Form 8915-F

Form 8915-F - You can choose to use worksheet 1b even if you are not required to do so. Streamlined document workflows for any industry. I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). Web when and where to file. It is used to report qualified disaster distributions, qualified distributions received for the purchase or construction of a. There are instances when the projected availability date gets pushed back to ensure we've accurately incorporated the form into the turbotax. It also allows you to spread the taxable portion of the. Starting in tax year 2022,. Find forms for your industry in minutes. Web for 2019, none of the qualified 2016 disaster distribution is included in income. Starting in tax year 2022,. The timing of your distributions and repayments will determine. January 2023) qualified disaster retirement plan distributions and repayments. Find forms for your industry in minutes. You can choose to use worksheet 1b even if you are not required to do so. It is used to report qualified disaster distributions, qualified distributions received for the purchase or construction of a. You can choose to use worksheet 1b even if you are not required to do so. It also allows you to spread the taxable portion of the. January 2023) qualified disaster retirement plan distributions and repayments. There are instances when the projected. See worksheet 1b, later, to determine whether you must use worksheet 1b. You can choose to use worksheet 1b even if you are not required to do so. Streamlined document workflows for any industry. Starting in tax year 2022,. It also allows you to spread the taxable portion of the. There are instances when the projected availability date gets pushed back to ensure we've accurately incorporated the form into the turbotax. The timing of your distributions and repayments will determine. See worksheet 1b, later, to determine whether you must use worksheet 1b. It is used to report qualified disaster distributions, qualified distributions received for the purchase or construction of a.. You can choose to use worksheet 1b even if you are not required to do so. Web please download the february 2022 revision of the instructions pdf for the revised text. See worksheet 1b, later, to determine whether you must use worksheet 1b. The timing of your distributions and repayments will determine. It is used to report qualified disaster distributions,. (january 2022) qualified disaster retirement plan distributions and repayments. Web when and where to file. There are instances when the projected availability date gets pushed back to ensure we've accurately incorporated the form into the turbotax. See worksheet 1b, later, to determine whether you must use worksheet 1b. You can choose to use worksheet 1b even if you are not. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web please download the february 2022 revision of the instructions pdf for the revised text. Starting in tax year 2022,. January 2023) qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to do so. Web this takes some time. You can choose to use worksheet 1b even if you are not required to do so. The timing of your distributions and repayments will determine. I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). There are instances when the projected availability date gets pushed back. The timing of your distributions and repayments will determine. There are instances when the projected availability date gets pushed back to ensure we've accurately incorporated the form into the turbotax. Web this takes some time. Web please download the february 2022 revision of the instructions pdf for the revised text. Web for 2019, none of the qualified 2016 disaster distribution. Web when and where to file. It is used to report qualified disaster distributions, qualified distributions received for the purchase or construction of a. January 2023) qualified disaster retirement plan distributions and repayments. It also allows you to spread the taxable portion of the. Web this takes some time. Web this takes some time. See worksheet 1b, later, to determine whether you must use worksheet 1b. Streamlined document workflows for any industry. Web please download the february 2022 revision of the instructions pdf for the revised text. Starting in tax year 2022,. Find forms for your industry in minutes. Web for 2019, none of the qualified 2016 disaster distribution is included in income. I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). See worksheet 1b, later, to determine whether you must use worksheet 1b. Web when and where to file. It also allows you to spread the taxable portion of the. January 2023) qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to do so. The timing of your distributions and repayments will determine. You can choose to use worksheet 1b even if you are not required to do so. It is used to report qualified disaster distributions, qualified distributions received for the purchase or construction of a. There are instances when the projected availability date gets pushed back to ensure we've accurately incorporated the form into the turbotax. (january 2022) qualified disaster retirement plan distributions and repayments.form 8915 e instructions turbotax Renita Wimberly

Form 8915 Turbotax 2023 Printable Forms Free Online

Fillable Online Form 8915F (Rev. January 2023). Qualified Disaster

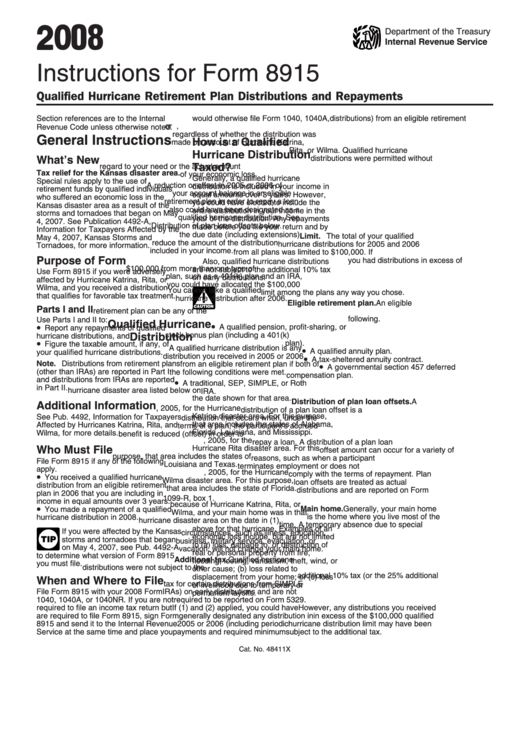

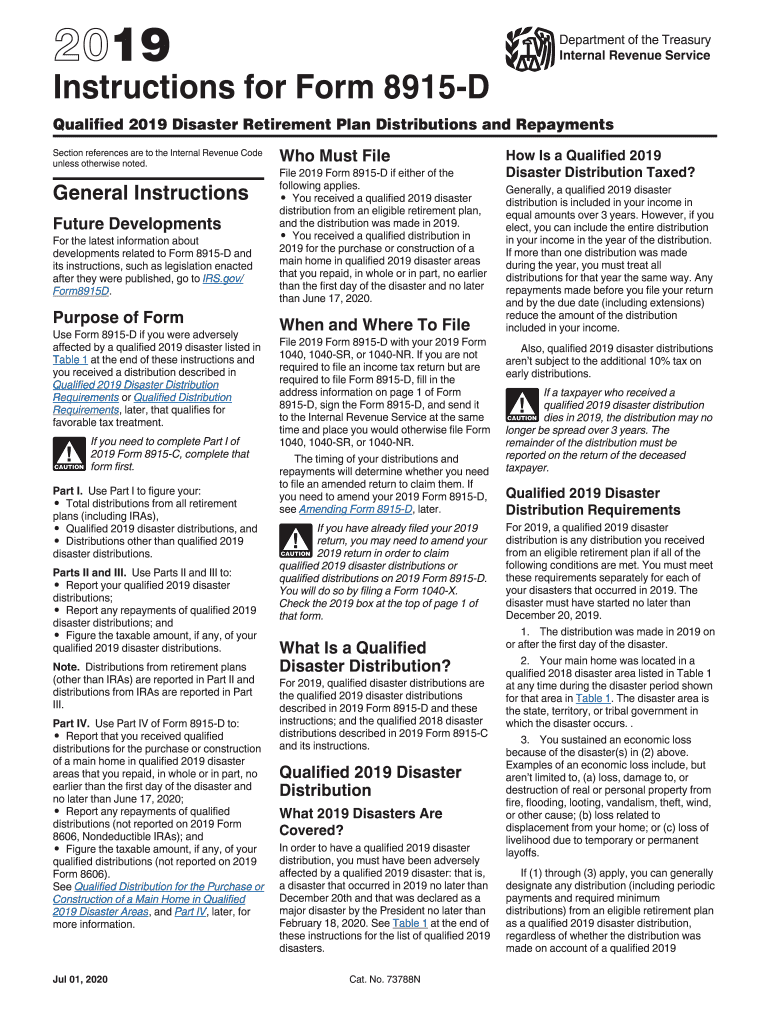

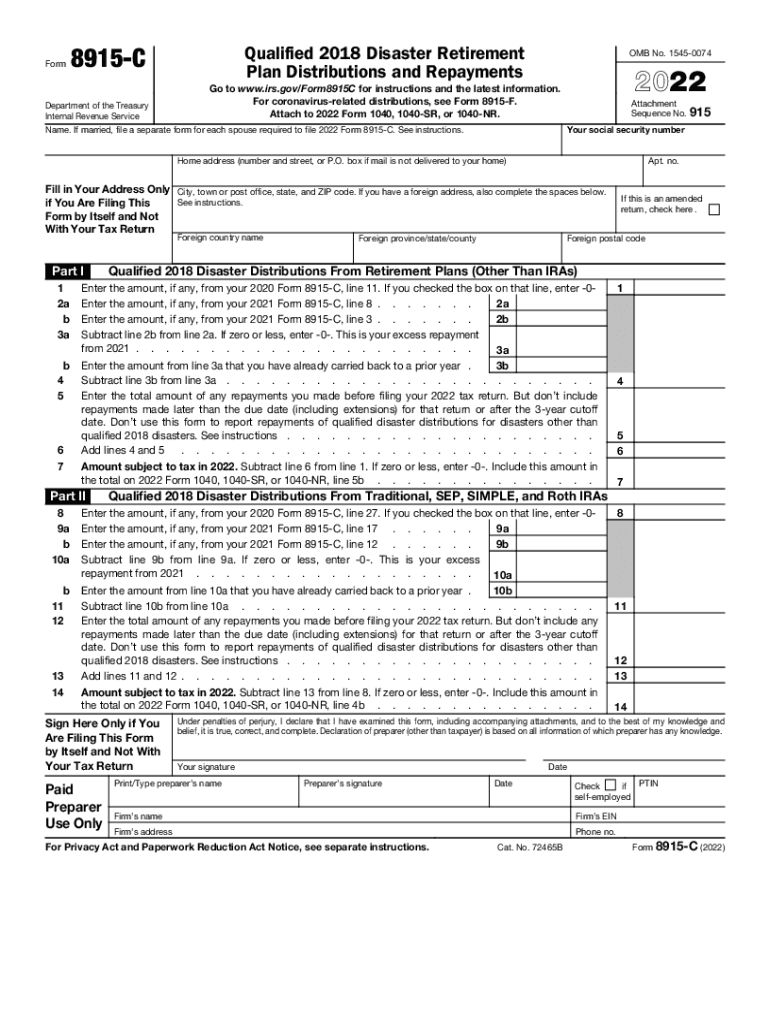

Instructions For Form 8915 2008 printable pdf download

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Form 8915 Qualified Hurricane Retirement Plan Distributions and

Form 8915 F T 2023 Printable Forms Free Online

Fill Free fillable Form 8915E Plan Distributions and Repayments

Instructions 8915 Fill Out and Sign Printable PDF Template signNow

About Form 8915F, Qualified Disaster Retirement Plan Distributions and

Related Post: