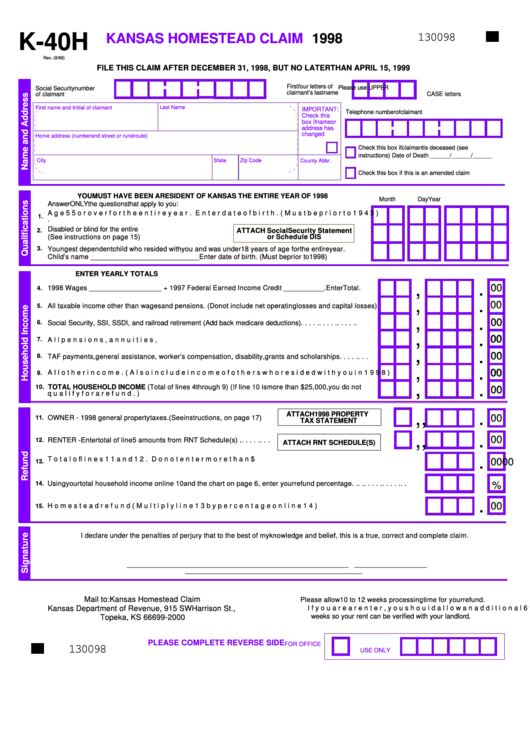

Fillable Form K40h Kansas Homestead Claim Kansas Department Of

Kansas K4 App

Kansas k4 form 2019 Fill out & sign online DocHub

Kansas K 40 Form ≡ Fill Out Printable PDF Forms Online

Form K 40 Kansas Individual Tax YouTube

Related Post: