Fillable Form 1041

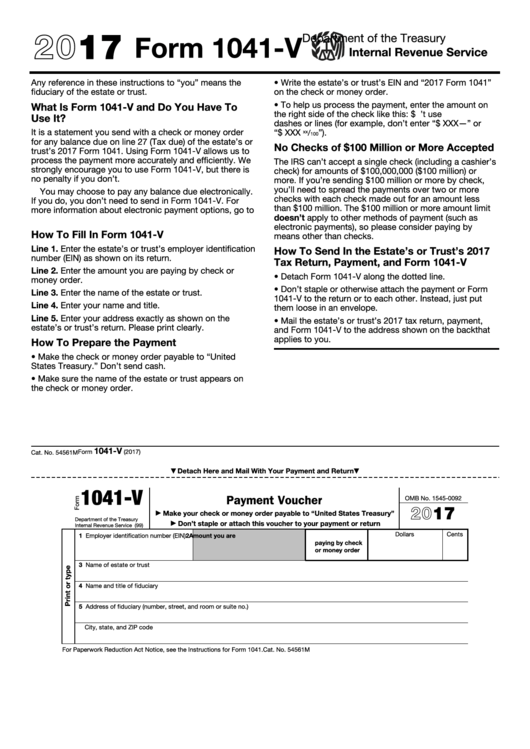

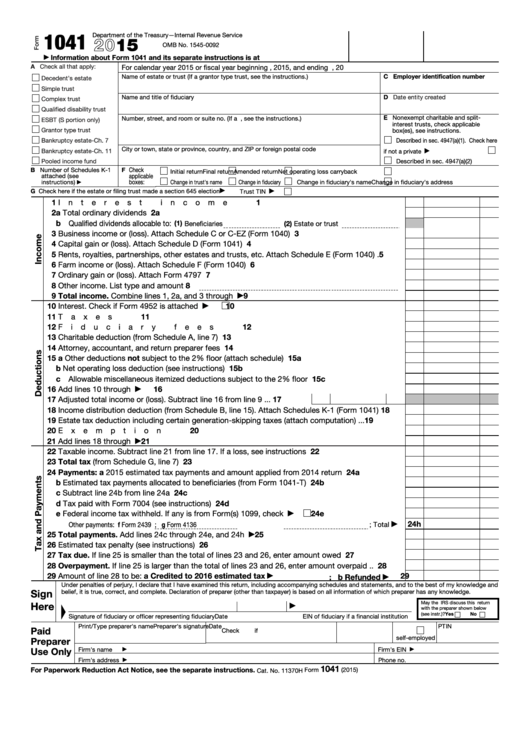

Fillable Form 1041 - Don’t complete for a simple trust or a pooled income fund. Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see. Income tax return for (irs) fill online, printable, fillable, blank form 1041: Web this document is filed annually and reports income, deductions, gains, losses, and any applicable credits or tax liabilities. Department of the treasury internal. Department of the treasury—internal revenue service. 2 schedule a charitable deduction. Source income of foreign persons; Beneficiary’s share of income, deductions, credits, etc. Web all others, stop here and report this amount on form 3800, part iii, line 4h. Print irs form 1041 or use a handy editor to complete & file the pdf online. Clean interface to facilitate use process. Smart form filling function to. Web all others, stop here and report this amount on form 3800, part iii, line 4h. Irs form 1041 is an income tax return, the same as an individual or business would file,. Smart form filling function to. Department of the treasury internal revenue service. Information return trust accumulation of charitable amounts. Complete, edit or print tax forms instantly. Print irs form 1041 or use a handy editor to complete & file the pdf online. Ad access irs tax forms. Information return trust accumulation of charitable amounts. Income tax return for (irs) fill online, printable, fillable, blank form 1041: Department of the treasury internal. See back of form and. Information return trust accumulation of charitable amounts. Clean interface to facilitate use process. Income tax return for (irs) fill online, printable, fillable, blank form 1041: Check out the newest instructions and examples. Ocr function converts any scanned pdf files into editable and searchable. Web this document is filed annually and reports income, deductions, gains, losses, and any applicable credits or tax liabilities. Download or email irs 1041 & more fillable forms, register and subscribe now! Web all others, stop here and report this amount on form 3800, part iii, line 4h. Don’t complete for a simple trust or a pooled income fund. Fill. Download or email irs 1041 & more fillable forms, register and subscribe now! Source income of foreign persons; Beneficiary’s share of income, deductions, credits, etc. Ad download or email irs 1041 & more fillable forms, register and subscribe now! Department of the treasury internal. Income tax return for estates and trusts. Download or email irs 1041 & more fillable forms, register and subscribe now! Ocr function converts any scanned pdf files into editable and searchable. Department of the treasury internal. Don’t complete for a simple trust or a pooled income fund. Beneficiary’s share of income, deductions, credits, etc. Use fill to complete blank online irs pdf forms for free. 2 schedule a charitable deduction. Ad access irs tax forms. Web all others, stop here and report this amount on form 3800, part iii, line 4h. Income tax return for (irs) fill online, printable, fillable, blank form 1041: Web fillable form 1041: Use form 8949 to list your transactions for. Department of the treasury internal revenue service. Form 1042, annual withholding tax return for u.s. Download or email irs 1041 & more fillable forms, register and subscribe now! Smart form filling function to. 1 what is the statute of limitations for the pte and fiduciary income taxes? Form 1042, annual withholding tax return for u.s. Income tax return for estates and trusts. Complete, edit or print tax forms instantly. Web this document is filed annually and reports income, deductions, gains, losses, and any applicable credits or tax liabilities. Income tax return for estates and trusts. Check out the newest instructions and examples. Department of the treasury—internal revenue service. Form 1042, annual withholding tax return for u.s. Income tax return for (irs) fill online, printable, fillable, blank form 1041: Information return trust accumulation of charitable amounts. See back of form and. Web fillable form 1041: Don’t complete for a simple trust or a pooled income fund. Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see. Use form 8949 to list your transactions for. Source income of foreign persons; 2 schedule a charitable deduction. Download or email irs 1041 & more fillable forms, register and subscribe now! Department of the treasury internal revenue service. The irs 1041 form for 2022 is updated to reflect the. Web all others, stop here and report this amount on form 3800, part iii, line 4h. Smart form filling function to.Fillable Form 1041V Payment Voucher 2017 printable pdf download

2020 Form IRS 1041T Fill Online, Printable, Fillable, Blank pdfFiller

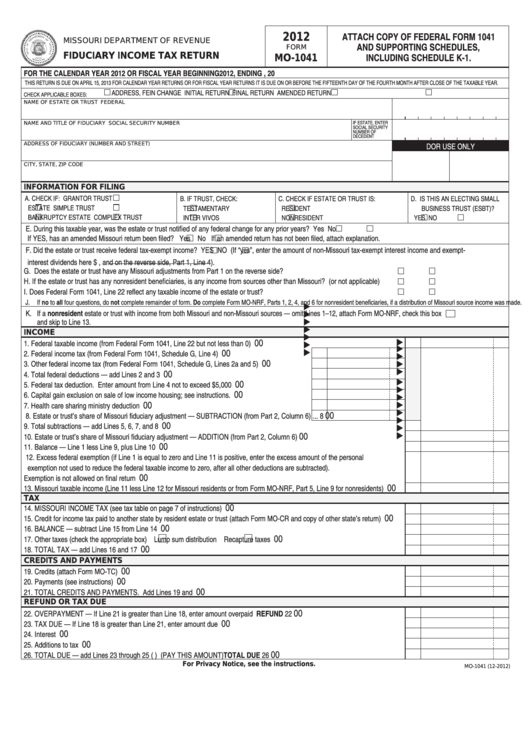

2020 Form MO MO1041 Fill Online, Printable, Fillable, Blank pdfFiller

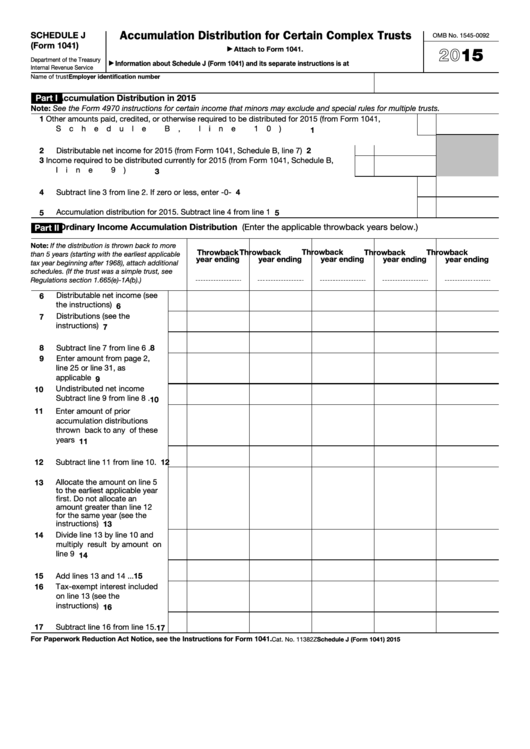

Fillable Schedule J (Form 1041) Accumulation Distribution For Certain

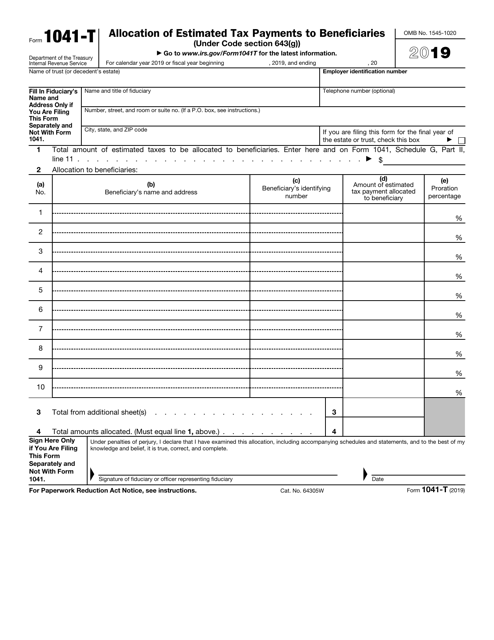

IRS Form 1041T Download Fillable PDF or Fill Online Allocation of

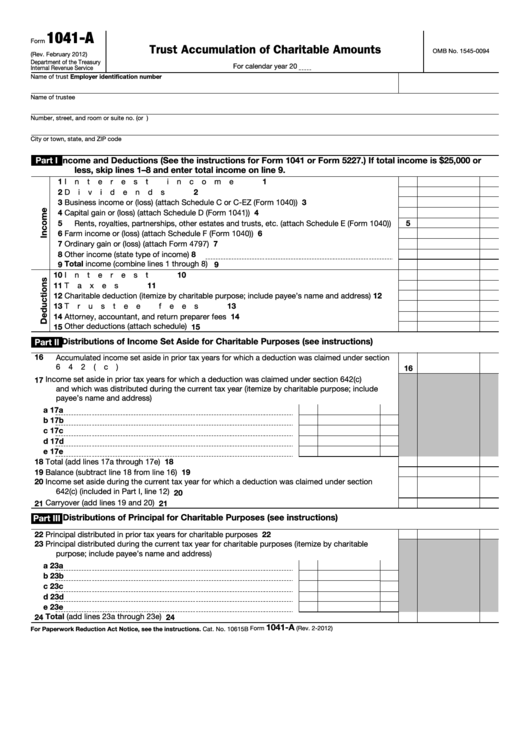

Fillable Form 1041A U.s. Information Return Trust Accumulation Of

Fillable Form Mo1041 Fiduciary Tax Return printable pdf download

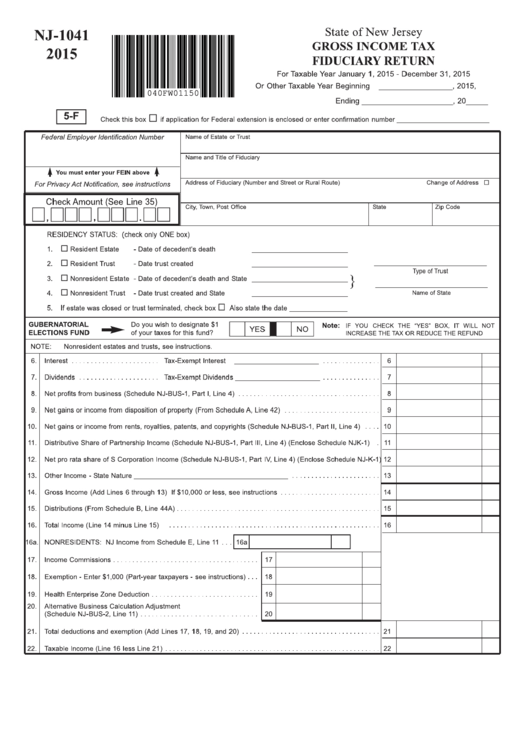

Fillable Form Nj1041 Gross Tax Fiduciary Return 2015

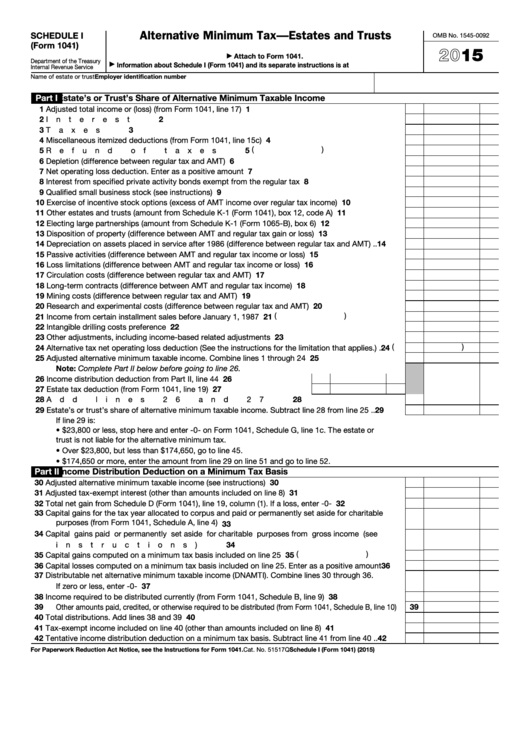

Fillable Schedule I (Form 1041) Alternative Minimum TaxEstates And

Fillable Form 1041 U.s. Tax Return For Estates And Trusts

Related Post: