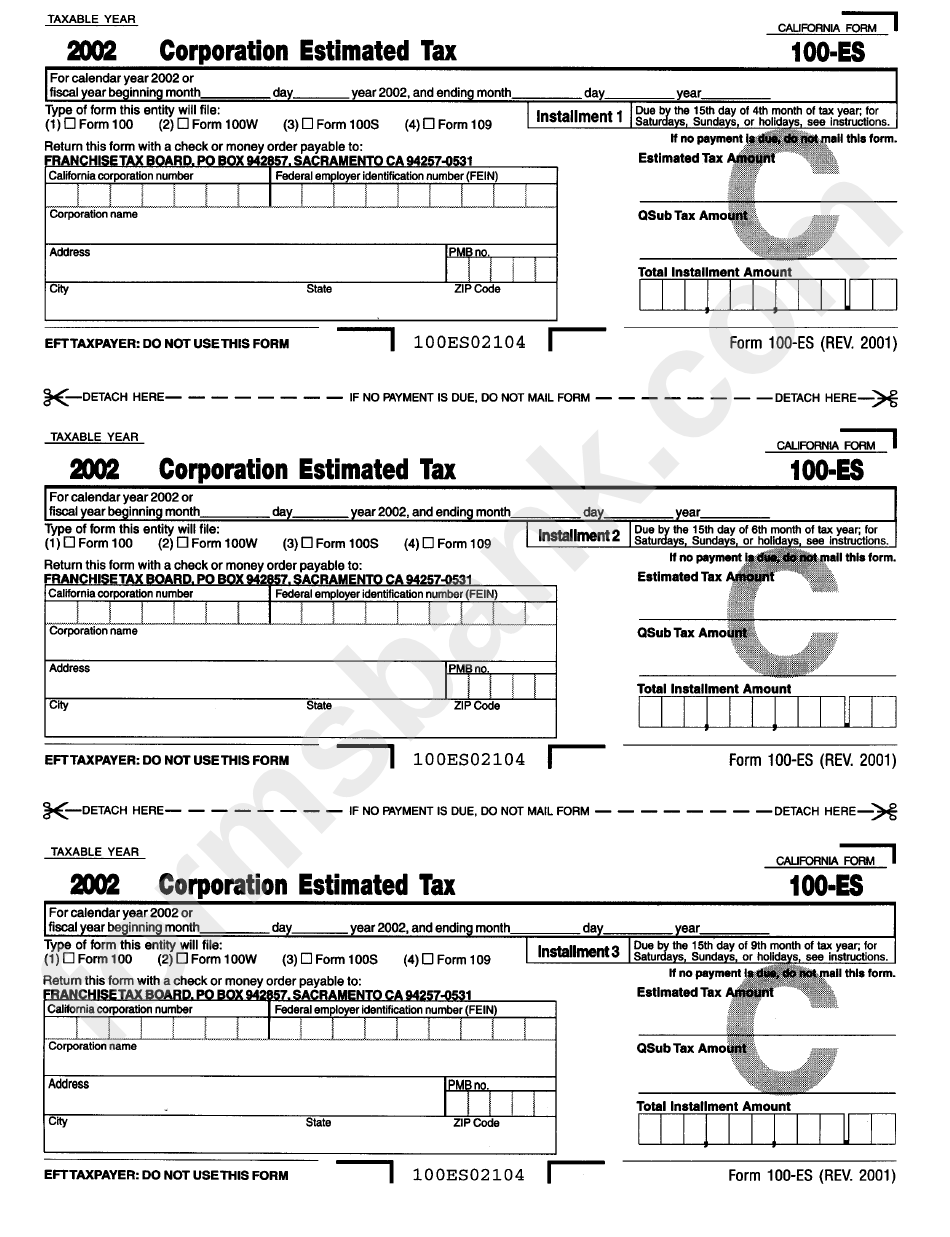

Ca Form 100 Es

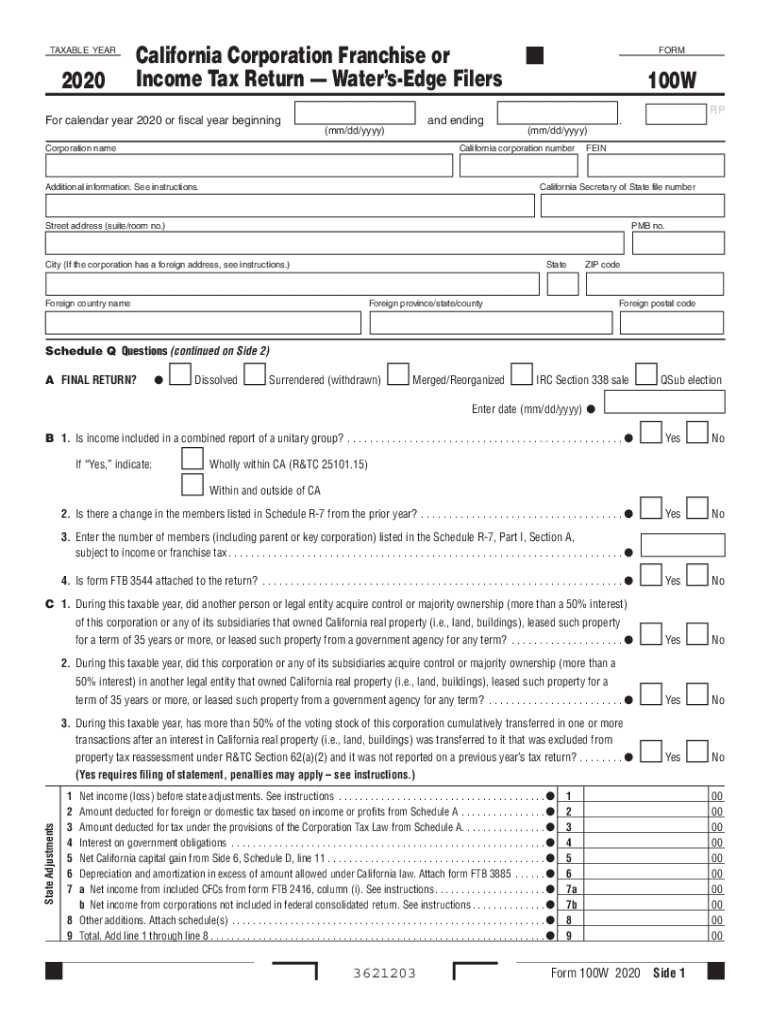

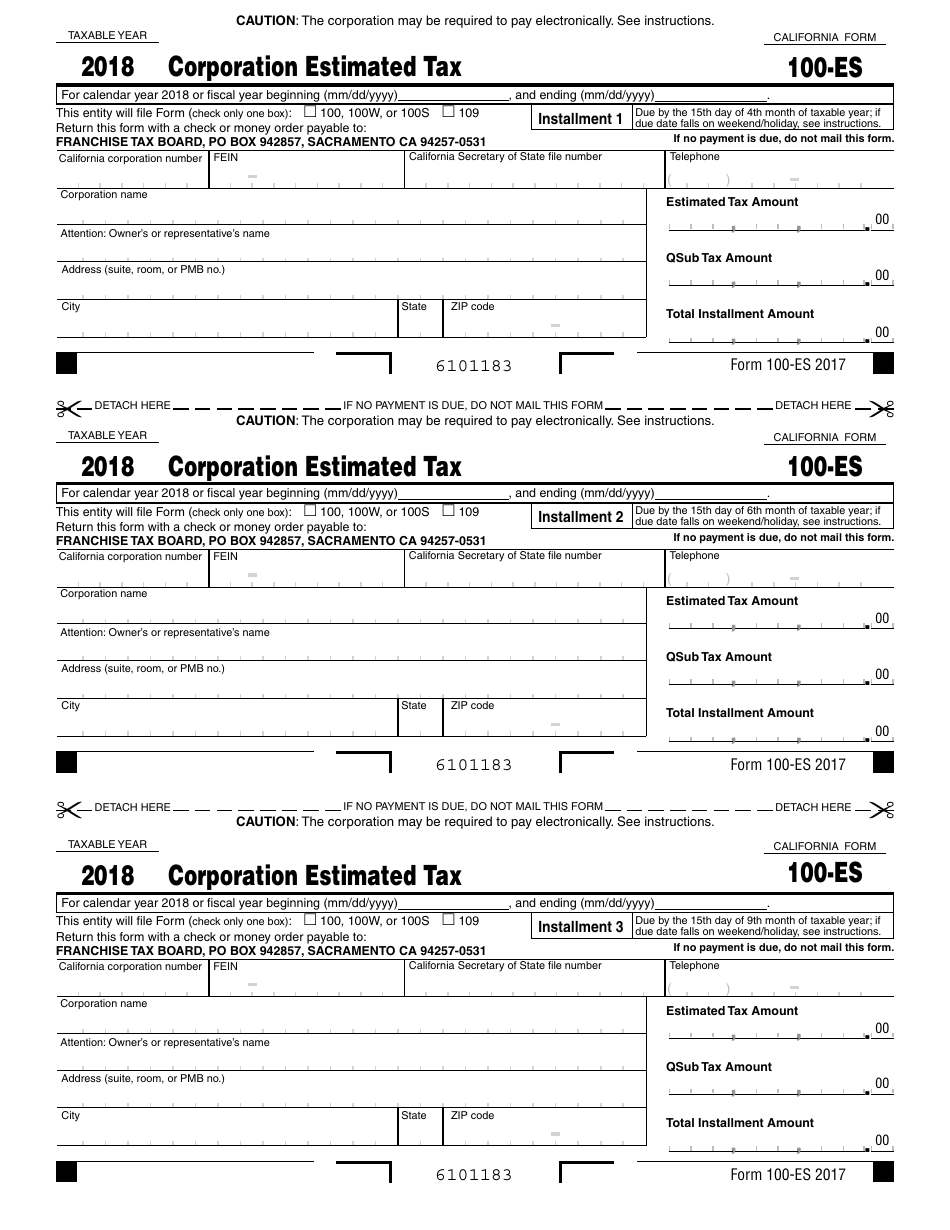

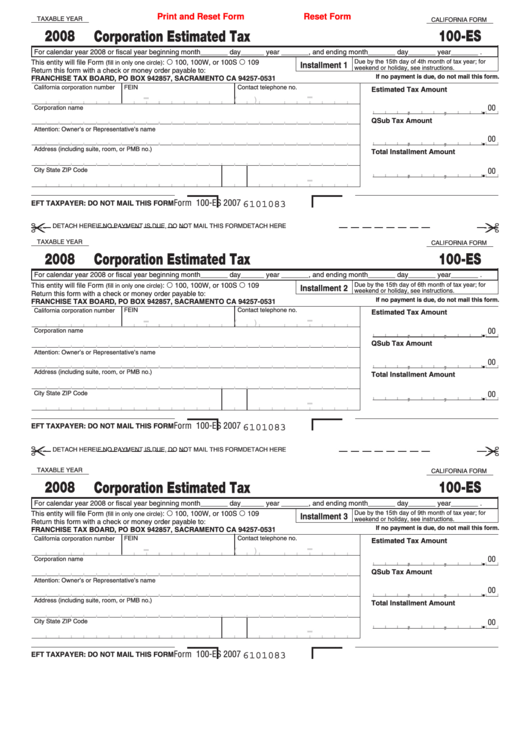

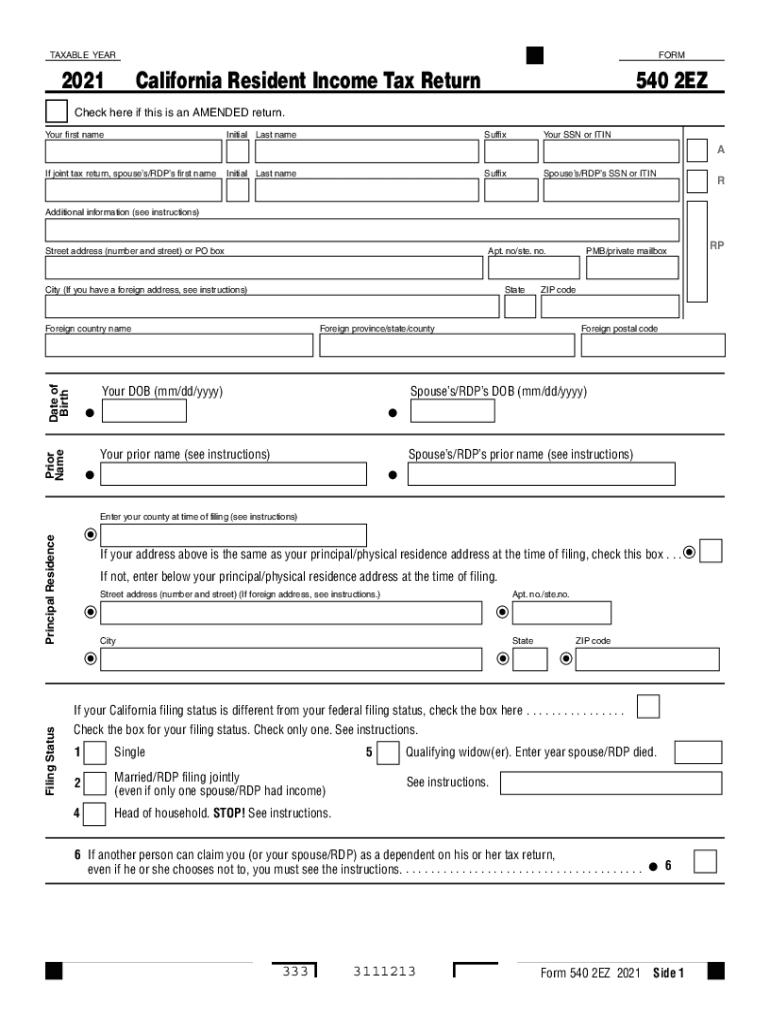

Ca Form 100 Es - The corporation may be required to pay electronically. Corporations are required to pay the following percentages of the estimated. M 100, 100w, or 100s m. Fill in the requested fields which. Estimated tax is generally due and payable in four installments: Corporations are required to pay the following percentages of the estimated. Underpayment of estimated tax (pdf), form 5806; Download blank or fill out online in pdf format. Web corporation estimated tax (pdf), form 100es; This form is for income earned in tax year 2022, with tax returns due in april. Web 2022 corporation estimated tax. Web 2019 corporation estimated tax. Complete, sign, print and send your tax documents easily with us legal forms. You can download or print current or past. Fill in the requested fields which. Web detach here if no payment is due, do not mail this form detach here. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). For calendar year 2023 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). This entity will file form (check only one. Use revenue and taxation code (r&tc). Web detach here if no payment is due, do not mail this form detach here. Web corporation estimated tax (pdf), form 100es; Complete, sign, print and send your tax documents easily with us legal forms. Corporations are required to pay the following percentages of the estimated. All federal s corporations subject to california laws must file form 100s. Fill in the requested fields which. 3601213form 100 2021 side 1. Complete, sign, print and send your tax documents easily with us legal forms. Corporations are required to pay the following percentages of the estimated. Web 64 rows form 100: Estimated tax is generally due and payable in four installments: M 100, 100w, or 100s m. All federal s corporations subject to california laws must file form 100s. Fill in the requested fields which. 100, 100w, or 100s 109. For calendar year 2022 or fiscal year beginning (mm/dd/yyyy) this entity will file form (check only one box): 2021 california corporation franchise or income tax. Web select this payment type when paying estimated tax. Web 2019 corporation estimated tax. See the following links to the ftb instructions. Web 64 rows form 100: The first estimate is due on the 15th day of the 4th month of. Web corporation estimated tax (pdf), form 100es; M 100, 100w, or 100s m. Web 2021 form 100 california corporation franchise or income tax return. For calendar year 2022 or fiscal year beginning (mm/dd/yyyy) this entity will file form (check only one box): Web detach here if no payment is due, do not mail this form detach here. Complete, sign, print and send your tax documents easily with us legal forms. Web select this payment type when paying estimated tax. Underpayment of estimated tax (pdf),. This entity will file form (check only one. For calendar year 2019 or fiscal year beginning (mm/dd/yyyy) this entity will file form (check only one box): The first estimate is due on the 15th day of the 4th month of. For calendar year 2023 or fiscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). Web select this payment type when paying. See the following links to the ftb instructions. Make all checks or money orders. This entity will file form (check only one. 100, 100w, or 100s 109. The corporation may be required to pay electronically. This form is for income earned in tax year 2022, with tax returns due in april. The corporation may be required to pay electronically. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). This entity will file form (check only one. Web 2022 corporation estimated tax. 3601213form 100 2021 side 1. For calendar year 2022 or fiscal year beginning (mm/dd/yyyy) this entity will file form (check only one box): For calendar year 2019 or fiscal year beginning (mm/dd/yyyy) this entity will file form (check only one box): Web 2019 corporation estimated tax. Download blank or fill out online in pdf format. Fill in the requested fields which. The first estimate is due on the 15th day of the 4th month of. 100, 100w, or 100s 109. Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax requirement for california. Corporations are required to pay the following percentages of the estimated. Estimated tax is generally due and payable in four installments: You can download or print current or past. Complete, sign, print and send your tax documents easily with us legal forms. 2021 california corporation franchise or income tax. Web 64 rows form 100:2020 Form CA FTB 100W Fill Online, Printable, Fillable, Blank pdfFiller

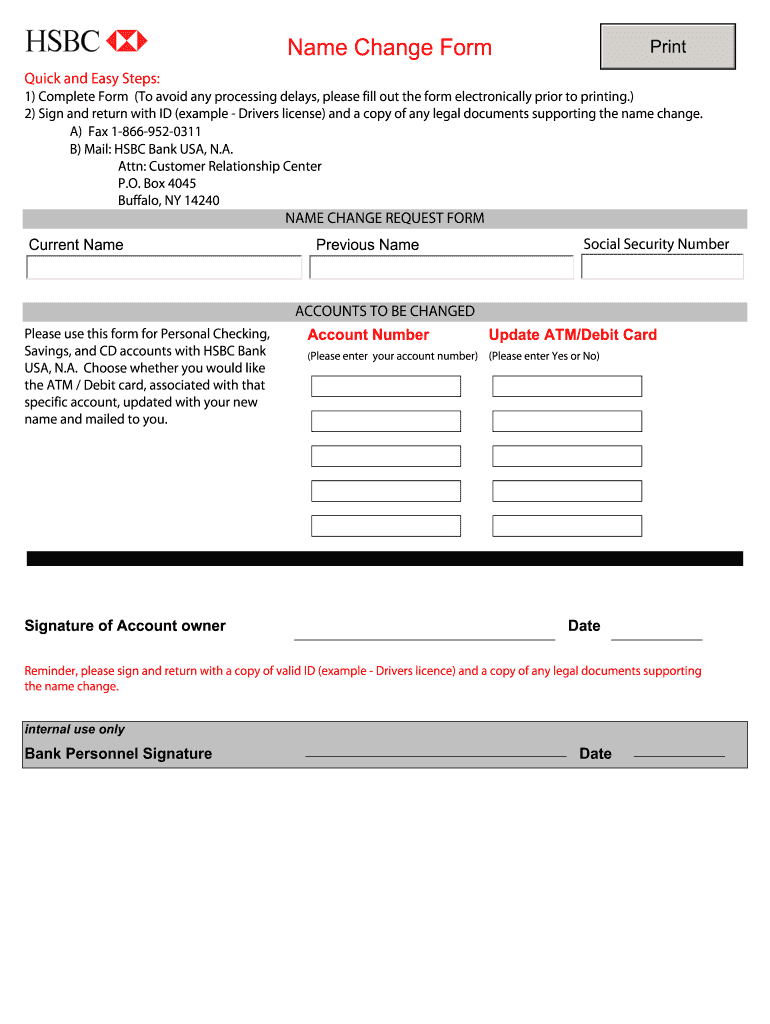

Form 100ES Download Fillable PDF or Fill Online Corporation Estimated

Fillable California Form 100Es Corporation Estimated Tax 2008

CA FTB 540 2EZ 20212022 Fill and Sign Printable Template Online US

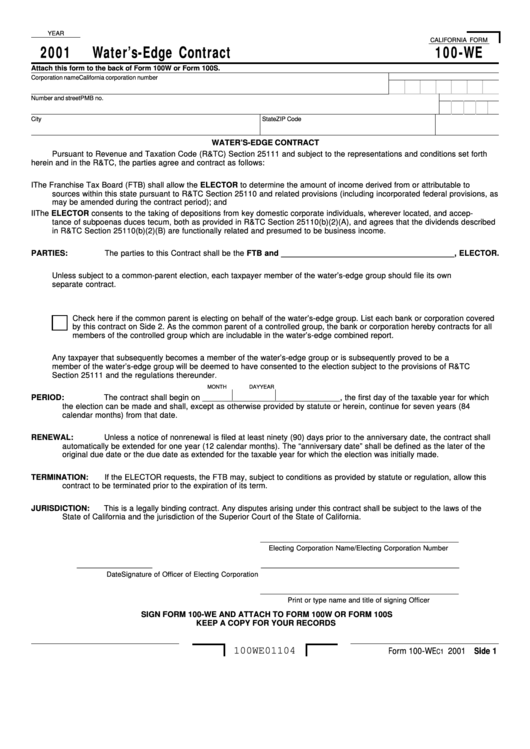

California Form 100We Water'SEdge Contract 2001 printable pdf

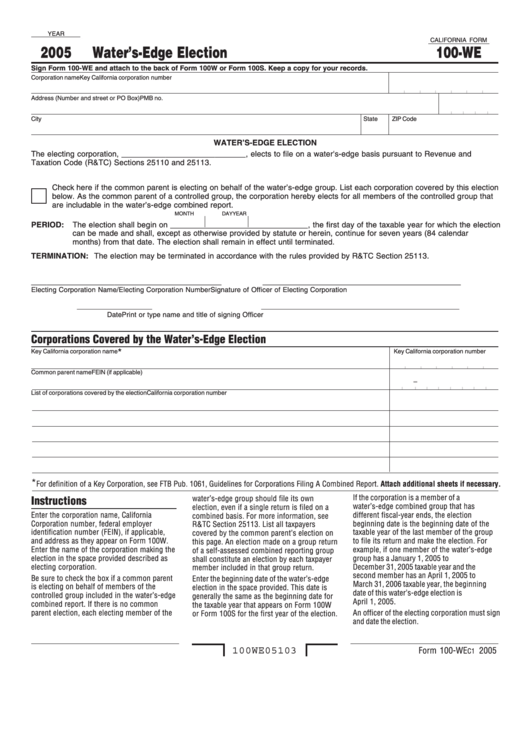

California Form 100We Water'SEdge Election 2005 printable pdf

2016 Form 100Es Corporation Estimated Tax Edit, Fill, Sign Online

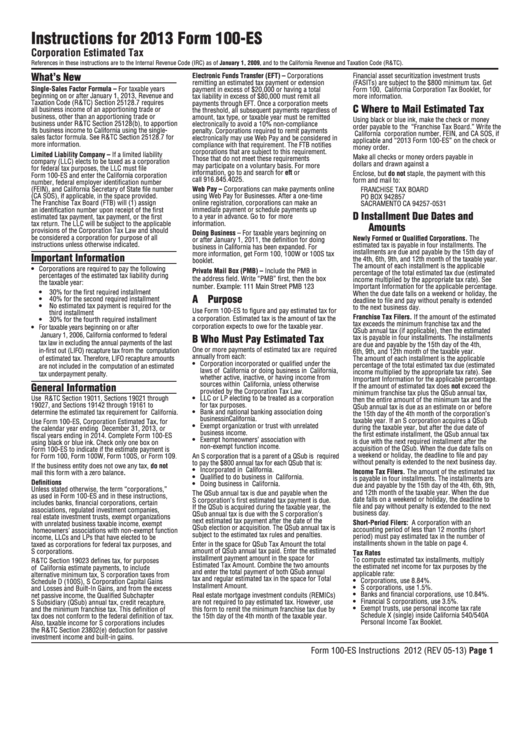

Instructions For Form 100Es Corporation Estimated Tax 2013

Ca Form 100 Es Fill Out and Sign Printable PDF Template signNow

Form 100Es Corporation Estimated Tax printable pdf download

Related Post: