Adjustment Codes For Form 8949

Adjustment Codes For Form 8949 - If the sale (or asset) is the type that requires special treatment, such as a wash sale or. On line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. File form 8949 with the schedule d for the return you are filing. Follow the instructions for the code you need to generate below. Web 17 rows correct the error by entering an adjustment in column (g). Web 8 rows form 8949 adjustment codes (1040) form 8949 adjustment codes are. Ad signnow.com has been visited by 100k+ users in the past month Web file form 8949 with the schedule d for the return you are filing. If you go to sch d > form 8949 long. Web what are the form 8949 (schedule d) transaction type codes? On line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Instead of reporting this transaction on. Web 8 rows form 8949 adjustment codes (1040) form 8949 adjustment codes are. Ad signnow.com has been visited by 100k+ users in the past month Web on the appropriate form 8949 as a gain. Web these adjustment codes are included on form 8949, which will print along with schedule d (form 1040) capital gains and losses. Web (see the form 8949 instructions here for an explanation of all the adjustment codes.) if an adjustment is needed, select adjustment code and choose the code that applies. Web what are the form 8949 (schedule d) transaction. If the sale (or asset) is the type that requires special treatment, such as a wash sale or. (f) code(s) from instructions (g) amount of. Web (see the form 8949 instructions here for an explanation of all the adjustment codes.) if an adjustment is needed, select adjustment code and choose the code that applies. The taxpayer’s adjusted basis in the. Web what are the form 8949 (schedule d) transaction type codes? The taxpayer’s adjusted basis in the home is $150,000. Web file form 8949 with the schedule d for the return you are filing. Web these adjustment codes are included on form 8949, which will print along with schedule d (form 1040) capital gains and losses. Web (see the form. Ad signnow.com has been visited by 100k+ users in the past month Web adjustment, if any, to gain or loss. Instead of reporting this transaction on. (f) code(s) from instructions (g) amount of. Web adjustments (if any) to gain or loss and the adjustment code. (f) code(s) from instructions (g) amount of. If you go to sch d > form 8949 long. Web (see the form 8949 instructions here for an explanation of all the adjustment codes.) if an adjustment is needed, select adjustment code and choose the code that applies. This was your only 2022 transaction. Web on the appropriate form 8949 as a. (f) code(s) from instructions (g) amount of. On line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Web form 8949 (sales and other dispositions of capital assets) records the details of your capital. (f) code(s) from instructions (g) amount of. Web (see the form 8949 instructions here for an explanation of all the adjustment codes.) if an adjustment is needed, select adjustment code and choose the code that applies. Web these adjustment codes are included on form 8949, which will print along with schedule d (form 1040) capital gains and losses. The adjustment. Ad signnow.com has been visited by 100k+ users in the past month Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. On line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Report the transaction on form 8949 as you would if you. Web adjustment, if any, to gain or loss. If the sale (or asset) is the type that requires special treatment, such as a wash sale or. If you enter an amount in column (g), enter a code in column (f). The adjustment amount will also be listed on. If you go to sch d > form 8949 long. The taxpayer’s adjusted basis in the home is $150,000. Web form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. On line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Enter code t in column (f) then report the transaction on the correct. Web on the appropriate form 8949 as a gain. This was your only 2022 transaction. Report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any. Web adjustment, if any, to gain or loss. Web adjustments (if any) to gain or loss and the adjustment code. Web these adjustment codes are included on form 8949, which will print along with schedule d (form 1040) capital gains and losses. If the sale (or asset) is the type that requires special treatment, such as a wash sale or. (f) code(s) from instructions (g) amount of. File form 8949 with the schedule d for the return you are filing. If you enter an amount in column (g), enter a code in column (f). Web what are the form 8949 (schedule d) transaction type codes? Follow the instructions for the code you need to generate below. If you go to sch d > form 8949 long. Web file form 8949 with the schedule d for the return you are filing. Web 8 rows form 8949 adjustment codes (1040) form 8949 adjustment codes are. Instead of reporting this transaction on.IRS Form 8949 instructions.

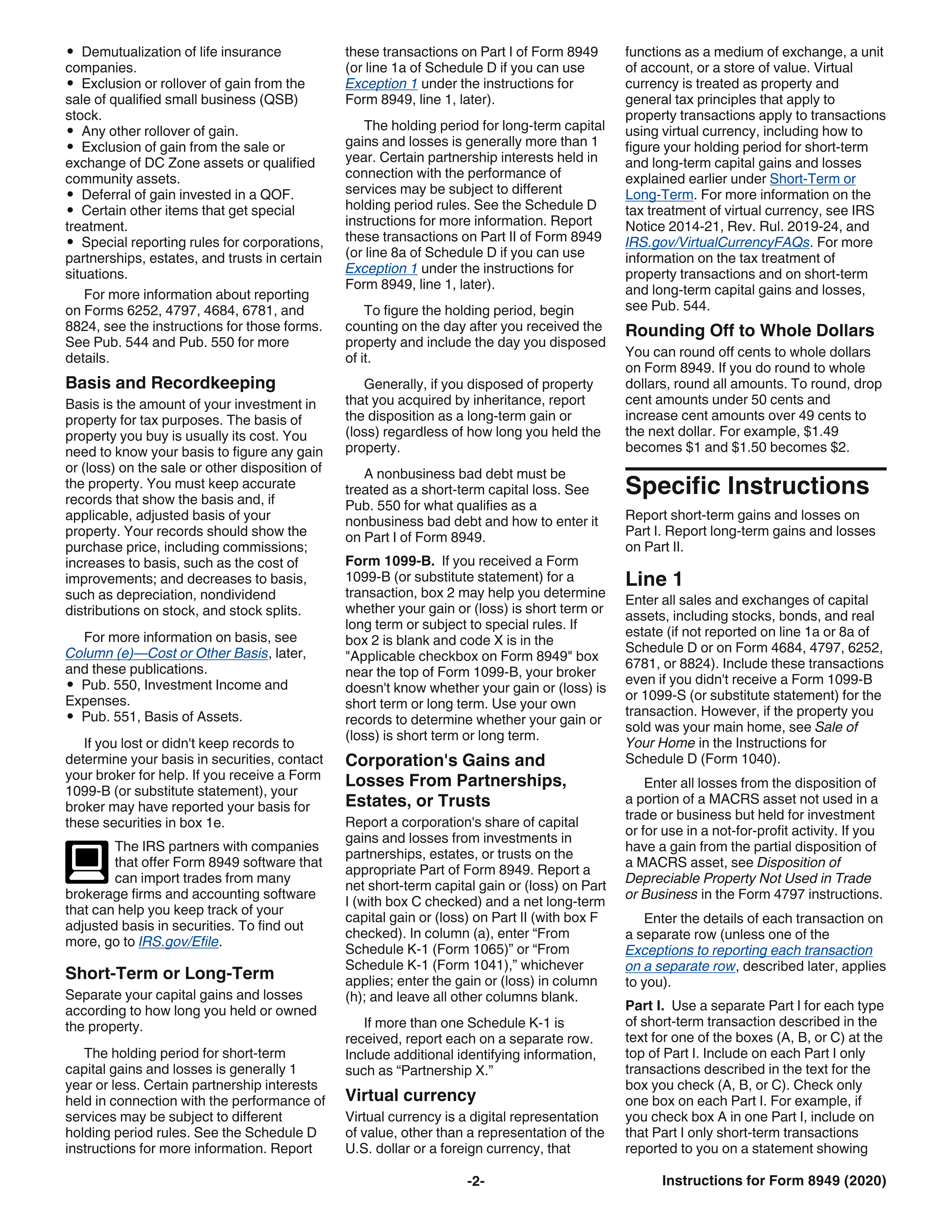

IRS Form 8949 instructions.

Form 8949 and Sch. D diagrams I did a cashless exercise with my

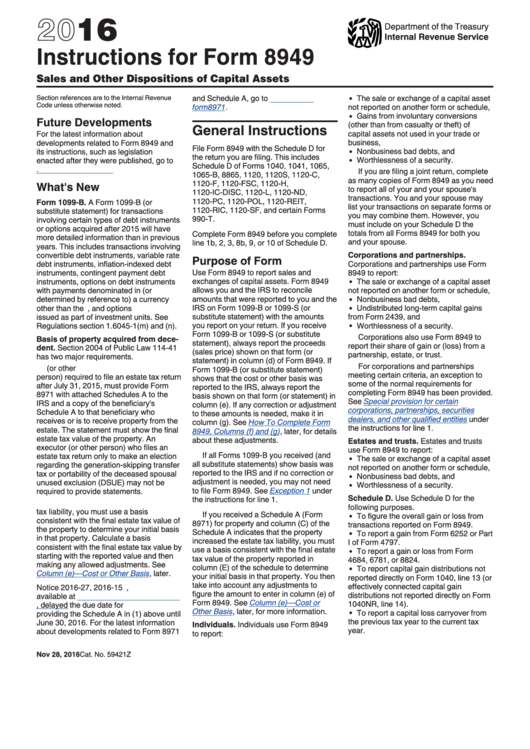

Instructions For Form 8949 2016 printable pdf download

In the following Form 8949 example,the highlighted section below shows

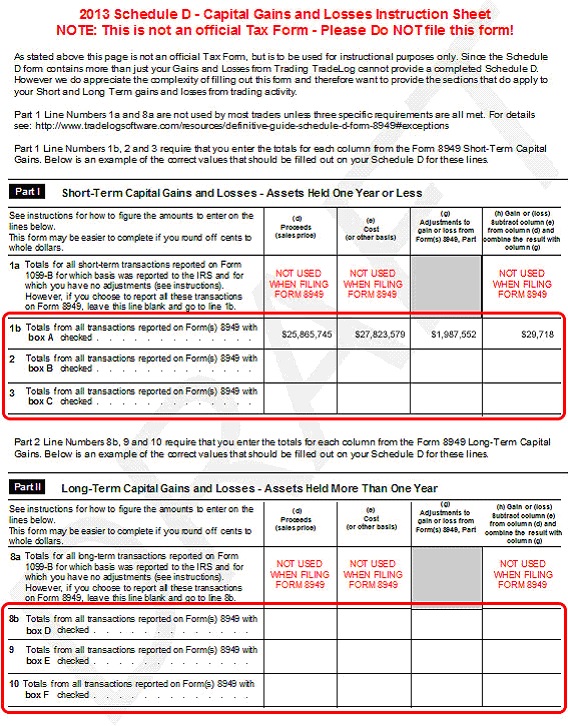

Generating Form 8949 for Tax Preparation TradeLog Software

irs form 8949 instructions 2020 Fill Online, Printable, Fillable

8949 Bitcoin / Import Print Or Attach Form 8949 For Bitcoin Capital

Detail View of Statement Explaining Form 8949 Differences and

Entering Form 8949 Totals Into TaxACT® TradeLog Software

Related Post: