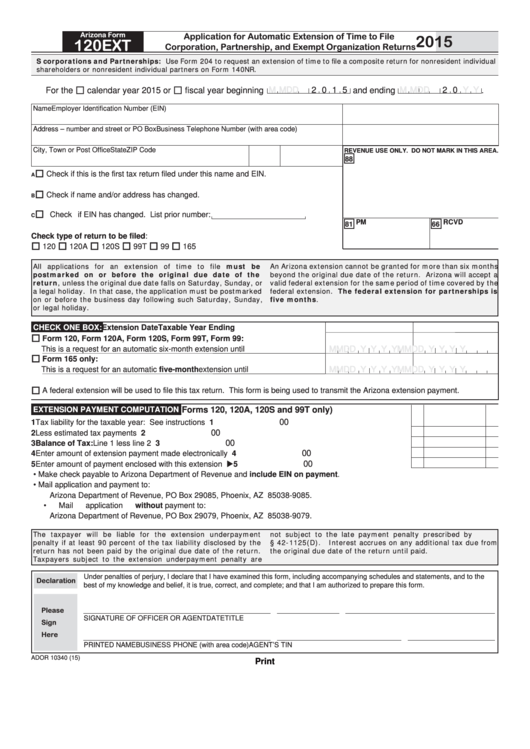

Arizona Extension Form

Arizona Extension Form - Application for automatic extension of time to file corporation, partnership,. But remember that in some. Individuals to file federal form 4868 to request an extension with the state rather than requesting an extension using the state. Avoid this penalty if you pay up to 90% of the final arizona taxes. The completed extension form must. Web this form is being used to transmit the arizona extension payment. Ad access irs tax forms. What are the withholding tax. If you include a payment with the arizona extension, mail forms 120/165 ext to the. Web an arizona extension cannot be granted for more than six months beyond the original due date of the return. What are the unemployment tax rates? Ad access irs tax forms. Extension based late tax payment penalty: If you include a payment with the arizona extension, mail forms 120/165 ext to the. Printed all of your arizona income tax forms? .5% penalty of tax unpaid of each month or fraction of month. Web form 120ext is an arizona corporate income tax form. Web form 120/165ext mailing address. Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost here. Ad access irs tax forms. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022. Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165. Individuals to file federal form 4868 to request an extension with the state rather than requesting an extension using the state. Only 44%. Web an arizona extension cannot be granted for more than six months beyond the original due date of the return. Web arizona form 2020 filing extension for individuals 204 for information or help, call one of the numbers listed: Application for automatic extension of time to file corporation, partnership,. Web the arizona department of revenue will accept a valid federal. Web form 120ext is an arizona corporate income tax form. Individuals to file federal form 4868 to request an extension with the state rather than requesting an extension using the state. If you include a payment with the arizona extension, mail forms 120/165 ext to the. The completed extension form must. .5% penalty of tax unpaid of each month or. The completed extension form must. What are the withholding tax. Web application for filing extension for fiduciary returns only. Web can i submit a filing extension request online for individual income or small business income tax? Web the arizona department of revenue will accept a valid federal extension for the same period of time that is covered by your federal. Web application for filing extension for fiduciary returns only. What are the withholding tax. What are the unemployment tax rates? Web application for electronic filing of extension request for calendar year 2022 individual income tax returns only | arizona department of revenue. Web form 120/165ext mailing address. Web an arizona extension cannot be granted for more than six months beyond the original due date of the return. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022. Web application for filing extension for fiduciary returns only. Get ready for tax season deadlines by completing any required tax forms. The completed extension form must. Form is used by a fiduciary to request an extension of time to file the estate or trust's income tax return. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022. The cost is $450 for. Individuals to file federal form 4868 to request an extension. Ad access irs tax forms. Individuals to file federal form 4868 to request an extension with the state rather than requesting an extension using the state. .5% penalty of tax unpaid of each month or fraction of month. The cost is $450 for. Extension based late tax payment penalty: Web application for electronic filing of extension request for calendar year 2022 individual income tax returns only | arizona department of revenue. Web arizona form 2020 filing extension for individuals 204 for information or help, call one of the numbers listed: Extension based late tax payment penalty: Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost here. Web the completed extension form must be filed by april 18, 2023. If you include a payment with the arizona extension, mail forms 120/165 ext to the. The cost is $450 for. Web this form is being used to transmit the arizona extension payment. Individual income taxpayers who received a filing. Avoid this penalty if you pay up to 90% of the final arizona taxes. Ad access irs tax forms. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022. Application for automatic extension of time to file corporation, partnership,. .5% penalty of tax unpaid of each month or fraction of month. For individuals who filed a timely arizona form 204 for an automatic extension to file, the due date for an arizona. Get ready for tax season deadlines by completing any required tax forms today. Web can i submit a filing extension request online for individual income or small business income tax? Web the arizona department of revenue will accept a valid federal extension for the same period of time that is covered by your federal extension. What are the unemployment tax rates? Web file this form to request an extension to file forms 120, 120a, 120s, 99, 99t, or 165.Form 27 Fill Out, Sign Online and Download Printable PDF, Arizona

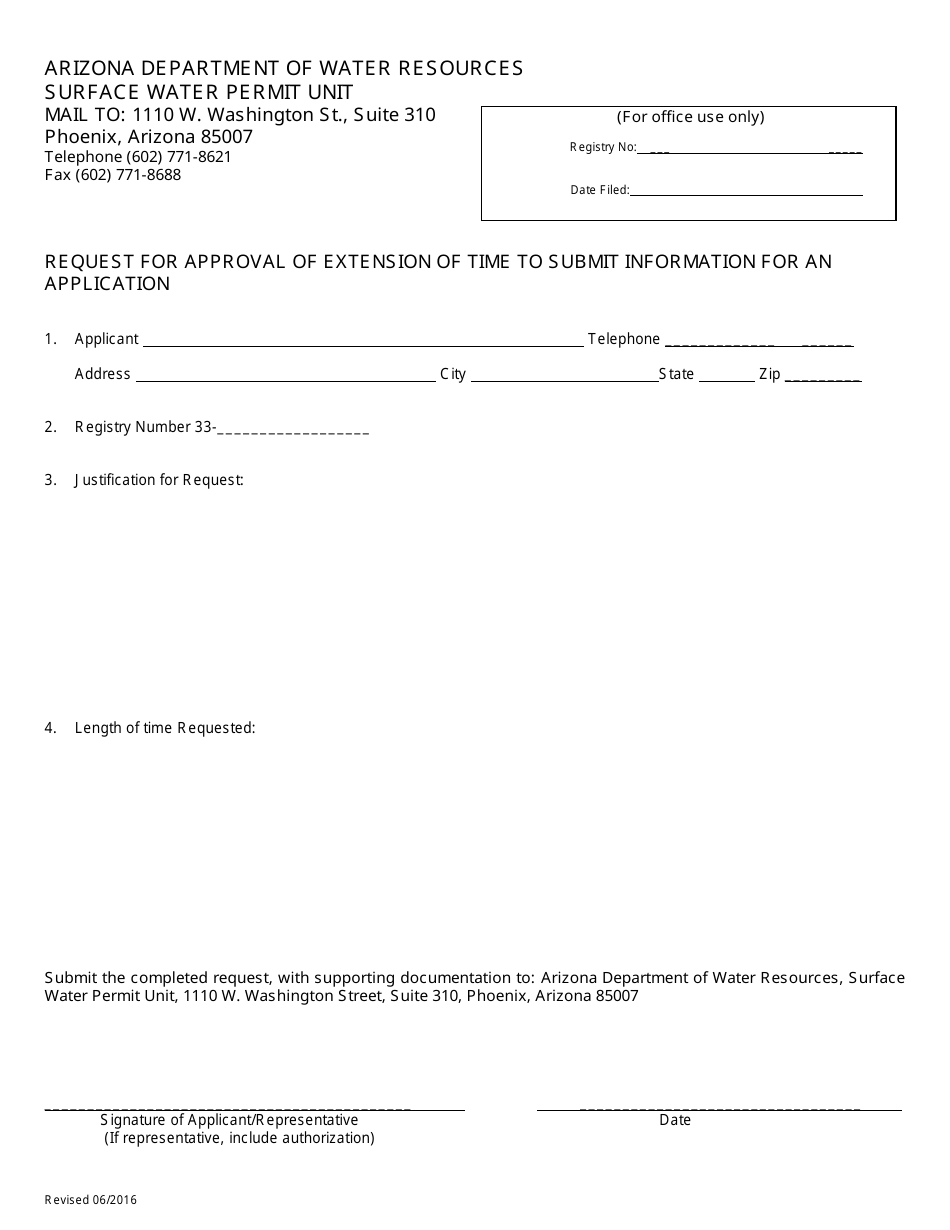

Arizona Request for Approval of Extension of Time to Submit Information

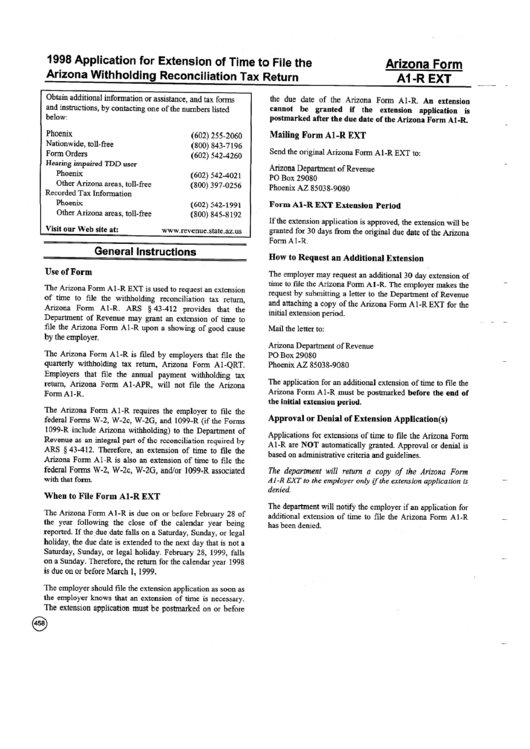

Form A1R Ext 1998 Application For Extension Of Time To File The

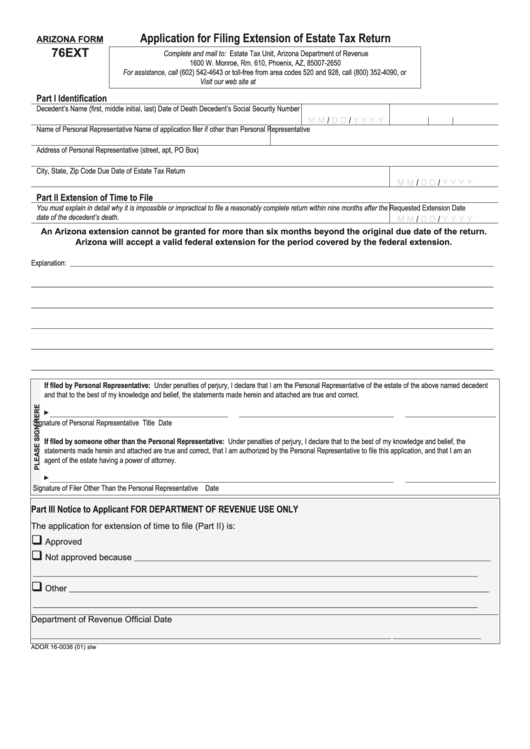

Form 76ext Application For Filing Extension Of Estate Tax Return

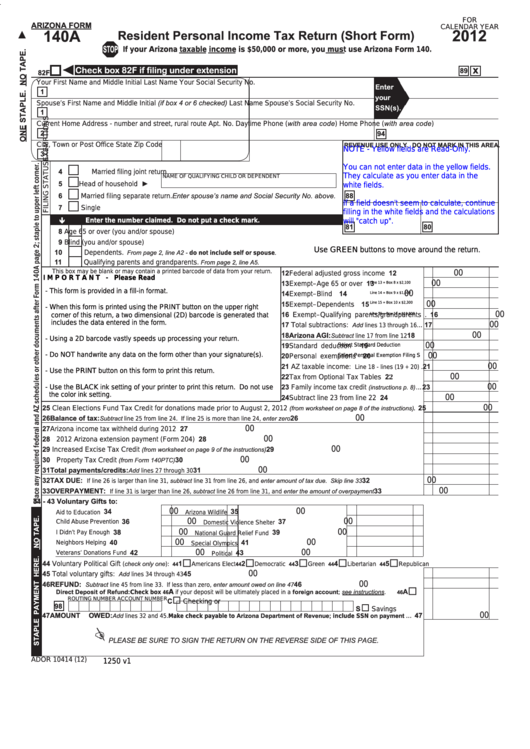

Az 140a Fillable Form Printable Forms Free Online

Form 4868 Application for Automatic Extension of Time to File U.S

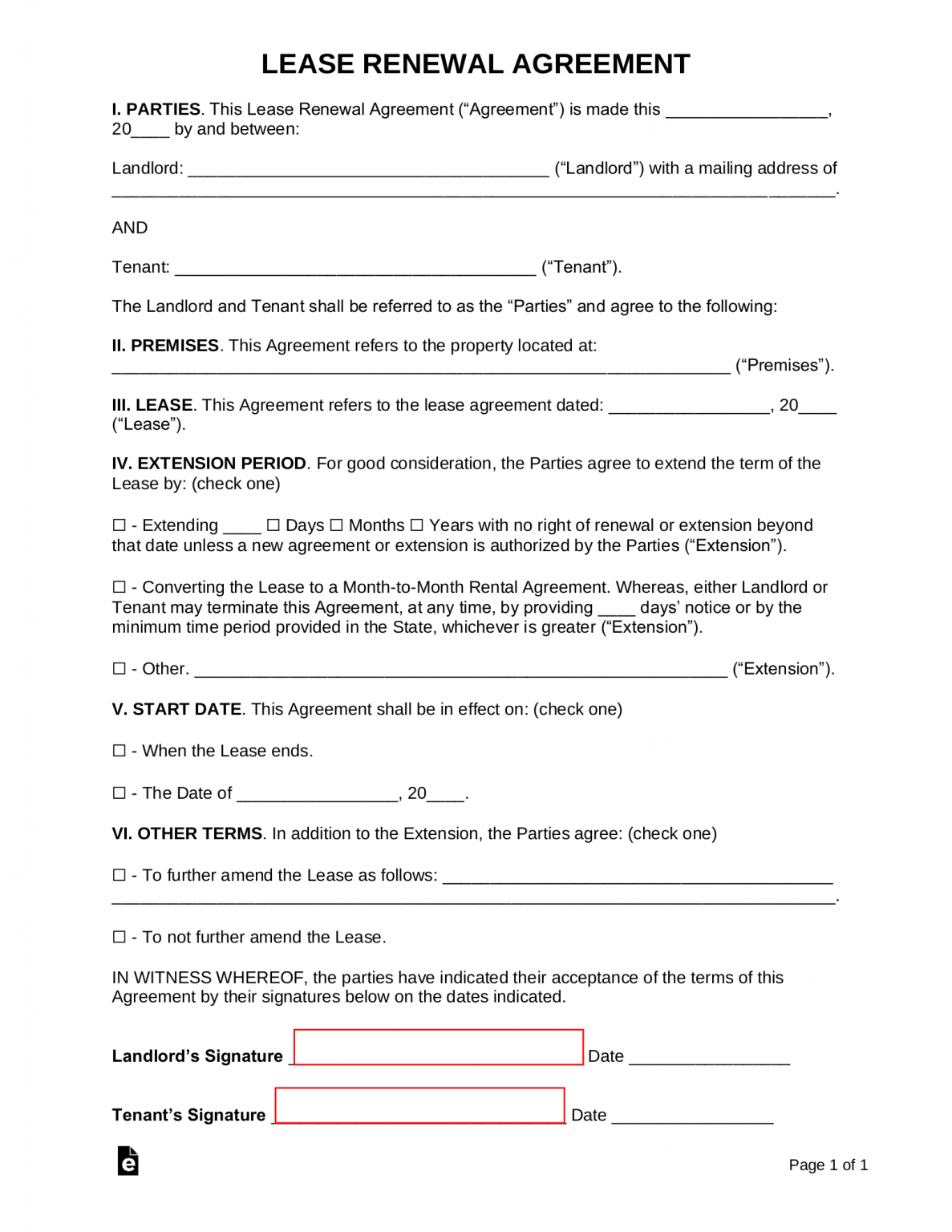

Free Printable Lease Extension Agreement Printable World Holiday

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

Fillable Arizona Form 120ext Application For Automatic Extension Of

Arizona Form 120ext Application For Automatic Extension Of Time To

Related Post: